An important part of the concept behind the Bitcoin blockchain is the limited issuance of coins. Coin mining becomes more complex over time due to the addition of new miners and thehalving of rewards(halving). Bitcoin’s issuing algorithms increase the processing power required to create each block. Therefore, it becomes more difficult to produce new coins. The total number of BTC coins that can be issued is 21 million. The principle of limitation avoids the threat of inflationary depreciation.

History of the emergence of Bitcoin

Bitcoin blockchain was launched in 2008. The identity of its creator with the pseudonym Satoshi Nakamoto is still unknown. The history of the coin began with the posting of an article titled “Bitcoin: a peer-to-peer electronic monetary system” on a crypto mailing list. This caught the attention of community members and sparked discussion.

In 2009, the Bitcoin software became publicly available. Its mining began. This is the process by which new coins are created and processed in the blockchain.

The first example of practical use of cryptocurrency and determining its value occurred the following year. In May 2010, programmer Laszlo Hanec exchanged 10 thousand BTC for 2 pizzas worth 25 US dollars. Before that, Bitcoin was only mined, no one traded it, so its real value was not determined.

Purpose

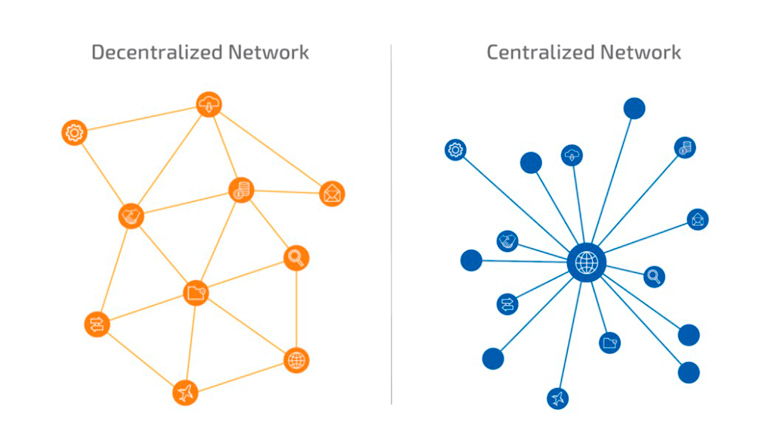

The Bitcoin network is designed to conduct and process transactions without the involvement of banks or payment companies, making the coin a more economical, transparent, and fair way to pay. An individual can send funds directly without a central governing body and associated fees.

Bitcoin, like most other cryptocurrencies, is designed with governance placed in the hands of community participants in a way that prevents government agencies from interfering with their operations, promoting economic freedom and transparency.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Bitcoin issuance

A new block is added to the chain after 10 minutes. When the cryptocurrency first launched, miners were rewarded with 50 BTC per block that was validated. This meant that the Bitcoin issuance rate was approximately 7,200 koins per day.

Difference from fiat

Most paper money such as the euro, dollar and others have legal tender status. They are officially recognized and accepted as payment for goods and services, as well as for debts. Digital assets do not have this status. There is no legal obligation to accept them.

The difference between crypto coins and paper money lies in their nature. Rubles, dollars, euros are issued, guaranteed and controlled by a country’s central bank. Cryptocurrencies are not regulated by financial institutions and are decentralized.

Mining

This is the process of verifying the blocks of bitcoin payments and adding these transactions to a large public registry. Is the only way for new BTC to emerge and be added to the market. Without mining, transactions would not go through as there would be no one to verify their legitimacy.

Bitcoins are issued in different countries. In the first half of 2021, China accounted for the largest share of mining due to cheaper energy. For example, they are 10 times more expensive in Germany. However, after bans from the Chinese authorities in May and June, local companies were forced to move to other countries or close their businesses. The advantage in Bitcoin mining has shifted to the United States, Russia, and Kazakhstan.

