With the development of the digital industry, the scope of application of virtual coins has also expanded. In 2024, any user can take out a loan secured by cryptocurrency. It is quick, easy and sometimes cheaper than in a bank. Transactions take place in the P2P format without intermediaries. Bitcoin or another leading asset serves as collateral. In return, the client receives cryptocurrency or fiat money. Borrowed funds can be used to replenish liquidity or spent for other purposes.

Principle of operation of loans secured by cryptocurrency

According to the World Bank, almost a third of the world’s population does not have accounts. But cryptocurrencies can work anywhere on the planet where there is an internet connection, without ratings or the need to contact financial organizations. A loan secured by digital coins works like a regular loan with a few features:

- The user places an asset on a deposit smart contract.

- In return, the system (direct lender) issues digital or fiat currency at a certain interest rate.

- The user repays the loan in equal installments or deposits the entire amount in a lump sum.

- After full settlement, the asset is unlocked and can be withdrawn.

A loan secured by cryptocurrency is usually fixed in traditional money. This is due to the high volatility of digital coins. If during the term of the contract the rate of the pledged asset grows, the borrower will receive a profit.

The table shows how this works.

| Contract terms | Value |

|---|---|

| Initial price of ETH | $3.8k |

| Credit amount | $15 th. |

| Contract term | 180 days |

| Rate | 8% per annum |

| Discount | 30% |

| Collateral amount | 5.86 ETH ($22.26 thousand) |

| ETH exchange rate at the end of the contract | $10 th. |

| Accrued interest | $590 |

| Need to return | $15.59k |

| Final value of collateral | $58,6 thousand |

| Borrower’s profit from the transaction | $36.34 thousand. |

Financing terms are determined by the platforms. If the service supports the P2P format, the details are discussed by borrowers and lenders in the negotiation process. Then the platform provides only safe storage of assets.

Varieties of loans

In 2024, any member of the network can get a cryptocurrency loan, even if they have no financial history. Lending platforms work in 2 ways:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- Centralized (Salt Lending). The operator issues loans, takes over the functions of holding deposits or assigns them to partner services. Verification is required for funding.

- Decentralized (Nexo). The service attracts private investors and traders. Participants agree on the terms of the transaction. The platform provides the parties with tools for its realization and provides storage of coins.

To get a favorable loan, you need to study the conditions of operators. Do not risk responding to too attractive offers of little-known platforms. Such schemes are often used by fraudsters. It is better to monitor the services and choose those that give a fair loan secured by cryptocurrency, taking into account the amount of collateral, interest rate and repayment period. Most of them work on the basis of Ethereum and fix the terms of transactions in a smart contract.

What to consider when taking out a loan

To borrow in cryptocurrency, it is enough to provide another digital asset as collateral. But before entering into a contract, it is worth assessing the risks and considering the factors that determine the basic terms of the deal. A loan secured by cryptocurrency will help you get additional liquidity without having to sell assets.

Risks

Cryptocurrencies have no physical expression. In fact, it is a record in a distributed ledger that encrypts information about the asset (characteristics, transactions, number of coins). The owner of the digital currency owns the private key. Therefore, it is important to ensure the safety of capital storage. The client of the lending service should clearly understand where the collateral will be placed and how it will be protected.

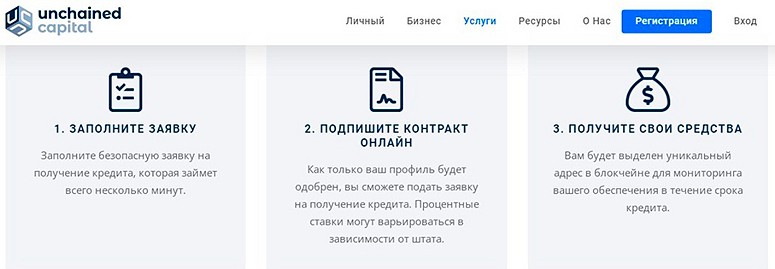

For example, at Unchained Capital, the borrower can control the assets with one of 3 private keys. This also ensures that the company will not use the cryptocurrency for secondary profit (lending it to other users).

