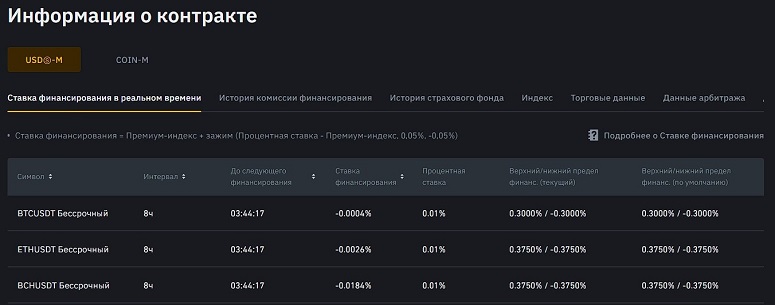

It is no longer convenient for experienced traders to trade on the spot market: short trades are not available, and you have to pay high interest rates for using margin lending. These disadvantages are not present in futures trading: Binance offers free leverage up to 125x. However, there are nuances. For example, every 8 hours the trader is charged an amount proportional to the funding rate. It can be positive or negative. Funding on Binance is a mechanism to reduce the difference between the base coin and perpetual contracts. The rate depends on the market trend, trader sentiment and is calculated for each cryptocurrency separately.

What is Funding Rate on the Binance Exchange

Funding rate is a payment to crypto traders on open orders on open-ended contracts. The rate is calculated daily and helps to reduce the deviation of futures prices from the value of the underlying assets. Thanks to Binance funding, users can maintain positions for as long as they want. The algorithm automatically deducts money from the accounts of some clients and credits it to others (with opposite positions).

The operation is carried out directly between traders without the participation of the exchange, so no commission is charged.

How to calculate

On the Binance exchange, the funding rate is debited (or credited) every 8 hours. The actual value is calculated by an algorithm. To find out the amount of the instrument, you need to:

- Log in to your account and go to the “Futures” tab.

- Select an asset and open the trading terminal.

The funding rate is displayed in the upper right corner. If the value is positive, longs pay shorts, if it is negative, vice versa. To calculate the amount of write-off (interest), multiply the nominal value of the asset by the funding rate.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Principle of operation

The futures value may deviate from the underlying asset. To level out this difference, the Binance platform uses a funding system. The rate is calculated automatically and depends on the demand, the correlation between the underlying asset and the futures. Principle of operation:

- Log in to your account and open the “Futures” tab.

- Select an asset. Open the trading terminal.

The funding rate is displayed in the upper right corner. If the value is positive, longs pay shorts, if it is negative, vice versa.

To calculate the amount of write-off (reward), you need to multiply the nominal value of the asset by the funding rate.

Nominal value of assets

On a minute chart of cryptocurrencies, you can notice squeezes – sharp deviations from the market price due to a large sale or purchase. To avoid manipulation and unnecessary liquidation of positions, traders use the mark-to-market price. This is a more accurate value of the asset, when calculating which the algorithm takes into account the rate on other platforms. Positions are liquidated at this price.

To determine the nominal value of assets, you need to multiply the marking price by the size of the contract.

Technical analysis of the funding rate

The history of funding rate for any asset is available on Binance. To get the information, you need to:

- Click on the current value in the upper right corner of the trading terminal.

- Select “Transaction History”.

This data can be used to predict the behavior of the asset. For example, a high positive rate, which persists for a long time, indicates a short market sentiment. If the price starts to grow, most positions will be liquidated – by stop losses or margin calls. To close the deal on the downside, you need to buy the coin. This will give an additional growth impulse. The phenomenon is called “short-squeeze”.

What affects the funding rate of perpetual contracts

Traders can hold USD-M futures for as long as they want (until liquidation). In the market, the price of cryptocurrency depends on supply and demand. Margin lending is not available on the spot, and futures are traded with leverage. This means that during a powerful trend, the demand for the underlying asset is lower than for perpetual contracts. This difference can lead to a strong discordance. The automatic funding system was launched to combat it. When calculating the funding rate, 2 components are taken into account. Details are in the table.

| Parameters | Comments |

|---|---|

| Binance has a fixed interest rate of 0.3% per day (0.1% for each debit). This does not apply to all contracts: for BNB/USDT, ETH/BTC and BNB/BUSD the rate is zero. | |

| The rate changes every 8 hours, taking into account the spread between spot and futures. It depends on the average contract price on all exchanges and the index of margin impact on bid and ask. Formula: premium = [max (0, bid impact – average price) – max (0, average price – ask impact)] / average price. |

Crowd Sentiment

The funding rate is needed to maximize the convergence between the price of the futures contract and the spot. Therefore, the value depends on the trend of the underlying asset. The rules are:

- During an impulsive rise in the price of a coin, most traders are confident that the rise will continue. The funding rate increases.

- The higher the value of the parameter, the more crypto traders have to pay out for holding the long. This will lead to a narrowing of the spot/loan spread.

- The smaller the difference between the prices of the underlying asset and the futures, the lower the funding rate. At the minimum spread, it reaches 0.0001%.

Positive and negative rates

According to technical analysis, the probability of trend continuation is always higher than reversal. This is due to the psychology of traders. The higher the price rises, the more willing to buy. Therefore, in general, traders who stand on the trend take losses and pay participants with opposite positions. This compensates for the higher demand for the coin and brings the prices of the underlying asset and perpetual contracts closer together.

