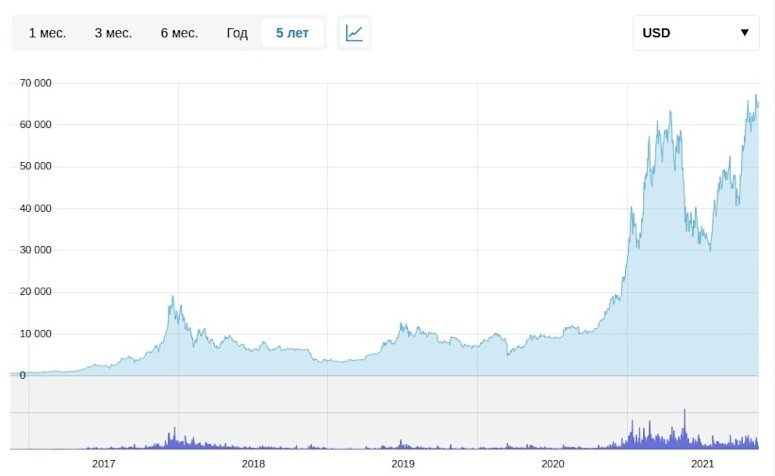

The main cryptocurrency in 2021 has updated an all-time high. The price is about 3 times higher than the last record value. On this wave, the question of the limit of the value of digital assets is again raised. There are optimists who talk about the price of $1 million. This was stated back in 2017 by the famous businessman John McAfee, the owner of the eponymous company, a manufacturer of software in the field of computer security. True, he predicted that already in 2021 it will be possible to buy bitcoin for a million dollars. So far, the assumptions of the businessman and former US presidential candidate have not come true, but this question remains open.

Prerequisites for the growth of bitcoin value

Unlike John McAfee, experts in the field of digital assets are more cautious in their predictions about the rate. The price is influenced by many factors. Not all of them can be analyzed, so it is difficult to answer the question about bitcoin reaching $1 million.

In addition to the standard factors affecting the value of assets (including virtual assets), cryptocurrency is influenced by the trust of users, their desire to invest their funds. Dogecoin can be used as an example. Its rate has grown hundreds of times due to promotion through social networks, statements of famous people, including Ilon Musk. The second coin, the value of which increased due to the hype, is Shiba Inu. Ilon Musk bought a dog breed Shiba Inu and posted a photo in the social network. This provoked a rise in the price of the coin of the same name.

Unlike other cryptocurrencies, bitcoin is trusted by users. This is the first digital asset that became not just a guide, but also a benchmark for subsequent projects – altcoins. Changes in its price are reflected in other coins and fichas.

In 2021, the first cryptocurrency was on the rise. Experts (economists, blockchain researchers, large coin owners) name the following main factors for the increase in value:

- An increasing base of holders of the asset.

- The ongoing coronavirus pandemic. Cryptocurrency is gaining more investor confidence than traditional instruments.

- Interest in digital assets from big businesses.

- Growing need to change the traditional financial system.

- Increasing proportion of people who are positive about digital assets.

At the same time, it is difficult to make serious predictions. It is impossible to accurately predict the exchange rate, as the high volatility of assets prevents making calculations. The head of the Kraken exchange Jesse Powell believes that over the next 10 years bitcoin may cost 1 million dollars. At the same time, he does not name the exact date and reasons for such a price increase.

5020 $

bonificación para nuevos usuarios

ByBit proporciona condiciones cómodas y seguras para el comercio de criptomonedas, ofrece comisiones bajas, un alto nivel de liquidez y modernas herramientas para el análisis del mercado. Admite operaciones al contado y apalancadas, y ayuda a operadores principiantes y profesionales con una interfaz intuitiva y tutoriales.

Gane una bonificación de 100 $

para nuevos usuarios

La mayor bolsa de criptomonedas donde puede iniciar de forma rápida y segura su viaje en el mundo de las criptomonedas. La plataforma ofrece cientos de activos populares, bajas comisiones y herramientas avanzadas para operar e invertir. La facilidad de registro, la alta velocidad de las transacciones y la protección fiable de los fondos hacen de Binance una gran opción para los operadores de cualquier nivel.

Other experts point to the possible preconditions for a multiple increase in the rate of the asset. In their opinion, bitcoin must fulfill a number of conditions, namely:

- Stop being a speculative asset.

- Receive more trust from the largest companies in the world, up to the real application for savings, settlements.

- Become an alternative to gold and fiat currencies.

The main obstacle on the way of koin to the specified value is the financial illiteracy of users, lack of knowledge about the technical aspects of cryptocurrency. This applies both to individuals and managers, analysts of large companies, banks.

Negatively affect the attempts of some governments to ban cryptocurrency, to limit its status. There are more than 7 thousand cryptoassets in the world (as of November 2021). Bitcoin’s competition is quite strong. The coin is inferior to some innovative projects in terms of transaction speed and other parameters.

The price of BTC at the maximum coin issue

Satoshi Nakamoto laid down a limited number of bitcoins. A total of 21 million BTC can be issued. As of October 2021, almost 90% of the total has been mined.

