For the cryptocurrency market, 2022 was not a good year. Mainly because the value of the world’s first digital coin, Bitcoin, fell dramatically. The same problem affected many other virtual assets.

The reasons that contributed to the negative dynamics of the cryptocurrency market are the economic crisis caused by international conflicts, as well as the collapse of several digital exchanges. Now, many analysts are eager to understand what the virtual coin market has in store for the near future.

Top 3 promising cryptocurrencies today

New digital coins appear on the market almost every day, but only a few of them are able to gain recognition. Only those assets that have proven their usefulness can win the trust of cryptocurrency market participants. Today we will talk about the three most promising new digital projects in 2023. Here they are:

- Love Hate Inu – the coin of the first crypto platform for conducting votes and polls.

- DeeLance – a unique Web3 platform with a transparent economy designed for freelancers.

- Ecoterra – an eco-project with the concept of Recycle-to-Earn.

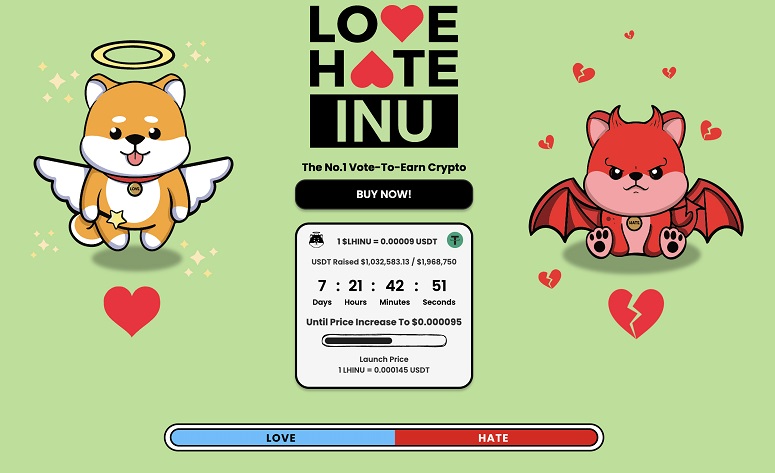

Love Hate Inu

Love Hate Inu, a young cryptocurrency project based on the latest Vote-to-Earn technology, offers clients the opportunity to receive rewards for completing various surveys and votes. The reward is presented in the form of the platform’s native token – LHINU.

The project coin is in the pre-sale stage, and already now the amount of investment exceeds $3.4 million. At the moment the token is sold at the price of $0.000105, and in the future its value will rise to $0.000145.

The developers will keep 10% of the assets for future awards and listings. All other coins have already been released for pre-sale.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Staking, backed by smart contracts, guarantees protection against spam and vote rigging. This means that all results will be as fair and transparent as possible.

Startup advantages:

- First-of-its-kind Vote-to-Earn project.

- Anonymous and secure voting, transparent results.

- 90% of all issued coins are available for pre-sale.

- Users have the opportunity to earn by taking interesting surveys, as well as through staking.

DeeLance

DeeLance is a young Web3-based platform for freelancing and employee search. It offers a convenient way for potential employers to interact with performers. The project has its own token DLANCE, which was created specifically to provide comfortable and secure financial transactions. A pre-sale is currently underway. The token can be purchased for $0.025. The asset is sold for ETH and USDT.

The platform operates on the Ethereum blockchain and offers customers not only low transaction fees, but also effective functionality for finding and hiring performers.

The relevance of the cryptocurrency is supported by the general idea of the project and the huge volume of the online freelancing market, which amounts to billions of dollars. Given the growing popularity of remote work, we can already say that the platform has promising prospects.

According to the developers, the project will use Metaverse and NFT technologies to ensure the stable operation of this ecosystem. At the time of creation of the material, $82 thousand was invested in the token.

Advantages:

- Security of transactions is controlled by smart contracts.

- Comfortable cooperation between customers and performers.

- Transparency and fairness of the platform is ensured by blockchain technologies.

Ecoterra

Today, the prospects of the cryptocurrency ECOTERRA are considered the most promising in the field of Recycle-to-Earn. The project uses blockchain to improve the world’s environmental situation. Users of the platform will be able to earn rewards in the form of digital coins for recycling.

The native coin of the project is now in the pre-sale stage, you can buy it for $0.004. At the moment $273 thousand has already been invested in the startup, and many analysts assume further growth of interest in this platform.

By combining blockchain technology with the sphere of waste recycling, the cryptocurrency ecological project Ecoterra has all chances to change a lot not only in the economic sphere, but also in the environmental situation. Considering how many pollution-related problems there are now, the platform offers hope for a better future.

Advantages:

- High relevance of the project idea for producers, recyclers and eco-activists.

- Rewards for participating in eco-activities.

- Large-scale plans to build a closed-loop economy.

