A few years ago, the financial services market was controlled by large banks and microfinance companies. With the emergence and development of cryptocurrencies, the situation has changed. In 2021, managed and decentralized online services that conduct financial transactions with digital assets without intermediaries are at the peak of popularity. Anyone who has access to the Internet can invest in a promising project or take out a loan in bitcoins. The blockchain acts as a guarantor of the transaction, and the user’s digital capital serves as collateral.

How cryptocurrency lending works

The principle of digital P2P loans is very similar to the traditional one: users give each other money without the participation of a bank. Both parties register on a special platform, which acts as a guarantor of fulfillment of obligations. The difference between fiat and cryptocurrency lending lies in the accounting of funds. Traditional services calculate loan amounts and risks using the scoring method (a system for assessing the solvency of clients). For digital loans, ratings are not needed. Instead, traders can use their assets as collateral.

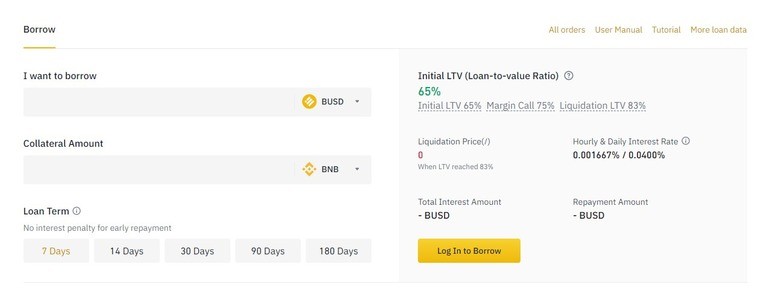

Cryptocurrency loans use hourly rates and short repayment terms (7 to 180 days on Binance). This is due to the high volatility of digital coins, which carries high risks for both parties. If the price of the assets falls, the collateral received by the lender can become much less than the amount given to the borrower.

In 2021, online cryptocurrency loans are being made by regulated (CeFi) and decentralized digital platforms(DeFi). The former work with verified customers, offer relatively low loan rates, and often protect assets with insurance or cold storage (Binance, FTX). The latter don’t require proof of identity, but their loan interest rates are higher (Maker, Compound).

Who can get one and what it takes

Taking a loan in digital currency is easier than taking out a loan from a traditional financial institution. You don’t need a credit history for peer-to-peer transactions. It is enough to have a cryptocurrency wallet to store and use coins and provide other assets as collateral.

5020 $

bonificación para nuevos usuarios

ByBit proporciona condiciones cómodas y seguras para el comercio de criptomonedas, ofrece comisiones bajas, un alto nivel de liquidez y modernas herramientas para el análisis del mercado. Admite operaciones al contado y apalancadas, y ayuda a operadores principiantes y profesionales con una interfaz intuitiva y tutoriales.

Gane una bonificación de 100 $

para nuevos usuarios

La mayor bolsa de criptomonedas donde puede iniciar de forma rápida y segura su viaje en el mundo de las criptomonedas. La plataforma ofrece cientos de activos populares, bajas comisiones y herramientas avanzadas para operar e invertir. La facilidad de registro, la alta velocidad de las transacciones y la protección fiable de los fondos hacen de Binance una gran opción para los operadores de cualquier nivel.

On Binance, lending is available to all registered users. The trader himself chooses the coin (BTC, BNB, USDT and others), collateral and loan term (up to 180 days). Depending on the amount of collateral, the system will automatically determine the interest rate. Under such conditions, you can get up to 65% of the provided collateral for any purpose.

DeFi platforms have become very popular in 2021. For example, Maker issues DAI fichas against ETH collateral. To get a loan, the user blocks ether in a smart contract. To repay the debt, the same amount of DAI must be returned. The interest rate is 3% per annum. The amount of collateral is 150% of the loan amount.

With the growing popularity of the DeFi industry, it became possible to take a cryptocurrency loan without collateral. The size of the loan is not limited, but there is a mandatory condition – the money must be returned within one transaction (block).

Flash loans can be used to arbitrage digital currencies, repay and refinance loans. However, if the assets are not returned to the pool in a timely manner, the system will cancel the transaction.

How lending platforms work

Lending bitcoins (ETH, USDT and other coins) involves lending assets against or without collateral of other digital currencies. The user is obliged to repay the loan funds and accrued interest before the expiration of the transaction, otherwise they forfeit the collateral. Given the volatility of cryptocurrencies, the loan amount is fixed in fiat equivalent. If the price of the asset rises during the loan period, the user will receive a profit when the collateral is returned.

Regulated platforms independently determine the interest rate, the amount of collateral, repayment terms and other terms of transactions. On P2P sites, borrowers and lenders negotiate loans among themselves. CeFi projects work only with verified users. Decentralized sites do not require identity verification.

