Digital assets are an alternative to cash and credit cards. Some companies have long been accepting cryptocurrency payments in exchange for their goods and services. The growth of market capitalization shows that investors are showing interest in bitcoin and altcoins. But the use of cryptocurrency is not limited to settlements and long-term investments. There are other areas in which digital assets play an important role.

The main uses of cryptocurrency

Digital assets are another type of commodity. Investors using cryptocurrency prefer it over traditional fiat money. All because neither the government nor banks can control payment systems on the blockchain, and transactions with them are secure and anonymous.

Some countries (such as North Macedonia or Algeria) have banned the use of cryptocurrency. Others, on the contrary, are intensively introducing them (such as El Salvador). Among all financial markets, the sphere of digital assets is the youngest. And this does not prevent people from using bitcoin and altcoins to solve different tasks.

Digital payments

The main purpose of the invention of crypto-assets is to replace fiat money. Bitcoins and altcoins can be used to pay for digital and physical goods. The first time cryptocurrency was involved in a transaction was on May 22, 2010, when programmer Laszlo Heinitz bought 2 large Papa John’s pizzas in exchange for 10 thousand bitcoins. At the time, 10k BTC were worth approximately $41. In February 2022, they are worth over $378 million.

Cryptoassets have long been used in mutual settlements, for example, by Microsoft, AMC and Overstock. The Dallas Mavericks basketball club accepts Bitcoin and even Dogecoin for tickets and merchandise. Some real estate sellers are settling payments in coins and tokens. And as of September 7, 2021, bitcoin is considered legal tender in El Salvador. Since that day, major retailers (McDonald’s, Starbucks) began accepting BTC in branches opened in this country.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Collectors and sellers of rare assets also began to make settlements in cryptocurrency. In July 2021, Sotheby’s auction announced that it would auction a 101-carat diamond for Bitcoin or Ethereum. The $12.3 million deal came just after the sale of a work by British artist Banksy. But none of these contracts compares to the irreplaceable “Every Day is the First 5,000 Days” token created by artist Beeple. NFT sold for $69 million in Ethereum coins.

Microtransactions

Visitors to online stores have often encountered a situation where they need to order items for a certain amount to process a delivery. This is because the seller’s overhead costs are not covered by a payment below the minimum order value.

Microtransaction channels are a technology that allows many small digital currency transactions to be combined into one to pay a common fee.

Smart Contracts

This is a decentralized protocol that automatically performs an action in response to certain events. For example, a smart contract can be programmed to allocate funds for someone’s birthday every year. The protocol is also configured to unlock payment when a customer confirms receipt of delivered goods, or used to protect certain rights of digital asset owners.

Despite the name, smart contracts are not legally binding agreements. Their function is to execute different tasks, processes or transactions in a consistent and automatic manner.

Cryptoassets enable smart contracts to operate on a specific blockchain. By performing programmed actions, the protocols create transactions for which a fee is charged.

Alternative methods

As with traditional asset classes (e.g. real estate), the market has introduced the option of using cryptocurrency to originate or collateralize loans. This option has found implementation in decentralized finance.

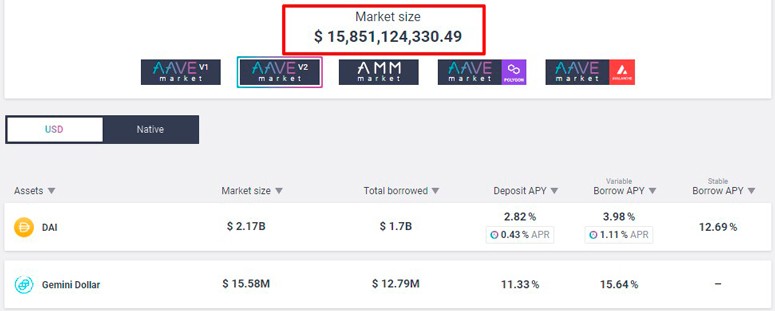

For example, on the DeFi platform Aave, customers can lend or borrow coins and tokens and earn a profit. The profitability of any crypto assets is automatically and algorithmically regulated depending on the supply and demand in the protocol. This means that several factors affect the final percentage:

- The coin or token used as collateral.

- The ratio of the loan amount to the value of the collateral.

- The term of the loan and other parameters.

The Aave protocol also allows customers to participate in transactions called “quick loans” (situations in which the borrower borrows and repays the debt with the same blockchain).

This option may seem favorable, but due to volatility, there is a high risk of the collateral value decreasing. It will take more coins (tokens) to pay back the loan.

