The main way to make money from the exchange of digital assets is speculative trading. Traders purchase tokens and coins for the purpose of further sale. But this is not the only method. Online scanners for cryptocurrency arbitrage allow you to earn income from the difference between the exchange rates of assets on one or more platforms. In this case, the trader’s profit does not depend on the market situation. In addition, scanners allow you to receive income almost instantly, since the user does not need to wait for the price of the asset to rise or fall. Therefore, bots for arbitrage are popular among beginners who are not ready to understand the intricacies of market analysis of cryptocurrencies.

The principle of operation of scanners

Cryptocurrency arbitrage in simple words is reselling at the best price. The trading rate of assets is formed based on the balance of supply and demand. The more buyers in the market, the higher the quotes. But since crypto trading is conducted simultaneously on many exchanges, the rates of tokens and coins on different platforms are different. This feature can be applied to earn money on arbitrage of digital currencies:

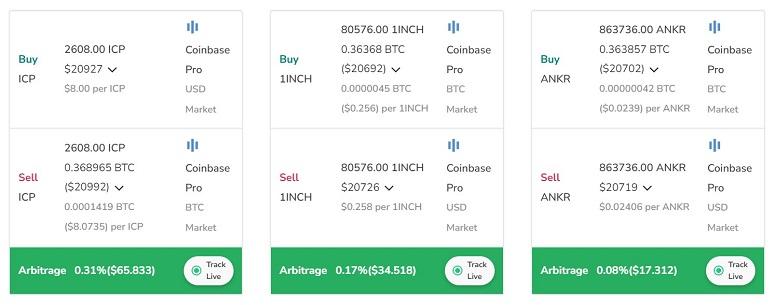

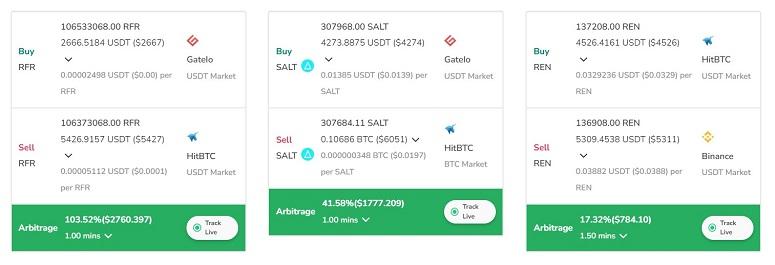

- A trader manually or with the help of an app finds 2 exchanges where the price of a crypto asset differs.

- The coin or token is purchased on the platform with the lowest exchange rate.

- The digital currency is transferred to the crypto exchange with the best quotes.

- The asset is sold at a more favorable price for the trader.

In addition to classic arbitrage, there is a more complex method – exchange triangle (triangle arbitration). In this case, the trader earns on the difference of quotes of several trading pairs within one crypto platform.

The principle of operation of intra-exchange arbitrage can be considered on such an example:

- A trader, analyzing the quotes of one of the platforms, notices that on it the bitcoin-to-stablecoin USDC exchange rate is 57,000. At the same time, 58,000 Tether tokens can be obtained for 1 BTC.

- Since both USD Coin and USDT have a fixed value expressed in American dollars at a 1:1 ratio, the disparity in the quotes of the 2 trading pairs is noticeable.

- A trader buys 1 BTC for 57,000 USDC.

- Simultaneously, the user sells this bitcoin, receiving 58,000 USDT in return.

Since the Tether to USDC exchange rate is about 1:1, the trader’s earnings are about $1000 (excluding trading commissions). Scanners for in-exchange cryptocurrency arbitrage allow you to find such opportunities automatically. The algorithm reconciles the quotes of the sites and identifies the disproportion between the value of different assets. The trader only needs to make a deposit to the crypto exchange and fill out an order form.

5020 $

bonus uusille käyttäjille!

ByBit tarjoaa kätevät ja turvalliset olosuhteet kryptovaluuttakaupalle, tarjoaa alhaiset palkkiot, korkean likviditeetin ja nykyaikaiset työkalut markkina-analyysiin. Se tukee spot- ja vivutettua kaupankäyntiä ja auttaa aloittelijoita ja ammattimaisia kauppiaita intuitiivisella käyttöliittymällä ja opetusohjelmilla.

