In 2024, there are many ways to profit from digital assets without actively engaging in the procedure of making money. The list includes steaking, long-term investments, exchange lending, and other methods. All these options bring passive cryptocurrency income to users of different blockchain networks. To successfully invest money, it pays to know the basics of each of them.

Ways to get passive income from cryptocurrency

Since 2009 (when Bitcoin was created), the digital money market has been growing steadily, adjusted for periodic price corrections (price reductions after a strong increase in the value of virtual assets). This is influenced by:

- The development of blockchain and related technologies.

- The increasing popularity of cryptocurrency funds among the public.

- News headlines in the media and other.

The growing popularity of virtual assets gives digital network participants the opportunity to invest profitably in cryptocurrency. But in 2024, there are 10 other top ways to make money. Before using them, it is recommended:

- Study the main areas of investment.

- Thoroughly analyze the risks.

Staking

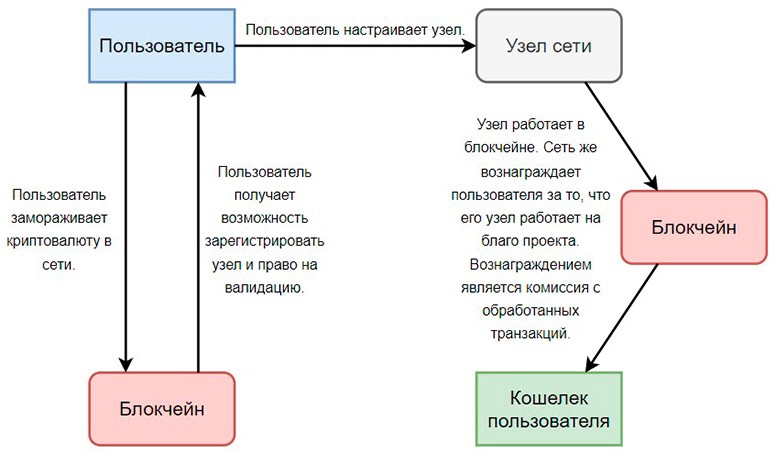

This concept means contributing to a digital project to maintain its cryptocurrency network. To participate in steaking, the user transfers savings to a wallet or exchange account, where they are frozen. Usually, the investor does not manage the blocked funds.

In return, he gets the opportunity to register a node (node) in the blockchain and the right to validate (check the validity of transactions and new parts) within the system. As payment for the work of the node, the user picks up a commission from the trades entered into the chain link. In the cryptocurrency community, such nodes are called validators. Staking is possible only in networks with the Proof-of-Stake (PoS) consensus algorithm and its analogs.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

To start earning passive income from cryptocurrency in this way, you first need to:

- Choose a digital project.

- Download the software on the website of the creators or through the source specified by them.

- Set up the software to run the node.

- Make and freeze a deposit.

Setup instructions are usually in the software or on the project’s website. Before making a deposit, it is worth reading all the requirements for the validator. This will help to avoid unpleasant situations in the future and not to lose your investment.

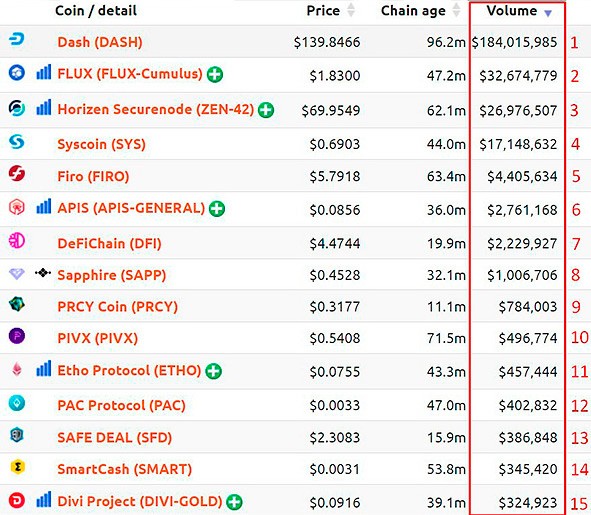

Masternodes

In the cryptocurrency community, this concept refers to a type of nodes that provide:

- Protection of users’ digital assets.