Assets realized in the form of management tokens give owners a say in the blockchain project. With these cryptocurrencies, customers have access to create and vote on proposals for changes to the protocol. Only users, not the project team, can influence the project’s characteristics. Management token holders change the interface, the procedure for distributing the commission on the decentralized exchange, and decide other important issues of the system. Voting is not the only function of this type of cryptoasset. Management tokens allow holders to earn money from steaking, lend money, and profit from income farming.

Digital intellectual property

In early 2021, NFTs (Cryptopunks, Crypto Kitties, Lazy Lions, and others) were selling for several tens or even hundreds of ETH ($110k on average).

A non-interchangeable token can technically contain any digital information – from simple drawings to animated GIFs, songs, and even artifacts in video games. This type of digital unit is fundamentally different from conventional cryptocurrencies.

Interchangeable tokens (BTC, ETH, BNB) are identical. They can be easily exchanged one for another, just like fiat money. For example, an ABC user asked to borrow 100 BTC from his friend SBA and received it in one transaction. If ABC repays the debt with transfers of 50, 20 and 30 BTC, he will still repay the loan as the total amount of transactions will be 100 BTC.

Each NFT is unique and has its own price. A record of its owner is placed in the token, this information is stored in the blockchain. Sellers of non-replaceable tokens usually only accept digital assets as payment, and ownership is recorded in the corresponding blockchain.

Investments

Owners of digital coins often use the word HODL, which means “buy and hold.” Cryptocurrencies are a new asset class, so they are subject to high volatility. For example, in early December 2020, BTC cost $19.7 thousand. Then the rate rose to $29.3 thousand. And in 2021, bitcoin reached ATH (highest price point) of $68 thousand. Such volatility is considered extreme.

Bitcoin’s compound annual growth rate (CAGR) over 10 years was 150-200%. For comparison, the S&P 500 stock index is valued at about 11% on the same parameter. Only in 2014 and 2018. BTC had a negative annualized return. In other periods since 2010, the bitcoin price has appreciated by 100% or more.

A similar approach can be used for other crypto assets (Ethereum, Solana, Binance Coin). The table compares the returns of the S&P 500 and the stocks of some publicly traded companies relative to bitcoin over the past 10 years. Other cryptoassets were not evaluated as they have been around for less than 10 years.

| Asset | Price in December 2011 ($) | Price in December 2021 ($) | Growth (%) |

|---|---|---|---|

| Bitcoin | 3,93 | 56 600 | 1 462 647,33 |

| S&P 500 | 1244 | 4500 | 261,84 |

| Amazon | 196 | 3400 | 1276,35 |

| Disney | 36 | 142 | 426,76 |

| JPMorgan Chase | 32 | 157 | 405,95 |

The strategy of long-term bitcoin ownership is being utilized not only by private investors, but also by corporations. Since Microstrategy announced its first BTC purchase in August 2020, its share price has risen from $150 per security to over $700 (in December 2021).

Exchange trading

Some investors prefer the HODL strategy, while others try to take advantage of the extreme volatility of crypto-assets and profit from short-term trading.

You can trade digital currency on specialized platforms (Coinbase, Gemini) and on traditional exchanges. The main difference between cryptocurrency and stock markets is that the former operates 24/7, while the latter closes for the weekend.

Digital asset exchanges occasionally fix technical glitches and fail to fulfill placed orders, but the market itself never closes.

Another difficulty of day trading cryptocurrencies is the large number of coins and tokens. The analytics platform CoinMarketCap has over 17,500 different altcoins as of February 2022. This large selection of assets can make researching crypto projects difficult.

Some exchanges allow traders to trade with leverage (a situation where the funds for a transaction are borrowed from the venue). Given the extreme volatility to which the market of coins and tokens is subject, day trading is not always profitable, and transactions with margin represent an increased risk for the investor.

Benefits of using cryptocurrency

Digital assets are not just a financial instrument. It is a technology that offers its users significant benefits.

Low commission

The most common way to use cryptocurrency is to make cross-border payments. Transaction fees for transferring coins and tokens are reduced to insignificant amounts. Third parties (Visa, PayPal and other payment systems) do not verify transactions, so there is no need to reimburse additional intermediary fees.

Anonymity

The execution of transactions in the blockchain is based on solving mathematical puzzles that are difficult to decipher. This makes cryptocurrency secure compared to other electronic transactions.