Reward for a mined block

Miners are given a predetermined amount of BTC in exchange for transactions they have approved. Since a new block in the network is formed every 10 minutes, 144 chains are mined per day (6 per hour). The maximum amount of BTC mined per day is presented in the table. The data is given for 2021, and it will decrease by 2 times with the next halving in 2024:

| Number of blocks processed per day, units | Current reward per mined block, bitcoins | Calculation of reward for miners, BTC |

|---|---|---|

| 144 | 6,25 | 144 * 6,25 = 900 |

Halving

The blockchain has a mechanism to reduce the reward for a mined block by a factor of 2 every 4 years. As of August 2020, this number is 6.25 BTC. The last Bitcoin in history will be mined in 2140 because the issue volume has a maximum supply of 21 million coins. The realization of the next halving is programmed for 2024, when the reward will once again decrease by 2 times:

| Year | Reward per mined block, BTC |

|---|---|

| 2009 – network launch, mining of the first block | 50 |

| 2012 | 25 |

| 2016 | 12,5 |

| 2020 | 6,25 |

How many issued

As of mid-August 2021, the total number of bitcoins mined exceeds 18.77 million. When a new block is added to the network, the total number of BTC in circulation increases. Thus, every 10-12 minutes (the time it takes to process and join the chain), new coins are added to the total market capitalization.

How much is left to mine

The last Bitcoin will be obtained by miners by 2140. There are 2.33 million left to be issued. The mining system will stop once the number of 21 million is reached.

In comparison, Ethereum (ETH) has no limit to the number that can be mined, while Ripple XRP has created 1 billion coins from the start and destroys a small amount with each transaction.

Bitcoin’s value

The advantages of the coin include such merits:

- Cryptocurrencies through decentralized infrastructure make money transfers fast, traceable, transparent and immutable.

- If the principles of network effect are followed, they will gain more value as their adoption grows.

- Bitcoin and many digital coins are fiat currencies. This increases their appeal compared to other assets, including gold.

- Coin has the security of a blockchain, making it difficult to counterfeit or experiment.

- BTC gains its utility as a payment method due to 2 key factors – transaction costs and processing time.

What explains the limited issuance of Bitcoin

There are 2 theories on the Bitcoin issue: mathematical and economic. Each of them has its own rationale.

Mathematical

The 21 million limit is believed to have been set when Nakamoto made 2 key decisions, namely:

- New blocks are added to the Bitcoin network every 10 minutes.

- The remuneration paid to miners should start at 50 BTC with it halving every 4 years.

The StackExchange developer forum says that limiting the number is more of a mathematical coincidence than a conscious choice.

The calculation of the number of Bitcoins is presented in the table:

| Indicator name | Value, calculation |

|---|---|

| Blocks per hour, units. | 6 |

| Hours per day | 24 |

| Days per year | 365 |

| Cycle, years | 4 |

| Blocks per four-year cycle, units. | 6 * 24 * 365 * 4 = 210,240, or approximately 210,000 |

| Remuneration per block, VTS | 50 + 25 + 12,5 + 6,25 + 3,125 +… = 100 |

| Number of BTC, units. | 210 000 * 100 = 21 000 000 |

Economy

At the time of the creation of virtual currency, the volume of money supply in the world was equal to 50 trillion dollars. When it is replaced by 21 million Bitcoins, the smallest unit (satoshi) would be worth less than a penny. This is handy when making calculations.

Nakamoto planned that Bitcoin prices would be in line with traditional fiat currencies, so that, for example, 0.001 BTC would be worth 1 euro. A fixed supply limit gives anti-inflationary properties.

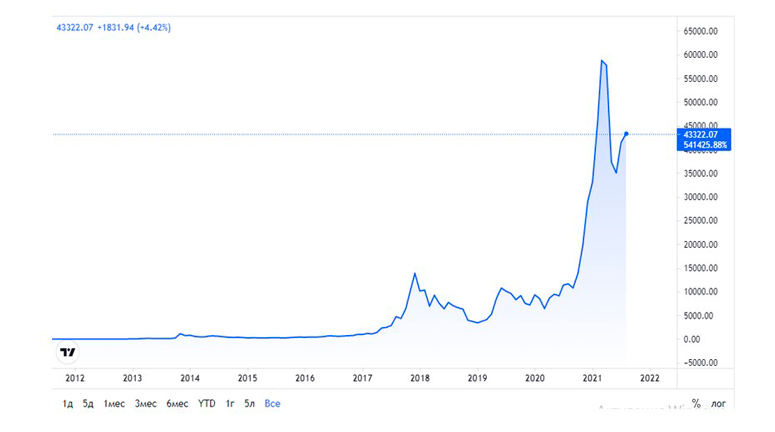

Graph of the BTC exchange rate by year

When Bitcoin was first introduced in 2009, it was worth $0. A year later, when the first followers started trading the digital currency, it was valued at a fraction of a cent. In 2011, the coin reached the $1 mark.

Bitcoin surpassed the $1,000 value in November 2013, when it began to attract worldwide attention. During the second major price spike in its history, it approached the $20,000 mark in 2017, but fell to $3,300 in the following 12 months. In December 2020, the coin broke the $20,000 mark before leaping to a record high of $64,900 on April 14. As of mid-August 2021, the coin’s price had risen to $47,600 after a recovery.