Ansaitse 100 $-bonus

uusille käyttäjille!

Suurin kryptopörssi, jossa voit nopeasti ja turvallisesti aloittaa matkasi kryptovaluuttojen maailmaan. Alusta tarjoaa satoja suosittuja omaisuuseriä, alhaiset palkkiot ja kehittyneet työkalut kaupankäyntiin ja sijoittamiseen. Helppo rekisteröityminen, nopea transaktioiden nopeus ja luotettava varojen suojaus tekevät Binancesta loistavan valinnan kaiken tasoisille kauppiaille!

| Method | Edut | Haitat |

|---|---|---|

It is important for beginners to remember that arbitrage strategies are not without disadvantages. In particular, unlike classical trading, the profit from each transaction is usually limited to fractions of a percent. At the same time, the user risks losing his deposit if he does not have time to complete all transactions before the quotes change.

The best scanners for cryptocurrency arbitrage

Earning on the difference of exchange rates attracts traders with seeming ease and safety. In fact, many arbitrage finder services advertised on the Internet are created to deceive gullible beginners. These sites and applications may provide outdated, inaccurate quotes or contain malware altogether. To avoid being cheated, crypto traders try to choose scanners verified by other users. Currently, the list of the best bots and resources for arbitrage digital currencies includes:

- ArbitrageScanner – A paid service, but by far the best scanner for cryptocurrency arbitrage between CEX and DEX. Supports over 50 regulated exchanges, through support you can connect any marketplace for tracking. The only scanner to date that tracks arbitrage spreads between 40 blockchains for any coin and over 25 DEX. With support you can connect any blockchain to monitor, fully manual bot.

Price – from $70 per month, but users pay for a product that has no analogues on the market. Convenient admin on the site, all trades are sent to Telegram with updates every 4 seconds even on blockchains. Also the service provides free training and cases to all clients of the service.

- ArgoP2P. This is a paid service, but you can get a 10% discount with the promo code CRYPTOARGO. The combination of symbols must be entered after registering an account in the “Profile” section. The scanner allows you to find the most relevant bundles with the best spread via P2P. 10 national currencies, 5 exchanges (Binance, OKX, Bybit, Huobi, Gate.io) and 7 assets (BTC, USDT, BUSD, BNB and others) are available. You can set up a filter to reduce your time searching for bundles with high spreads. Also, ArgoP2P updates data about tokens and exchanges every 5 seconds. This allows you to receive only liquid offers and filter out fraudulent coins.

- Bitsgap. A cross-exchange platform that allows you to send bids to different venues from one terminal. The project was launched in Estonia in 2018. In addition to arbitrage operations, trading robots with different settings are available to users. Subscription to the service is paid: the price of monthly use was from $22.

The disadvantages include the lack of a list of current exchange offers. Crypto traders need to independently search for platforms with optimal rates of tokens and coins.

- Coygo. Scanner for cryptocurrency arbitrage (interexchange). Allows you to find trading pairs, quotes for which differ from the market average. To work requires the installation of a desktop or mobile version of the application. Subscription to the service is paid, rates start from $1 per day.

- TriangularArbitrage. An open-source bot. Tracks quotes on Binance and generates recommendations for intra-exchange strategies. The bot’s source code is available in the GitHub repository (file storage). As a thank you, the creators of the project ask to register on the crypto exchange using the referral link.

- Coingapp. A mobile application for searching inter-exchange arbitrage opportunities, compatible with iOS and Android operating systems. Connection via an automated interface (API) to accounts on 38 crypto exchanges, in particular CEX.IO, Binance and KuCoin, is available. The application has Russian language.

- Cryptohopper. A bot for automated trading. The application functionality includes tools for classic and intra-exchange arbitrage. The subscription price starts at $49 per month.

Kirjoittaja: Saifedean Ammous, kryptovaluutan taloustieteen asiantuntija.