The Bitcoin network accounted for more than 90% of the total market kapitaliseerimine for 8 years. In 2017, this figure dropped sharply to 40%. Part of the capital began to flow into other coins. The altcoin 2024 season is periodically repeated. Then investors begin to actively invest not only in bitcoin.

What is the altcoin season

In total, there are more than 7,000 coins on the market. A few years after the launch of the Bitcoin network, other cryptocurrencies began to appear. Most of them copied the code of the first coin to varying degrees, so they received the name “altcoins” (from English alternative coins).

Not all developers were engaged in repetition. There are enough assets with a unique code on the market, nevertheless the name of altcoins is forever fixed for them.

The emergence of more technologically advanced cryptocurrencies has led to increased competition. The altcoin season usually refers to a decrease in bitcoin’s dominance in the market, with other märgid closing the gap in terms of capitalization size.

Reasons for active coin growth

Investors are paying attention to altcoins for the following reasons:

5020 $

boonus uutele kasutajatele!

ByBit pakub mugavaid ja turvalisi tingimusi krüptovaluutaga kauplemiseks, pakub madalaid vahendustasusid, kõrget likviidsust ja kaasaegseid vahendeid turuanalüüsiks. See toetab spot- ja finantsvõimendusega kauplemist ning aitab algajaid ja professionaalseid kauplejaid intuitiivse kasutajaliidese ja juhendmaterjalidega.

Teenida 100 $ boonust

uutele kasutajatele!

Suurim krüptovahetus, kus saate kiiresti ja turvaliselt alustada oma teekonda krüptovaluutade maailmas. Platvorm pakub sadu populaarseid varasid, madalaid vahendustasusid ja täiustatud vahendeid kauplemiseks ja investeerimiseks. Lihtne registreerimine, kiire tehingute kiirus ja usaldusväärne rahaliste vahendite kaitse teevad Binance'i suurepäraseks valikuks mis tahes taseme kauplejatele!

- Technology. Fundamentally, some cryptocurrencies turn out to be more functional. They can be used not only for transfers, but also to build ecosystems on their basis. A good example is Ethereum – arukad lepingud have made the network the main platform for ICOs.

- Mitmekesisus. Experienced investors prefer to invest in different assets. Therefore, when investing in cryptocurrencies, part of the money goes to bitcoins and the rest is divided between altcoins.

- Pamp. Digital assets with low capitalization are often pumped up. The surge in value is the result of collusion by a group of traders. Usually a dump occurs afterward and the price returns to previous values.

- Opinion Leaders. Statements by celebrities spread quickly on the web. The statements and opinions of Ilon Musk have the greatest influence. In 2021, the entrepreneur published a message with a puppy, which he named Floki. After that, the token of the same name rose in price by 1300%.

Altcoin Season Index

The market is characterized by cyclicality. If the capitalization and dominance of bitcoin increases, it entails the growth of other assets. After the price spike, investors lock in profits and pour capital into other coins. The growth of BTC slows down and cryptocurrencies catch up with the leader.

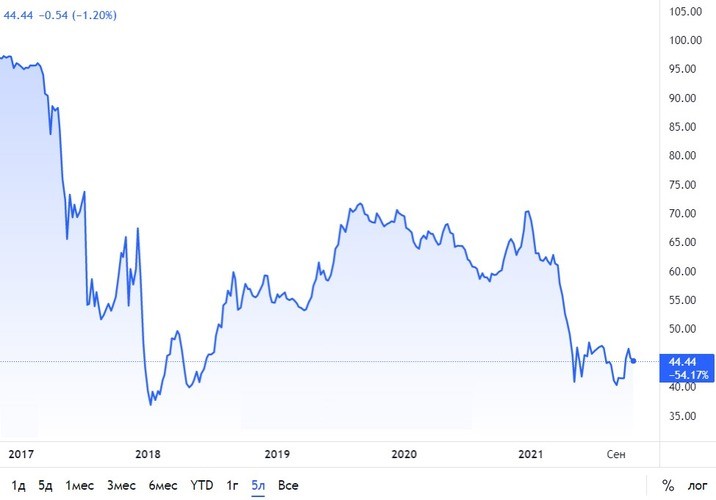

Bitcoin’s dominance over altcoins

By the end of October 2021, BTC’s capitalization was $1.15 billion, with the entire cryptocurrency market valued at $2.61 billion. Approximately 44% of capital is concentrated in bitcoins.

Investors sometimes find themselves misled. If the exchange rate is rapidly increasing, the dominance, on the contrary, decreases. Such conclusions are based on historical events:

- Bitcoin hit an all-time high of $19,666 at the end of 2017. Despite this, the dominance index gradually fell until it reached a low of 36% on January 13, 2018.

- After the bullish (increasing) trend was replaced by a bearish (falling) one, and a prolonged decline in the exchange rate began. This period in history was called “cryptozyme”. The BTC rate fell until the end of 2018, until it was fixed in the range of $3000-$4000. The dominance index meanwhile, on the contrary, increased.

- In March 2021, the situation repeated itself. Bitcoin began to set new records of value, but the dominance index went down.

The growth of the BTC rate has a positive effect on the capitalization of altcoins.

Kuidas seda arvutatakse

Dominance is determined very easily with the help of a formula:

asset capitalization/market capitalization.

Having access to simple statistics, you can quickly determine the share of all altcoins. To do this, another formula is used:

100 – (BTC capitalization/market capitalization).

