The digital asset market is booming. The ecosystem includes more than 7,000 coins and poletit. Not all of them are interesting for investors, most of them are “empty” projects. The price of such assets depends on public attention, information support from celebrities. Coins with the top 50 by pääomitus level are of greater interest to investors. They demonstrate strong growth, bring profit. In terms of prospects, it is better to invest in bitcoin, which shows relative stability and dynamics, enjoys the trust of large investors. On the contrary, “meme” cryptocurrencies, “fan” tokens, scam projects are not secured by anything. Their price is related to temporary interest, hype.

Reasons for the explosive growth of bitcoin

By 2024, the first cryptocurrency has passed several stages in its development. Many countries adopted loyal legislation, legalized digital assets (as a means of payment or goods). Bitcoin gained the trust of users. Large institutional investors and financial companies began to look at digital assets.

In 2021, the coin increased the maximum price several times. In early November, a rate above $68,000 was recorded, after which there was a korjaus. Among the reasons for the growth of the cost of the koin, experts call:

- Interest in cryptocurrency from institutional investors. In 2020, MicroStrategy, Tesla and other world-renowned companies invested in digital assets.

- Fears and public distrust of the traditional banking system due to the coronavirus epidemic changed people’s attitudes towards the usual way of life. Bitcoin seemed more stable than other instruments and fiat currencies.

- The development of DeFi projects, NFTs and blockchain-based applications, their accessibility and simplicity.

- Liberalization of cryptocurrency legislation in different countries.

- Investments of ordinary users.

- Statements of famous people, excerpted in a positive way.

Even after updating the high, investors continue to invest in bitcoin in 2024.

Should we expect a rapid growth of BTC in the future

Predictions of analysts and experts in the crypto industry regarding the exchange rate differ. The future value of BTC in the period from a year to 10 years can range from $100,000 to $1 million. It is difficult to unambiguously predict the price of the coin because of the high volatility of digital assets. The rate is influenced by such factors:

5020 $

bonus uusille käyttäjille!

ByBit tarjoaa kätevät ja turvalliset olosuhteet kryptovaluuttakaupalle, tarjoaa alhaiset palkkiot, korkean likviditeetin ja nykyaikaiset työkalut markkina-analyysiin. Se tukee spot- ja vivutettua kaupankäyntiä ja auttaa aloittelijoita ja ammattimaisia kauppiaita intuitiivisella käyttöliittymällä ja opetusohjelmilla.

Ansaitse 100 $-bonus

uusille käyttäjille!

Suurin kryptopörssi, jossa voit nopeasti ja turvallisesti aloittaa matkasi kryptovaluuttojen maailmaan. Alusta tarjoaa satoja suosittuja omaisuuseriä, alhaiset palkkiot ja kehittyneet työkalut kaupankäyntiin ja sijoittamiseen. Helppo rekisteröityminen, nopea transaktioiden nopeus ja luotettava varojen suojaus tekevät Binancesta loistavan valinnan kaiken tasoisille kauppiaille!

- News background.

- Prohibition of digital assets in some countries.

- Negative statements of famous people.

- The refusal of large companies to use the first cryptocurrency as a means of payment.

- Political and economic crises.

Bloomberg in September 2021 predicted the bitcoin rate until the end of December at the level of $100,000. The same opinion is held by Morgan Creek Digital co-founder Anthony Pompliano and a number of other major investors, analysts of cryptocurrency exchanges and financial organizations.

Wall Street investment fund managers hold a different opinion. A CNBC poll showed that the mood of financiers is more pessimistic. They forecast the rate to fall to $30,000 by the end of 2021.

A correction of the price in the short term is possible. Therefore, investors who invest in bitcoin at the end of 2021 in the hope of a quick profit need to calculate all the risks. Those who work according to the HODL strategy with a long-term retention of koins, on the contrary, it is worth buying more coins during the fall. In the long run, the rate will grow.

The main risks of investing in Bitcoin

The current situation in the digital world is quite different from 2017. Assets have increased their status in the eyes of society, large investors. Decentralized applications in the field of lending, deposits have appeared. However, investment risks exist, and you need to be aware of them when choosing a tool for trading or saving capital.

The main negative factors of buying BTC.

| Risks of investment | Ominaisuudet |

|---|---|

| Volatility | Throughout the history of bitcoin, the price could go up tens of percent and crash down. Predicting or forecasting such a dramatic change in the exchange rate is difficult. Too many uncertain factors can affect the value of a coin. |

| Regulation by governments | There are polar attitudes to cryptocurrency in different countries: from full legalization and recognition as the main unit of currency (El Salvador) to a ban on mining, buying and owning. The actions of the Chinese authorities in May 2021 provoked a drop in the coin’s exchange rate. |

| Blockchain challenges | Bitcoin is the first distributed network. During its existence, problems have arisen: low transaction speed, busy servers. |

| Competition from altcoins | Ethereum and other coins have a smaller capitalization than bitcoin. However, they are drawing some investors to themselves, competing with the first cryptocurrency. |

| Regulators’ interest | Previously, fiscal authorities of different countries paid little or no attention to cryptocurrency. It was an obscure and unregulated instrument used by digital enthusiasts. In 2021, the capitalization of all cryptocurrencies exceeded $3 trillion, which is more than the GDP of Canada or Spain. Fiscal authorities are interested in investments in digital assets. We should expect changes in tax laws. |

The problem is the growing energy consumption of coin kaivostoiminta.

In terms of total annual spending on bitcoin mining is comparable to Thailand. In this country use as much electricity as the miners of the whole world.

Experts’ opinion

Taking into account the risks, investing in bitcoin is profitable in the long term. At least this is true for beginners in the digital asset market. It is better to invest money in BTC and hold.

