Investors are usually divided into 2 categories: private and institutional. The second group includes large companies that invest in cryptocurrency. They can be specially created funds and corporations, whose activities are not related to digital assets. Usually, institutional investors invest a large amount of money (sometimes billions of dollars) in the cryptocurrency market. Also, shares of some corporations are listed on stock exchanges.

Top 10 companies that invest in cryptocurrency

Institutional investors were enterprisingly buying bitcoins in the summer of 2021. However, investor interest in digital assets increased even more in the fall due to increased confidence in many cryptocurrencies. Also in October, institutionalists turned their attention to altcoins. These facts provoked stability in the prices of digital assets.

Against the backdrop of increased institutional interest, the number of large investors in cryptocurrencies increased significantly. The table shows the corporations with the largest stocks of coins as of February 2022.

| Company | Description |

|---|---|

| Microstrategy, Inc. | US-based company develops mobile software and cloud services, and provides business intelligence to clients based on non-linear mathematical methods. Microstrategy made its last major bitcoin purchase on November 29, 2021. As of early 2022, the organization owns 122,500 BTC worth $5.9 billion. |

| Tesla | The corporation produces electric cars of the same name and develops solutions for energy storage. The head of Tesla is a well-known inventor in the Internet community, Ilon Musk. In February 2021, the businessman reported that the company acquired 48 thousand BTC worth $1.5 billion. A month later, Tesla sold 10% of the coins and made a profit of $101 million. At the beginning of 2021, the corporation holds 42.9 thousand bitcoins totaling $2.05 billion. |

| Galaxy Digital Holdings | This is a young holding company focused on the development of software and various systems using blockchain technology in the field of digital assets. Galaxy Digital has one of the few cryptocurrency banks under its management. The company’s director is American investor Michael Novogratz. As of early 2022, Galaxy Digital has 16.4 thousand BTC in its vaults, totaling $786 million. |

| Voyager Digital Ltd. | A young company is developing and monetizing a trading platform that will allow users to enter the digital money market through multiple cryptocurrency exchanges with just one account. Voyager Digital is backed by its subsidiary organizations. As of February 2021, the holding company holds 12.3k Bitcoin worth $590 million. |

| Block, Inc. | Previously (until December 1, 2021), the American company was called Square, Inc. The corporation works in the technological sphere to create equipment and software that will allow to accept and process electronic payments. Block was founded by Jack Dorsey (an American software architect and entrepreneur). As of the beginning of 2022, the corporation’s accounts hold 8 thousand bitcoins totaling $383 million. |

| Marathon Digital Holdings | The cryptocurrency holding company was founded by Fred Thiel. The main goal of Marathon Digital is to win the Bitcoin mining marathon. The holding plans to achieve a hashrate (number of calculations per second) of 13.3 EH/s. In early 2022, this would represent 7.7% of the total Bitcoin network. Marathon Digital envisions the goal to be reached in 7 months. As of February 2022, the holding has 7.7k BTC, which is $369 million. |

| Hut 8 Mining Corp. | The cryptocurrency related company is considered the #1 mining corporation in North America. Hut 8 focuses on Bitcoin market cycles in mining the cryptocurrency. The organization also promotes decentralized systems with high-performance computing. As of February 2022, Hut 8 holds 5.2k BTC, which is valued at $249 million. |

| Coinbase Global, Inc. | Under the management of this American organization is the Coinbase exchange, which is well-known in the cryptocurrency community. The trading platform is considered to be the largest in the United States. However, Coinbase offers other products to its clients. For example, decentralized applications (dApps) based on smart contracts and an exchange for institutional traders. As of February 2022, the organization has an investment portfolio with 4,500 BTC worth $216 million under management. |

| Riot Blockchain, Inc. | The success of the mining corporation lies in the periodic upgrading of outdated equipment. With these actions, the director of Riot Blockchain expects to influence the growth of the U.S. crypto mining market. By the 4th quarter of 2022, the company plans to increase the hash rate to 9 TH/s. By that point, the organization will receive 58.5 thousand units of Bitmain S19j – a new generation of mining units. At the beginning of 2022, the corporation owns 4 thousand bitcoins totaling $192 million. |

| Bitcoin Group SE. | The holding company invests capital in the cryptocurrency market. In 2021, the investment company is working towards innovative business models, blockchain technology and digital assets. Bitcoin Group SE focuses on bitcoin trading. The company’s investment decisions are based on strategic capital management, coordination and control. As of February 2022, Bitcoin Group SE holds 4 thousand BTC equivalent to $192 million in its accounts. |

Best stocks of cryptocurrency companies

In the realm of virtual assets, investing in coins and tokens is considered optional for generating profits. Digital network participants can invest in the securities of cryptocurrency-related companies. However, before investing in the shares of projects, it is worth analyzing them.