What awaits the cryptocurrency market: analysts’ forecasts

The opinions of most analysts regarding the prospects of the cryptocurrency market are relatively restrained. First, this is due to the fact that digital coins can be used only within the Internet, and this is associated with certain risks.

For example, if there is no access to the web, a desktop computer or a mobile device, it will be impossible to use a cryptocurrency account.

In addition, given the crises of recent years, which have strongly affected the digital coin segment, many investors are now wondering what to expect and in which direction the situation will change.

What are the key influencing factors in the cryptocurrency market

Among the key influencing factors on the digital coin market are cryptocurrency exchanges, stablecoins and, of course, the Bitcoin exchange rate, on which the value of many other assets depends.

As you know, recently the level of confidence in virtual currencies has seriously fallen, and one of the reasons for this was the bankruptcy of many trading platforms.

The starting point was the collapse of the FTX digital exchange due to excessive centralization, and this conflicted with the fact that the entire blockchain industry is based on the promise of full decentralization to customers.

After Binance refused to buy the exchange, all FTX customers began to withdraw funds en masse, which led to the platform’s bankruptcy.

This case led to the so-called domino effect: some time later, several other platforms collapsed. As a result, trust in digital coins decreased, and major exchanges even had to make public data on their reserves to convince customers of their reliability.

A significant cause of distrust in cryptocurrencies was the closure of the Terra project (LUNA). Stablecoin lost its link to the dollar, and as a result, a whole category of assets (stablecoins) lost the trust of clients. Also, we cannot fail to mention the strong drop in the bitcoin exchange rate in recent months.

Thus, the digital coin segment will have to try hard to regain the trust of users.

Analysts’ forecast for the cryptocurrency market for 2023

The first quarter was not easy for virtual assets, because the world’s financial regulators have not yet softened their positions on rates. In addition, the recent statements by the head of the U.S. Federal Reserve that the fight against inflation will take a long time played a role.

Among other things, the VTS was able to seriously strengthen its own positions in the first half of 2023. The price of the first cryptocurrency rose to $25 thousand. To some extent, this was facilitated by the increased willingness of investors to take risks again.

Then both a sharp decline and a slight rise in the price of this coin were recorded. Some experts believe that from this period may begin an uptrend, and by the end of the year Bitcoin should rise in price to at least $35-40 thousand.

However, fresh forecasts of cryptocurrencies indicate that high growth is unlikely to be expected. It is highly probable that the situation in the global economic environment will remain challenging throughout 2023.

Talk of a “cryptocurrency winter”

Coinbase analysts predict the dominance of the bearish trend in cryptocurrencies at least until the end of 2023. In their forecasts, experts pointed out that the bankruptcy of FTX and some other digital exchanges scared away many investors, as a result of which the crypto industry had to face a global outflow of institutional and retail capital.

The virtual currencies segment is still in a state of “cryptozyme” and it is expected to drag on for a long time. Investors are either shifting their funds into stablecoins or leaving the crypto market altogether. It will definitely take a long time for the situation to recover.

When should we expect the bull market to return

Some analysts are of the opinion that the “cryptozyme” will last not until the end of this year, but much longer. The return of the bullish trend and, as a result, the improvement of the situation can be expected closer to the beginning of 2025. The experts also mentioned that at the moment it is not so easy to determine when exactly the bear market will reach its bottom.

Against the background of the collapse of altcoins by 50%, BTC has fallen by about 15%, but still remains relatively stable.

According to experts, the growth prospects for cryptocurrencies still remain. However, in order to restore customer confidence in the digital coin industry, it is necessary to strengthen the control of companies in this area. Particularly those that offer services for storing financial assets. We are talking about the control of organizations, as the assets themselves cannot be controlled – digital coins are too inert for that.

Is it worth investing in virtual currency in 2023?

Most digital coins, even the top ones (such as Bitcoin and Ethereum), are high-risk assets. While their upside potential is great, just like that they can also sag in value by 70-90%. For this reason, a cryptocurrency investor should be constantly aware of the risks and keep several different coins in their portfolio. At the same time, none of the positions should dominate. Then the overall risks of the investment portfolio will be reduced.

The share of cryptocurrencies in the investment portfolio should be divided into about 10-30 coins, giving preference to those digital coins, which in their time have proven themselves the best.

It is reasonable to keep from 40 to 60% in BTC and ETH, and choose the rest of the coins only after a thorough analysis of important parameters – scalability of the project, liquidity, market capitalization, transparency, functionality and others.

In conclusion

Digital coins are still a new word in the modern economy. They are endowed with a whole list of advantages compared to fiat funds, which only contributes to the widespread use of cryptocurrencies.

Although many countries have not yet developed a unified position on the regulation of digital assets, the prospects for the development of the cryptocurrency market remain quite optimistic.

Missing text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.