The world of digital technology is diverse. Cryptocurrencies on the blockchain are only one of the areas of decentralized registries. Trading and investing in coins and poletit requires experience, analytical tools, constant monitoring of the market and situation. There are passive methods of earning money that are based on älykkäät sopimukset. These are lending, panostus and other methods that involve transferring funds to other users and platforms to manage for a while. Investing in startups is also earning from smart contracts. The initial coin offering is used for crowdfunding – raising funds and developing a project.

What is a smart contract

It is a mechanism of interaction between counterparties described in a programming language. Smart contracts are recorded in the blockchain and serve as a guarantee of automatic fulfillment of conditions. They eliminate fraud and increase trust.

Smart contracts were developed after the development of the Ethereum blockchain. The first bitcoin cryptocurrency and its network do not provide conditions for writing applications. Buterin chose a Turing-complete programming language – Solidity. It allows the creation of complex smart contracts. Ethereum blockchain for 2022 leads by a large margin in terms of blocked funds, the number of applications based on it.

For correct execution, you need to correctly describe the conditions. For this purpose, mathematical algorithms and program code are used. The criteria for classifying smart contracts are summarized in the table.

| Parameters | Varieties |

|---|---|

| Environment | Centralized, distributed |

| Level of anonymity | Open (fully or partially), confidential |

| Mechanism | Limited, preset |

There is also a division by the level of automation:

5020 $

bonus uusille käyttäjille!

ByBit tarjoaa kätevät ja turvalliset olosuhteet kryptovaluuttakaupalle, tarjoaa alhaiset palkkiot, korkean likviditeetin ja nykyaikaiset työkalut markkina-analyysiin. Se tukee spot- ja vivutettua kaupankäyntiä ja auttaa aloittelijoita ja ammattimaisia kauppiaita intuitiivisella käyttöliittymällä ja opetusohjelmilla.

Ansaitse 100 $-bonus

uusille käyttäjille!

Suurin kryptopörssi, jossa voit nopeasti ja turvallisesti aloittaa matkasi kryptovaluuttojen maailmaan. Alusta tarjoaa satoja suosittuja omaisuuseriä, alhaiset palkkiot ja kehittyneet työkalut kaupankäyntiin ja sijoittamiseen. Helppo rekisteröityminen, nopea transaktioiden nopeus ja luotettava varojen suojaus tekevät Binancesta loistavan valinnan kaiken tasoisille kauppiaille!

- Fully.

- Partially.

- Automated in storage.

The need for a paper medium is taken into account. Smart contracts are used in different spheres of economy, business, management:

- Healthcare.

- Banking, finance.

- Electoral process.

- Logistics and others.

Smart contracts proved their effectiveness on the example of initial coin offerings (ICO). Developers prescribe the following conditions, which the program performs automatically:

- Recording the addresses of investors.

- Distribution of the required number of tokens depending on the amount of the contribution.

- Legitimacy control.

Sometimes token remnants after the ICO are burned to increase the value of the asset. This condition can also be written in the code for automatic fulfillment after the end of the procedure.

The advantage of the technology is to increase people’s trust. Ways to earn money are related to the transfer of coins, fiat and other valuable assets for a while. Smart contracts automate the accrual of profits, return of funds. To their advantages can be attributed:

- Avoimuus

- Immutability

- Predictability.

The main directions of earning on smart contracts are given in the table.

| Method of earning income | Ominaisuudet |

|---|---|

| Lending (lending) | Transfer of part of the funds in cryptocurrency at interest. The recipients of the loan are other users or the cryptocurrency exchange (increasing liquidity). Smart contract locks funds, it prescribes the terms of unfreezing. |

| Staking | This method is possible in networks with a Proof-of-Stake (PoS) mechanism. Users block a part of the assets in the smart contract, maintain the operability of the blockchain, receive rewards, participate in management. |

| Farming | The method consists of lending and staking. The difference is the redistribution of assets to improve efficiency. |

| ICO | Attracting investment to promote a new project. The user gives part of the funds, receives tokens. The income is in the growth of cryptocurrency, discounts on the product (if the startup is promising). |

Income depends on the number of tokens that the user provides to the platform. Interest rates are different on each platform.

Despite the apparent safety and advantages of smart contracts, there are risks of such earnings. They are associated not with the software part, but with the human factor. Projects can turn out to be fraudulent, after collecting investments, the startup simply disappears with the money. An error or false information is introduced into the code in advance, which will allow attackers to withdraw funds and hide.