Collateral protection works like this:

- The user provides the operator with one of the keys to open a multi-signature address where the currency will be stored.

- The second secret code belongs to the company and the third to the independent financial controller Citadel SPV.

- The parties agree to store the private keys in cold wallets (Trezor, Ledger).

- Activation of the pledge will require signatures of 2 of the 3 parties to the transaction. Neither party can transfer cryptocurrency on their own.

If the client defaults, Citadel SPV will confirm the liquidation of the collateral via an out-of-band communication channel. In case of lender violations, the controller will interact with the borrower to recover the collateral. The multi-signature model is also used on all P2P platforms. For each transaction, a new address is generated with private keys for the borrower, investor and the service. The collateral is unlocked when 2 out of 3 keys are entered.

Insurance

Cryptocurrency lending platforms protect customer assets in a variety of ways. Many operators insure digital coins. They also determine the coverage of electronic policies. Typically, the set of risks includes:

- Losses incurred on re-lending (if used).

- Assets placed on hot wallets.

- Damage caused by the actions of third parties.

- Lender’s breaches of duty.

Insurance indemnity can be paid in BTC or the currency of the loan. But digital money is a fundamentally new asset class. They have no physical expression and cannot be recovered in the event of an erroneous transfer. Traditional methods are not enough to fully secure virtual coins. Therefore, the most effective way to protect cryptocurrencies is to own a private key.

Commissions

Usually, services do not charge fees for lending against cryptocurrency collateral. Some platforms may include a loan origination fee in the total amount. The amount of such a fee depends on the term of the contract and averages 0.1% of the loan provided. Others charge the fee upfront from the loan amount.

For example, Unchained Capital immediately deducts a percentage for the execution of the contract. When concluding a deal for $10 thousand, the company transfers $9.9 thousand to the client’s wallet, and $100 is retained as a commission. Binance does not charge a fee for granting a loan. The exchange calculates the rate taking into account the duration of the contract (from 7 to 180 days). Interest on the loan amount is calculated automatically every hour. You can repay them manually by making a transaction on the order page.

Interest rate

The total cost of a loan secured by cryptocurrency includes all fees and charges. This figure is expressed as an annualized interest rate. It is calculated according to a formula determined by the legislation of an individual state. For example, in the United States, loans are evaluated taking into account the term of the contract, current interest and commission for issuance. An example of calculation is presented in the table.

| Contract term, months | Current interest, % | Origination fee, % | Loan amount, $ | Annual interest rate, % | Total cost of the loan per year, $ |

|---|---|---|---|---|---|

| 3 | 9 | 1 | 10 th. | 11,97 | 1,189 ths. |

| 6 | 9 | 1 | 10 ths. | 10,94 | 1,087 thou. |

| 12 | 9 | 1 | 10 ths. | 9,93 | 987,67 |

The annual rate normalizes the interest on the loan if it is extended to 1 year. The table shows the total cost of a 3-month loan with a threefold increase in terms. Such a deal will cost the client more than an annual loan. The reason is that each new extension of the contract includes a loan origination fee.

Many platforms attract clients with a reduced interest rate. Often in such offers, the commission for the execution of the contract is increased. Even a small difference in the coefficient affects the total cost of the transaction. Therefore, low-interest loans with a high commission cost borrowers more expensive than standard offers.

An example of calculating such a deal is in the table.

| Contract term, months | Interest rate, % | Origination fees, % | Loan amount, $ | Annual interest rate, % | Total cost of the loan per year, $ |

|---|---|---|---|---|---|

| 3 | 8 | 2 | 10 th. | 16,11 | 1,589 ths. |

| 6 | 8 | 2 | 10 th. | 12,03 | 1,189 ths. |

| 12 | 8 | 2 | 10 ths. | 10 | 989,04 |

Repeat lending

Some servicers are looking to generate additional revenue and utilize customer assets to issue new loans. Repeat lending allows companies to generate recurring revenue through interest on transactions and lend out cryptocurrency at reduced rates. However, the risks of borrowers are higher in this case:

- The lender has access to and can use the collateral assets.

