Since 2015, millions of startups have used initial coin offerings to raise money to realize their ideas. An ICO is a type of crowdfunding used by companies that want to launch a new cryptocurrency or blockchain platform. Companies raise funds from individuals from different countries by issuing märgid in exchange for stablecoins or liquid coins (bitcoin, etherium). However, it should be remembered: it is risky to participate in the ICO of cryptocurrencies. First of all, the investor should study the mechanics of the work of this instrument.

What ICO in cryptocurrency means

Through crowdfunding platforms, investors receive unique startup tokens in exchange for their business investments. However, participating in tokenization can be a risky endeavor. Therefore, it is important to fully understand how this tool works before investing.

Purpose of ICO projects

The focus of the organizers of initial coin offerings is always on raising funding for the startup. When a cryptocurrency project wants to raise money through an ICO, it publishes a white paper and a roadmap to provide investors with full information about its plans. These documents necessarily contain goals and show the amounts needed to realize the ideas.

Investors benefit from participating in ICO projects

With the help of public coin offerings, new ICO projects raise capital. Start-ups deploy a smart contract and issue special project tokens in exchange for financial contributions from participants. These digital assets have different purposes, from access to certain services of the issuing companies to the right to receive dividends. There are 2 types of cryptocurrencies issued as part of the initial coin offering:

- Utility Tokens – holders of these units get access to the company’s products. Startups use such cryptocurrencies to raise capital to fund development in exchange for providing users with a service in the future. One example of service tokens is Filecoin. The project raised $257 million by selling a cryptocurrency that gives users access to a decentralized cloud storage program.

- Security Tokens (Security Tokens) – provide the right to own a share of the cryptoproject. When a user purchases such a unit, he or she becomes a “shareholder” and can vote on decisions related to the business.

The #1 benefit to getting involved in a cryptocurrency ICO is the potential future value of the token. Investing $10 in BTC or ETH early on would make their owners millionaires in 2023. However, it is important to understand why cryptocurrencies are rising in value.

Benefit #2 is to receive a portion of the profits for the fiscal year. This system works similarly to dividends paid to a company’s shareholders.

5020 $

boonus uutele kasutajatele!

ByBit pakub mugavaid ja turvalisi tingimusi krüptovaluutaga kauplemiseks, pakub madalaid vahendustasusid, kõrget likviidsust ja kaasaegseid vahendeid turuanalüüsiks. See toetab spot- ja finantsvõimendusega kauplemist ning aitab algajaid ja professionaalseid kauplejaid intuitiivse kasutajaliidese ja juhendmaterjalidega.

Teenida 100 $ boonust

uutele kasutajatele!

Suurim krüptovahetus, kus saate kiiresti ja turvaliselt alustada oma teekonda krüptovaluutade maailmas. Platvorm pakub sadu populaarseid varasid, madalaid vahendustasusid ja täiustatud vahendeid kauplemiseks ja investeerimiseks. Lihtne registreerimine, kiire tehingute kiirus ja usaldusväärne rahaliste vahendite kaitse teevad Binance'i suurepäraseks valikuks mis tahes taseme kauplejatele!

Pitfalls

The first and most common reason for the rise in the price of digital assets is hype. Supply and demand contribute greatly to the value of bitcoin and altcoins. Ethereum is a great example of how a cryptocurrency can significantly increase in value due to market participants’ willingness to buy the coin.

The widespread use of ETH in decentralized finance(DeFi) has caused an increase in the number of transactions of the asset on exchanges. This has led to an increase in the price of etherium.

On the other hand, ETH holders did not sell their tokens to raise its value as high as possible. This situation proves a basic economic statement: an item with high demand but low supply will rise in price. This is what happened with Ethereum.

Another factor in the rise of cryptocurrency value is its future use. A digital asset (technology) that has a chance to become a revolutionary solution will be valued more due to its high potential. However, the above reasons can also influence the fall in the price of cryptocurrency.

Excitement raises the value of a digital asset, but can also lower it very quickly. The success of the initial coin offering is not guaranteed. A startup can fail or fail to realize its plans at any time without any consequences.

Therefore, it is extremely important for the investor to study the team, their idea and the viability of the product. High ambitions are not always realized as no one can ever give a guarantee of success.

How to participate in a cryptocurrency ICO

The most common way to issue tokens for an initial coin offering is to use the Ethereum marketplace. A startup develops a smart contract on the Ethereum blockchain and investors put their money into it. There are some important details to check before participating in a cryptocurrency ICO.

