The transaction will be completed when its details are included in the next block. This is done by miners. Network participants generating new blocks, in addition to a fixed payment, receive the amount contributed by users. The size can vary. The current Bitcoin network fee is now 0.000069 BTC ($4.71) (as of October 25, 2024). This is the average value per transaction. In practice, the amount may vary: the higher the transaction fee, the more likely it is to be included in the next block. It is possible to choose the parameters of the reward for miners, taking into account the urgency.

The essence of fees in the Bitcoin network is reduced to payment for the services of miners. They spend resources to buy productive equipment, electricity to add another block to the distributed register of the network. Therefore, the amount of the minimum bitcoin transfer fee is affected by the costs. They vary depending on the country, the price of electricity, complexity. Sometimes the transaction can stay in the mempool (standby mode) for a long time.

Features of bitcoin transfer fees

Stages of transactions in the blockchain:

- A validity check is performed. This operation is carried out by nodes – nodes that store copies of the blockchain. The user’s transaction history is checked to confirm the amount of coins to be transferred.

- After successful validation, the transaction is queued for completion. This is called a mempool. This is where the coins reside before the miner adds to the block and completes the procedure. Until the next blockchain element is formed, it is unconfirmed.

- The transaction is considered complete when the next block is added to the blockchain.

This is a simplified bitcoin transfer scheme. There are Bitcoin transaction fee calculators to determine the amount of reward. It is possible to determine the minimum and recommended remuneration of the services of miners.

The payment consists of two parts:

5020 $

bonus uusille käyttäjille!

ByBit tarjoaa kätevät ja turvalliset olosuhteet kryptovaluuttakaupalle, tarjoaa alhaiset palkkiot, korkean likviditeetin ja nykyaikaiset työkalut markkina-analyysiin. Se tukee spot- ja vivutettua kaupankäyntiä ja auttaa aloittelijoita ja ammattimaisia kauppiaita intuitiivisella käyttöliittymällä ja opetusohjelmilla.

Ansaitse 100 $-bonus

uusille käyttäjille!

Suurin kryptopörssi, jossa voit nopeasti ja turvallisesti aloittaa matkasi kryptovaluuttojen maailmaan. Alusta tarjoaa satoja suosittuja omaisuuseriä, alhaiset palkkiot ja kehittyneet työkalut kaupankäyntiin ja sijoittamiseen. Helppo rekisteröityminen, nopea transaktioiden nopeus ja luotettava varojen suojaus tekevät Binancesta loistavan valinnan kaiken tasoisille kauppiaille!

- Incentivizing – the remuneration of the miners. This component affects the speed of inclusion of a record in the chain.

- Mandatory – required to support the blockchain’s performance. In 2021 was equal to 1 satoshi (0.00000001 BTC) for each byte of transaction weight.

The fee for a BTC transaction is independent of the transfer amount. What matters is the weight of the transaction in bytes, which is affected by the number of inputs and outputs (addresses where the digital assets came from and where they are transferred to). After all, a cryptocurrency transfer is a program code. Generation is based on data about where the coins came from and where they are sent. The size of such a code depends on the total number of addresses of the transaction.

Why you need to pay for transactions

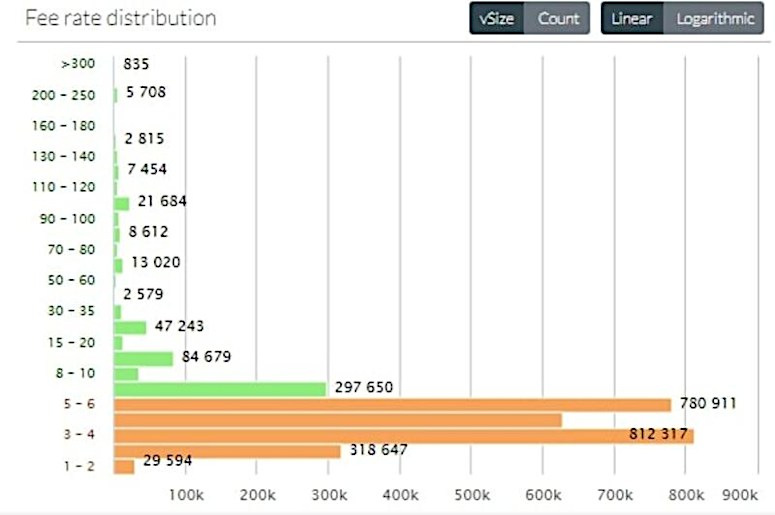

Due to the fact that the number of transfers on the Bitcoin network is growing and the block size is limited, the queue can move slowly. Transactions with a higher fee relative to weight are prioritized in the mempool. The lower the ratio, the less likely the request will make it to the next block.

