Clients of the Binance crypto exchange have access to a large number of tools for earning money. For example, you can trade on margin and futures markets using borrowed funds. But you need to consider the risks. One unsuccessful transaction can lead to the loss of the entire deposit. Liquidation on Binance is a procedure of forced closing of positions. The exchange resorts to it in case of unfavorable market conditions, when the account balance becomes less than the maintenance margin.

What is position liquidation

Private traders with small capital seek to maximize their potential profit. Binance offers leverage on the futures and margin markets. Borrowed funds can increase trading income many times over, but can also lead to significant losses.

While a trade is open, the user’s balance changes in real time with the quotes. If the market goes against the position, the account amount may become lower than the maintenance margin.

This is what is called the minimum amount of money that must be held to keep a trade alive. To calculate the margin, you need to multiply the order size by the stake (depends on the cryptocurrency and the value of the position in USDT).

When the balance drops below the maintenance margin, the broker starts liquidating positions – closing them completely or partially. In this case, the trader loses 90-100% of the deposit.

5020 $

bonificación para nuevos usuarios

ByBit proporciona condiciones cómodas y seguras para el comercio de criptomonedas, ofrece comisiones bajas, un alto nivel de liquidez y modernas herramientas para el análisis del mercado. Admite operaciones al contado y apalancadas, y ayuda a operadores principiantes y profesionales con una interfaz intuitiva y tutoriales.

Gane una bonificación de 100 $

para nuevos usuarios

La mayor bolsa de criptomonedas donde puede iniciar de forma rápida y segura su viaje en el mundo de las criptomonedas. La plataforma ofrece cientos de activos populares, bajas comisiones y herramientas avanzadas para operar e invertir. La facilidad de registro, la alta velocidad de las transacciones y la protección fiable de los fondos hacen de Binance una gran opción para los operadores de cualquier nivel.

Differences between the marking price and the last value

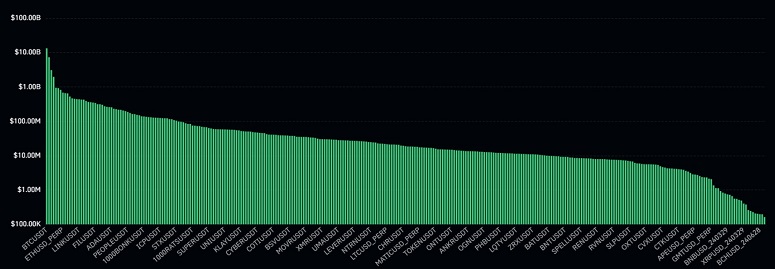

Liquidations of positions worth billions of USDT occur when quotes change dramatically. According to CoinGlass, in December 2023, when Bitcoin fell 7%, traders’ trades totaling $0.5 billion were closed.

Due to high margins, squeezes – short-term rate spikes – are common on the chart. They are most often caused by a large trade or price manipulation by whales. To reduce the number of unwarranted liquidations, the forced close level is determined using the marking price. The last value is the quote of the previous transaction on Binance. The parameter indicates the unrealized profit/loss.

The markdown price is taken as an average value from several exchanges. The quotes for the period and funding information are taken into account. If the liquidation price matches or exceeds the mark-to-market value, the position will be forcibly closed.

Binance users can switch charts with methods of calculating the liquidation price on Binance futures. To do this, you need to click on the icon at the top and select the option – Last, Mark, Index Price. When creating an order, you can specify the conditions for closing the trade. It is recommended to choose the last value for take profit, for stops – marking.

Calculation of the liquidation price on Binance

The level of risk depends on the amount of leverage and the user’s balance. To place an order, Binance requires freezing the collateral (initial margin). The smaller the loan, the larger the amount that needs to be frozen. When calculating the initial margin to hold a transaction, the formula used is: position size x rate – collateral.

The result in dollar equivalent is different from the amount of the order in cryptocurrency. If the trader’s balance falls below the maintenance margin, liquidation occurs. An example of calculation is in the table.

| Parámetros | Values |

|---|---|

The position liquidation price on Binance means the level at which a trade is automatically closed. To calculate the exact value, you need to determine by what amount the exchange rate should change when the forced liquidation is reached.

It is also necessary to take into account other open positions and interest for borrowing (for spot trading). Therefore, it is better to use a calculator to calculate the exact value. You need to click on the icon in the upper corner of the terminal and select the “Liquidation Price” tab.

Comisiones

For the operation of forced closing of a position, Binance charges higher fees – 1-1.5%. If several orders were opened on the account, the commission is charged for each one separately.

Description of the liquidation process

The procedure is initiated when the sum of the balance and unrealized profit/loss becomes less than the maintenance margin (the amount of money needed to keep the order). Forced liquidation of all traders’ positions is performed using a single Smart Liquidation protocol. The process is as follows:

- When the margin balance approaches a critical value, the program sends the user an email and SMS notification about the margin call event. To prevent a forced closure, the trader can assess the situation and add money to the account. However, due to sudden rate hikes, timely delivery of the notification is not guaranteed.

- When the liquidation price is reached, all pending orders are canceled.

- The program places a forced close order.

Binance tends to liquidate positions not completely, but partially. Transactions are closed sequentially. After each close, the sufficiency of collateral is checked. If the user’s balance becomes higher than the maintenance margin, the procedure will stop.