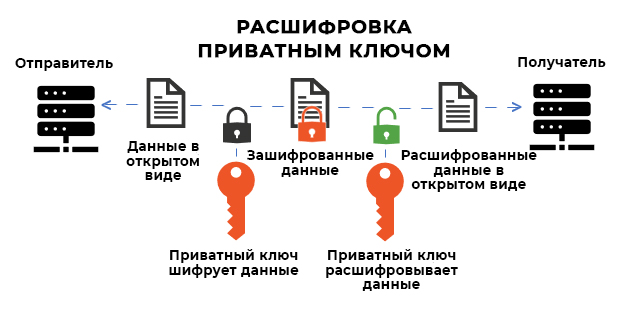

Customers do not need to provide their personal data to make a payment. Only a special code (private key) is needed, which allows them to decrypt the transfer information and receive crypto assets.

Decentralization

The advantage of cryptocurrencies is that they are not subject to governments or banks. Many protocols are controlled by developers or users who have a significant amount of coins and tokens.

Decentralization helps keep the currency monopoly loose and contained. No single organization has the right to determine the issuance and value of coins (tokens). This approach keeps crypto-assets stable and secure, unlike fiat money which is controlled by the government.

Inflation protection

The value of fiat currencies decreases over time due to the fact that governments can issue them with no limit on quantity. The issuance of cryptocurrencies is most often predetermined. It happens that a certain number of coins and tokens in the network are irrevocably withdrawn from circulation according to a given algorithm and periods. The demand for digital assets increases and their price rises. This helps prevent inflation.

Simple exchange

Crypto-assets can be bought for fiat currencies of different countries: the US dollar, euro, Indian rupee or Japanese yen. Various wallets and exchanges allow you to convert one digital unit to another through simple interfaces and for minimal fees.

Transparency of transactions

Transactions with digital assets take place on a secure network directly between clients. All transactions are displayed on the blockchain and are available for verification. The information that is stored on the network cannot be changed or deleted. This ensures transparency in transactions.

How to use cryptocurrency

Important nuances that will help you buy, spend and store coins and tokens:

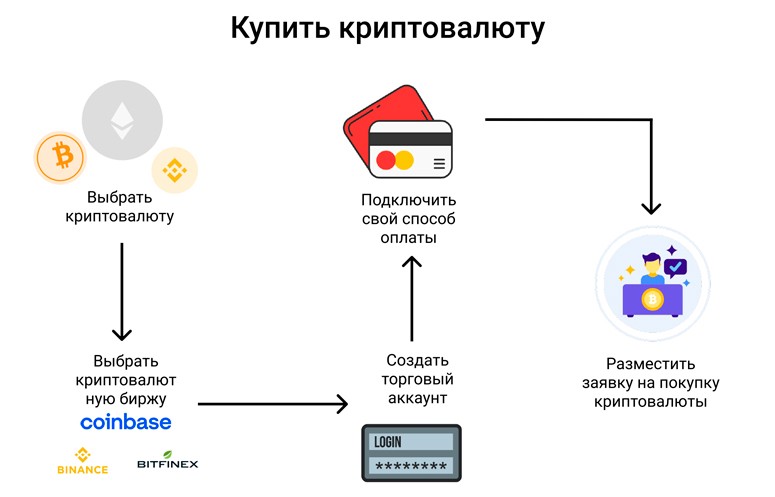

- Acquisition. As the crypto industry evolves, new ways to purchase digital currencies are emerging. The main methods include centralized and decentralized exchanges, P2P services, and exchanges. Each platform has its own pros and cons. You should choose a trading platform based on your investment goals, needs and desires.

- Usage. To spend his cryptocurrency, the owner must provide the network with a private key. This is a secret code that helps decrypt the signature of the owner of the coins (tokens) and complete the transaction. It is important to keep the private keys safe and never give them to third parties. Anyone who has this code can steal the cryptocurrency.

- Storage. For more control over your transactions, you need to download software. Cryptocurrency wallets are created for this purpose. The security of the user’s digital assets depends on the choice of storage.

Frequently asked questions

💵 Is cryptocurrency money?

Digital assets act as a means of payment, but they are different from government banknotes.

❓ Can bitcoin be touched?

The BTC coin is virtual and only exists online.

🔎 What is the blockchain for?

A blockchain is a system where data is stored.

📃 Are cryptocurrency and blockchain the same thing?

A digital asset is the unit of account that drives the network. A blockchain is a decentralized system for transferring and storing data.

💻 Can cryptocurrency be applied to games?

In the market of decentralized finance, the direction of blockchain gaming is actively developing. In these projects, it is allowed to use various altcoins.

An error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.