- The integrity of the network.

- The corrective operation of the blockchain.

Masternodes sign blocks and include them in the virtual network. The action of such a node requires a small amount of computing power – an average computer or a dedicated server is enough.

Such nodes complement the work of miners using the Proof-of-Service (PoSe) algorithm, a hybrid mechanism derived from Proof-of-Work and Proof-of-Stake. Because blocks are signed by masternodes, the overall speed of the network increases.

The work of such nodes is paid with a fraction of the total reward for generating blocks, e.g. 25%. If the generation of a new link is rewarded with 50 coins, 12.5 of them will be taken by the masternode. The balance goes to the miner.

As of December 12, 2021, out of over 7,500 virtual assets, only about 250 cryptocurrencies support the ability to create a masternode.

Mining

One of the well-known ways to profit from digital assets is to mine them. To do this, miners use the processing power of computer hardware. It is needed to solve complex cryptographic tasks – finding the hash (abbreviated identifier of the encrypted data array) of each transaction and block of the system. Thanks to the work of miners, the correct structure of the digital network is built.

Nodes receive passive income from cryptocurrency for generating blocks and writing them into the chain. The size of the reward is set at the program level. Over time, developers usually reduce the payment to nodes to reduce the rate of issuance (release of coins).

Cryptocurrency mining is available to users of only those networks with a Proof-of-Work (PoW) consensus algorithm. It eliminates collisions and errors in the work of the blockchain, allows all active nodes to synchronize personal copies of chains with the use of computing power.

Mining requires computer hardware:

- A PC central processing unit (CPU). Due to low power in 2024, this hardware is rarely used.

- PC graphics card (GPU). This is the primary device for mining in 2024. On average, GPU is 4-5 times more efficient than CPU.

- ASIC. This is an expensive single-tasking computer hardware, which in 2024 is more often used in cryptocurrency systems with high network complexity (the indicator reflects the number of calculations to generate 1 block) like Bitcoin.

Investments

Short-term and long-term investments through cryptocurrency exchanges are popular in 2024 methods of earning money on digital assets. However, users of virtual means of payment often have a negative rather than positive attitude towards investing. This is due to the complexity of the process and the high volatility (changeability) of the market.

Successful investments can bring a large income, because the price of coins and tokens of successful cryptocurrency projects sometimes grows hundreds of times. However, the investor must be cold-blooded and have an analytical mind to make the right decisions.

Advantages and disadvantages

Investments have a number of pros and cons. These are summarized in the table below.

| Advantages | Disadvantages |

|---|---|

| Significant profit | High risks of losing money |

| After investing it is only necessary to follow the market quotes | Dozens of projects should be analyzed before depositing funds |

| A wide range of assets to invest in cryptocurrency | Successful investing requires a cool head |

Lending

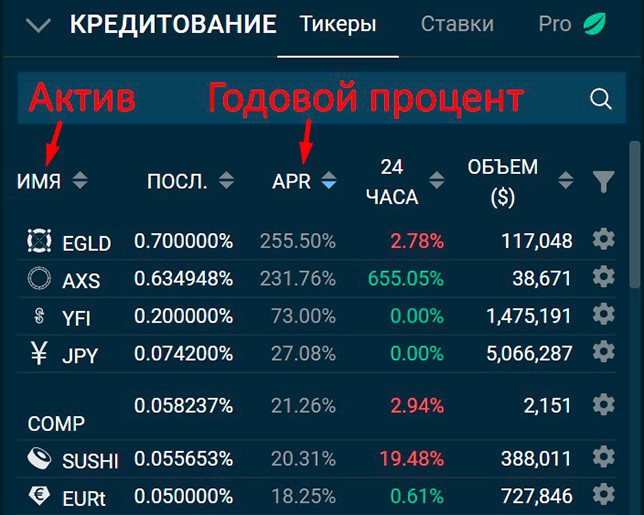

In the world of digital money, there are platforms that allow customers to earn a good passive income from cryptocurrency. Through special services, one user lends virtual assets to another at interest. But it is important to keep in mind that lending is a high-risk way to earn money. Loans should be issued only to verified persons.

