Russian citizens are actively investing in digital coins. According to the Central Bank of Russia, in 2022, the country’s share in the total turnover of cryptocurrencies amounted to 12%. The number of international transactions in BTC and other assets has increased sharply after the imposed sanctions. Against this background, the government is preparing a bill to regulate cross-border cryptocurrency transactions. The document is predicted to be adopted in 2023. In the article, readers will learn how to buy cryptocurrency to a legal entity. We will tell you how to conduct the transaction, reflect it in accounting records and what taxes need to be paid.

Legal status of cryptocurrency

Since 2021, digital assets in the Russian Federation are recognized as property. They can be bought, sold, used in settlements with creditors. The law authorizes transactions through operators – crypto exchanges, exchangers, banks. Digital coins may appear in cases involving the division of property.

However, it is impossible to pay with crypto-assets for purchases and services rendered. There are also no rules for mining virtual coins (mining) and no tax regime.

As of March 2023, lawmakers propose to be guided by general regulations when receiving income from business activities.

The government is already working on a new version of the law on digital assets. Negotiations are underway between the Ministry of Finance, the Central Bank, and tax authorities. Politicians are seeking to clearly outline the tax regime for holders of cryptocurrencies. According to preliminary calculations, deductions from transactions with virtual coins will bring at least 1 trillion rubles a year to the treasury.

Digital currency as an object of civil rights in the Russian Federation

The Civil Code of Russia refers money (cash and non-cash, shares), property (valuable equipment, the result of work performance), intangible assets (exchange of services) to the rights of citizens. The law does not have to define all objects, except when it is necessary to impose a ban on their use. Therefore, it is considered that transactions with cryptocurrencies in Russia are legitimate.

5020 $

boonus uutele kasutajatele!

ByBit pakub mugavaid ja turvalisi tingimusi krüptovaluutaga kauplemiseks, pakub madalaid vahendustasusid, kõrget likviidsust ja kaasaegseid vahendeid turuanalüüsiks. See toetab spot- ja finantsvõimendusega kauplemist ning aitab algajaid ja professionaalseid kauplejaid intuitiivse kasutajaliidese ja juhendmaterjalidega.

Teenida 100 $ boonust

uutele kasutajatele!

Suurim krüptovahetus, kus saate kiiresti ja turvaliselt alustada oma teekonda krüptovaluutade maailmas. Platvorm pakub sadu populaarseid varasid, madalaid vahendustasusid ja täiustatud vahendeid kauplemiseks ja investeerimiseks. Lihtne registreerimine, kiire tehingute kiirus ja usaldusväärne rahaliste vahendite kaitse teevad Binance'i suurepäraseks valikuks mis tahes taseme kauplejatele!

In essence, trading in digital assets is making an entry in a distributed ledger (blockchain). The process is similar to the transfer of rights to domain names on the Internet.

Cryptocurrency and monetary surrogate

Russian law prohibits the transfer of cash functions to anything other than the Russian ruble. Means of payment potentially capable of replacing the national unit of payment are commonly referred to as a monetary surrogate. This term refers to digital currencies, casino chips, tokens, promissory notes.

Is cryptocurrency a foreign currency?

The procedure for dealing with foreign currency is established by Federal Law No. 173 of December 10, 2003. The document lists assets that fall under the definition of foreign currency. In accordance with the Civil Code of the Russian Federation, digital assets are not foreign currency. Therefore, it is impossible to apply restrictions to them that are fair for currencies of other countries.

The Federal Tax Service, the Central Bank, and commercial institutions are not authorized to receive information on transactions of purchase and sale of virtual crypto coins from Russian citizens and non-residents.

Is the purchase of digital currency authorized for legal entities in the Russian Federation?

There is no official ban on transactions with bitcoin and altcoins. The data is confirmed by the letter of the Ministry of Finance of the Russian Federation dated October 3, 2016. The document says: “The purchase of coins by individuals and enterprises does not contradict the law.”

The Central Bank issued a number of appeals about cryptocurrencies. They do not have legal force, but clarify the regulator’s position. It follows from the letters that the Central Bank has not made statements about the ban on the use of virtual coins. Banks and other credit organizations can service transactions involving crypto coins.

Purchase restrictions for legal entities

Digital assets can be legally credited to the balance sheet of a Russian organization. To do this, you need to fulfill the requirements of the regulator:

- Provide documents confirming the transaction. You can not buy cryptoassets from anonymous counterparties.

- The transaction must be paid from the settlement account of the company. Cryptocurrencies are transferred to the wallet of the organization.

- When buying large amounts of crypto coins, the bank can request clarification on the expediency of investments.

Companies cannot purchase coins for cash or through EPS (electronic payment systems). Also, digital assets cannot be used for trading if the company’s activities are related to another area.