How to choose a smart contract project to earn money

Any investment is preceded by a complex verification procedure. You can’t just send money to a smart contract without knowing who wrote it and for what purpose. If it happens on a top platform or cryptocurrency exchange (many of them provide passive income opportunities), then the issue of trust is eliminated. But you should not trust unknown projects without analyzing them.

The work of any service or application is aimed at profit. There are no altruists, the team invests money, effort and time to come up with an idea, write the software part, and organize marketing. At the same time, there is a probability of fraudulent actions of the organizers, which will lead to the loss of investors’ investments.

The type of project does not matter, in any case you need to secure your money. The minimum required set of verification includes:

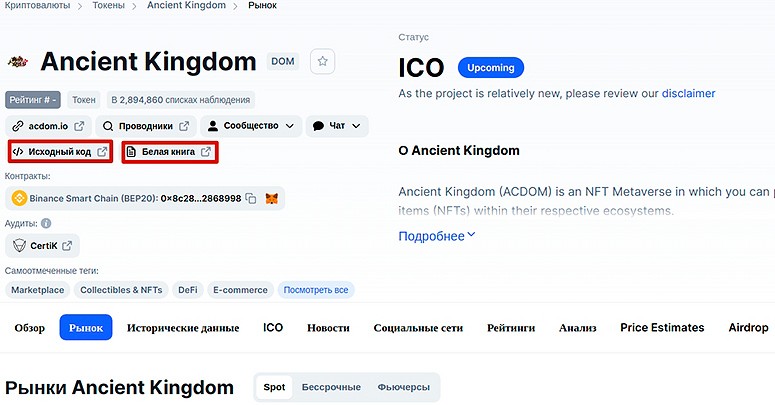

- The results of an independent audit.

- Checking the publicity of the code.

- Conditions of participation.

- Marketing.

- Term of employment (history).

- The team.

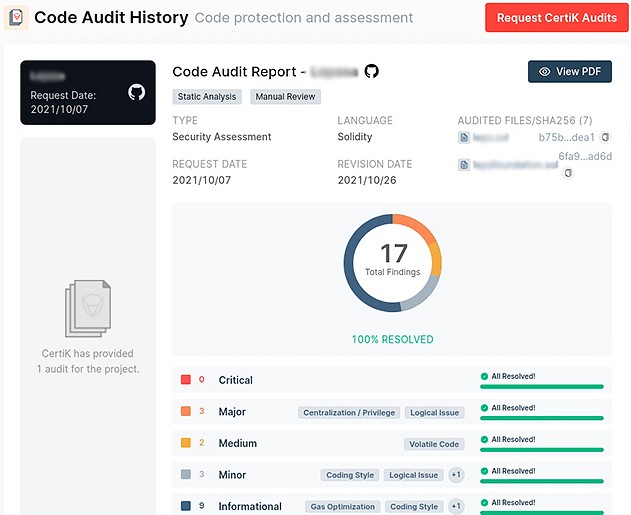

Independent audit

Honest business owners order an audit from third-party companies. The results of the audit are posted in free access. This is a confirmation of the honesty of the project, absence of errors in the code, fraudulent intentions.

If the team did not conduct an independent audit or hides the results, you should think about it. It is not necessarily fraudsters, but it is better to protect your assets and find another use for them.

The mere presence of an audit report on the site should not stop a potential investor. It is necessary to carefully study the materials, pay attention to:

- The essence of the audit. What the auditor reviewed and described in the report.

- Who was involved to study the documentation. The identity of the auditor, his prominence.

- Presence of the audit report on the website of the project and the company that conducted the assessment. It is quite possible to cheat when the developer faked the audit report and posted it at their place. There was nothing on the company’s website, they didn’t even know about the fact of the audit.

Auditors are human beings who can make mistakes, miss important points in the program or conditions.

Checking the publicity of the code

Projects put the program part in the public domain, for example, on GitHub. This is necessary to be able to check the code for errors, vulnerabilities. It is necessary to know the programming languages and peculiarities of application development.

In addition to Ethereum, there are other blockchains. They differ in programming language, algorithms, and other features.

A closed project should already alert a potential investor. It means that the developers are hiding something, do not want to show the public. This is at least suspicious, it is worth taking a closer look.

Terms of participation

Program code and technical documentation of the startup – this is not all that a potential investor should be interested in. It is necessary to check the terms of participation, assess them from the point of view of profitability and prospects. Startups attract investments for development. If there are no plans, then in the future there will be no return for investors either. At best it is a HYIP-project, at worst – scam. Fraudsters can collect funds from gullible investors and close the startup, taking investors’ money.