To minimize the probable losses, the investor can invest in exchange lendings and separate platforms for digital collateral. Often borrowed money from investors is used to increase trading liquidity (demand for assets). Platforms guarantee the fulfillment of obligations of both sides of the transaction.

Exchange lending

Such financial collateral is made through crypto platforms, which initially specialized only in providing customers with access to trading virtual money. From the point of view of the safety of savings, it is better to use exchange lending. Such a service is promoted mainly by popular and reliable platforms, for example:

Binance

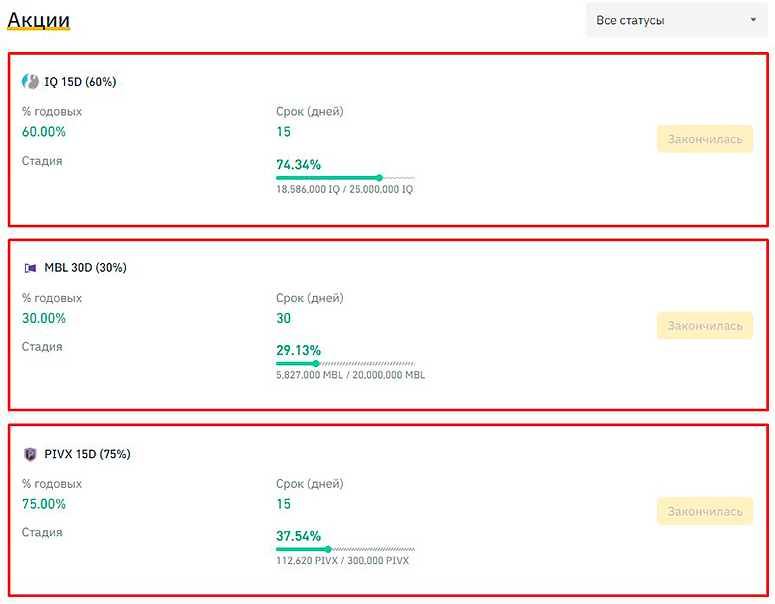

Clients of this crypto exchange can use a 3 types of lending:

- Floating rate deposits. The exchange will not define the term of the investment in days. As of December 12, 2021, the maximum yield was 12% per annum on the CAKE asset.

- Fixed rate deposits. Binance sets rates for different, predetermined collateral terms for each virtual asset. As of December 12, 2021, the maximum profitability was recorded on the FUN token – 45% per year when invested for 14 days.

- Equities. For each cryptocurrency there is only 1 lending period, for example 15 or 30 days. Binance paid dividends on all financial instruments on December 12, 2021 (no stock was available for investment). The maximum yield was fixed on the PIVX coin – 75% per annum.

Bitfinex

On this exchange there is a customizable tool Lending Pro. Using it, it is possible to financially provide cryptocurrency holders based on their requests and market conditions. The minimum lending offer is $150 or a similar amount in the equivalent of another asset.

There are 3 methods of lending digital collateral on Bitfinex:

- Dynamic. The lender’s offer is replaced by an order with a lower rate until a borrower is found or market conditions change.

- Static. The offer is replaced when exchange conditions transform by a certain amount.

- Market-based. The lender’s offer is made to the borrower at the interest rate of the last accepted order on Bitfinex.

Hodl Hodl.

On this trading platform, only inter-user collateral is available. If an investor wants to make money from Hodl Hodl’s exchange feed, they can do so in 2 ways:

- Accept one of the existing offers with terms and conditions from borrowers. Users who need a loan place their orders on the site.

- Create an offer with your own terms and conditions. The potential borrower accepts the lender’s order if they are happy with it.