Each purchase and sale transaction must be formalized through a contract.

Ways of acquiring digital currency by a legal entity

Virtual coins can not be credited to the balance sheet of the company without executing the appropriate documents. Buy cryptocurrency to a legal entity can be purchased in several ways. Details – in the table.

| Meetod | Kommentaar |

|---|---|

| The most simple and understandable way from the accounting point of view. The commission is set by agreement between the parties. | |

| The transaction is documented as a purchase of a fund share (crypto-assets do not appear). | |

| This way you can purchase a large volume of coins at the market price. For the operation you will have to pay 1.5-2.5% (trading commission and fiat deposit fee). | |

| The service must support work with legal entities and sole proprietorships |

How to buy cryptocurrency to a legal entity directly for foreign currency

Russian companies can conclude direct transactions with foreign partners. The procedure is as follows:

- A contract is concluded between an organization registered in the Russian Federation and a foreign company.

- The RF organization transfers foreign currency (dollars, euros and other monetary units) to the account of the counterparty.

- The second party to the transaction sends coins to the wallet specified in the agreement.

There are other ways:

- Using a letter of credit. The Russian company transfers money (in foreign units) to a bank account. The credit organization gives the counterparty access to the account after transferring digital assets to the address in the blockchain specified in the agreement.

- Buying digital coins through gold. Such an opportunity is provided by Soulu. It is a secure service of buying and selling digital assets within the framework of the current law. A legal entity purchases gold, receives a bank receipt and a token securing the right to gold. This token can be exchanged for real gold investment coins (e.g., George the Victorious) or digital assets (e.g., USDT) using a smart contract.

Transferring funds to an offshore fund for trust management

Formally, digital coins belong to an investment company – a non-resident of the Russian Federation. A Russian legal entity acquires part of the assets of an offshore firm. Under the terms of the contract, the buyer can obtain a secret key to access the coins. A resident of the Russian Federation has the right to sell crypto-assets at any time. In this case, the payment is simplified. According to the documents, the share of the fund is sold for foreign currency – this is more usual for financial organizations.

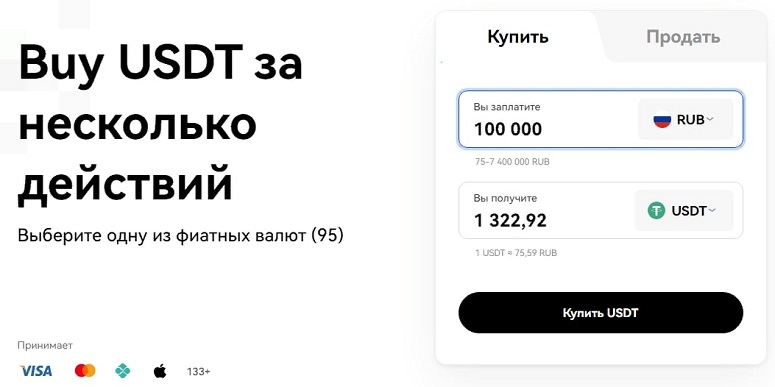

Stages of purchase through a cryptocurrency exchange

In 2022, many trading platforms introduced restrictions for clients from the Russian Federation. However, there are crypto exchanges that continue to work with Russian residents. It is necessary to choose such services that accept transfers from bank cards and accounts of legal entities. Usually, transactions are made by a trusted person of the company.

Instructions on how to buy cryptocurrency to a legal entity:

- Create an account and pass verification.

- Go to the “Buy cryptocurrency” section.

- Select the payment method – “Credit card” or “Transfer from bank account”.

- Specify the coin and volume.

- Kinnitage toiming.

Cryptoassets will be reflected on the internal balance of the service. To send coins to the company’s wallet you need to:

- Go to the “Assets” section and click on “Withdrawal”.

- Valige münt.

- Fill out the form: enter the wallet address of the organization, select the network, the amount of transfer. Confirm the operation.

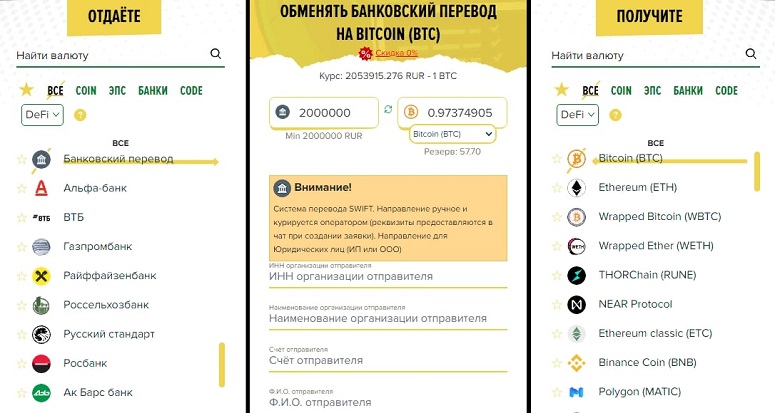

Conditions for the purchase of digital currency by a legal entity through a current account

A legal entity in Russia can purchase coins on the exchange or through an exchanger. For direct transactions, you need to use platforms that work with companies. Settlements are carried out through a bank account. The counterparty issues a document confirming the transaction.