The size of the fee is a signal of the urgency of the transaction. The higher it is, the more important the transaction is and the faster the miner will take care of it.

What factors affect the fee

Transfer fees are a major factor in the digital economy, the driving force behind blockchain. Without money, no one will want to spend resources and time to support the network, kaivostoiminta cryptocurrency.

In addition to the incentive function, the additional fee is a defense against spammers and scammers. Organizing an attack by sending multiple transfers would be easy. With high commission costs, it is expensive and time-consuming, because it is not possible to process all requests at once, some will get stuck in the mempool.

Different factors affect the amount of commission:

- The total number of transactions in the network. The more transfers, the higher the competition between requests.

- The weight of the transaction. The transfer fee cannot be less than 1 satoshi per byte.

- The weight of other transactions included in the next block. For example, if there are a lot of small transfers in a certain time, the fee will increase. Infrequent transfers of large amounts on the contrary reduce the cost of a BTC transaction.

Minimum size

Transactions with extremely low fees have low competitiveness and can take several days to process. It is theoretically possible to make a transfer at the minimum fee rate, but it is better not to do so.

Demand for cryptocurrency is growing constantly, and zero remuneration will not interest miners. For effective work with koins, you need to select the optimal value of the fee. To do this, you can make the calculation yourself or use special services. They give the average commission per bitcoin transaction today, the minimum and maximum value.

Cryptocurrency wallets offer a choice of remuneration when making a transfer. The size depends on the speed, for example, “Slow”, “Medium” and “Fast”. You can change the value at your discretion. It is necessary to take into account the desired time, network load. If the commission costs are low, you will have to wait for several hours or even days. If you choose a high level of fees, the payment will fall into the next block.

With the growing popularity of cryptocurrency, the transfer time increases. This also needs to be taken into account.

Calculating the commission for Bitcoin transactions

The amount of the fee can be calculated manually. Theoretically, it is not difficult if you understand the essence of the process. Any transaction is a program code, recording information in a block of the network. Payment data is characterized by volume or weight. A transaction consists of conventional 3 parts:

- Metadata – description of the transaction, service information.

- Inputs – information about where the coins came from, signatures confirming their presence.

- Output – volume and addresses for transfer.

All of the above affects the weight of the transaction. Payment is considered in satoshi for each byte of information. You can find out the average value of commissions (for example, on the monitoring site) and multiply by the volume of the transfer. Calculation of payment for a 1KB transaction at 3 satoshi/byte:

1000 bytes * 3 satoshi = 3000 satoshi = 0.00003 BTC = $1.92 (as of November 2021).

However, there are simpler methods to determine the size. Network activity is constantly changing, and factors affecting transfer fees change. When calculating manually, it is possible to make a mistake and accidentally send an inflated or insufficient fee.

Users apply such calculation services:

| Calculator website | Kuvaus |

|---|---|

| Bitaps.com. | Russian-language interface. The recommended price is specified in satoshis per byte. To convert the value to bitcoins you need to divide it by 100 million. |

| Bitcoinfees.earn.com | Selection of the unit of measurement (satoshi or bitcoin). Recommended fees for miners are highlighted in green, prioritized by time added to the block. Forecast calculations are made based on data for the previous 3 hours. Information about the number of blocks and time for the confirmation procedure is provided. |

| Calculator on the privacypros.io website | Russian language interface. Information on the size of the commission in 3 types – the optimal value for the transaction in the next, through 3 and 6 blocks recorded in the blockchain. Charts with historical data are present. |

Calculation with the help of special services should be carried out immediately before sending coins. The recommended transaction fee changes constantly under the influence of influencing factors.

