The major digital asset Bitcoin came into existence in January 2009. Bitcoin is the first implemented blockchain technology (decentralized system). The new financial market is actively developing. As of June 14, 2022, there were already 8552 coins and tokens. Bitcoin for 13 years occupies the first line in the ratings by capitalization – $411.27 billion. But there is a possibility of the end of Bitcoin and other digital assets.

Significant advantages of cryptocurrencies

The Bitcoin blockchain was created by an unknown person (or group of people) under the pseudonym Satoshi Nakamoto. His idea was a decentralized network for making payments. It was developed as opposed to classical banking systems. Digital assets have the following advantages:

- Decentralization.

- Low commissions.

- Anonymity of users.

- Development of blockchain technologies.

Decentralization

Different financial structures store data on transfers on their own servers. But they are vulnerable to hacking, so such a system is considered insecure. Also, banks and similar institutions control customer funds. And a lot of money is spent on maintaining their work.

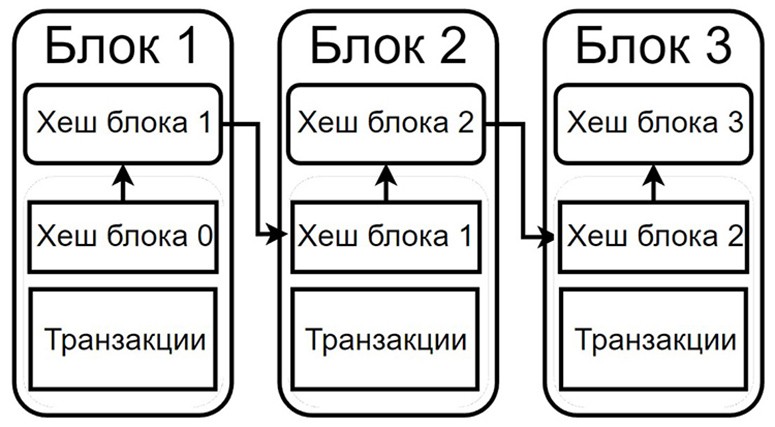

Another thing to consider is blockchain networks. They consist of a chain of blocks in which data about all transactions is recorded. Its storage and processing are handled by miners and validators. Their task is to synchronize the recorded information among themselves. This allows to avoid repetitions in the records. The number of miners in one blockchain can exceed a hundred thousand. According to the CoinDesk service, in February 2021, BTC crypto miners became more than 1 million. Each of them contains all the information in the blockchain network. Such a system of storage organization is called decentralized.

Low fees

Decentralized systems can boast of cheap transfers anywhere in the world. Also, the size of commissions is not affected by the amount of transactions. For comparison, international payment providers (SWIFT, SEPA and others) carry out operations up to 5 working days, and the commission for 1 transfer starts from $15.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

The transaction fee in cryptocurrency depends on the specific blockchain network. As of June 14, 2022, profitable transfers were conducted at Solana. The fee was $0.00015 per transaction. Solana can also process up to 65,000 transactions per second. In comparison, VISA’s throughput is 24 thousand.

Anonymity

Blockchains give users the ability to keep their personal information private. To transfer cryptocurrency, only a wallet address will be required (sometimes a Memo is needed). But personal information is requested by various services, vaults or exchanges. This is due to the introduction of AML and KYC anti-money laundering measures. However, there are ways to avoid data disclosure. The user of digital currencies can apply decentralized exchanges and anonymous wallets.

At the same time, blockchain networks are completely open to view. Anyone is able to see every transaction made in them. But information about the initiators of transactions cannot be found.

The anonymity of cryptocurrencies worries the governments of different countries. They have become a tool to pay for illegal services and goods on the Internet.

Development of blockchain technologies

Digital assets are the first successful implementation of decentralized networks. With them, it became possible to rapidly develop the technology. In 2015, smart contracts were created on the basis of the Ethereum blockchain. These programs start working at the moment when predetermined conditions are reached. They can be used for:

- Simplifying document flow.

- Conducting transparent elections.

- Eliminating fraud.

- Fair operation of betting companies and casinos.

- Issuing credit.

The possibilities of smart contracts are high. As of June 2022, many global companies (Visa, MasterCard, Nestle and others) are engaged in their implementation.

Significant disadvantages

New blockchain projects with their own coins and tokens are constantly appearing. But they are still unable to take the place of fiat money. The cryptoasset market has the following disadvantages:

- Software vulnerabilities.

- High rate hikes.

- Lack of regulation.