The rule is not always valid. In case of a sharp trend reversal, the rate can remain positive for a long time.

How to use fanding in trading on Binance

It is necessary to take into account the time of opening a deal. This will allow you to reduce commissions or get additional profit. On the Binance exchange there is an automatic fanding 3 times a day: at 00:00, 08:00, 16:00. If a client plans to start a transaction, and there is not much time left before funding, it is better to wait. It is unlikely that the user will have time to close the transaction in this interval. So, you will have to pay for holding at least one extra time. If the rate is positive – on the contrary, it is advantageous to open the transaction after the settlement.

Rate arbitrage

This method is used when there is a large difference between the price of the asset on the futures market and the spot. The trader takes a neutral position. He opens hedging trades of equal volume on futures and spot. This allows earning a positive funding rate on the futures market and avoiding the risk of price change. The main conditions for getting profit when implementing the strategy are simultaneous closing of orders and working through a broker with small commissions and narrow spreads.

Margin

In the futures market traders can work with a large leverage, but it is necessary to keep an eye on the collateral. The amount of funding depends on the size of the position. A margin call can occur after a negative rate is written off. Therefore, it is important to keep a reserve of money in case of force majeure. The opposite is also true: if market conditions are favorable, a positive funding rate can significantly increase capital with little or no risk.

Hedging

In general, to close shorts, a trader must buy an asset. However, at Binance clients can launch a hedging mode, which allows them to hold multidirectional positions at the same time. In this case, it is possible to earn on any market movement. Hedging is used in such strategies:

- Countertrend trades. The main position is opened on the market. It is possible to take a correction with a smaller volume (to reduce risks). In this case, the trader will not receive a loss.

- Locking. The trader is sure of the trend direction, but the entry point is chosen unsuccessfully. To avoid a margin call, he opens an opposite trade on the same volume. This allows to wait out an unfavorable period.

The funding rate is charged on both trades. If the amount of cryptocurrency is the same, the financial result is zero. If the user is outweighed, he can get both a profit and a loss.

Setting up notifications

The situation in the crypto market changes very quickly. In case of a sharp jump in the financing rate, it is necessary to react immediately. Therefore, it is important to receive timely notifications. On Binance, you can set up email, SMS or push notifications in the mobile app. Activation procedure:

- Authorize in your profile and go to the “USDⓈ-M Futures” section.

- Click on the settings icon in the upper right corner.

- Go to the “Notifications” tab.

- Click on the item “Activate Funding Fee”.

- Enter a value between 0.0001 and 0.75%. If the rate exceeds the set level, the trader will receive a notification.

Loss and liquidation of the counterposition

Arbitrageurs open 2 trades – on spot and open-ended futures. This strategy works well in a bear market:

- There is no charge for buying and holding a position on the spot. However, the market is falling, so the user receives a loss from the decrease in the price of the asset.

- For open shorts on futures, Binance does not write off funding, the crypto trader is paid the funding rate.

In general, the funding amount on both accounts should be the same. However, holding a 1 BTC contract requires only 209.36 USDT. This means that you can buy 5-8 times more coins on the spot market. The remaining amount will be enough to open a counter position. However, in case of a sharp change of trend due to a jump in the funding rate, the order can be liquidated. Funding will begin to bring not profit, but loss. When the free balance runs out, the money will be deducted from the margin. This can lead to liquidation of the position.

Tips for developing a trading strategy

On the Binance exchange, the funding rate is paid out every 8 hours. Therefore, short-term strategies are not suitable for its use. You need to hold the trade for at least a day. It is also necessary to take into account such features:

- The choice of instrument. Coins in the sideways will not be suitable, the trend should be well tracked.

- Direction of the transaction. It is more profitable to choose coins with a high financing rate. This can be a signal for a reversal: the user will stand up against the trend and will earn well after the realization of the scenario.

- Risk assessment. You need to consider several options for the development of the situation. One cannot allow a complete loss of capital in a single transaction regardless of the market environment.

- Obtaining data from multiple sources. The crypto market is very volatile. It is necessary to monitor data in real time, analyze and take action. Routine tasks are better left to robots.

Frequently Asked Questions

📢 If a trader opened a position at 8 hours 55 seconds, the funding commission will no longer be assigned?

The actual settlement time may deviate by 1 minute. Therefore, the user will still be charged the funding rate.

📌 What is the Impact Margin Nominalization (IMN)?

It is an average ratio that reflects the impact of trading at maximum leverage with a deposit of 200 USDT. To calculate it, divide the account balance by the initial margin level.

✨ How do I activate the hedging option on Binance?

You need to open the trading terminal, click on the “Settings” icon in the upper corner and select “Position Mode”. The change will require the completion of all transactions.

⚡ During extreme market volatility, can Binance change the funding rate write-off period?

You need to open the trading terminal, click on the “Settings” icon in the top corner and select “Position Mode”. The change will require all trades to be completed.

🔥 What are the risks of arbitrage betting?

In a calm market, the funding commission is very small (less than 0.01%). Therefore, users are forced to spend the entire deposit and open a counter position with leverage. This can lead to losing money.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.