What are the commissions for transactions on cryptocurrency exchanges

There are dozens of popular services for transactions with digital assets. They appeared in the last decade and by 2021 are in an active state, experiencing a period of growth on the wave of general interest in cryptocurrency. Exchanges differ in parameters, features, and approach to working with clients. Commission fees are one of the features of services for trading cryptocurrencies. Each of them has its own rules of payment for transactions.

Some crypto exchanges may have different commission costs for different categories of users – makers or takers. The former add liquidity by placing limit orders. Takers change cryptoassets at the current price. Liquidity (the amount of money available) is reduced in this process. Therefore, takers usually pay more. Other services set the same rules for all traders.

The price for withdrawing bitcoins from the exchange usually costs higher than the similar value in the blockchain. This is due to the fact that, in addition to fees for miners, the crypto platform takes some of the money to itself. In addition, the increased commission can be set in the interests of the clients themselves. The higher the value, the faster the user will receive coins, they will not hang in the mempool. Exchange employees do not track the optimal value of the reward in real time. Therefore, the rate set by the service is selected for guaranteed confirmation of the operation in the network.

Tips and recommendations on BTC transfers

The size of commissions for small volumes can amount to a large sum. It happens that even the profit from a profitable transaction is leveled by the fee for the work of miners. Because of this, users abandon cryptocurrency in favor of fiat money or other methods of settlement.

There are different options for reducing transaction fees. The first way is to reduce the size of the fee below the recommended (by a wallet or a special service) value. This approach is possible if the speed of execution of the request is not important.

But by underestimating the size of the fee, the user risks losing time. If the fee is too small, the transaction may hang in the mempool for a long time or return with an advice to change the fee amount.

The size of the fee depends on the activity of the network. You can play on this and choose a time with minimal activity, early morning or night (the main thing is to remember the time zones). Viewing the network load is available on different services, for example, Blockchain.info. If the indicator is below average, transaction verification fees are also reduced. Otherwise, it is better not to take risks.

You should not engage in independent calculation of the indicator. Theoretically, it is possible, all the data are known. But it is better to calculate the reward with the help of special services or recommendations of the cryptocurrency exchange (wallet).

If the bitcoin rate is growing, it is better to postpone non-urgent transfers, the miners’ remuneration will also grow. You can wait until the excitement subsides and make a delayed transfer.

There are cryptocurrency wallets for Bitcoin with the SegWit feature. They provide minimal fees due to the use of the updated protocol.

The size of the fee depends on the number of inputs. The principle is that the more there are, the higher the commission costs are. For example, a user may have a couple of addresses in one wallet. In this case, the transaction will be sent from several inputs, its weight will increase. It is recommended to perform grouping. To do this, you should send coins with multiple inputs to your address. It is better to do this with a small load on the blockchain. The subsequent transaction will use only one input, the withdrawal fee (cryptocurrencies) is lower.

Yhteenveto

The fees in the Bitcoin network primarily depend on the load on the blockchain and the weight of an individual transaction. In November 2021, an average of 0.000057 BTC had to be paid per transaction.

Some methods allow you to reduce costs and optimize the work with cryptocurrency. The main thing is to remember the possible risks of losing time. If the application is unfavorable to miners, it will end up at the bottom of the mempool and can be canceled.

Usein kysytyt kysymykset

🤨 What are the pros of cryptocurrency if there are fees and delays?

Blockchain has several advantages over the traditional banking system. The amount of commission costs does not depend on the amount, it is influenced by other factors. For large transfers, the transaction cost is lower than in a bank.

❌ Can I cancel the operation if the value of cryptocurrency changes dramatically?

You can’t do anything until it’s fully completed, you have to wait for the process to complete.

🤏 Why is the fee for exchanging coins smaller than it was before?

The size of the fee depends on the load on the network. The more people who want to make transactions with bitcoin, the higher the payment for the services of miners.

💰 Why is the exchange commission higher than the optimal value indicated on the service?

The platform cares about customers, the high fee is due to the fear for the timeliness of the transaction. In addition, exchanges not only pay for the transfer services in the blockchain, but also take some of the money for their own needs.

🤔 Do all blockchains have the same approach to calculating fee costs?

Each system has its own peculiarities, but service costs are everywhere.

Wrong text? Highlight it with your mouse and press Ctrl + Astu sisään.

Kirjoittaja: Saifedean Ammous, kryptovaluutan taloustieteen asiantuntija.