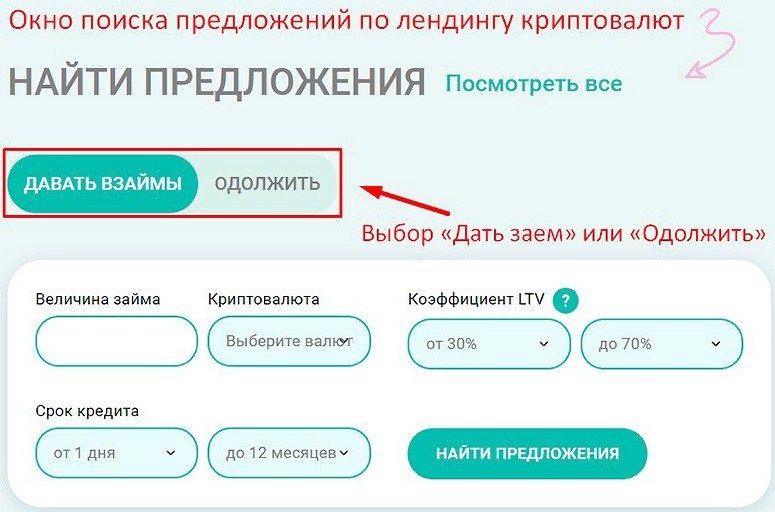

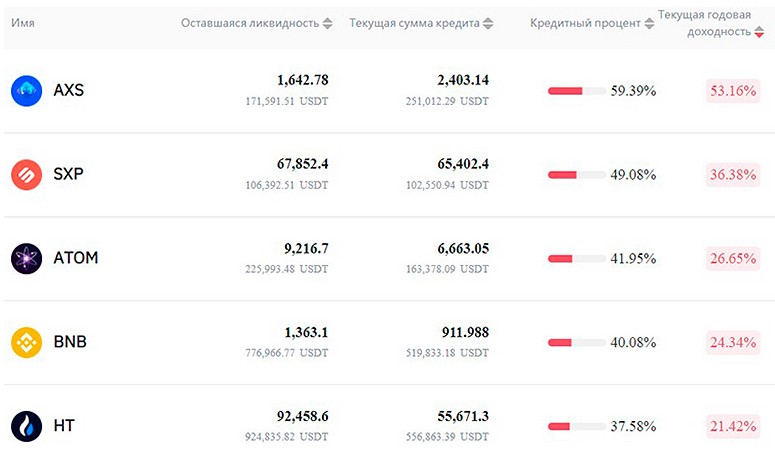

Gate.io.

On this trading platform, users lend only to the exchange itself. Gate.io applies collateral from investors to increase the liquidity of the assets traded here. Basically, the organization raises funding to increase the cryptocurrency demand for new digital projects.

As of December 12, 2021, the maximum annualized lending profitability on Gate.io was 53.16% on the AXS asset. Such passive income from cryptocurrency is not offered by every exchange.

Yobit

There is an InvestBox tool on this exchange. With its help, developers of cryptocurrency projects post their investment plans. Through InvestBox, they attract attention to new digital assets and increase their liquidity.

With the tool from Yobit, an investor can invest capital at a rate of 10% per day for some altcoins. Such plans are considered high-risk, but they are backed by the exchange’s fund.

Lending platforms

P2P cryptocurrency lending platforms work as intermediary organizations. They conduct the transaction between lenders and borrowers. As of the end of 2021, there are 3 reputable lending platforms:

- Nexo

- Blockfi

- Celsius network.

Nexo

The platform was created in 2018 by Credissimo, a large European corporation that works with new technologies in different financial sectors and is involved in loan origination. Prior to founding Nexo, the parent company had been successfully operating for 11 years.

On this lending platform, an investor can earn up to 20% per annum. At the end of 2021, 26 different digital assets were available for investment.

Client savings that are stored in Nexo wallets are insured to the tune of $375 million.

Blockfi

This platform offers lower interest rates on lending compared to Nexo – around 6% on average. Blockfi also has a scarce variety of crypto assets. As of the end of 2021, only bitcoin and etherium are available for lending.

The low rates and small representation of virtual currencies available for investment are explained by the fact that Blockfi’s main focus is lending. A client can leave collateral in crypto-assets and get a loan of up to 50% of the deposit amount in US dollars.