Vulnerability to hacker attacks

Blockchain networks, cryptocurrencies and smart contracts are software products. Therefore, they may have vulnerabilities in their code. Over $3.2 billion was stolen through hacks in all of 2021 (according to analytics company Chainalysis). DeFi projects accounted for about 72% of the attacks. But if we look at the whole market, it has the following weaknesses.

| Problem | Description | Solution |

|---|---|---|

| Viruses | Hackers use them to hack wallets, exchanges and other services. As a result, users lose their funds. | Observe the principles of cyber literacy |

| Attacks on stock exchanges | Many trading platforms have been subjected to server hacking. The most famous case is the MtGox exchange. 850,000 client bitcoins were stolen from it. | Store coins and tokens in cold or non-custodial vaults |

| Scammers | A portion of blockchain projects turn out to be scams. Their crypto-assets quickly depreciate in value and investors lose their funds. | Research the project before buying their assets |

| Coin loss | Transferring cryptocurrency to a non-existent wallet will result in their loss. For example, according to analysts from Chainalysis, more than 3.7 million bitcoins have been liquidated permanently. And it’s impossible to undo transactions on the blockchain. | Verify the address before transferring coins |

High volatility

Most coins and tokens are unsecured. Their exchange rate depends on the trust of users. Digital currencies are considered to have high volatility in the market. This makes it impossible to use them in settlements. Therefore, as of June 2022, they are unable to replace fiat money, which could lead to the end of cryptocurrencies.

Stablecoin is a token backed by another asset. For example, the price of Tether (USDT) is pegged to the value of the US dollar (1 to 1).

Unregulated market

The main advantage of crypto-assets is decentralization and lack of control. But on the other hand – it can be seen as a disadvantage. The cryptocurrency market has become a tool for fraud and other illegal activities. Governments of different countries take measures to regulate the market. However, there is no unified understanding of this process. Therefore, states have endowed cryptocurrencies with different statuses (in Russia, they are considered property).

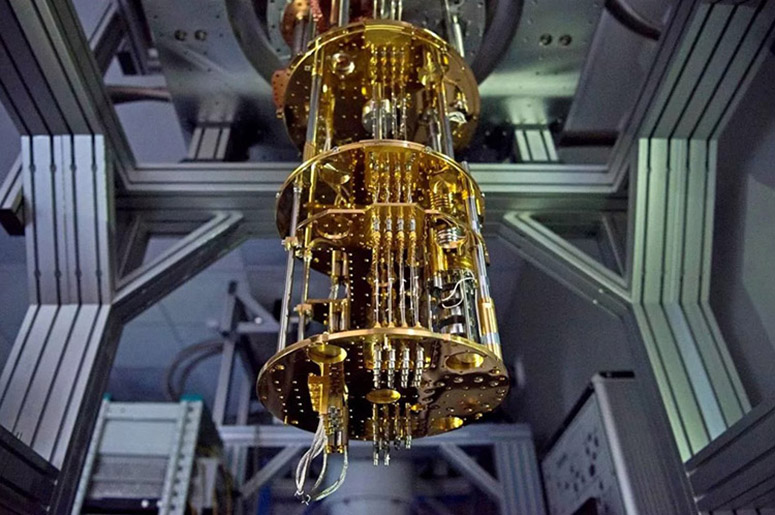

The problem of the quantum computer

Its advantage over conventional computing devices is the ability to quickly digest data. This poses a threat to blockchains based on cryptography. But quantum computers are not so simple. They work on the superposition effect, when a particle is in two or more states at the same time. However, when you try to record the result, the superposition breaks down. The particle assumes one single state. In quantum mechanics, this is called the observer effect.

It is likely that such a computer would crack the blockchain. But in an attempt to use the result of the calculations, the client will get one random answer. And because of the large number of possible outcomes, it will often be wrong. This makes a quantum computer useless for hacking a blockchain network (as of June 2022).

Should we expect the end of bitcoin and cryptocurrencies

Central banks of different nations are interested in controlling money. Therefore, the replacement of fiat currencies with crypto-assets is still far away. But part of the experts believe that it will eventually happen. For example, Peter Thiel (founder of PayPal) in 2023 at a conference in Miami said about the inevitability of replacing fiat with cryptocurrencies. He believes that the central banks of countries around the world are on the verge of bankruptcy. This will eventually lead to the adoption of digital assets. He also stated that the cryptocurrency market is more honest and efficient.

Whether the end of bitcoin and other coins will come, it is impossible to predict exactly. But some experts, politicians and financial institutions agree that crypto-assets will have an impact on the traditional monetary system. They will become a component of it.

Frequently Asked Questions

💰 Can altcoins replace Bitcoin?

Yes, this is the opinion held by some analysts. Ari Paul (co-founder of BlockTower Capital) believes that Bitcoin is obsolete and it will lead to the loss of primacy in the cryptocurrency market.

❓ How many digital assets will remain in the future?

It’s impossible to say for sure, but most blockchain projects do not benefit society. Brad Garlinghouse (CEO of Ripple) believes that 99% of crypto assets will disappear.

💲 What is the ultimate limit of BTC?

By 2140, the last bitcoin will be mined. The total issuance is 21 million coins.

🖥 Have there been any instances of blockchain hacking?

Yes, for example, Ethereum Classic was repeatedly attacked by 51%. In August 2020, a hacker reorganized 4 thousand of the last mined blocks. He stole $5.6 million.

❗ What is the more likely scenario for the end of the cryptoasset market?

Ban by the states.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.