The order is as follows:

- Pay for the purchase in rubles through the settlement account.

- Reflect the transaction in the accounting report.

- Put the assets on the balance sheet of the company. To do this, it is necessary to issue a corresponding order.

- After the sale of coins, it will be necessary to pay taxes.

Reflection of cryptocurrency in accounting records

Digital currencies can not be equated with intangible assets. Reflect coins in accounting can be reflected as “Financial Investments” of the firm in sub-account 58. In this case, there are peculiarities:

- When buying for foreign monetary units, it is necessary to specify “Currency accounts”.

- If the payment was made in rubles – “Current accounts”, for cash – “Cash”.

- In case of crediting, the transaction is carried out on account 58 “Financial investments”.

To put digital assets on the balance sheet of the company should be guided by the letter of the Ministry of Finance of the Russian Federation № 03-03-06/1/61152 from 28.08.2018 “On the procedure for taxation of income in transactions with cryptocurrency”. The essence of the Ministry’s position is that there is no separate regulation of the taxation of coins, so the general provisions of the Tax Code are taken into account.

Taxes on transactions with digital currency

At the beginning of 2023, the law does not provide a special regime for transactions with cryptoassets. Therefore, the tax must be paid on general grounds. The following procedure is established:

- Determine the tax base. From the amount of the sale of crypto coins (according to the receipt), you need to deduct the documented expenses for its purchase.

- Submit a declaration for the past tax period (year) in the form 3-NDFL. It must be sent no later than April 30. The form will need to attach supporting documents and an explanatory note with the calculation of income and the chain of transactions.

- Wait for the results of a desk audit by an employee of the Federal Tax Service.

- Pay the tax by June 15. An LLC contributes 20% of the profit. When registering a sole proprietorship, you can save money – 12% or 6% of the “simplified” tax is charged.

Consequences for non-payment of tax

The enterprise can keep crypto-assets on the balance sheet for as long as you want. Tax needs to be paid only when coins are sold for fiat. All transactions must be documented.

The tax code does not establish separate rules for transactions with crypto-money.

Sanctions for late payment of fees are set according to general norms:

- Documents must be sent by April 30. In case of delay, penalties are accrued. Violators must pay for each month of missed deadlines 5% of the tax amount (minimum 1 thousand rubles), but not more than 30%.

- In case of non-payment of the accrued tax, penalties of 0.0033% of the key rate for each day of delay are imposed.

- The tax authorities have their own channels to detect “gray” income. If evasion or money laundering is detected, they will impose a fine of 40% of the total amount and penalties.

- If the amount of damage exceeds 2.5 million, the responsible person may face up to 7 years of imprisonment. At the discretion of the court, the punishment may be replaced by correctional labor.

Korduma kippuvad küsimused

🔔 Is there criminal liability for possession of cryptocurrencies?

Officials put forward such proposals. However, the March 2023 law does not provide for these measures.

📢 What is the Central Bank’s position on transactions with cryptoassets?

There is no ban on coin trading in the law. However, the Central Bank considers such transactions suspicious. The bank may ask for an explanation of the reasons for the investment.

✨ How do I accept payment for services in cryptocurrency?

From the point of view of the legislation of the Russian Federation, such transactions are illegal. You can only pay for goods and services in Russian rubles. However, clearing services will be legal. So, for example, a client can pay the administrator for a bill in a restaurant with cryptocurrency, and the administrator pays the client’s bill in rubles.

📌 How to sell coins through an exchanger?

You need to choose a service that works with legal entities (BitokBy, HASchange). It will be necessary to contact the support service and clarify what documents they are ready to provide.

🛒 Can I buy coins for a legal entity via P2P services?

Yes, if the counterparty agrees to draw up a contract with passport data. Otherwise, the person may face a number of fraudulent risks.

💳 How to reduce the risks of blocking accounts due to cryptocurrency transactions?

Russian banks freeze transactions on the Central Bank’s order, may refuse to provide service and ask for an explanation of the economic feasibility of transactions. It is possible to open a foreign account for transactions involving cryptocurrency. It will have to be declared.

Viga tekstis? Märkige see hiirega ja vajutage Ctrl + Sisesta

Autor: Saifedean Ammous, krüptorahanduse ekspert.