Experienced traders play on the volatility of the asset. In doing so, they apply different trading strategies, analyze information, monitor the situation, and study the news background.

Experts and famous people in the digital world have spoken about the bitcoin rate:

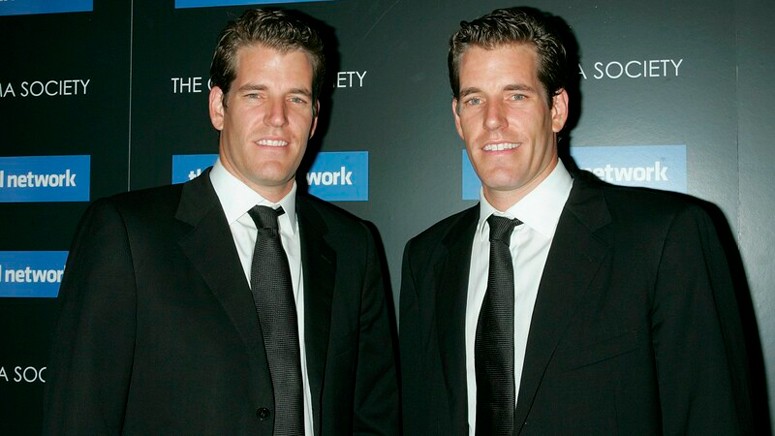

- Tyler Winklevoss is the first crypto-billionaire (together with his brother Cameron). He stated that the coin’s exchange rate will rise to $0.5 million in the next 5 years. Tyler provides an interesting explanation for his prediction. He believes that bitcoin is an alternative to gold. The capitalization of the precious metal is $10 trillion, Bitcoin’s volume is $1.1 trillion (end of November 2021). To catch up with gold and start displacing it, the first cryptocurrency needs to grow in value 10 times.

- Michael Novogratz is the founder of Galaxy Digital. He believes that in the next 10 years bitcoin will rise in price 100 times. The financier also bases his predictions on the gradual replacement of gold as a stable instrument for saving capital.

- Adam Back – CEO of Blockstream, a well-known person in the world of digital assets, indirectly had a hand in the development of bitcoin. He predicts the rate to rise to $600,000 by 2026 and does not recommend getting out of the asset, give in to corrections.

There is also an opposite opinion. The writer and economist Robert Kiyosaki, Internet analyst PlanB and others predict the fall of the asset. When the rate reaches $70-$90,000, capital withdrawal is expected, which will negatively affect the value.

To novice crypto investors, experts recommend:

- Never invest all your savings in bitcoin. Especially not to sell assets for the sake of investment. You can lose everything. It is necessary to diversify deposits, use different instruments: fiat currencies, gold, other cryptocurrencies.

- The coin is influenced by the market, the attitude of large investors, “whales”.

- To buy bitcoin for a long period of time, it is necessary to take care of a place to store the coin in advance. Wallets of cryptocurrency exchanges are not suitable for this role. It is necessary to use cold storage methods. This is safer and more reliable.

So whether it is worth investing in bitcoin

According to experts and analysts, you need to buy assets. Investing money in Bitcoin now is better for a long term. This is not the limit of value, even if there is a correction of the rate, there is an upward trend in the future.

It is worth considering the possible risks, especially during short-term investments in bitcoin.

The best options for working with cryptocurrency are portfolio diversification, using coins from the top 20, fiat currencies, other assets (stocks, securities).

It is preferable to consider long-term investments in bitcoin, in this case the chances of profit are much higher.

How to properly store your investments

In addition to choosing a tool for saving, you should also decide on a cryptocurrency wallet. It should ensure the safety of storage. There are different variants of cryptocurrency wallets on the market, which differ in functionality and reliability. Depending on the presence or absence of an internet connection, the storages are:

- Hot – are online all the time, provide fast and convenient interaction. They are suitable for constant work with cryptocurrency.

- Cold – not connected to the Internet. Presented in the format of individual flash drives of information. Autonomous storage mode is more preferable for investment activities.

The best hardware wallets for cryptocurrency:

- Ledger – Nano S and X models.

- Trezor One and Model T.

- KeepKey.

- CollWallet – several versions are available, differ in features.

- BitBox.

The main selection criteria: support for the desired cryptocurrencies, security options, reliability of the manufacturer, ease of use.

Frequently asked questions

❓ Why buy for the long term, you can buy with all your money now and sell quickly when the price rises?

It is very risky to do it this way. Bitcoin’s high volatility does not allow you to make short-term forecasts. Experts recommend investing in the coin no more than 5% of the entire investment portfolio.

🤔 Can I buy bitcoin now or wait for the price to drop?

The time to enter the market depends on the purpose and planned term of the investment. If bitcoin serves as a capital-saving tool, you can buy it regardless of the price. Short-term investors need to choose an entry point.

✅ Why has bitcoin gained such trust from users in 10 years?

The coin is the first to be implemented on the blockchain – a distributed decentralized network. No one controls it, no one manages the price. The rate depends solely on how much people are willing to pay for bitcoin.

👛 Is hardware storage only used for one type of cryptocurrency?

Popular wallet models support dozens of coins, providers periodically update the lists.

❕ What does it mean to grant bitcoin the status of the official currency of El Salvador?

The coin serves as a full-fledged means of payment on par with the US dollar. Bitcoin can be paid in stores, transactions in cryptocurrency are not taxed.

Virhe tekstissä? Korosta se hiirellä ja paina Ctrl + Astu sisään.

Kirjoittaja: Saifedean Ammous, kryptovaluutan taloustieteen asiantuntija.