In financial markets, this is the name given to intermediaries between investors and the issuer of securities. Bitcoin brokers are not needed to buy crypto coins – users can make a direct transaction on DEX. However, trading through intermediaries has advantages – they offer the use of margin lending and shorting trades. OTC trades are available on OTC platforms. Beginning traders can get training or analytics.

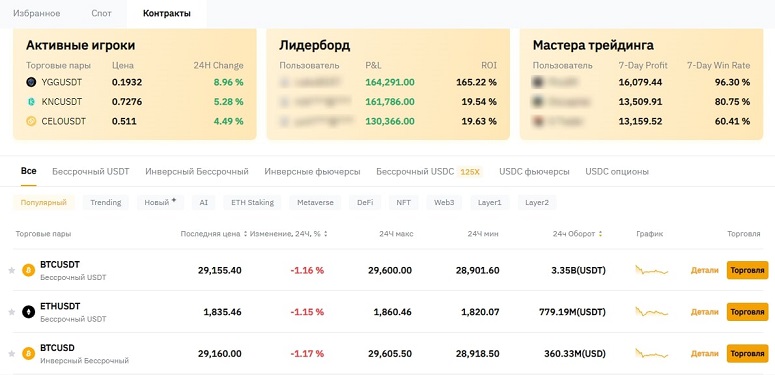

Best cryptocurrency brokers in 2024

When choosing a trading platform, you need to consider many factors – the reputation of the site, trading conditions, the need for verification, the number of instruments. In 2022, many companies closed registration for Russian clients. The table shows the rating of companies. It will help you decide from which broker you can buy cryptocurrency in 2023.

| Platform | Number of coins | Available leverage | Trading commissions | Depositing by card |

|---|---|---|---|---|

What is a cryptocurrency broker

Trading in the digital asset market involves risks. Successful trading requires knowledge and skills.

A broker acts as an intermediary in transactions and provides analytical support. He can simply aggregate orders or buy a large volume of cryptocurrency and sell it in small lots to clients.

Unlike DEX, the broker provides leverage with its own funds and allows short positions. It is safer to trade on such platforms because of their financial services licenses.

Differences from a regular crypto exchange

Brokers offer to trade various assets – fiat, CFDs (CFDs) on stocks and stock indices, commodities. Crypto exchanges have appeared relatively recently, and they are designed for convenient trading and investing only in digital coins. Assets bought on the spot market can be transferred to a personal wallet and stored as long as necessary. Brokers do not allow you to withdraw cryptocurrency. There are other differences as well:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- Terminal. Each crypto exchange provides a different platform. This can be inconvenient. Brokers adapt scripts to the popular trading program – MetaTrader.

- Leverage. The use of leverage can increase the trader’s profitability or lead to the “drain” of the account. On cryptocurrency exchanges, conservative investors buy assets without leverage. Forex brokers do not provide such an opportunity. Most companies have a minimum leverage size of 5.

- Instruments. Hundreds of coins, including new and illiquid ones, can be traded on exchanges. Brokers support only popular assets.

- License. Unlike exchanges, brokers need a permit to operate. Companies are responsible for their work and insure operations.

Types of cryptocurrency brokers

These platforms act as intermediaries in transactions involving digital assets. Cryptocurrency brokers provide analytics for self-trading, offer trust management services, copy trading and OTC transactions. The companies can be categorized into these types:

- Forex. Since 2016, the interest of the owners of the oldest platforms (Amarkets, RoboForex, FXClub, NordFx) in the market of digital assets has been growing. The platforms started adding cryptocurrency instruments to their listings.

- OTC platforms. Over-the-counter. Since 2009, bitcoin exchange transactions were conducted on forums and in chat rooms. After CEX appeared, this method became OTC. It is used by large participants who lack liquidity in the stack. Selling on OTC allows you to withdraw from the asset without affecting the price.

- CEX. Centralized trading platforms are focused on the cryptocurrency market. Some platforms offer gold or fiat as an additional instrument.

How to choose a cryptocurrency broker

It is worthwhile to responsibly approach the search for a company. The broker is a business partner, the quality of its services depends on the profitability. Before you start working, you need to familiarize yourself with user reviews. There are a lot of fraudsters on the market, so you should choose a large company with a good reputation and attractive conditions. The best brokers for cryptocurrency trading offer a large number of instruments, affordable leverages and commissions.

