On forums and in articles about cryptoassets, the words “FUD”, “Moon” and “HODL” are often used, which originated as slang. They are now industry terms. The expression “hold cryptocurrency” is used among traders who do not sell their assets for a long time. It has become an investment strategy for many users.

What it means to hold cryptocurrency

“HODL” is a misspelled word. It translates to “hold”, when used correctly it means “hold”. It is the advice to not be afraid of drops. The difference between bitcoin holders is their ideology. Hodlers do not sell digital assets because they believe that the future is behind them.

History of the emergence of the term

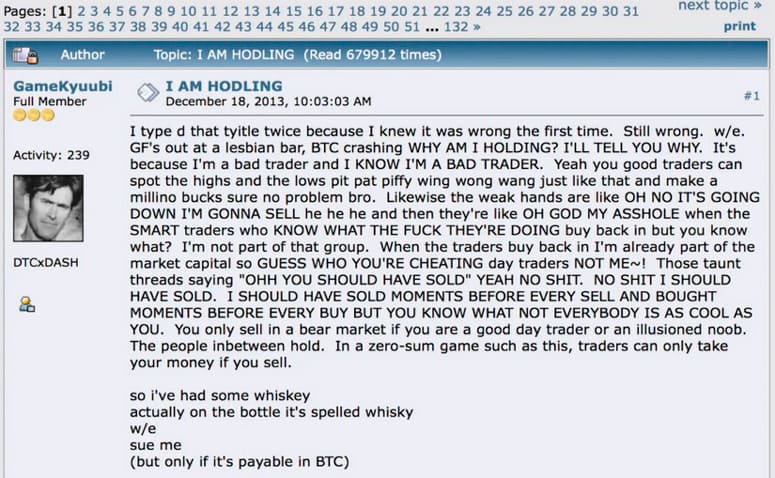

The origin of the HODL meme is attributed to a post on the BitcoinTalk forum by a user named GameKyuubi. On December 18, 2013, bitcoin was worth $551. In the I AM HODLING post, the investor wrote that he was a bad trader and was going to hang on to bitcoins. He has no intention of trying to predict their price movement. The meme has been in use since that time.

Since the post was published, many users have spoken out in favor of conservative approaches to investing. For example, dollar cost averaging as a way to mitigate short-term coin volatility.

Who it’s good for

Deciding how long to keep or when to sell cryptocurrency is a personal choice for the user. Investors should do their research and exercise discretion before acting. Some people prefer to hold cryptocurrency. This means that assets are bought and not scheduled to be sold for a long time.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Other users hold bitcoin but trade unpromising coins. The hodl strategy is suitable for investors who don’t want to spend a lot of time on a cryptocurrency portfolio or are not well versed in technical analysis. They can simply choose which coins to buy and hold them. There is no need to check the market every day and make trades.

Holding example

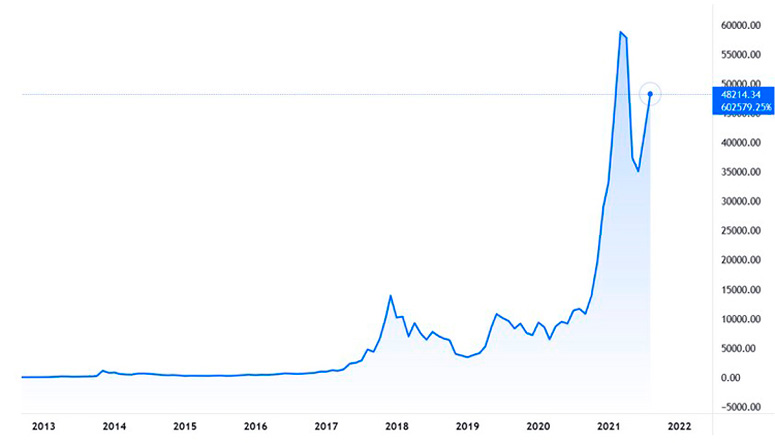

When bitcoin was introduced in 2009, the coin was worth nothing. Further, the token went through such stages:

- A year after the start of trading, the digital currency was valued at fractions of a cent.

- In 2011, BTC reached the mark of 1 dollar for the first time. Bitcoin crossed 1k in November 2013, when it began to attract attention to itself.

- In 2017, during the second major price spike in its history, it approached $20k. But fell to $3.3k in 2018.

- In December 2020, the coin broke the $20k mark.

- Made a leap to a record high of $64.9k reached on April 14, 2021.

It is difficult to predict where the bitcoin price is moving. But the long-term trend is in favor of HODL.

Hodl

The term has spread to other cryptocurrencies. Investors use it for the process of holding assets. They are bought and not sold for a long time.

Strategies

Holding cryptocurrency is similar to the “take and hold” principle. It is used by participants in the stock market.

Investors who don’t hold crypto are like day traders in stocks or forex who profit from volatility. They buy cheap and sell high or look for a position to short.

The HODL strategy involves long-term investment in digital assets. Investors believe that the value of the coins they buy will rise despite any short-term volatility.

By employing the HODL strategy, they understand that the market fluctuates up and down and hold their assets during downturns. This is especially important for inexperienced market participants who are prone to panic.

It is unlikely that a downturn will cause all cryptocurrency to drop to zero and disappear. Often the market will recover. Although it may take time to return to previous highs.

Common Cryptocurrency Storage

Earning money from digital assets in a passive way is easy. To do this, you can buy coins from exchanges or exchangers. Then keep them for a long time on your crypto wallets to increase the rate. This strategy is suitable for top assets with a developed community and a good development team.