- If new customers become insolvent, the money provided by previous borrowers to secure the loan will be lost.

Platforms practicing re-lending often pool client assets and lend them to large traders. If their trades turn out to be unprofitable, the risks will affect many borrowers.

Another type of re-lending is providing clients with their own collateral assets. This practice is common on Binance. The exchange allows you to use the provided collateral for steaking to reduce the rate on the loan. At the same time, the service is not responsible for losses incurred by the client due to security issues of onchain contracts.

Percentage assessment of credit risk

The amount of collateral is calculated taking into account several factors:

- The amount of the loan financing.

- The term of the agreement.

- The annualized interest rate.

- The discount rate (shows the expected decline in the exchange rate before the price of the collateral equals the loan amount and the transaction closes).

The safety margin of the loan is determined by the borrower. The greater the discount the user specifies, the higher the amount of collateral will be. The ratio of the value of the loan to the collateral is referred to as LTV (percentage risk score). This indicator determines the limit of the loan that the service can grant to the user.

An LTV of 50% means that a cryptocurrency loan of the equivalent of $10k would require collateral worth $20k at the current exchange rate. Some companies reduce the valuation ratio by increasing the minimum collateral. This allows them to reduce the risks associated with the volatility of digital coins. The LTV also depends on the asset selected.

Capital amount of collateral

Digital currency is a highly volatile asset. To assess the current state of the collateral, clients of lending platforms use various tools. The inverse of the percentage risk score is the capital amount of the collateral. At an LTV of 50%, it is equal to 200% of the funding amount. This indicator helps to understand the condition of the collateral assets when exchange rates fall.

Penalties

In traditional bank loans, the rate is fixed for the entire period of the contract. Interest is not reduced in case of early fulfillment of obligations. To get a predetermined profit in full, banks use a system of penalties.

Loans secured by cryptocurrency can be closed early without additional costs. For example, on Binance, a trader pays interest for the actual hours during which he used the borrowed coins. On Nexo, the interest rate for early repayment is calculated in proportion to the number of days. Similar conditions on BlockFi, Nebeus, Coinloan and other popular platforms.

Tax liability

In Russia, cryptocurrencies are equated to property. Profits received from transactions with digital assets are subject to taxation. If the owner of virtual coins provides them as collateral, he does not receive income. In this case, the taxable base is not formed. Even if the exchange rate of the digital currency rises during the contract period, its use as collateral is not a sale. Therefore, borrowers do not need to pay income tax.

Interest payments on loans may be taken into account when calculating the taxable base. For example, if a company owner takes out a cryptocurrency loan for business, the costs of repayment are included in the expense side. A loan intended for personal purposes does not reduce the taxable base. But if a private person takes a loan to purchase real estate that will bring investment income, loan payments can be included in the declaration.

Tax liability arises if the collateral is liquidated. Large lending companies (Nexo, Binance) allow you to adjust the loan-to-collateral ratio to avoid closing the deal. But if the client fails to increase the collateral or repay the loan in full, the contract is canceled. The operator sells the asset on behalf of the client to recover the borrowed amount. Such a transaction is treated as a revenue transaction and may be taxable depending on the amount of the transaction.

Token requirements

Many services use their own cryptocurrency for internal settlements. Borrowers are entitled to a lower interest rate on the contract if they make payments in native tokens. For private investors, the platform can offer increased rewards. Transactions with native tokens are more favorable for all participants. However, they involve 2 risks:

- The issuer of native currencies is the lending platform. The operator controls the supply of tokens and can devalue them at any time.

- Companies use customer assets to re-lend and pay less liquid native tokens as interest.