Celsius Network

This lending platform is a direct competitor of Nexo. Customers have access to almost 50 investment plans with a maximum rate of up to 17%. Lending can increase returns by 25% for any crypto asset when using the Celsius token – CEL.

The platform also has mobile apps for iOS and Android devices. They are free to download via the App Store and Google Play.

Comparative analysis

Exchange lendings and dedicated lending investment platforms have several differences. Their comparative analysis is summarized in the table below.

| Operational quality | Cryptocurrency exchange | Lending platform |

|---|---|---|

| Access to trading on the crypto market | Yes | No |

| Minimize the risks of the lending platform | ||

| Increase liquidity of coins and tokens | Often | Only direct lending to other users |

| Insurance of investors’ investments by the platform | Rarely | Often |

| Annual profit | Up to 400% | Up to 25% |

| Payment guarantees | ||

Advantages and disadvantages

Digital money lending in general has several advantages over other methods of generating passive income from cryptocurrency:

- High returns.

- Low risks when using an intermediary.

- Ease of earning money.

Also cryptocurrency lending has 2 disadvantages:

- High risks in the absence of a reputable intermediary.

- Many investment plans on crypto exchanges are valid for about 30 days.

Lending

This direction of earning money on crypto assets is considered the opposite of digital lending. In this case, on the contrary, the investor takes a loan to trade in the digital money market. There is a lending function on many reputable crypto exchanges. For example, on Binance, loans can be used for spot, margin and futures trading, as well as for staking.

Lending is only recommended for experienced traders. Beginning investors should first research the topic of cryptocurrency loans and exchange trading.

Liquidity mining

This method is similar to lending and is possible just because of crypto trading platforms. However, liquidity mining has a difference – the investor gives the digital project his savings for a promotion campaign. In return, the investor receives new tokens from the developers. When altcoins are credited to the account, they can be sold immediately.

At the end of the investment period, the invested funds are fully returned to the user. As a result, the depositor’s wallet gets a certain amount of new token and cryptocurrency, which he previously provided to the selected project.

On Binance on December 12, 2021, the maximum return on liquidity mining was 120.77% for the SANTOS asset.

Cloud mining

This type of earning is offered by some mining companies. They provide ordinary users with the opportunity to rent some of the equipment in large data centers. Cloud mining allows network participants not to buy their own computer equipment, but to receive passive income from cryptocurrency mining.

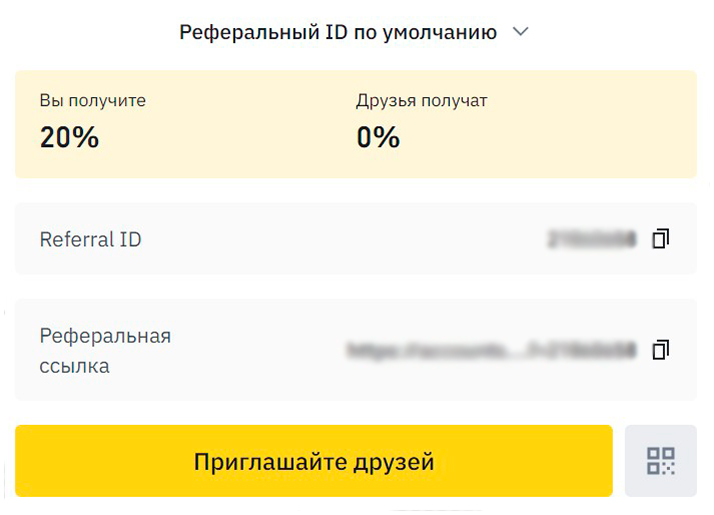

Affiliate programs

They are considered one of the main ways to earn money on digital assets without investment. At the same time, you can participate in affiliate programs on several trading platforms at once.

The essence of generating income is to attract unique users. For this, exchanges pay part of the commission they charge in transactions with new clients. To earn more, you can invite additional referrals.

Forks and Airdrops

The first term refers to updates to the cryptocurrency network. They are divided into simple (soft) and global (hard) improvements. It happens that large-scale updates are not accepted by the majority of users. Then, as a result of a hardfork, a branch of the native blockchain with proposed rules appears. A new altcoin usually circulates in such chains.

