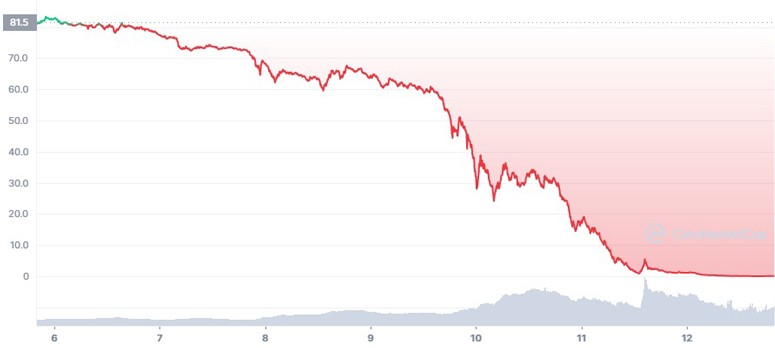

In early May, most cryptocurrencies fell in price by more than 20%. However, Terra (LUNA) lost 99.99% of its value in a week, collapsing from $87.15 below $0.01. Its related stablecoin UST dropped in value by more than 60% in 3 days. On the evening of May 12, the asset was trading at $0.37.

The collapse of one of the largest coins destroyed the fortunes of crypto investors. Members of the TerraLuna community wrote about unprecedented losses of tens of billions of dollars. To capitalize on the cryptocurrency’s growth, people took out loans and mortgaged their homes. To support the victims, moderators of some forums fixed posts with helpline phone numbers in Europe and the United States.

Why the LUNA exchange rate collapsed

According to analysts, the collapse is due to the UST losing its peg to the dollar. Stablecoin is part of the Terra ecosystem. The asset is pegged to the price of the underlying fiat currency (USD). But unlike other stable coins, UST has no monetary backing. To maintain the price, an algorithm and another native token of the network, LUNA, are used.

To create a UST, a user burns the pegged cryptocurrency for $1. Conversely, each stablecoin can be converted into LUNA for the equivalent of $1. Under normal circumstances, the price of UST fluctuated between $0.99 and $1.1. Traders used this variance to arbitrage by buying one asset at a discounted price and converting it to another.

The larger the difference with the peg, the more profitable the arbitrage. On the night of May 10, the UST rate fell sharply below $0.62. Then the price recovered to $0.93. But it failed to hold it. In the evening of May 12, the asset cost $0.37. Thus, the stable coin lost more than 60% of its value in a few days.

However, the fall of LUNA began earlier – on May 6. Within 3 days, the price of the altcoin fell from $87.15 to $60.14. A sharp drop of 98% from the April maximum ($119) occurred in just 24 hours, from May 10 to May 11. By the following evening, the coin had collapsed to nearly zero and was trading for $0.01.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Many experts attribute the altcoin’s collapse to the decrease in Luna Foundation Guard (LFG) reserves intended to provide UST. On the afternoon of May 9, CEO Do Kwon announced the sale of $1.5 billion worth of BTC and UST to support the stablecoin. Large asset outflows from DeFi platforms have led to a decline in LUNA’s exchange rate. But most importantly, Do Kwon’s announcement meant that Terra’s reserve was manually managed, not by an algorithm. Whales (large investors) used this information to “sell” the price of the stablecoin and create a lucrative arbitrage opportunity.

In the Terra ecosystem, other assets in the UST ecosystem also supported the stability of UST. After withdrawing a significant portion of the reserve, they also fell in value. The table shows data as of May 10.

| Coin | Price (USD) | Balance | Equivalent in USD ($) |

|---|---|---|---|

Community Reaction

As long as UST is trading below $1, traders still have an arbitrage opportunity to burn Stablecoin and mint LUNA. To slow down the Terra token sell-off, major exchanges have taken restrictive measures. Binance administration has temporarily suspended LUNA and UST withdrawals. On KuCoin, Terra transactions are stuck indefinitely due to high network load.

On Wednesday, May 11, Do Kwon on Twitter unveiled an action plan to restore Terra coins. The company plans to:

- Increase UST issuance to $1.2 billion.

- Raise a $1.5 investment to stabilize the asset.

However, the developers’ attempts to stop the coins’ decline are not finding support in the community. In social networks and forums, users actively criticize the company and call to return lost investments.

The situation is aggravated by the information about the identity of the head of Terraform Labs (TFL) that appeared in the network. According to the media, Do Kwon is involved in the creation of at least one cryptocurrency scam project. The Basis Cash (BAC) algorithmic stablecoin was launched in 2022 and crashed in 2021, dropping from $147.96 to below $0.01. BAC’s collapse was not widely publicized. The cryptocurrency did not have a big impact on the market, having managed to collect a capitalization of $54.6 million. However, in 2022, history repeated itself with LUNA and UST. This time, the damage amounted to tens of billions of dollars.

BAC was promoted by anonymous developers. However, some of them confirmed the participation of Do Kwon and TFL in the project. In particular, former company engineer Hensook Kang stated this. Another Basis Cash developer spoke to reporters on condition of anonymity.

What’s happening to other stablecoins

The collapse of LUNA and its pegged token UST has shaken the entire cryptocurrency market. Over the past few days, increased volatility has been seen across all the stablecoins. On the afternoon of May 12, USDT was falling to $0.95 in the moment. On the same day DAI was falling to $0.99 and rising to $1.01. The situation is already being monitored by regulators. The U.S. Securities and Exchange Commission is studying the Terra incident and calls on the government to adopt a law concerning the regulation of stable cryptocurrencies by the end of 2022.

Experts state: the collapse of LUNA and UST greatly undermined investor confidence in stablecoins. Practice has shown that the stability of secured coins turned out to be only a name. The crypto community once again recalled the scandals of two years ago related to the USDT collateral. After the recent 5% drop in the price, depositors began to transfer assets to USDC. This koin has an understandable reserve structure. Some experts believe that it may overtake USDT in capitalization in the near future.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.