Make sure that the capital is in a personal wallet and not in an exchange

When users buy cryptocurrency on trading platforms (like Coinbase), the assets go into a centralized vault. Exchanges are prohibited from sending cryptocurrency directly to crowdfunding platforms. This is because the address of the platform from which the user makes the transfer will not be able to accept the project tokens back. Centralized wallets are not owned by investors, which means that tokensale participants cannot use them to work with smart contracts.

Personal wallets are available only to the owners. They cannot be managed by third parties and exchanges. These wallets can be used when dealing with smart contracts because they are identified with a specific person. The most popular application that investors prefer to participate in ICOs with is MetaMask.

You can only send your coins and tokens to an exchange if you need to buy or sell assets. In other situations, it is safer to store cryptocurrencies in a personal wallet. In addition, large platforms are highly regulated, vulnerable to hacking or may go bankrupt.

Check the address of the smart contract

Moving cryptocurrencies incorrectly can result in their loss. The user will have no way to get their funds back. Knowing the following conditions will save a tokensale participant from losses:

- Date and time of the ICO (you need to determine the timing in your time zone).

- Conditions of participation.

- Correct smart contract address.

To make sure that the public coin offering is safe, you can follow these guidelines.

| Rule | Kuidas see toimib |

|---|---|

| Add the official ICO website to your bookmarks. | Project resources usually contain step-by-step instructions on how to participate. You should not trust any site other than the official one. |

| Subscribe to the project’s newsletter. | ICOs usually use email as a way to remind investors of the date of the event and the correct smart contract address. |

| Join the ICO’s official Telegram chat and subscribe to the channel. | These sources contain information on participating in the project. |

| Check the smart contract address with the account number posted on the official website of the startup. | If the data do not match, you can not transfer assets. It is better to inform the administrator and moderators of the channel. |

| Be careful with phishing links and fake URLs. | To prevent such situations, the smart contract address is reported on the day of the ICO, usually 1-2 hours before the expected release time. |

| Find out the date and time of the ICO. | Usually, the project indicates the expected start time on its website. But the most accurate way to get into the ICO is to determine its starting block number. |

Calculate the price of gas

When sending ETH to a smartcoin, it’s important to consider transaction fees. During a public coin offering, investors start making many transactions on the blockchain, causing the network to become congested.

If a user does not have enough funds to pay the fee, the transaction will not go through. One has to be prepared to increase the gas price for all ICO transactions.

Send cryptocurrencies in a smart contract

Initial coin offerings usually start with a specific block number rather than a designated time. To identify the blockchain element being mined on the Ethereum network, you need to go to the EthStats website.

For example, the current block number is #3,987,514. Startup A wants to launch an ICO on blockchain element #4,000,000. Hence, the time to send cryptocurrencies to the smart contract address is when the blockchain goes to block #4,000,000. An investor can also send cryptocurrency to blockchain element #4,000,005, but not before #4,000,000.

Receive tokens

If the user has successfully sent their cryptocurrencies to the ICO address, their goal has been achieved. The investor will receive the startup’s tokens immediately to his personal wallet, from which he made the payment. This will happen automatically because the action is programmed in the smart contract. When the investor receives the altcoins, he will be able to dispose of them. Some projects block their cryptocurrencies for a while to prevent a dump (collapse) of the price.

Ways to pre-sell tokens

Presale allows you to buy cryptocurrencies at a lower price. However, getting into presale is not easy. Altcoin presale comes in 2 types:

- Asset sales for venture capitalists who want to invest their money in a new cryptocurrency venture at an early stage. Such participants are given exclusive benefits that are not available in regular token trades.

- Open Presale. Allows private investors to buy tokens before they are listed on an exchange. Many cryptocurrencies are sold during a public offering.

Fixed sale

This method of token distribution uses the concept of a “hardcap” (hard cap). This is the maximum amount that a startup expects to receive as a result of the ICO. It is impossible to exceed the hardcap amount, as the number of tokens is also limited. The maximum threshold is set for two reasons:

- The issuance of supply tokens is limited.

- The limits are defined by the project roadmap. The team must explain the purpose of each amount raised and how it will be recouped.

Uncommitted sale

There is another category – the minimum fundraising limit for a public coin offering – softcap. Teams seek the smallest amount of funding to keep a startup running. There is no upper limit. If a softcap fundraiser fails, the investment is most often returned to investors. And since there are no limits, the price of the project token is determined after the ICO is completed.

Fixed auction

When the hardcap is determined, but the price per 1 token is not set, investors decide for themselves how much the asset will cost. Usually it depends on the size of the investment. If tokens are bought at a high price, the ICO cap will be reached with the lowest number of digital units sold.