As of the beginning of 2023, there are a number of cryptocurrency companies whose securities have growth prospects:

- Binance.

- Coinbase.

- CME.

- Marathon Digital.

- Riot Blockchain.

- Voyager Digital.

Binance

Changpeng Zhao is building an international ecosystem based on blockchain. Some members of the professional community consider Binance to be the No. 1 infrastructure provider for the virtual money industry. The company emerged in 2017 along with a digital asset trading platform of the same name. As of February 2022, Binance ranks second in the ranking of cryptocurrency exchanges in terms of average daily trading volume.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Officially, the organization has not issued securities. However, Binance has its own exchange token BNB. Investors apply it to pay for the services of the trading platform and use it as a financial instrument to reduce risks. In February 2022, Binance Coin is traded on the US stock exchange NASDAQ. However, it is also possible to buy BNB through digital trading platforms.

Coinbase Global, Inc.

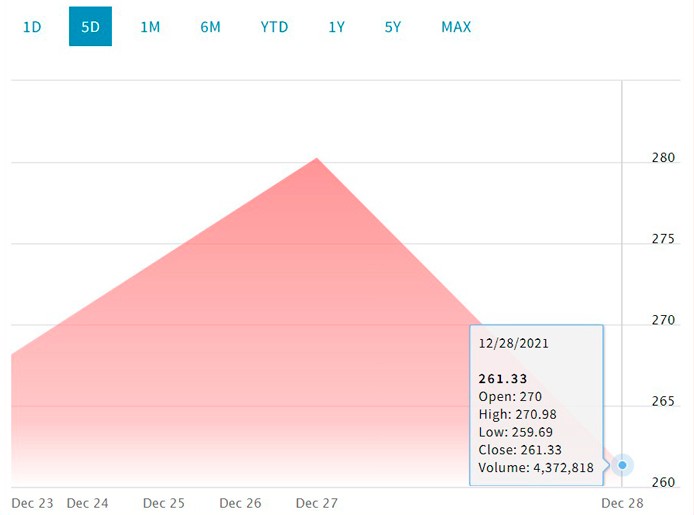

The American company operates a cryptocurrency exchange of the same name. In April 2022, Coinbase Global, Inc. announced the direct listing of its own shares on NASDAQ. This means that the securities are pre-sold to the first investors. The value of COIN shares at the opening of trading amounted to $381. Later, the price reached the mark of $429. But by the end of 2021, the quotes fell to $261.3.

At the start of trading COIN increased the total capitalization of the company to $100 billion. This caused controversy in the cryptocurrency community. Many believed that the figure was overstated. According to the financial information portal MarketWatch, the fair capitalization of Coinbase should be about $19 billion.

CME Group, Inc.

A group of cryptocurrency-related companies, is considered the largest options, futures and derivatives marketplace in North America. CME Group came into existence in 2007 through the integration of several businesses. It includes:

- Chicago Mercantile Exchange (CME).

- New York Mercantile Exchange (NYMEX).

- Chicago Board of Trade (CBOT).

As of February 2022, the CME also works with cryptocurrencies. Through the exchange, investors can utilize the Bitcoin-ETF financial instrument and micro-Ethereum futures.

The company has equity securities with the CME ticker symbol. They were officially listed on NASDAQ in early 2012. In 9 years, CME Group shares have grown by 355%. At the end of 2021, the securities were trading at $229.02.

Marathon Digital Holdings

Previously, the holding company was called Marathon Patent Group and worked with patents. In March 2021, the company changed its name and area of activity. Marathon Digital was engaged in mining of cryptocurrencies.