Lending

One of the ways when the owner of tokens contacts the borrower through the lender platform. The essence of earning is as follows. The user places a deposit for a certain period of time and receives a profit. The percentage is specified in annual equivalent. Rates for September 2021 start at 6.2% and rise to 12.7%, depending on the cryptocurrency asset. Their size can also change due to the market situation.

The term of placement is from a week. The platform withholds a commission from the one who takes funds on credit. An example of profit calculation is presented in the table.

| Annual percentage, % | Days per year | Number of lending days | Calculation |

|---|---|---|---|

| 12 | 365 | 7 | 12 / 365 * 7 = 0.23% for the term of lending digital assets in the lending period |

For example, ZebPay Exchange borrows coins at interest for a period of 7 to 90 days. The rate of return depends on the number of days selected. You can get up to 3% per annum for bitcoins, up to 7% for Ethereum and Dai, and up to 12% for Tether. The platform presents a 6-coin program.

This lending feature is aimed at long-term investors. It allows you to earn passive income, in addition to profits from the growth of cryptocurrency prices.

The Vauld exchange lends coins from its clients for a period of 30 to 90 days. You can get up to 6.7% per annum for bitcoins and Ethereum, up to 12.68% for DAI and Tether. The platform works with 30 digital assets and pays interest to customers.

However, to receive % by lending, it is mandatory to transfer cryptocurrency to the wallet of the exchange. Upon maturity, the income received will be credited to the trading account along with the principal amount.

For example, a user lends bitcoin for 3 months on the ZebPay exchange. The interest will be credited along with the principal amount after the end of the loan period.

Staking

This is locking tokens in a DeFi smart contract (decentralized finance protocols) to get more coins in return. The process is similar to a fixed deposit in a bank that pays interest on the money deposited there.

By blockchaining a crypto asset in the DeFi system, the user becomes part of the node for the project’s network. Each blockchain protocol with proof-of-ownership (Proof-of-Stake algorithm) relies on them to securely verify transactions. Users who put tokens into the staking to protect the network are rewarded.

For example, an Ethereum owner puts a coin into an Ethereum 2.0 smart contract. He will receive additional ETH for his role in securing the network by following basic consensus rules. For Ethereum 2.0, the minimum requirement for staking is 32 ETH. On some platforms, a smaller number of tokens can be staked.

In addition to direct remuneration for placing the tokens, holders receive a percentage of revenue from the products and services offered by the platform.

Alternatives to hodling

Trading and holding coins for long periods of time are among the main ways to make money from cryptocurrencies. However, part of the community is looking for more acceptance of digital assets. Therefore, 2 other strategies are created and utilized:

- SpendingPhilosophy (SPEDN) – digital coins are spent to buy goods and services. Promotes their adoption in the real world.

- Infrastructure Development (BUIDL). Refers to the creation of companies, platforms, applications and tools to utilize such assets.

Advantages and disadvantages of holding cryptocurrencies

The pros for digital koin holders are as follows.

- High returns. Investors hold their assets for long periods of time to capitalize on the increase in value.

- Lack of trading skills. No need to understand trading and follow the market.

- Emergence of hardforks. When the blockchain is split into 2 independent networks, holders of one coin usually get new coins for free. An example is Bitcoin Cash, which is based on the Bitcoin source code.

- Security. Hodling can provide greater safety of funds. Since investors are not exposed to short-term volatility and avoid buying high and selling low.

Market participants should also consider the risks of holding cryptocurrency.

- Sufficient capital to avoid forced sales or provide liquidity.

- Impairment of the asset. Not only can a coin rise in value, but it can also lose value.

- Uncertainty. Digital assets face unknowns, lack of developed legislation. Some coins may disappear altogether.

- Politics. Governments of countries have different attitudes towards the use of cryptocurrencies. This can affect transactions and their value.

Tips and advice for investors

It is important for hodlers to create and maintain a balanced portfolio. This means that if an investor only owns bitcoins, their collection is disharmonious. The selection of cryptoassets should be careful. Not all coins are suitable for hodling. Many may disappear after a few years.

While hodling is a good strategy, it is not completely passive. The investor is supposed to pay attention to his portfolio. Changes it over time and also performs rebalancing.

Popular memes

After the term “hodl” was first mentioned, a whole trend of memes emerged. These pictures have an entertaining nature. They are usually used in cryptocurrency channels in the messenger Telegram.

Frequently asked question

🤔 Is there any risk in hodling?

Although it’s a good way of passive income, you need to watch out for risks: access loss, hacker attacks. Therefore, before placing your token on any platform, you need to carefully analyze its reliability, weigh the pros and cons.

🤫 Who are hodlers?

These are people who believe in cryptocurrency. For many, owning bitcoins is more than just an investment. Holding digital assets allows them to be part of something revolutionary. They believe that cryptocurrencies are the future.

❗ Which industries are the big hodlers?

Information technology companies have the largest amount of bitcoins on their balance sheet. Their share is 66.8%. They are followed by the consumer sector (20.2%) and financial sector (11.8%).

❔ Is it worth holding bitcoin?

Experts recommend traders with small investment amounts to choose a hodling strategy. This approach has 2 advantages. First, the main goal of bitcoin hodlers is to buy the coin and achieve greater profits in the long run. Second, liquidity and volatility are less affected as users hold coins during the ups and downs of the market.

❓ How many bitcoin holders are there and how long have they been holding it?

The number of bitcoin hodlers has reached 20 million or roughly two-thirds of the addresses with a balance. 60% of the circulating supply of coins has been at these addresses for an average of 4.7 years.

Is there an error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.