Orders

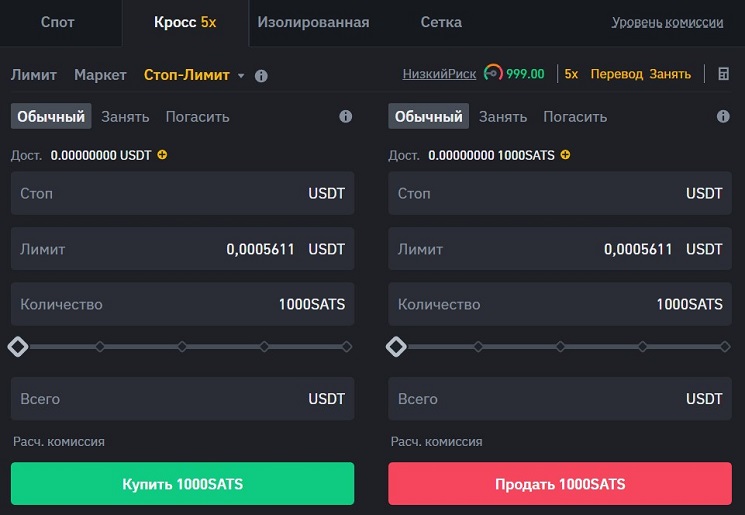

When a position is liquidated, the program places a stop order. To create an order of this type, the user selects the activation level and the limit price (at which the transaction will be made). At forced closing of a position:

- Stop – the level of liquidation of the transaction.

- Limit – bankruptcy price. This is the value at which the user’s balance is equal to zero.

Liquidation order – an order of the “Execute Immediately or Cancel” type. It is executed in any case (fully or partially). This is its difference from regular stop orders. They are canceled if a counterparty with the required volume cannot be found.

Zeroing out a negative balance

Cryptocurrencies are highly volatile. Therefore, it is possible that the algorithm will not be able to close positions in time. The trader will not only lose his deposit, but will also remain owed to the exchange (a negative balance will appear).

Binance has an insurance fund for such an event, which is supported by funds from liquidation commissions. When the event occurs, the account is automatically replenished to zero. The operation is performed if the user meets these conditions:

- There are no open transactions on the account.

- The client has not transferred funds to cover the loss. The multi-asset mode is not activated.

Tips to avoid liquidating positions on Binance

With a competent approach, leveraged trading brings high profits in a short period of time. But you need to remember the risks – in case of failure, the trader will lose the entire deposit. Before the transaction it is necessary to calculate the potential income in the calculator and determine the level of position cancellation. If the market situation develops to the disadvantage of the user, you can add money to the account. This pushes back the level of forced cancelation.

But it is not necessary to replenish the deposit on emotions. Additional investments in a knowingly unprofitable position will only increase losses. In this case, it is better to set a stop-loss a few points above the forced closing price. This will save on commission.

Another way to avoid forced closing is to place an opposite order of the same volume. This operation is available only on the futures market. As long as the hedging transaction is active, the financial result does not change from the quotes. This gives the trader time to assess the situation and make a decision.

Using a stop loss

For successful trading, you need to learn how to manage risks. Inexperienced traders’ trades are liquidated when they enter a trade without a plan. When placing an order, it is necessary to determine the take profit level and the conditions for taking a loss.

Experts recommend setting a protective stop loss at the level of 20% of the entry point. This will allow you to close the order before liquidation and save your deposit. This approach is justified for medium-term speculators with take profit of 100-200% and more. Scalpers and intraday traders should set smaller stops. The size of the loss should not exceed 30% of the average profit.

Leverage reduction

The price of liquidation depends on the user’s balance and the amount of margin maintained. The higher the leverage used, the less collateral is needed. Accordingly, the liquidation level is closer to the current quotes. Therefore, to reduce the level of risk of forced closing of a trade, a small leverage should be used.

The value is selected when placing an order. It can be done later, but only if there are enough funds on the balance. For this purpose, open the trading terminal and press the “Change leverage” button. If an error occurs, it will be necessary to add funds to the account or reduce the position.

Tracking the margin ratio

To avoid forced closing of a deal, one should monitor the margin. The margin ratio is the ratio of the minimum support of all positions to the account balance. It is recommended not to allow this parameter to decrease less than 200-300%. At the value of 100% the trader’s trades will be forcibly closed.

The amount of support to hold the transaction varies with the cryptocurrency exchange rate. The higher it is, the higher the supporting margin. Therefore, you need to check the sufficiency of funds at each significant rise or fall of quotes. This will require:

- Log in to your Binance account on the website or app. Open the “Trading” section.

- Select the “Margin” or “Futures” tab.

FAQ

💳 After liquidation the balance became negative and it was not replenished to zero. What is the reason for this?

Automatic debit occurs every 10 minutes. If the replenishment is not made during this time, you need to contact the support service.

🔎 Why does Binance liquidate the transaction before the balance is zero?

In the cryptocurrency market, it is difficult to guarantee accurate execution of orders due to high volatility. Therefore, the exchange aims to liquidate positions before the user goes bankrupt. This helps to prevent a negative balance.

📣 What leverage is recommended for beginners?

Inexperienced users are better off trading without borrowed funds. You can take a small leverage – up to 5x. This will allow you to sit out losses in case of a mistake.

📌 What is auto-deleveraging (ADL)?

There are always 2 sides to the market. If one trader loses money, the other makes money. The “socialized loss” method involves sharing the loss among all profitable participants. Trades are selected based on profit rating and leverage. They are liquidated to cover the losses of the bankrupt users.

💡 How much money is in Binance’s insurance fund?

In January 2024, the amount is $844.6 million USDT. Real-time data is published on the Insurance Fund History page.

¿Hay algún error en el texto? Resáltalo con el ratón y pulsa Ctrl + Entre en

Autor: Saifedean Ammousexperto en economía de las criptomonedas.