Unfixed auction

Here there is no limit on the amount of investment, but participants also determine the value of their share in the startup themselves. The order of investors is set by the highest price offered.

Kuidas valida investeerimisprojekt

Investors who decide to participate in an ICO at an early stage are exposed to the risks of instability due to the hype surrounding the startup. It is important to manage your expectations about how much money you will be able to make from the initial coin offering. To do this, it’s helpful to evaluate the profit potential of a particular cryptocurrency and technology.

Learn about the project team

The developers and management of the startup should demonstrate experience and have a proven track record. The absence of this parameter can be a red flag for investors. Some ICOs are run by established companies that are looking for ways to scale.

Choose breakthrough concepts

The product or service should fulfill a real need and include revolutionary solutions. Investors should focus on concepts that disrupt the status quo in a particular industry by leveraging the strengths of blockchain.

Understand the target market

It is important to place the company, its technology, product or service in the context of the audience. Knowing the environment will give the investor an understanding of the challenges and opportunities these businesses face. For example, the application of blockchain in healthcare will have great potential because laws are being passed that require drug manufacturers to use modern record-keeping systems.

Evaluate the technology

The viability of the project needs to be analyzed. A participant will reduce risks if they examine proof of concept and pilot studies. ICOs that offer only an idea are of no value to investors compared to businesses that have tested the product.

Initial coin offerings with functioning technology have a better chance of being viable than those whose development has not yet begun.

Study the white paper and roadmap

A white paper is a presentation of a project to investors that describes it in great detail. When an initial coin offering participant reads the white paper, it will become clear to them why they can entrust their capital to the team. The quality of the content shows how well the project is prepared. It is important to pay attention to numbers and citations. If in the document the team refers to the media instead of using academic sources and expert papers, the startup is not worth investing in.

The project roadmap is an overview of the expected results. If the investor does not understand how the startup will develop, the investment will be risky.

Understand what cryptocurrency is for

In addition to determining investors’ stake in a project, digital assets often fulfill other functions related to a platform or ecosystem. Filecoin, for example, offers decentralized file storage.

Ways to mitigate investment risks

Investing in the initial coin offering is among the high-risk instruments. However, classic rules and strategies that work in all financial markets can help investors reduce risk:

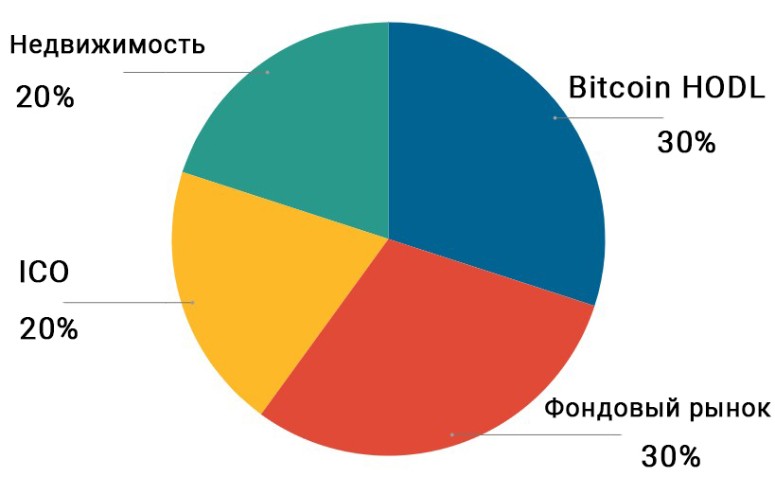

- Mitmekesisus. Competent distribution of assets in the portfolio is the most important factor of success. For example, an investor has allocated 20% of capital to participate in an ICO. If the cryptocurrency project does not bring the expected results, losses will be limited to only 20%, because 80% of the funds are allocated to other areas.

- Analyze the industry and the project. If users want to invest safely, they should look for instruments with lower risk and higher reliability (for example – stable coins or well-known platforms).

Investing in crypto projects is a constant monitoring of the market situation. At any moment something can go wrong, and then the first rule of investing – diversification – will save you.