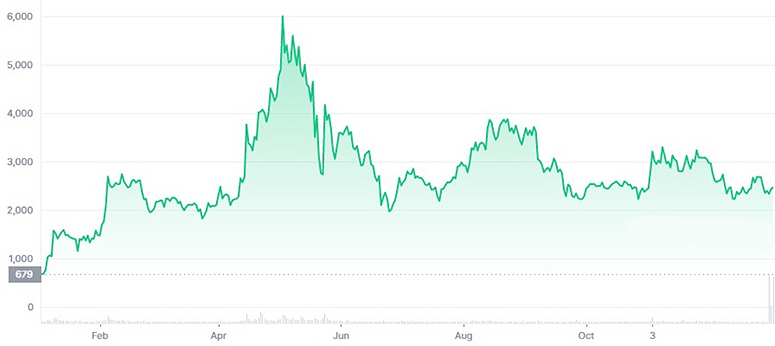

The internal currency of lending projects can generate additional income for users. For example, the MKR (Maker) token grew 3.5 times in 2021 (from $678 in January to $2.24k in December). At the peak in May 2021, the price of the asset was $6 thousand. COMP (Compound) token increased in price by 36.9% (from $146.2 to $200.2) during the same period. The historical maximum was reached in May 2021 at $854.4.

Loan repayment terms

After the expiration of the contract, the user can extend it or close the deal. In the first case, the financing is transferred to a new term. The repaid loan is automatically canceled. The collateral is transferred to the new loan. Depending on the current exchange rate of the coin, it may be necessary to increase it. The terms of the contract are also capable of changing with the market situation.

To close the transaction, the client returns the full amount of the loan financing and interest. The calculation is made in the currency of the loan. The pledged amount is automatically unlocked by the smart contract, the asset is returned to the owner’s account. If the coin rate has increased, it is possible to repay a certain percentage of the loan and take a new one. Another option is to sell part of the asset to close the deal, and withdraw the rest of the money to the wallet.

The attitude of banks to such transactions

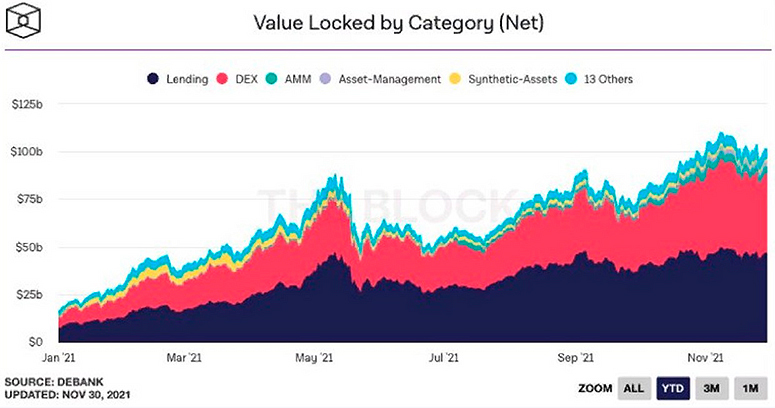

Lending against digital currency is one of the main services in the DeFi sector. In 2021, the decentralized finance market grew almost 9 times (from $18.5 billion to $162 billion in December). Crypto-loans are popular. Investors and traders see them as an opportunity to manage money without selling their assets. However, banks do not trust digital coins yet and do not consider them as collateral. The reason is the complex legal status of cryptocurrencies.

In Russia, transactions with digital assets have been legalized. Virtual coins are equated to property. But the Central Bank’s attitude to them remained negative. In 2021, the regulator carried out active work with financial organizations, urging them to block payments to crypto exchanges. During this time, the volume of transactions with BTC and other coins in Russia grew to 5 billion rubles. According to the Central Bank, the real figures could be much higher, as many investors and traders use VPNs.

The Federal Financial Monitoring Service has calculated: about 17.3 million Russians have digital wallets. Almost 10 million of them invest in cryptocurrency. Many are thinking not only about earning on the growth of exchange rates, but also about other ways of using coins.

In 2020, for the first time in Russia, a loan secured by digital currency was arranged. The deal between Expobank and entrepreneur Mikhail Uspensky became a precedent for the traditional financial community. However, the legal field for cryptocurrencies in the country remains imperfect.