Features of obtaining in Russia

Borrow Bitcoin (BTC) on the CeFi platform can any user, regardless of where they live. Decentralized projects work anonymously, so there is no question about the regional affiliation of clients there. However, on peer-to-peer sites it is easier to get a loan in digital coins for Americans and Europeans, who are considered more solvent and conscientious borrowers. Applications for loans from citizens of the Russian Federation are not always approved, but you can register on several sites at once and count on a higher percentage.

In 2021, Russian services are also working in the crypto-loan market. For example, the Cryptobroker platform issues fiat and koins against the security of digital assets. To take advantage of the offer, you need to make a cryptocurrency deposit and create an application for a loan. The requested amount should not exceed 70% of the current market value of the collateral. The borrower withdraws the loan money to a card, electronic or digital wallet, and after repayment of the debt takes the amount left as collateral.

The first bank loan secured by cryptocurrency in Russia was granted in 2020 to entrepreneur Mikhail Uspensky. The borrower provided Waves tokens as collateral. Under an agreement between Uspensky and Expobank, the digital assets were placed in escrow in an escrow account.

How to get a loan or credit in bitcoin

Technically, a cryptocurrency loan is not a traditional banking service. Peer-to-peer loans are provided by individuals, not credit organizations. Transactions take place on special platforms, which act as a guarantor of the fulfillment of obligations by the parties. Therefore, borrowing bitcoin is easier than a regular bank loan.

The best platforms

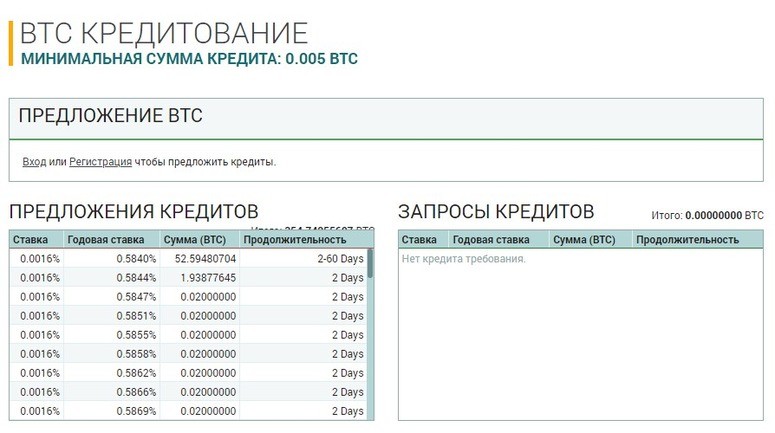

Loan in digital assets is offered by all major crypto exchanges. On Poloniex, the service is available in the Lending section, which is organized on the principle of peer-to-peer lending. The exchange provides insurance for the lender and sets limits for the borrower to evenly spend the funds. The assets can only be used within the platform. Similar conditions apply on Binance Loans, Bitfinex Borrow and other services.

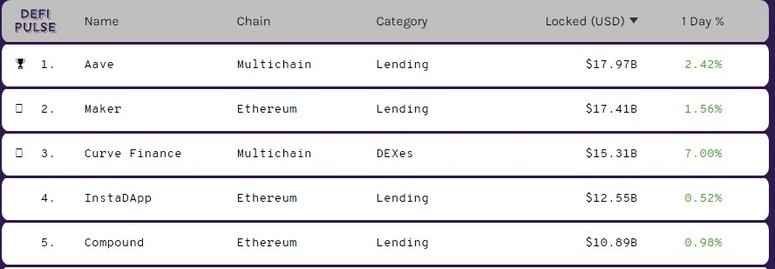

Several large companies are leading the cryptocurrency loan market in 2021. Centralized platforms provide users with technical support and insurance for cryptoassets. DeFi projects allow borrowing quickly and without P2P interactions.

| Decentralized platform | Loan rate per year (%) | Native token | Capitalization native token in October 2021 ($) |

|---|---|---|---|

| Uniswap | 6 | UNI | 15.79 billion |

| Fabricante | 3 | MKR | 2.04 billion |

| Aave | 4 | AAVE | 4.5 bln |

| Compound | 3,7 | COMP | 1.9 bln |

| dYdX | 6,1 | DYDX | 886.98 mln |

BTCpop

The platform supports a large number of popular coins and provides loans of different types: personal, instant, unsecured and asset-backed. BTCpop is an ecosystem with its own exchange, staking pools, exchanger, faucet and P2P lending platform. Only verified users can get a loan. The interest rate is 15-30% per annum.

NEXO

The service was formed from the Credissimo lending service, has been operating since 2007 and is KYC (Know Your Customer) and AML (Anti-Money Laundering) compliant. NEXO is a platform that positions itself as the world’s first provider of loans secured by digital currencies. The site lends funds in fiat currencies to a card or bank account at 5.9-11.9% per annum, and accepts BTC, ETH, XLM and other coins from the top ten as collateral.

Nebeus

The platform combines the functions of digital and banking services. The Nebeus project allows trading, storing, borrowing or earning from loans. Loans are issued in EUR or crypto coins. BTC, ETH or native Nebeus tokens are used as collateral. The interest rate is 6-25% per annum depending on the program.