Frequent problems of new projects

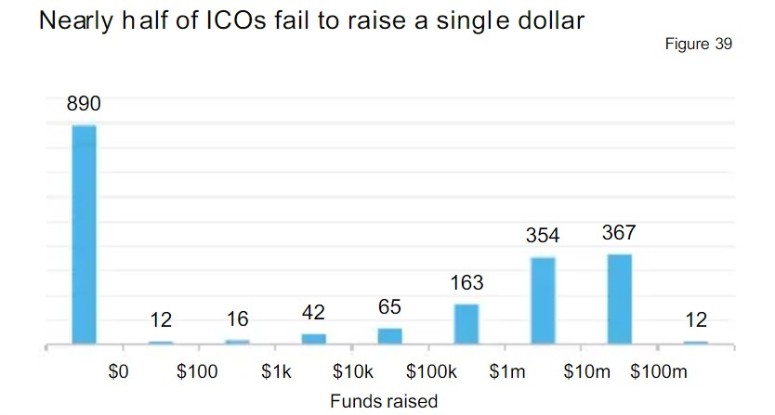

Research company GreySpark Partners studied the ICO market for 2017-2018 and found that 890 tokensails failed to attract investment. Conversely, 743 startups managed to raise $1 million in capital by launching through early cryptocurrency sales. GreySpark analysts also noted that many projects fail to deliver a positive ROI, especially over time.

Token is unnecessary

All digital currencies, especially little-known ones, are susceptible to investors intentionally changing the price. If the investor’s capital size is large enough, he or she can buy most of the project’s tokens and then try to promote the cryptocurrency’s reputation in the market and “pump up” the price. Investors who observe the support of whales (owners of large capitals) start buying up altcoins. And the more demand for the new asset becomes, the higher its price rises. If this does not happen, the token does not get sufficient kapitaliseerimine and ceases to be interesting to investors.

Counting on amateurs

Sometimes an investor participates in the initial coin offering only because the product concept is well described. But when the project hits the market, it fails to impress at all. Investors get disappointed and ask for their money back, complaining that they didn’t study the prototype right away. This scenario happens when amateur newbies invest in a hyped concept rather than a project with an alpha or beta version. Most users tend to invest in an afterthought around which there is hype, rather than funding actual products. If investors decide to participate in cryptocurrency ICOs without test editions, they are likely to fail.

Weak program code

Parity created multi-signature (multi-sign) cryptocurrency wallets to manage ETH coins. The wallets were smart contracts developed from open source code. The protocols required more than one digital signature (private key) before the etherium associated with them could be approved for transfer. In 2017, an unknown hacker stole 150k ETH (about $30 million) using the call and rollback delegation feature in a smart contract library for multi-signature wallets. All ICO participants who used Parity’s software lost their money.

Exaggerated ambitions

For any startup founder, the traditional route to funding is through business angels, private investors and large venture capitalists. Ambitious players in this field earn significant sums of money by identifying game-changing opportunities early on. If experience and aspirations are lacking, the startup fails to become viable. As a result, investors’ expectations are not met and the project makes losses.

Legal regulation

In most countries there is no legislation on ICOs. In some countries (USA, Singapore), investors are prohibited from participating in the initial coin offering. The governments of these countries define tokens as securities and call ICO a sale of capital. Problems with regulators arise because projects cannot guarantee that only accredited investors will participate in the preliminary bidding.

Large companies are hiring lawyers to resolve the situation. This is a necessary step because tokensales are very vulnerable to criminal charges. If the SEC decides to intervene, the industry will inevitably be affected.

Unsuccessful website and/or presentation

Marketing tools that don’t inspire investor confidence can cause initial coin offerings to fail. If the website or presentation has a poor layout, slow loading speed, incorrectly working forms, and the presented materials do not give full information about the product or are constantly inaccessible, users are more likely to mistake the company for a scam rather than a real startup.

Weak project promotion

There are two critical mistakes that are commonly encountered in ICOs:

- Projects are released with a small marketing budget.

- Companies end up becoming over-publicized.

In both cases, promotion can lead to the failure of the ICO. The company’s digital assets won’t make it to market. Investors will not be able to sell the tokens purchased during the initial offering and will lose the money invested in the project.

Korduma kippuvad küsimused

❓ Was Bitcoin released through an ICO?

The main cryptocurrency is developed without raising funds from the general public.

🔎 What is a smart contract for an initial coin offering?

It is a program code that manages the transfer of altcoins in the blockchain.

💻 Who determines the total supply in a cryptocurrency presale?

Typically, the development team sets a limit of tokens as part of the initial offering. The amount of cryptocurrency available for sale is determined in the white paper.

⁉ Are initial coin offering and venture capital investment the same thing?

An ICO is a public sale of cryptocurrency that startups use to raise funds for their project. Venture capitalists are large investors who buy a stake in a company and work with it on a long-term basis.

🤵 Is it possible to hedge against losses when conducting an initial coin offering?

The ICO market is poorly regulated, so it is most often not possible to compensate for damages.

Kas tekstis on viga? Märkige see hiirega ja vajutage Ctrl + Sisesta

Autor: Saifedean Ammous, krüptorahanduse ekspert.