The ETH cryptocurrency was created by a team of programmers led by Canadian developer Vitalik Buterin. The ethereum market is the second largest in terms of capitalization, and the coin is considered the most technologically advanced digital asset. Transactions in the Ethereum network are much faster than in other blockchains with PoW consensus. But the most important advantage of etherium is the ability to deploy automated algorithms(smart contracts). It is only mined on video cards. However, there is an opinion in the crypto community that the era of Ethereum mining on GPUs is coming to an end. When etherium mining will end, no one knows. The answer to this question depends primarily on the transition of the network from the Proof-of-Work consensus mechanism to the Proof-of-Stake algorithm.

Etherium mining

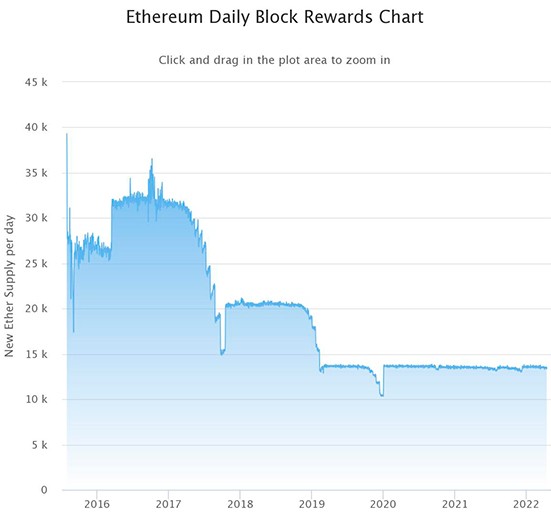

When Ethereum was launched, the target block mining time was 15 seconds and the reward was 5 ETH. Thus, every minute, miners confirmed 4 blocks, which amounted to 240 chain elements per hour, or 5,760 per day. However, according to Etherscan reviewer metrics, the network is mining an average of 6,400 to 6,600 blocks per day in June 2022. It takes about 13 seconds to mine one blockchain element. In 2017, after the Byzantium hardfork, the reward per block decreased from 5 to 3 ETH (by 40%).

Later, in February 2019, as a result of the Constantinople hardfork, payments to miners were reduced once again – from 3 to 2 ETH (by 33%). In April 2022, the reward per block was 2 ETH. The Ethereum community assumes that payments for mining 1 blockchain element will be reduced again – from 2 to 0.5 ETH (by 75%). This will be done to preserve the purchasing power of the cryptocurrency to bring its inflation rate closer to bitcoin. But this initiative has not yet been passed.

All ideas to change the block mining time or the size of the reward for mining are spelled out in the EIP (Ethereum Improvement Proposals). This document covers the technical specification of the prescribed update and the reason for it.

EIP is a common way to request and make changes to the Etherium network (similar to Bitcoin’s BIP). Not only the development team, but any member of the community can submit a request to add new features to the blockchain.

This is how application standards and network updates are discussed and developed. There are several EIPs regarding block mining time, appropriate reward, number of coins and consensus. But these proposals are still being discussed and not every proposal will be implemented.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

For example, to ensure the economic sustainability of the Ethereum platform, co-founder Vitalik Buterin introduced an EIP and proposed to severely limit the supply to 120 million units. This is 2 times the amount of ETH sold on the crowdsale. Later, the specialist also proposed to limit the issuance of etherium to 144 million, which is only 2 times the number of coins generated in the genesis blockchain. But both EIPs are yet to be adopted.

Over the years, developers and community members have proposed solutions for Ethereum issuance, but none have been implemented. As of April 2022, the issuance of ETH is still unlimited.

Author: Saifedean Ammous, an expert in cryptocurrency economics.