Since the advent of Bitcoin, digital assets have become part of the global financial system. The main coin competes with the dollar and other fiat currencies – users have an alternative for making international payments and payments. More than 35 million bitcoin wallets are registered in the world. And the market capitalization of BTC in early 2022 exceeded $700 billion.

Bitcoin also forms a growing part of investment portfolios (the U.S. Securities and Exchange Commission first accepted Bitcoin-ETF in 2021) and serves as the basis for futures contracts. Research emphasizes the impact of bitcoin’s liquidity on the cryptocurrency environment. The high realizability of the asset also points to the stability of the market, with participants trading quickly, easily and at fair prices. Therefore, the focus of cryptocurrency exchange developers is to strengthen features that help increase liquidity on trading platforms.

What is liquidity

Asset realizability relates to an assessment of the market’s ability to convert a notional unit quickly without causing a sudden change in price. The value of less liquid resources (real estate, private equity, gold) is not as volatile as the rate of investment instruments that can be quickly sold or exchanged (currencies, stocks).

The concept of liquidity is important for traders and investors. It determines whether they will be able to enter or exit trades in desired positions or will suffer from price volatility.

If a user wants to convert their bitcoins into US dollars, there must be enough demand on the other side of their bid to allow them to make a sale at the current rate.

High liquidity offers traders and investors advantages. The following features can be highlighted:

- Fair prices for everyone. A larger number of buyers and sellers in a liquid market creates a level playing field. For example, an exchange with high trading activity ensures that users can sell digital assets at the most favorable rate for buyers. And the other side of the transaction will offer the most cost-effective rates to sellers. This creates an equilibrium market value that is fair for all bidders.

- High volatility. The tradability of cryptocurrencies does not protect the market from fluctuations due to high value transactions. For example, whales (large holders of bitcoin and altcoins) can influence and even manipulate prices in illiquid markets with low activity. A single buy or sell order can be the cause of large fluctuations in cryptocurrency rates. This leads to increased volatility and risks for market participants. Conversely, a large number of traders and orders in a liquid market helps maintain relatively stable prices.

- Fast transaction turnaround time. A liquid environment speeds up and simplifies the buying and selling of cryptocurrencies. With a large number of participants, orders are executed much faster. Traders can seamlessly enter or exit a transaction.

- More accuracy for technical analysis (studying historical cryptocurrency prices). While many disagree with the validity of this research approach, the methodology has become mainstream because it contributes to understanding the field of digital assets and trading. In markets with high circulating coins and tokens, more accurate data is emerging.

What factors affect bitcoin’s liquidity

When determining the circulatability of a major cryptocurrency, it is also important to consider these conditions:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- Exchangeability. The value of bitcoin for payments and investments depends on the speed and ease of conversion to fiat or digital currencies on exchanges. The number of trading platforms has grown significantly. Cryptocurrency trading has become a widespread phenomenon. However, the circulatability of bitcoin and altcoins remains difficult to determine. The cryptocurrency space lacks a single regulated data stream (e.g., a consolidated stock feed). This makes it difficult to calculate high-frequency spreads (the difference between the best bid and ask prices) and prevents bitcoin and altcoin’s tradability from being adequately compared. Nevertheless, the more investment instruments are traded on exchanges, the higher its turnover and liquidity.

- The possibility of payment with cryptocurrency. The number of outlets where settlements can be made with digital assets also matters. The more often cryptocurrency is accepted in companies, stores, hotels, the higher the turnover and liquidity.

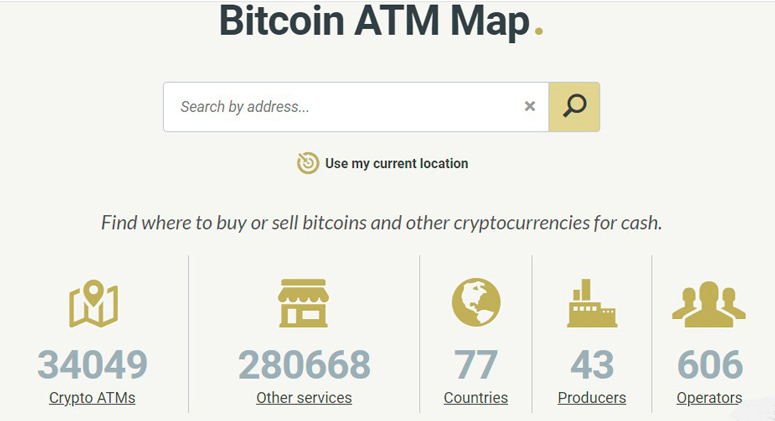

- Cryptocurrency ATMs. Have already become commonplace, allowing you to quickly exchange BTC and other coins for fiat money. As of December 2021, there are about 40 thousand cryptocurrency ATMs in the world.