What Bitcoin is backed by

Like fiat currency, Bitcoin is not backed by gold or silver, hence has no intrinsic value. Its price depends on government support for new technologies and people’s trust. Consequently, for any money to become an exchange of value, it is important for it to be recognized, regardless of who (or what) backs it.

The trust that millions of people have placed in a cryptocurrency in a completely untrustworthy environment determines its value.

Supply and demand

Bitcoin’s price is expressed in relation to fiat currency in rubles, dollars, and euros. It depends on supply and demand like any other commodity. The issue of BTC is determined by an algorithm and is completely predictable for decades to come. The demand comes from the fact that it is a better alternative to money.

Before Bitcoin, the only means of payment that were not controlled by a central bank were tangible assets – gold, silver, platinum and others. Bitcoin and other cryptocurrencies are the first bearer instrument in history that does not have the limitations of fiat money.

Lost Bitcoins

According to the New York Times, about 20% of mined BTC as of August 2021 are in wallets whose owners have lost access to them. In the early years, when Bitcoin was not given much value, many followers lost their private keys. Unfortunately, it is impossible to access the coins without them.

About 2.7 million were lost due to the death of owners and loss of private keys, while another 1 million were lost due to cyber thefts. Some of the most significant thefts from crypto exchanges include huge losses: Bithumb ($30 million), Coinrail ($37.3 million), Coincheck ($534 million) and Bitgrail ($195 million).

The future of cryptocurrency

The prospects for digital assets are in question. Supporters see limitless potential, while critics see nothing but risk.

Professor Grundfest of Stanford’s Center for Professional Development remains skeptical, but admits that there are certain applications where cryptocurrency would be a viable solution.

According to Deutsche Bank, the current monetary system is fragile. The Imagine 2030 report indicates that digital currency could replace cash as demand for anonymity and more decentralized means of payment grows. The bank predicts that the number of cryptocurrency users will quadruple in the next 10 years to reach 200 million users.

Diogo Monica, co-founder and president of Anchorage Digital, and Dan Egan, vice president of finance and investments at Betterment, believe that digital assets aren’t going anywhere in the near future.

Ivory Johnson, founder of Dalancey Wealth Managment, believes that cryptocurrency is a threat to traditional money because it has the ability to efficiently transfer payments with little or no fees, delays or rate fluctuations. He believes that if Bitcoin is not replaced by better technology, it could become the world’s fiat.

Nigel Green, founder of deVere Group, says the rapid pace of digitalization of the economy and life means there will now be a growing demand for virtual global money without borders.

Futurist Ian Khan believes that the future of Bitcoin and cryptocurrency in general will continue to fluctuate and make waves. One reason is that this is a hype-driven cryptoera, where influencers like Ilon Musk and others will continue to play with the emotions and tensions of the investor community.

Dragan Bošković, founder of the Blockchain Research Lab, notes that the Central Bank’s leadership is in the process of drafting regulations on cryptocurrencies. This means recognizing that digital coins will become mainstream in the next 10 years.

Turning physical money into a digital representation does have a number of technological advantages in terms of payments and as a means of saving. Many experts believe that cryptocurrency will become a widely accepted form of payment such as debit or credit cards.

Frequently Asked Questions

🚹 Who controls cryptocurrencies?

They are verified using a technology known as blockchain. The registry includes all transactions. Since it is publicly available and its contents are verified by different people, it makes it almost impossible for a fraudulent transaction to be included.

🤔 What is the purpose of bitcoins?

They were created to allow people to send money over the internet. The digital currency is intended to provide an alternative payment system that could operate without centralized control, but otherwise be used in the same way as traditional money.

❓ What is the Ilon Musk factor?

In February of this year, the coin’s exchange rate rally was sparked by a $1.5 billion investment by Tesla. Bitcoin became volatile in May when Musk abandoned plans to accept them for Tesla cars. Sales resumed when he, suggested Tesla might sell its corporate assets. He then tweeted that the automaker had no plans to do so and could keep its bitcoin position.

✅ At what price did BTC start trading?

In July 2010, the price of the coin ranged from $0.0008 to $0.08.

🔼 What are the predictions about the value of bitcoin in 2030?

Experts’ estimates vary. Some analysts suggest that Bitcoin may reach $500,000 for 1 coin in the future, while others indicate a price of $397,000.

Error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.