Näited

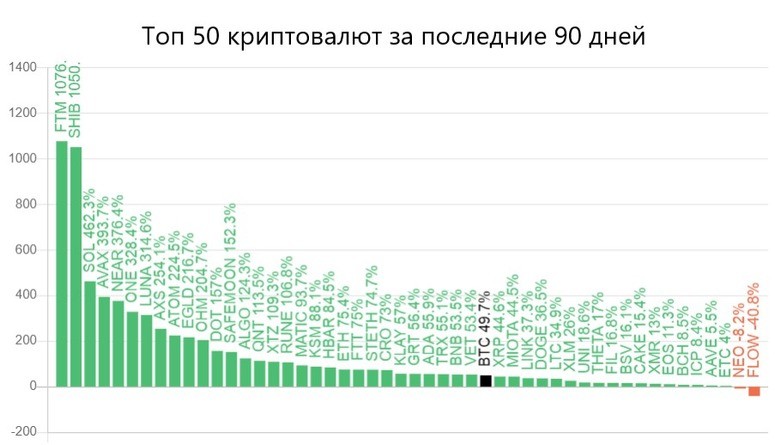

Monitoring services resort to more complex calculations of the altcoin season index. For example, only the first 50 coins by capitalization size or tokens with the highest returns over the last 90 days are taken into account.

Which coins you should pay attention to

A few years ago, quite high competition in the market was represented by “improved versions” of the first cryptocurrency, such as Litecoin, Bitcoin Cash and others. Recently, the gap in the size of capitalization between them has only increased.

New assets are emerging. They turn out to be more competitive and gradually break into the top 10. To find a promising token, one pays attention to:

- The development team. The network should be run by a public company with relevant experience. If there are several successful projects under their belt, it inspires faith in investors.

- Roadmap. Developers share their plans with the community. Their previous promises have been kept on time.

- Uniqueness. The asset should offer something new. Practice has shown that interest in “improved versions” of bitcoin is gradually declining. In addition to increased throughput – the maximum number of transfers per minute – depositors need something more meaningful.

- Listing. If a token is added to a major trading platform, it often has a positive effect on quotes.

- Kogukond. Each project has user groups on forums and social networks. It is necessary to assess the volume of the community, its mood and willingness to keep the coin even in the fall.

| Nimi | Aasta | Omadused |

|---|---|---|

| Ethereum | 2015 | Platform with smart contracts for decentralized applications |

| Binance Mündi | 2019 | The token is used to reduce trading fees. The exchange regularly burns some of the coins until their number is reduced by 50% of the original issuance. |

| Solana | 2020 | Another platform for creating decentralized applications. Unlike Ethereum, it runs on PoS. |

| Cardano | 2017 | One of the first major platforms on the PoS algorithm. The developers have a fairly detailed roadmap. |

| Polkadot | 2020 | The network enables the creation of new applications. It is capable of running several parallel chains and provides data exchange between them. |

How to make money in the altcoin season

When investing in cryptocurrencies resort to diversification. Such an approach not only reduces risks, but also increases the probability of profit. For this purpose, the capital is divided between several assets. Ready-made investment portfolio:

- 35% – Bitcoin.

- 25% – Ethereum.

- 10% – Binance Coin.

- 10% – Solana.

- 10% – Cardano.

- 10% – Polkadot.

For a riskier strategy, reduce the share of bitcoin to invest in altcoins.

Which cryptocurrencies shot up in 2024

The following coins brought investors the most interest in the short range, according to the charts of the altcoin season:

- FTM. In August 2021, the value of the token did not exceed $0.50. Since September, the asset has attracted the attention of investors. At the end of October, the cryptocurrency updated the historical maximum of $3.48.

- SHIB. Initially, the coin was perceived as a meme and the main competitor of Dogecoin. However, the developers did not abandon the cryptocurrency project. In the summer of 2021, the price of the token dropped to $0.000005605. Among the holders there were enough holders – their patience was rewarded in the fall. SHIB managed to surpass Dogecoin in capitalization and update the historical maximum of $0,00008845.

- SOL. The Solana project made its way into the top 10 coins in terms of capitalization quite quickly. From July to the end of October 2021, investments in the cryptocurrency increased by 462%.

Kokkuvõte

Bitcoin remains the main driving force. As the rate rises, investors are paying more attention to the crypto market as a whole. So far, the first coin manages to hold the leadership, but in 10 years the situation may change. In order not to be left behind, it is necessary to invest in altcoins.

Korduma kippuvad küsimused

💻 Where do people buy cryptocurrency?

Most of the transactions fall on exchanges. Assets are also bought through exchanges, P2P services and terminals.

❓ How much is recommended to invest during the altcoin season?

You can invest any amount of money in digital assets, such as $100. It is recommended to invest only the money that the user is willing to lose without harming the financial situation.

🔗 Is cryptocurrency banned in Russia?

No, it is allowed to buy assets on foreign platforms and store them on personal wallets. It is prohibited to pay with bitcoin and other coins for goods and services in Russia.

📝 Who regulates the price of altcoins?

Quotes are updated based on supply and demand. The more users are willing to buy tokens, the higher the quotes will be.

🔍 Where is it safe to store cryptocurrency?

Hardware wallets are the most secure – the cost is $50-$100. If the user stores coins on an exchange for constant trading, two-factor authentication should be enabled.

Kas tekstis on viga? Märkige see hiirega ja vajutage Ctrl + Sisestage.

Autor: Saifedean Ammous, krüptorahanduse ekspert.