- Debit cards. The Crypto.com company together with the Visa payment system has released a financial product for cryptocurrency payments. The card can be used to pay for purchases and receive cashback. Such products enable cryptocurrencies to be quickly converted into real money and therefore increase liquidity.

- Awareness of bitcoin and altcoins. The more people know and use digital assets, the higher the turnover and realizability of coins and tokens.

Coin mining is another important factor. Typically, if miners slow down, bitcoin’s circulatability decreases. Conversely, if there are many participants involved in obtaining the asset, the cryptocurrency is in high demand. Accordingly, the level of liquidity increases.

Altcoins with small trading volumes constantly face liquidity problems. This leads to market manipulation.

Early investors usually accumulate most of the circulating supply. They have the ability to change the value by suddenly dumping their assets into an unsuspecting market. When the coin’s exchange rate drops, they re-buy it at a low price.

Bitcoin liquidity on an exchange cannot be quantified with a one-dimensional variable. It consists of several parameters.

| Parameter | Description |

|---|---|

| Trading time | Whether a transaction can be executed immediately at the prevailing price |

| Density | A market has high density if it is possible to buy and sell assets on different exchanges at a very similar price (spread between the buy and sell price) |

| Depth of the coin market | When you can buy or sell a large amount of cryptocurrency without a significant change in price, the market is called a deep market |

| Stability | An environment is considered stable if any imbalances can be corrected quickly – in a fraction of a second |

Calculating the index for Bitcoin

The convertibility differs from most other criteria for evaluating a cryptoasset, as it does not have a fixed value. It is difficult to calculate the exact marketability of a particular coin (token) or exchange. However, there are some indicators to determine the estimated liquidity:

- Trading volume. This is the total number of coins and tokens that are transacted on a cryptocurrency exchange during a set period. This indicator determines the direction and behavior of market participants. A higher trading volume means that there are many transactions (purchases and sales) on the exchange. Hence, there is a high turnover of coins and tokens. Lower trading volume means lower activity and unrealizability of assets. For example, the BTC/USDT pair is more attractive to large traders than LTC/ETH because of the higher trading volume.

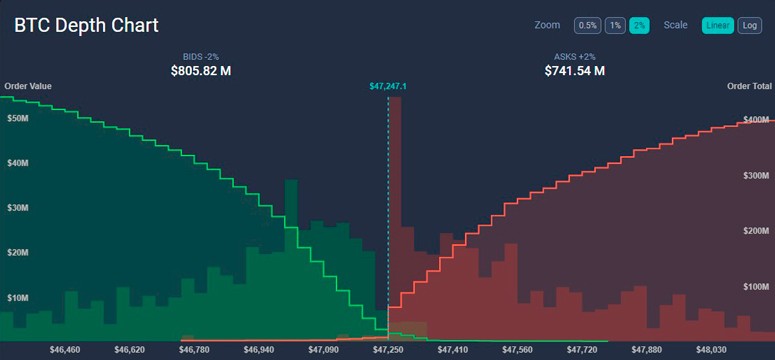

- Bid-ask spread. This is the difference between the highest bid price and the lowest possible ask rate in the order book. A tighter spread can increase the liquidity of cryptocurrency exchanges. It promotes more advanced price discovery and accurate forecasts. In the case of low cryptocurrency tradability, distortions of charts and the expected rate of some assets appear. The bid-ask spread method for checking the liquidity of coins and tokens is suitable for trading platforms that work on the order stack model.