Lending platforms

While banks are not ready for direct interaction with digital assets, it is possible to get a loan secured by cryptocurrency from commercial companies. Many of them offer low interest rates and convenient ways to manage assets. In some cases, you don’t even need to prove your identity.

Binance Loans

The lending service on the exchange appeared in 2020. Loans on Binance are issued in USDT and BUSD stablecoins. BTC and ETH are accepted as collateral. Coins can be used for trading on the platform or withdrawn to a wallet. Funding is provided for a period of 9 to 180 days.

Biterest

Russian P2P platform acts as a guarantor in transactions between borrowers and lenders. It provides ready-made tools for interaction between the parties. Users negotiate the terms of lending themselves. The rates are 5-50%. Usually the collateral is valued at 30% cheaper than the current rate. Assets are stored on a multi-signature wallet.

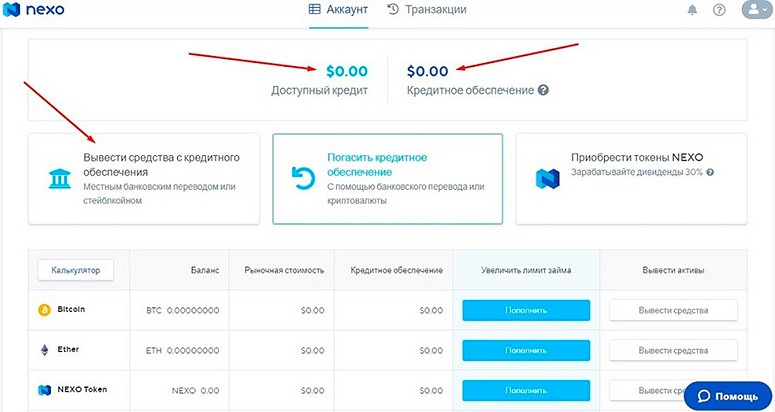

Nexo

One of the largest services opens a credit line immediately after placing a deposit. Money can be received for any term. The main thing is to maintain a balanced loan to collateral ratio. The annual rate is 5.9% with the use of native Nexo tokens and 11.9% when paying interest in the currency of the loan.

Pros and cons of cryptocurrency secured loans

Loans secured by digital assets have advantages over bank loans:

- You can use the money for capital appreciation without selling assets.

- Minimal requirements for borrowers. You don’t need credit history and income certificates.

- Low interest rates.

- Quick decision on the loan.

Minuses of the transactions:

- If the rate of the asset falls, you can lose most of the collateral when the loan is closed.

- The popularity of the sector attracts fraudsters. Need to check the platform thoroughly before making a deposit.

Summary

When an investor needs money to make new deals, it may not be profitable to sell a growing asset. It is much more convenient to borrow against digital coins. If the asset’s rate rises, the potential income will far exceed the interest costs. Traders can pledge cryptocurrency to increase liquidity on transactions.

The risks of such transactions are related to the volatility of digital coins. In addition, in many countries, the industry operates virtually outside the legal framework. However, the development of a new sector is a logical step to continue integrating cryptocurrencies into everyday life.

Frequently Asked Questions

💰 How do I borrow on Binance?

Lending on the exchange is available to all registered users. The main condition is to make a deposit. BTC and ETH are accepted as collateral. The loan amount and rate are calculated depending on the amount of collateral and the loan term.

❓ What is a margin call?

If the exchange rate of the pledged currency falls, the collateral will equal the loan amount and the transaction will be closed. This situation is called a margin call.

💡 How do credit services calculate the amount of collateral?

The collateral is determined taking into account the amount and term of the loan, the annual interest rate and the discount (expected decline in the exchange rate during the contract period).

✅ What coins can be lent on Nexo?

The platform accepts collateral in BTC, ETH, XLM, XRP, USDT and other assets.

⏱ How long can I get funding on Binance?

Loans are issued for 7, 14, 30, 90, 180 days.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.