Round-the-clock working hours

The digital market operates on a 24/7 basis. However, not all brokers that trade cryptocurrency serve clients on such a schedule. Some companies do not work on weekends, at night, or they conduct clearing (breaks during the day). During this time, users are deprived of the ability to manage positions.

In most cases, there is little liquidity in the market during such hours, so there are no strong movements. However, an important news may come out at this time, which will change the trend. Traders will not have time to leave the market and will incur heavy losses.

Opening short positions

The cryptocurrency market is volatile – intraday movements can reach 30-40%. Many experts recommend investing (trading from long without shoulders). However, such tactics will bring losses on short positions. At least half of the time coins fall, so you need to choose a broker with the ability to open short trades.

Insurance of operations

Margin transactions are highly risky. Users borrow trades from the broker against the collateral of digital assets. In case of unfavorable market conditions, there is a risk of non-repayment of the loan, then the position is liquidated (margin call). However, in case of strong movements or gaps (price gaps due to lack of trading), the intermediary may not have time to close the transaction. In this case, the client does not just lose his deposit, but remains indebted to the company.

It is safer to choose platforms with protection against minus balance. Then, when an insured event occurs, the debt is written off.

How to start trading with a cryptocurrency broker

Trading digital assets involves risks, so you need to prepare – learn the basics of technical analysis, learn how to use the terminal, choose a strategy. Next, you will need to:

- Choose a reliable intermediary.

- Create a personal account.

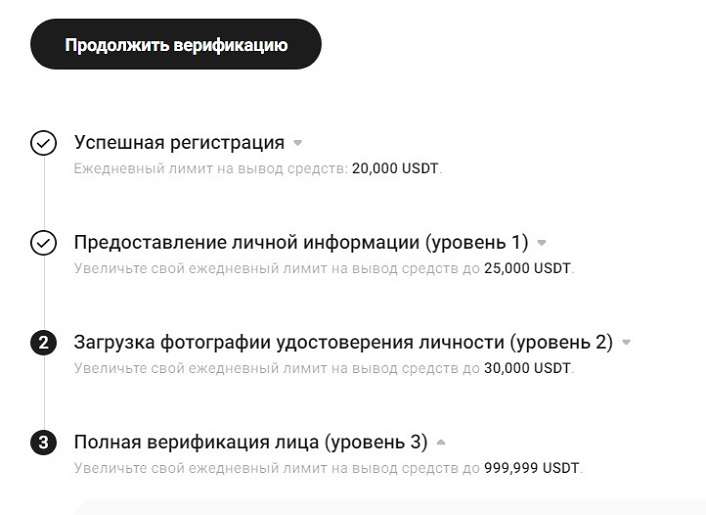

- Verify your identity. You need to upload a photo of the document and fill in the questionnaire.

- Download the terminal and install it on a desktop computer or smartphone.

- Refill the account. Broker organizations offer many payment methods – bank accounts, EPS, cryptocurrency.

- Open the terminal and customize the interface. It is necessary to choose a theme and add tools.

- Create a buy or sell order.

The bank card must also be verified – upload a photo of both sides of it (CVV can be closed). The name on the “plastic” must match the name in the profile. Transfers to third party accounts are prohibited.

Replenishment and withdrawal of cryptocurrency

Many intermediaries support payment gateways for deposits in digital coins. But on the balances the money is stored in USD, EUR. Some platforms open accounts in Bitcoin and Ethereum. When depositing in another digital currency, money is converted at the internal exchange rate. There are no commissions for transactions, but users pay network fees. Companies support deposits and withdrawals in these coins:

Supported digital currencies

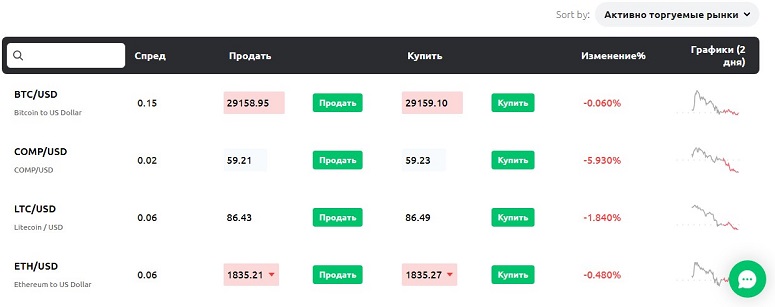

Brokerage companies offer to trade only popular assets – 20-40 coins. Cryptocurrency pairs with USD are supported:

Available payment methods

Platforms offer clients different methods of funding their accounts. In 2022, many companies introduced restrictions and removed RUB accounts. When making a deposit from a ruble card, the exchange is made at the internal exchange rate. It may differ from the exchange rate by 5-10%. Companies offer other payment methods:

- Cryptocurrency. BTC and USDT are available on all platforms, other coins are optional.

