Etherium is a popular blockchain project that is used as a payment system and a medium for decentralized applications (dApps). Between January and November 2021, the ETH coin rate increased by about 561%, reaching a record high of $4864. Against this backdrop, the launch of Ethereum futures was an expected event that allowed large traders and investment funds to invest in cryptocurrencies. Butderivatives trading can also interest beginners. It allows you to use leverage and make a profit during a drop in quotes.

What are futures

Derivatives are contracts (agreements), the terms of which stipulate the obligation of the parties to perform certain actions in the future. This category includes futures, options, swaps, and forward transactions.

Ethereum futures is a contract under the terms of which the seller undertakes to deliver a certain amount of ETH coins to the buyer at the time specified in the contract at a predetermined price. In some cases, instead of the actual transfer of cryptocurrency, a settlement method of execution is allowed: the exchange pays the trader the difference between the initial and final value of the underlying asset.

Why the launch of Ethereum futures is a significant event

The first cryptocurrency derivatives traded on exchanges were tied to the price of Bitcoin. The launch of Ethereum futures came later:

- In July 2016, the crypto exchange Deribit began operations. For the first few months, the list of instruments included Bitcoin futures and Bitcoin options. The launch of derivatives on Ethereum did not happen until March 2019.

- The largest cryptocurrency exchange Binance initially worked with contracts for BTC. Trading instruments with ETH appeared in November 2019. Despite similar actions by executives of other crypto platforms, the volume of transactions with Ethereum contracts remained low, as large traders and investors prefer to work on stock and commodity exchanges.

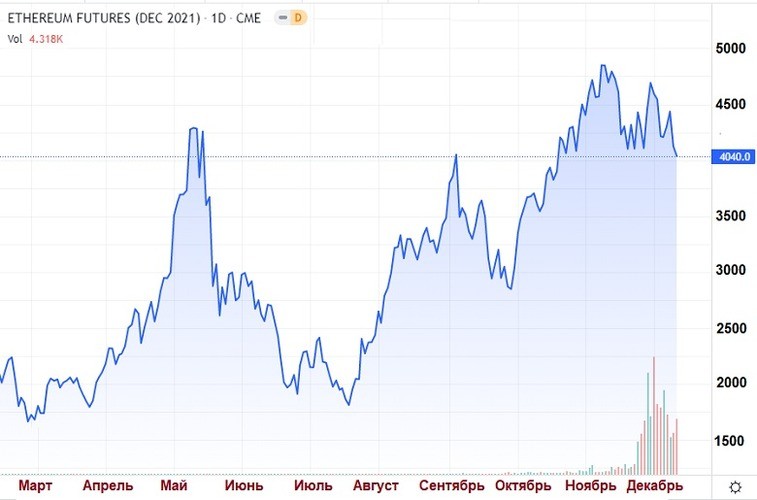

- In February 2021, the Chicago Mercantile Exchange (CME) listed settlement contracts tied to the exchange rate of the Etherium coin. The minimum transaction volume was 50 ETH.

- In December 2021, trading in Ethereum micro futures began on the CME. Each contract is concluded for 0.1 ETH.

- According to experts of the Bloomberg information company, in the first half of 2022 it is possible to start trading in shares of an exchange-traded fund(ETF), the capital of which consists of Ethereum futures.

Price determination

Digital currencies are characterized by high volatility (dynamics of quotation changes). During spot transactions (transactions on the terms of immediate delivery) traders can earn only on the growth of the price. ETH futures affect the exchange rate of the base currency. Due to leverage, traders are available large shorting transactions – operations with a forecast for a decrease in the quotations of the asset.

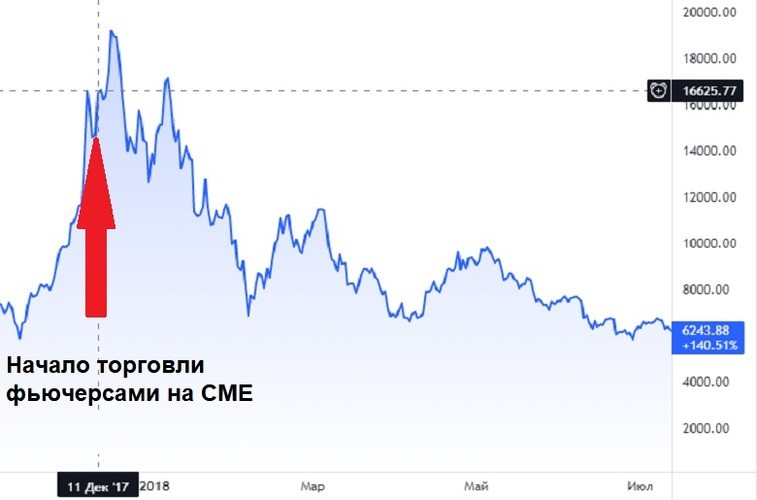

According to some experts, the long and intense fall in the Bitcoin exchange rate in 2017-2018 was caused precisely by the introduction of bitcoin futures. The emergence of derivatives tied to ethereum could have a similar impact on the market.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