The listing of the company’s shares with the ticker MARA was successfully conducted in July 2013 on the NASDAQ stock exchange. At the opening of trading, the price of the asset was $56.4. But after a sharp jump to $149.5 at the end of 2014, the value began a prolonged decline. The price even dipped as low as $0.5 per share. It wasn’t until Marathon Digital rebranded that MARA’s value began to rise. At the end of 2021, the price was $35.1 on average.

Riot Blockchain, Inc.

Corporation was founded in 2000. However, according to information from open sources, Riot Blockchain engaged in bitcoin mining only in 2013. The first batch of Bitcoin mining equipment was purchased with funding from early investors. The company went public in January 2012. At that time, shares with the ticker RIOT were successfully listed on NASDAQ.

The opening price of trading was $46.6. However, it was impossible to call the corporation successful until early 2021. For a long time, RIOT’s asset value only fell. The lowest point on the chart ($0.67) was reached on March 23, 2020. In December 2021, RIOT was already trading at $23.2.

Voyager Digital Ltd.

Shares of the cryptocurrency company with the ticker VYGVF were listed on NASDAQ in January 2012. At the opening of trading, the value of the asset was equal to $3.89. However, by August 2018, the price had dropped to $0.0001. At the end of 2021, VYGVF showed a rapid growth of 260k times (up to $26). At the beginning of 2023, the asset was trading at $13.8 on NASDAQ.

The top 5 startups utilizing blockchain

By early 2023, digital blockchain technology has become very popular. Hundreds of cryptocurrency-related companies use blockchain in their projects. The following startups are worth highlighting:

- Solana.

- Terra.

- Avalanche.

- Axie Infinity.

- Solve.Care.

Solana

The digital project was founded in 2018. Solana has its own cryptocurrency with the ticker SOL. The creators of the platform are:

- Anatoly Yakovenko – a Ukrainian employee of Qualcomm wireless communications development corporation.

- Greg Fitzgerald – founder of the BREW platform, focused on creating mobile applications.

- Eric Williams is a doctoral candidate in particle physics.

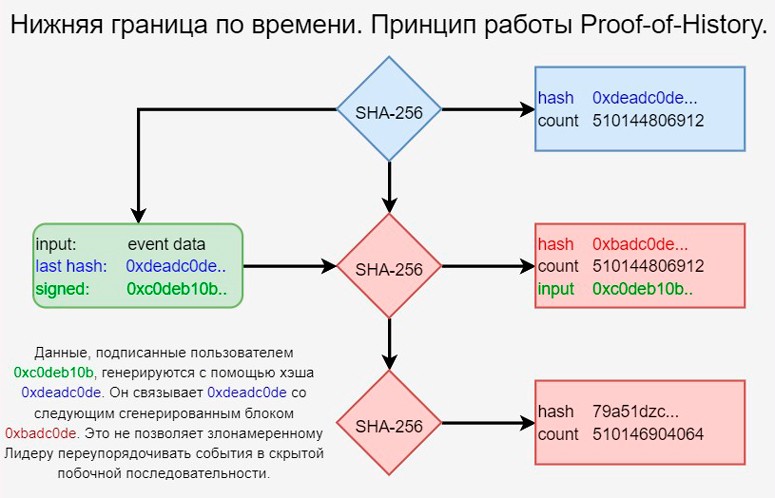

The founders put together a team of experienced developers from major IT companies like Microsoft, Google, and Apple. The hired programmers created a new protocol for the Solana project – the Proof-of-History (PoH) consensus algorithm. It allowed to realize high fault tolerance of the network even under a massive attack from intruders.

At the end of 2021, Solana presents a strong competition for Ethereum. The project develops a platform for deploying decentralized applications and fast smart contracts. At the beginning of 2023, the Solana system processes much more transactions than Ethereum – 50 thousand transactions per second.

Forty-seven months after its creation, the SOL cryptocurrency has reached the third place in terms of market capitalization (total price of issued koins) among all virtual assets.

Terra

The leaders of the project are developers from Terraform Labs:

- Doo Won.

- Daniel Shin.

The project was founded in 2018 on its own blockchain. The main idea is to create an efficient payment system. The platform is based on decentralized technologies that allow cheap and fast international transfers. Terra (LUNA) cryptocurrency circulates in the system. It is used by the participants of the network as a payment unit.

