Krüptoraha äratab tähelepanu: bitcoini kurss kasvab ja investorid investeerivad miljoneid dollareid krüptovaradesse. Selles artiklis räägime sellest, kuidas krüptovaluutaga turvaliselt kaubelda ja tehinguid plusspoolele viia.

Krüptoraha vahetuse valimine

Alustamiseks on vaja kauplemishoiust täiendada rahaga. Kauplemisplatvormi valikut tuleks käsitleda hoolikalt:

- Seeon hea, kui vahetus on tegutsenud vähemalt aasta.. See on piisav aeg kapitali loomiseks ja tagasiside saamiseks. Selliste platvormide vastu on rohkem usaldust. Selles valdkonnas on veteranid: Binance, Huobi, Bittrex või EXPO, tuntud runet. Vahetuse ajalugu tasub uurida häkkerite rünnakute ja kasutajate isikuandmete varguse kohta;

- Kaubandustehingu (ostu või müügi) komisjonitasu ei tohiks olla kõrge.. Kui Binance võtab tehingu eest 0.1%, siis noored projektid pakuvad veelgi paremaid tingimusi. On Bibox, omanik sisemine märgid maksab 0,05%;

- kauplemismaht - kauplejate seas populaarsuse ja seega tehingute likviidsuse näitaja.. CoinMarketCap teenus aitab kauplemisplatvormi valimisel;

- 30% krüptovahetuste ei nõua kontrollimist - mugav, kui soovite kaubelda anonüümselt, kuid vähendab turvalisuse taset.. Konto tuvastamine võimaldab teil kiiresti taastada juurdepääsu oma isiklikule kontole ja muudab börsi ja kliendi vahelise suhte läbipaistvaks. Tasub selgitada ettevõtte esindatust Venemaal. See kiirendab probleemide lahendamist.

| Exchange | Keskmine kauplemiskomisjon | Täiendavad andmed |

|---|---|---|

| Binance | 0.1% | Vene liides, rohkem kui sada krüptoraha paari |

| Coinbase Pro | 0.1-0.2% | Hoiuste kindlustus kuni $250k USA residentidele |

| Huobi Global | 0.1-0.2% | Vene kasutajaliides ja cashback programm. Kasutaja hoiused üle $10 bln |

| Bitfinex | 0.1-0.2% | Vene liides, tagasivõtulimiit puudub |

| Kraken | 0 kuni 0,26% sõltub kaupleja aktiivsusest | Finantsvõimendus marginaaliga kauplemisel 1:5 |

Näiteid krüptovahetustest Coinmarketcapi 10 parima nimekirja järgi

Krüptovahetuste probleemiks on kasutajate vahendite tsentraliseeritud säilitamine mitmetes jagatud rahakottides, millele juurdepääs on avatud ettevõtte töötajatele.

Detsentraliseeritud börsidel (DEX), kus kliendid hoiavad valuutat eraldi, eraldatud kontodel, on juurdepääs rahalistele vahenditele väljastpoolt suletud. Sellised platvormid koguvad alles populaarsust ja neile ei ole kauplemistegevus iseloomulik. Nende hulgas: Poloni DEX, Atomex, Binance DEX, Nash ja teised.

5020 $

boonus uutele kasutajatele!

ByBit pakub mugavaid ja turvalisi tingimusi krüptovaluutaga kauplemiseks, pakub madalaid vahendustasusid, kõrget likviidsust ja kaasaegseid vahendeid turuanalüüsiks. See toetab spot- ja finantsvõimendusega kauplemist ning aitab algajaid ja professionaalseid kauplejaid intuitiivse kasutajaliidese ja juhendmaterjalidega.

Teenida 100 $ boonust

uutele kasutajatele!

Suurim krüptovahetus, kus saate kiiresti ja turvaliselt alustada oma teekonda krüptovaluutade maailmas. Platvorm pakub sadu populaarseid varasid, madalaid vahendustasusid ja täiustatud vahendeid kauplemiseks ja investeerimiseks. Lihtne registreerimine, kiire tehingute kiirus ja usaldusväärne rahaliste vahendite kaitse teevad Binance'i suurepäraseks valikuks mis tahes taseme kauplejatele!

Kauplemise peamised eeskirjad

Mõned kasumlikud tehingud järjest annavad kindlustunnet, kuid sellest ei piisa stabiilse sissetuleku saavutamiseks. "Risk-tulu" mudel aitab pidevalt säilitada kasumit. Kaupleja börsil ei saa ennustada hinna liikumist 100% ja tehingute tõenäosust. Tulu kujuneb kasumlike tehingute ülekaalu tõttu kahjumlike tehingute üle. Näiteks kui riski ja kasumi suhe on 1:1, ei ole ruumi vigade tegemiseks - me kaotame ühe dollari ühe tinglikult teenitud dollari kohta. Kui suhe on 1:3, on juba parem - kasum ületab riske kolm korda. Turg annab võimaluse teenida. Positsiooni tasub avada, kui prognoositav tulu on suurem kui kahjum.

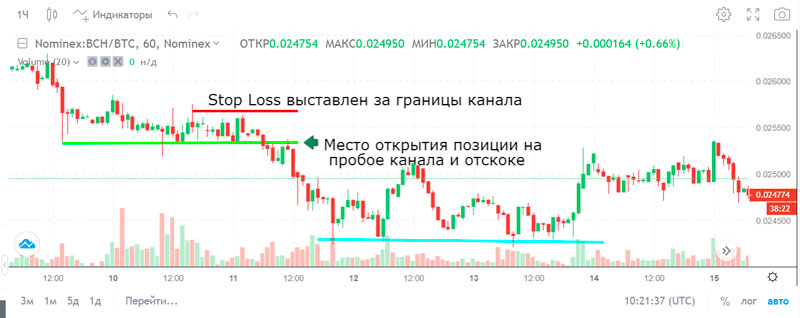

BitcoinCash määr oli kitsas kanalis. Olles läbi murdnud tugeva tugitaseme (roheline joon), läheb krüptovaluuta allapoole, kus miski ei takista edasist langust. Risk (piiratud Stop Loss väljaspool kanali piiri)-kasumi suhe on 1:3.

Ühe kauplemissessiooni jooksul on mitu tehingut. Võttes arvesse kasumlike tehingute protsenti, optimeeritakse kauplemisstrateegiat. Oletame, et tegime kümme tehingut. Neist ainult 20% osutusid plussiks, kuid kõik need avati riski-kasumi suhtega 1:2. Tulemus on null:

- 8 tehingut * $1 = $8, kus saadud summa on kaheksa tehingu puhul Stop Lossist saadud kahjum;

- 2 tehingut * $4 = $8, kus kaheksa dollarit on kahe tehingu kasum, mis mõlemas oli $2;

- $8 – $8 = 0.

Börsil tasutakse kauplemiskomisjon ja hinnavahe - ostu- ja müügihinna vahe - ning tegelik tulu on väiksem. Valides kasuks tehinguid, mille suhe on 1:3, saate tulla välja plussis.

Autor: Saifedean Ammous, krüptoraha majanduse ekspert.