The last coin will be mined in 2140. The slowdown in mining is due to halving (halving ), the process of reducing the reward for each block of information recorded. The next reduction will be in 2024 (to 3.125 BTC). Halving occurs every 210,000 blocks mined.

Dates of the halving reward process:

| Date | Block number | Reward for mining, BTC |

|---|---|---|

| 28.11.2012 | 210 000 | 25 |

| 07.09.2016 | 420 000 | 12,5 |

| 11.05.2020 | 630 000 | 6,25 |

| 2024 (tentative) | 840 000 | 3,125 |

| 2028 (tentative) | 1 050 000 | 1,5625 |

| 2032 (tentative) | 1 260 000 | 0,78125 |

| 2036 (tentative) | 1 470 000 | 0,390625 |

| 2040 (tentative) | 1 680 000 | 0,19531125 |

The initial reward for a mined block was 50 BTC.

Halving is often cited as the main reason for bitcoin’s price rise. If the demand for the coin remains or increases and the supply decreases, the value should rise. In other words, limited issuance creates a natural scarcity of bitcoin.

Analyzing historical data shows changes in the value of the coin after each halving. In 2012, the price of bitcoin increased from $100 to $1000. In 2016, the value also increased, but the biggest increase was the year after the halving. The third halving, which occurred on May 11, 2020, is also due to a hike in price. Eleven months later, the bitcoin exchange rate was over $60,000.

The necessary capitalization for a bitcoin value of one million dollars

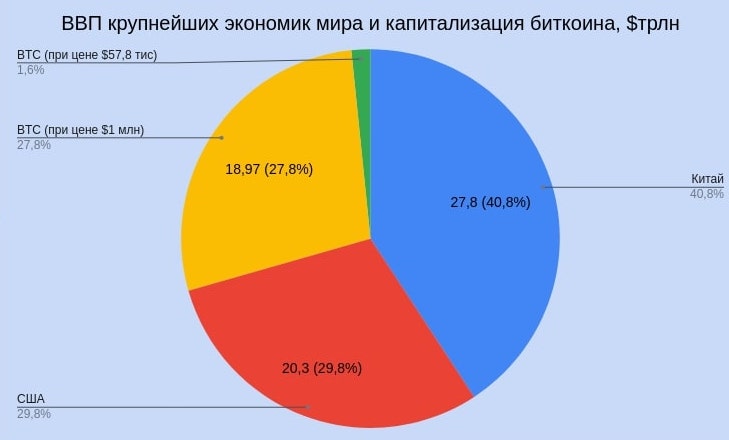

The price affects the amount of all the assets of the project. In November 2021, the capitalization of bitcoin was $1.2 trillion with a coin value of $64 thousand and a total volume of mined coins of 18.97 million.

At the same time, fewer coins are actually in use than indicated. Many bitcoins stored in wallets with forgotten private keys were lost in the early years. Satoshi Nakamoto is rumored to have 1 million BTC, they are lying unmoved. It is likely that the access keys have been lost by the developer or his heirs. The movement of such a cryptocurrency mass will lead to a sharp drop in the exchange rate.

Given the maximum possible number of coins, we can calculate the capitalization assuming a selling rate of 1 BTC per million dollars:

21 million × $1 million = $21 trillion

This capitalization value is calculated assuming the maximum issuance is reached. For the actual number of coins in use, the volume is $18.97 trillion.

This level of capitalization is comparable to the GDP of the world’s second economy, the United States (data for 2020). It represents a quarter of the global gross domestic product. This means that at $1 million per BTC, the share of the latter in international settlements should be 25-30%.

Conclusions

The value of digital assets is growing, and this trend may continue. New projects emerge, cryptocurrency becomes more popular, the scope of its application expands. Bitcoin is the flagship of the digital world. Even despite the use of blockchain 1.0 with all its shortcomings, the first cryptocurrency remains the leading one in terms of capitalization and price.

Experts are trying to predict the value of bitcoin in 1, 5 and even 10 years. They call different rates, including $1 million for Bitcoin. However, high volatility, dependence on the news background, unclear prospects of legalization in different countries can make adjustments in the forecasts of analysts, and in any direction.

Preguntas más frecuentes

💵 What will miners earn on after the last coin is issued?

There will remain transaction fees, which will grow with the increase in value.

🤔 Is it worth buying the first cryptocurrency now in anticipation of a price jump?

There is no unambiguous answer to this question. While the uptrend continues, a correction of the rate is possible, but in the long term, the price can both rise and fall.

🙄 Is it better to buy only bitcoin, or will other cryptocurrencies also rise in price?

The rate of digital assets depends on different factors. You need to carefully study the market, understand the key indicators, follow the trends. It is recommended to choose several effective cryptocurrency pairs and monitor their movement. Investments are better to diversify.

🔻 If the price of a coin is falling, should you sell it?

Not always. You should not panic, study the reasons for the fall, identify trends and make a decision.

💰 What is the minimum amount to enter the cryptocurrency market?

There are no restrictions on the size of investments. It is easier to work out strategies on small amounts without a lot of risk. In the future, you can increase the amount you invest. However, you should not use all free funds. It is better to diversify investments.

¿Error en el texto? Resáltelo con el ratón y pulse Ctrl + Entre en

Autor: Saifedean Ammousexperto en economía de las criptomonedas.