In January 2022, Terra surpassed the Binance Smart Chain in terms of total blocked value. Its TVL amounted to $17.62 billion. This made the network the second largest after Ethereum.

In 2023, the Terra digital project is an ecosystem with more options. Here’s what the platform can do:

- Provide stablecoins. These are cryptocurrencies that are backed by traditional assets. For example, the USDT coin is backed by the US dollar.

- Maintain stablecoin quotes. Due to increasing demand, the value of virtual coins usually increases. To keep parity (equality) between the prices of stablecoins and secured traditional assets, an elastic supply mechanism that automatically adjusts the required number of available coins, and other solutions are used.

- Operate smart contracts. This technology is at the heart of the virtual Terra project.

- Operate oracles on the blockchain. This is the third side of the Terra system. Their function is to relay the right information to users from the network.

Avalanche

The digital platform was created in 2020 by the cryptocurrency company Ava Labs. Within the ecosystem, the Avalanche coin (AVAX) functions. The main idea of Ava Labs is to develop a platform for enterprise blockchain deployment. The ecosystem allows dApps to be quickly migrated from the Ethereum network to Avalanche.

The project also has a community-oriented platform. It is called Avalanche Hub. There, community members and token holders can be rewarded for contributing to research and engineering initiatives for the ecosystem.

At the beginning of 2023, AVAX has cemented itself in the top 10 capitalized cryptocurrencies. The asset has an average daily trading volume of $41.55 billion with a coin price of $106.

Axie Infinity

The project is developing a fantasy video game of the same name based on NFT token technology. Axie Infinity has also released its own cryptocurrency AXS.

Within the game universe, users must breed pets. They have to pay 0.005 ETH and a transaction fee per breeding.

In Axie Infinity, players breed offspring and fight in the arena with other participants. It is possible to activate the Adventure mode. The user will be offered to go through 36 levels. On each of them it is necessary to win a card battle against different monsters under the control of artificial intelligence (AI).

Solve.Care.

In 2017, the project started working on a decentralized ecosystem to enable enterprise blockchains in healthcare. The network is called Care.Networks. It allows medical centers to control their services.

Solve.Care tokenizes 5 main aspects of healthcare:

- Patient identities.

- Medical records.

- Patient consent for data processing.

- Payments for healthcare services.

- Transactions between clinical centers and patients.

SOLVE cryptocurrency circulates within the Solve.Care ecosystem. It is used by users for different purposes: paying network fees or creating a wallet within the platform.

In 2019, Solve Care was awarded for the most innovative blockchain project at the Blockchain Life 2019 forum in Singapore.

Summary

Investors are divided into private and institutional investors. The second category includes large corporations that typically invest large sums of money in financial instruments. As of early 2023, Microstrategy is considered to be the most significant institutional investor in Bitcoin. The company has 122.5 thousand bitcoins in its accounts. The total amount of savings is $5.9 billion.

It is possible to earn on virtual money without investing in it. To do this, you need to invest in shares of companies related to cryptocurrency. In February 2022, the securities of Coinbase Global, CME Group are available to users. However, investing in the virtual assets themselves is also profitable. Only the best startups should be chosen for investment. In 2023, for example, Solana and Axie Infinity are considered as such. But it is better to rely on your own opinion and choose projects based on your personal preferences.

Frequently Asked Questions

💰 Why do companies invest in cryptocurrency?

The main purpose is to earn money on investments. Investments in digital currencies bring high returns. However, such transactions are accompanied by high risks.

❔ Why do institutional investors choose virtual money for investment?

Investors see cryptocurrency as a financial instrument for saving capital.

❗ How many cryptocurrencies can be bought through NASDAQ?

As of early 2023, 20 digital assets are traded on the stock exchange: BTC, ETH, XRP, BCH, ADA and others.

📊 Why would cryptocurrency businesses list shares on NASDAQ?

The securities attract additional funding. It allows corporations to strengthen their position in niches they occupy.

✅ What to look for when investing in digital currencies?

One of the main criteria is the ideas invested in the project. It is also important to consider the prospects of their realization by the developers.

A mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.