Algorithm of actions

Centralized platforms work like regular lending institutions and issue loans after the application is approved. To obtain a loan, you need to:

- Register in the system.

- Fill out a profile, attach documents.

- Create a loan application.

- Wait for approval of the system.

- Make a digital deposit.

- Receive money.

Decentralized projects do not require verification. All operations in them are automated. The user only needs to bind a wallet and make a deposit. If the value of the collateral falls as a result of volatility, it can be redeemed. Any participant of the system has the right to deposit up to 50% of the value of the collateral and receive the corresponding part with a 5% discount.

Tips for beginners

Cryptocurrency loans open great opportunities for investors and traders. The former can utilize the value of digital assets without selling them. The latter get free funds for trading without having to close current positions. To get a loan on the best terms, a user needs to earn a reputation. For beginners, higher rates apply, but there is an opportunity to increase the rating. To do this, you need to link your cell phone number, email, profiles in social networks to your account. In P2P loan services, a completed profile has a better chance of attracting the attention of lenders.

When looking for a platform to work on, newcomers will have to choose between anonymity and security. Managed sites require identity verification upon registration, but offer asset protection. On DeFi platforms, transactions are conducted between users without the involvement of a third party.

How to make money from cryptocurrency lending

CeFi and DeFi platforms bring together borrowers and lenders. Both parties want their assets to work. The borrower generates a funding request, specifies the amount, interest rate, and repayment period. Other users respond by offering to transfer a specific tranche in digital or fiat currency. Each lender independently determines the amount it is willing to invest. This mechanism allows you to participate in several transactions at once, reducing the likelihood of losing money.

You can earn on cryptocurrency lending in several ways:

- Asimple scheme – issuing loans and receiving interest under predetermined conditions. The risk of non-repayment is reduced due to internal ratings, which are based on verification, history of previous transactions, user reviews.

- Arbitrage – receiving a loan at a low interest rate and issuing loans with a higher rate. Stable income can be obtained on a large number of large transactions.

- Capital turnover – involves the use of borrowed funds for cryptocurrency trading.

Managed platforms use cryptocurrency loan insurance. An investor can also protect themselves by independently vetting potential borrowers and laying down the risks of non-repayment in their investment strategy.

Advantages and disadvantages of bitcoin lending

“The law on digital assets” in the Russian Federation considers the sale of cryptocurrency as one of the ways to generate taxable income. Lending against the security of bitcoins allows you to save digital capital and not pay personal income tax. Other pluses of bitcoin loans include:

- Quick processing of the loan without going to banks.

- No credit history is needed.

- Low interest rates.

- It is possible to make a profit when returning the collateral if the rate of coins grows.

- Decentralized services do not require documents to confirm the loan.

Minuses of cryptocurrency lending:

- The high volatility of digital coins carries the risk of losing part of the funds when returning the collateral if the rate drops.

- Short terms of crypto loans (from 1 day to a year).

- There is a risk of non-repayment of the debt.

The future of cryptocurrency lending

According to the Dove Metrics service, cryptocurrency companies raised more than $8.2 million in venture funding in Q3 2021. About half of the funds raised were invested in centralized finance projects, while nearly 4% were invested in DeFi. Digital loans are growing in popularity due to low interest rates, convenient asset management and minimal requirements to the borrower. Russian legislation allows the use of coins as collateral for transactions. There is already a precedent in banking practice of issuing a loan secured by digital assets. Transparent and understandable regulation of cryptocurrencies is required to spread the experience.

Resumen

Cryptocurrency loans can help when you need “fast money” to make a one-time transaction or implement a trading strategy. You don’t need a credit rating to get additional funds. Any koin holder can open a loan account and determine its term, limit, and interest rate on their own. Users can also choose where to borrow money. Peer-to-peer platforms will suit those who want a cryptocurrency loan. Centralized projects will be the solution for those looking for a loan against assets.

Preguntas frecuentes

💰 Can I get a cryptocurrency loan if I don’t have a bank account?

It depends on the type and terms of the transaction. If fiat is needed, a bank account or e-wallet will be required to withdraw the money. To receive coins, a digital address is sufficient.

📝 Is verification required to get a crypto loan?

No. DeFi platforms work without identity verification.

📌 Do I have to pay tax on a cryptocurrency loan?

No. The profit from the sale of digital assets is taxable. You don’t need to close your current positions to borrow coins.

🔍 On which exchanges can I take a cryptocurrency loan?

Such an opportunity is available on Binance, Poloniex, EXMO, Bitmex and other platforms.

💵 From what amount can I invest in lending platforms?

It is possible to receive income from cryptocurrency lending with minimal investments. The investor himself chooses the amount he is ready to provide to the borrower, and can break it into several transactions (collective lending).

¿Un error en el texto? Resáltalo con el ratón y pulsa Ctrl + Entra.

Autor: Saifedean Ammousexperto en economía de las criptomonedas.