Separately, it is worth mentioning HYIPs on smart contracts. These are ordinary financial pyramids, each new user is a source of income for previous participants up to the organizers. Smart-contract provides trust, excludes the human factor in the distribution of profits. Such projects are not real sources of income on the blockchain. They are more fraudulent ways to earn money.

Marketing

Promotion of the project affects the speed and volume of fundraising. And from this depend on the output on the working mode, development and return – profit of investors, payment of dividends. Advertising takes place in social networks, on specialized forums, thematic media. Everything is determined by the budget and the desire of the owners to promote their development. The lack of marketing indicates an “empty shell”, in which no one will invest, and it will not bring dividends in the future. Tokens of such a service are worthless, they can not even be sold.

List of deposits

Openness is the main chip of any honest project. If the developers hide information about the collected amount, the data on the deposit is encrypted, then you should not contact the company. You can not get income here, but you can lose money.

Professional team

The website should have information about the founders of the startup. Without complete information about the people to whom the investor is going to entrust his money, it is not worth even considering the company as a source of income.

Examples of projects

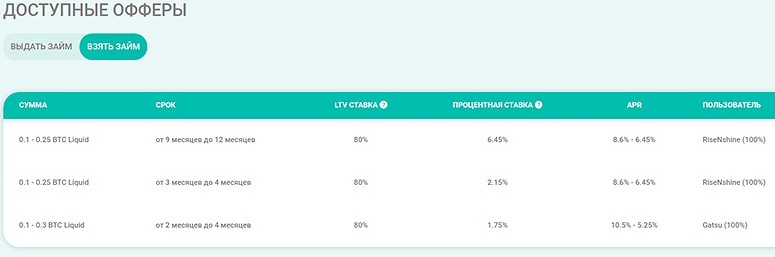

Each direction of earning money on smart contracts contains many options to choose from. Examples of stock lending platforms:

These are all examples of stockbroker lending platforms. Different types of deposits are available: floating or fixed rate, stock, dynamic, static, market. Each stock exchange offers different options.

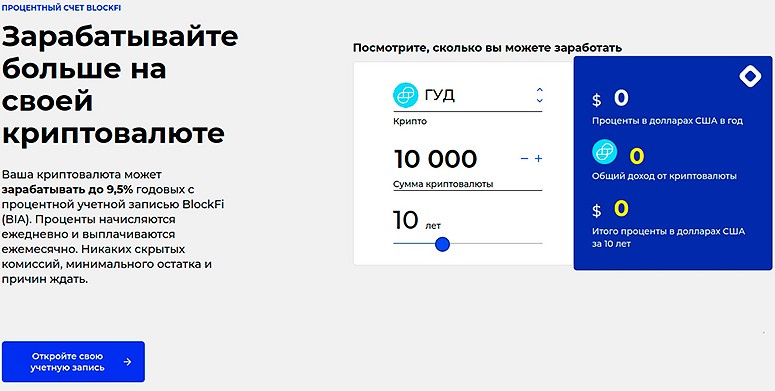

In addition to trading platforms, there are lending platforms:

- Blockfi

- Nexo

- Celsius network and others.

Platforms are intermediaries between users. Some act as lenders, others as borrowers.

Lending on exchanges and lending platforms is different. The former provide access to trading and other sources of income. Exchanges themselves borrow, raising liquidity. Lending platforms more often insure depositors’ funds.

Liquiditykaivostoiminta is another example of making money from smart contracts. Exchanges borrow from their customers to raise assets. In return, they provide project tokens, which the owner sells.

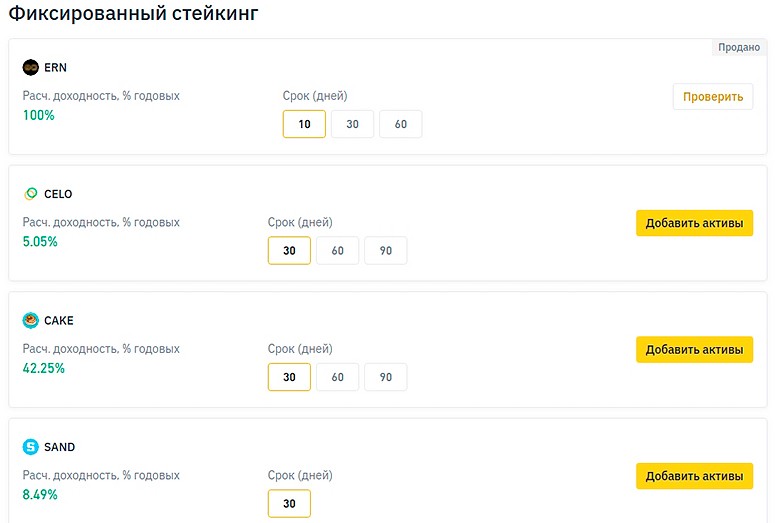

It is possible to make money on steaking with cryptocurrency that supports the PoS algorithm and other similar methods of transaction confirmation. There are exchanges, wallets or decentralized applications for this purpose. Popular cryptocurrencies for steaking:

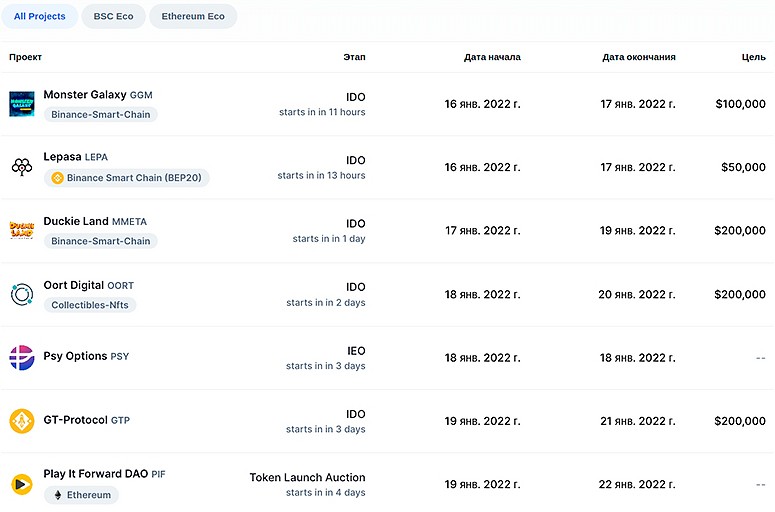

Making money from an ICO is simple. You need to identify a project, the potential of which will allow you to make a profit in the future on the growth of the rate of the asset, invest money. It is better to participate in the early stages of the ICO. There is a higher probability of income, discounts of up to 70%. It is necessary to conduct a comprehensive analysis, understand at what stage to contribute assets. The main risks of earning money on the ICO:

- Low prospects of the selected project.

- Volatility of assets, the token can fall in price following the market.

- Scam. Fraudsters also want to earn money, create pseudo-startups, the purpose of which is to collect money.

To get money as a result of the activities of scammers is unrealistic. There are few such examples.

Algorithm of actions when investing

Before investing in passive earnings on smart contracts, you need to carefully analyze the options and choose a safe one. A simple principle applies here – projects with high income are high-risk and vice versa. A balance between the willingness to lose cryptocurrency and the desire to earn a lot is important.

Large platforms (exchanges, lending services, DeFi applications) are safer than unknown startups.

There are risks, for example, of a hacker attack. The exchange can lose its money and clients. It is very difficult to get them back.

The algorithm of actions when choosing a crowdsale is simple:

- Determine the relevance and prospects of the startup.

- Study documents, team, audit acts.

- Choose a platform for investment.

- Read reviews on thematic forums, including contributors who have already invested.

Among the examples of profitable ICOs, whose investors have made a lot of money: Polkadex (DeFi exchange), OMG (platform for access to financial services), TRX (platform for content exchange) and others.

Yhteenveto

Smart contracts are a promising technology that provides blockchain and distributed ledgers with a great future. There are already entire industries where serious funding is being put into budgets for project implementation. In addition to lending, steaking and other passive income options, programmers can earn money on smart contracts. After all, blockchain is code. To create applications, implement them in enterprises, government agencies, financial organizations, you need experienced professionals with knowledge of the relevant languages.

Usein kysytyt kysymykset

❓ How do I detect scam in an ICO?

This is difficult to do, especially for a non-specialist. You need to scrutinize the technical documentation provided on the site, gather information about the team, creators, invite third-party experts for evaluation.

🧾 What is a white paper?

White paper is a white paper, a document where developers talk about the product.

❗ Can fraudsters use smart contracts in their schemes?

This is program code that people create. If there is intent, it is possible to knowingly prescribe malicious intentions in the terms and conditions and deceive users. Therefore, it is recommended to analyze the technical documentation of the project.

📐 Is a HYIP on a smart contract a pyramid?

By signs, it corresponds to the description of an investment scam. The creators promise fabulous profits to depositors, which are paid from the contributions of the next participants. At one point, the project closes, and investors are left without funds.

💰 What kind of earnings is the most profitable?

According to the combination of aspects, liquidity pools and lending are more profitable.

Virhe tekstissä? Korosta se hiirellä ja paina Ctrl + Astu sisään.

Kirjoittaja: Saifedean Ammous, kryptovaluutan taloustieteen asiantuntija.