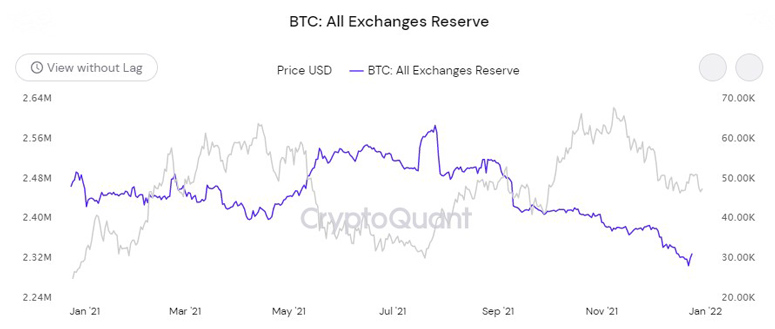

It is also important to realize that the supply of BTC dries up when the asset leaves exchanges in large volumes. A shortage and demand pressure is created. In essence, a liquidity crisis occurs. For example, the chart shows that the total BTC balance on exchanges from July 2021 to December 2021 fell from about 2.5 million to less than 2.3 million. This figure indicates a shortage.

To calculate the total BTC circulatability on exchanges, it is necessary to understand how many bitcoins are blocked in decentralized finance(DeFi) for the purpose of issuing wBTC. At just over 258k wBTC, that’s roughly 80% of all Bitcoin coins on Ethereum.

It’s important to estimate the number of coins stored on whale wallets, large hedge funds (e.g. MicroStrategy, Grayscale Bitcoin Trust) and corporations (Tesla). Find out how much BTC came to exchanges from miners. You need to look at each organization separately to make sure that BTC actually left the trading floors. Many exchanges act as custodians. However, there are participants in the market that still influence BTC liquidity: funds, corporations, and DeFi.

Is it worth investing in BTC

The decreasing circulation of the main cryptocurrency on exchanges means that bitcoin is becoming a scarce asset. If this continues, there will be a crisis that will lead to a significant price increase. Funds, corporations and DeFi are the 3 sectors that are absorbing a large amount of bitcoin leaving the exchanges. This speaks to two factors:

- Bitcoin is used as a hedging (risk management) tool.

- It is used as a means of collateral to generate income. Investors don’t need to sell bitcoin to get its value. Thanks to DeFi, it is possible to generate profits through secured loans.

By doing so, investors earn more than just speculating on BTC. Bitcoin can bring holders (those who hold the asset on a long-term basis) a double benefit: income from interest on loans in DeFi and the difference associated with the increase in the price of the asset.

Traders, on the other hand, are not advised to keep positions open for long periods of time. Price fluctuations may affect their trading strategies.

Summary

A liquid digital asset can be easily converted into fiat money or other cryptocurrencies without affecting the price because they are stable and less volatile. Coins and tokens with low realizability are more volatile. There is also no guarantee that they can offer a higher return on investment compared to highly liquid assets.

Low realizable coins and tokens are difficult to convert into other currencies due to their low trading volumes. Users cannot exit positions quickly, and slippage (the difference between the price at which a trader wants to sell a digital asset and the actual sale price) occurs. Assets are sold at a lower price than expected, causing sellers to incur losses.

An illiquid market means there are few participants, which makes it vulnerable. When fewer people control a larger percentage of coins and tokens, it is easier for a single trader (or group) to manipulate the market to their advantage. Even a single sell order can trigger a price fluctuation and affect the actions of other investors.

Liquidity is a characteristic that investors and traders consider when evaluating cryptocurrency. It affects both market stability and price volatility. Liquidity determines an asset’s ability to maintain value over time. The more realizable a cryptocurrency is, the more stable it is. Even if there are periods of changing rates, they will fluctuate within a certain range.

Frequently Asked Questions

❗ What is the most liquid cryptocurrency?

📊 What is the difference between exchange liquidity and realizability of a cryptocurrency?

The former takes into account the number of coins (tokens) that are available for sale on the platform, while the latter should consider all the ways in which the asset is converted into cash or other digital units.

✅ Can bitcoin affect the realizability of other cryptocurrencies?

Bitcoin is the main provider of liquidity to exchanges. The more users buy or sell BTC, the higher the volume and greater the realizability of other cryptocurrencies.

❔ Which liquidity assets are better to invest in?

Cryptocurrencies with high trading volume are considered safer to invest in. Low-liquid assets belong to instruments with higher risk – they can show high profits on a short distance, but at the same time quickly depreciate.

❌ Does the lack of cryptocurrency laws affect liquidity?

In states where digital assets are not accepted, investors are less enthusiastic about entering the market. However, the cryptocurrency environment is lightly regulated by governments, so laws don’t affect users much.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.