ETH, ETFS

A popular investment destination for large investors is exchange traded funds. These are companies whose authorized capital consists of one or more assets, and shares (stakes) are distributed on the market similar to company shares.

In October 2021, the first ETF based on bitcoin futures was admitted to trading on the New York Stock Exchange (NYSE). Shortly after the start of trading, the BTC exchange rate on crypto platforms updated the price high.

According to a number of experts, the next step in the development of the digital currency market will be the admission of ETFs based on Ethereum futures. Experts believe that this will happen in early 2022. Moreover, according to analysts, Ethereum-ETF will be approved before regulators allow funds whose capital consists of spot cryptocurrency to trade.

A tool for large investors

Regular crypto traders trade on the spot market. This allows them to earn on the growth of quotes of digital currencies. But large traders and investors often find it more profitable to work with derivatives: options and contracts. This can be due to reasons such as:

- Trust in stock and commodity exchanges. Crypto platforms have emerged recently, their legal status is still undefined in many countries. This stops institutional clients, for whom it is important to work in the legal field.

- Opportunity to hedge risks. Holders of large volumes of tokens and coins can lose money if their exchange rate collapses. Ethereum futures reduce the risks associated with the volatility of ETH, as the current price of the underlying asset is taken into account when concluding the contract.

Forecasts on the value of etherium

In 2020-2021, the rate of ETH and other altcoins was in an uptrend. But the future prospects of the second most capitalized cryptocurrency can be affected by such factors.

| Positive | Negative |

|---|---|

| Transition to the Ethereum 2.0 protocol. The new version of the blockchain is expected to increase the speed of transaction verification and reduce energy consumption. In addition, transfer fees will decrease. | Emergence of competitors. Etherium was the first blockchain with the ability to conclude smart contracts. Later, alternative networks appeared: Avalanche, Polkadot and others. There may be an outflow of investors into new altcoins. |

| Etherium remains the base protocol for smart contracts and dApps. As the market for decentralized applications develops, the demand for ETH will increase. | Risk of global cryptocurrency market collapse. Tokens and coins have been rising for a long time on the anticipation of blockchain technology adoption. But as of 2021, cryptoassets are mostly used as speculative trading tools. This could lead to investor frustration. |

| High trading volumes on exchanges. Pairs with ETH and derivatives are available on most crypto platforms. This protects the coin’s quotes from sharp fluctuations. | Ambiguous legal status. In some countries, cryptocurrency is still not recognized as a legal tender. In addition, the authorities of China and a number of other states have imposed restrictions on transactions with tokens and koins. If crypto-assets cannot be legalized, it will lead to an exodus of large investors. |

Summary

The Chicago Mercantile Exchange has approved an Efirium futures in 2021. This derivative is similarly applied to Bitcoin contracts as a tool for self-investment and risk hedging. According to experts, the first Ethereum-ETF may be admitted to trading in 2022.

The introduction of futures and other derivative instruments increases the interest of large traders and investors in cryptocurrency. At the same time, many factors influence the exchange rate of tokens and koins, so it is difficult to guess how derivatives transactions will affect the digital asset market.

Frequently Asked Questions

🔍 Can beginners trade futures?

Yes, this instrument is available to all traders. But derivatives transactions are different from spot transactions, so beginners should study the peculiarities of trading and not risk large sums.

⌚ How long is a futures contract for?

Basically, derivatives are valid for a quarter. But there are also open-ended contracts on crypto exchanges. They can be exchanged for currency at any time.

❓ Are derivatives transactions available only on CME?

No, beginners can purchase derivatives on cryptocurrency exchanges. Stock and commodity market transactions are more often conducted by large traders.

📌 Is it safe to invest in Ethereum futures?

No, no investment instrument guarantees income. Any financial transaction can lead to losses. Therefore, it is not recommended to use borrowed or last money to invest.

💰 How much can I invest in derivatives?

The minimum limit for investment depends on the rules of the crypto platform. For example, on Binance in 2021, you can buy Ethereum futures starting at $40.

Error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.