- EPS. 2023 brokerage companies work with Perfect Money, NETELLER, Skrill.

Minimum deposit

Limits depend on the payment method. For example, when depositing from a card, the minimum is $50-100, or 1000 rubles. The rules for depositing cryptocurrency depend on the service. For example, the company Amarkets does not allow deposits of less than 8 thousand rubles in equivalent. On the RoboForex platform, the minimum amount is $20 TRX ($1.5).

It is better to start trading with a deposit of $20 on a cent account (lots are 100 times smaller) or with $1000 on a standard account. This will help you stick to the rules of risk management. You should not use more than 1% of funds in one trade.

Commissions

Cryptocurrency brokers offer different trading conditions. However, all platforms charge a commission for transactions. When depositing and withdrawing, users pay network fees (they are deducted from the transfer amount). Also, the cryptocurrency broker charges for the following operations:

- Withdrawal. On average, 1-2% is deducted per fiat transaction. When withdrawing in cryptocurrency, a fixed fee of $1-2 is charged.

- Trading. On the exchange, there is virtually no difference between the buy and sell price (spread). On cryptobroker platforms it is significant – this is the profit of the service. Some platforms offer narrower spreads, but charge a fixed amount for opening an order.

- Position rollover. When holding a trade for a long term, a fixed amount will be charged every 24 hours.

Earnings from cryptocurrency trading with a broker

Exchanges are convenient for investing in digital coins, staking and farming. Cryptocurrency trading through a broker has these features:

- Highly leveraged trades. Crypto brokers offer 100 times higher returns on all available assets. On the spot exchange market, the maximum leverage is 5.

- Hedging. Since 2017, there has been a correlation between bitcoin and the stock market. Investors can use digital coins to reduce the risks of the underlying portfolio.

- Minimum trade. Crypto brokers allow orders starting from 10 cents, which helps to calculate the lot more accurately. For beginners, this is a good alternative to a demo account.

Pros and cons of cryptocurrency brokers

On DEX, users face technical difficulties. Cooperation with a crypto broker helps to avoid such difficulties. Traders work on a debugged platform. In case of errors, you can contact tech support. Unlike exchanges, cryptocurrency brokers in Russia offer to trade a number of instruments at once. Users can increase profits through margin lending.

There are disadvantages – commissions and spreads. On bitcoin, the difference between ASK/BID is $100-200, and at night and at times of increased volatility can reach $500-700. The intermediary independently sets quotes. Often these are rates of well-known liquidity providers. However, sometimes market prices are observed – they are used to collect liquidity (stop-losses or margin calls).

Frequently Asked Questions

📌 Where is it better to trade – on a crypto exchange or through a broker?

Each method has advantages and disadvantages. It is easier for beginner traders to perform their first trades through a crypto broker. It is better to go to exchanges if the user wishes to trade only cryptocurrency. On CEX, it is possible to build an investment portfolio and transfer to a cold wallet.

📢 Do you need verification to trade through a crypto broker?

These companies are professional market participants. Therefore, they fulfill international anti-money laundering requirements. Clients go through KYC, cards also need to be verified. Some companies additionally ask for proof of residential address.

⚡ What trading terminals do brokerage organizations use?

Exchanges offer to download clients from confirmed resources. Forex brokers support MetaTrader software. You can download the program or use the online version.

✨ What are the advantages of MetaTrader 4?

The software is written in the popular programming language MetaQuotes Language 4 (MQL4). There are many custom indicators and robots freely available. They are used in forex and crypto markets.

🔔 How to prevent a margin call?

You need to control risks, do not take a big leverage and keep an eye on collateral. In case of unfavorable development of events, it is worth fixing the loss to save the deposit.

💳 On crypto exchanges, do I have to pay to rollover a position to the next day?

Fees are charged on any platforms if the trader uses margin lending. On futures, swap is deducted 4 times a day, crypto brokers take a fee at the end of the day.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.