Once the blockchain is split, developers need to attract users from the native network to the newly created one. In this regard, project creators often charge coin holders of the old chain the same amount of cryptocurrency in the new system. For example, after the Bitcoin Cash hardfork, BTC holders received a similar number of BCH to their wallets.

Airdrops are a way to make money from cryptocurrency without investment. Airdrop conducts digital projects as part of an advertising campaign. Thus, developers increase the popularity of the new crypto asset.

Airdrop involves paying users small rewards for simple actions. At the end of Airdrop, the developers of the cryptoproject check the fulfillment of the conditions for participation in the giveaway. If the user has done everything correctly, then he receives a certain amount of tokens on his wallet. They can be sold after listing on exchanges.

Usually within Airdrop you need to perform primitive actions, for example:

- Make a repost of the record from the official social media account of the developers.

- Subscribe to the newsletter.

- Join the project group and so on.

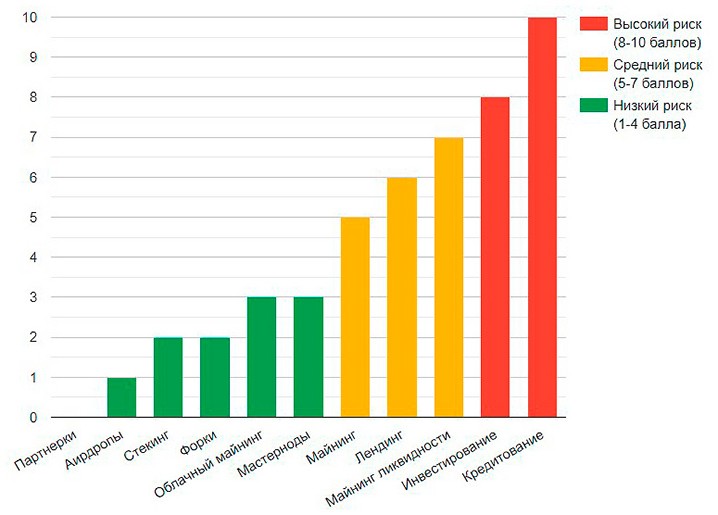

Summary table of risks of passive earnings on cryptocurrency

Each way of profiting from digital money has nuances. For example, when airdrops you have to specify the address of your wallet on different sites. Because of this, there is a small risk that when hacked, attackers can gain access to the vaults of Airdrop participants.

Investments also have their own specifics. In most cases, beginners lose their investments due to insufficient trading experience and poor understanding of the cryptocurrency market. Only lending on exchanges will be more dangerous.

Due to the presence of risks in almost every way of earning, the portal CryptoProGuide.com has created a summary table of them.

Conclusions

In 2024, 11 methods of passive income from cryptocurrency are available: from affiliate programs to investing credit funds. Some of these methods allow you to increase your capital by hundreds of percent annually. The main thing is to calculate the risks correctly and know exactly what to do. Otherwise, there is a chance to lose your investment.

Especially seriously should be taken to such ways of gaining profit from virtual assets as:

- Lending.

- Investing.

- Mining liquidity.

- Lending.

- Traditional mining.

Frequently Asked Questions

❓ How much computing power do I need for steaking cryptocurrencies?

One average computer is sufficient.

✅ What is required to run a masternode?

The user needs to download and configure a client to connect to the digital network. To do this, it is better to rent a remote server with a Linux operating system. It will also be necessary to freeze the amount of cryptocurrency set by the project (as for steaking) and link the wallet to the masternode.

💰 How is the payment to miners reduced?

Developers can do it manually through blockchain updates or automatically through a program that is embedded in the code of the digital project. The second method is called halving.

💡 How to invest properly?

Competent capital management in the cryptocurrency market can be considered a science that requires a lot of experience. An investor must be able to conduct accurate technical and fundamental analysis.

💲 What is the easiest way to earn money?

It is easiest to get cryptocurrency for airdrops. However, liquidity mining and lending are considered the more profitable of the simple ones.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.