A few years ago, digital coins were of interest only to those who invested in Bitcoin and believed in the growth of the rate. In 2024, the market offers many assets and technologies that will help a beginner to earn money on the cryptocurrency exchange even without special knowledge. The topic became popular after the rate began to grow actively.

Πόσα μπορείτε να κερδίσετε

Cryptocurrency can not guarantee a stable income because of the high volatility (dynamics of changes in quotes). But you can earn on price fluctuations in different ways.

Many investors prefer to invest money for a long period of time. This is the easiest way to make money on the cryptocurrency exchange for beginners from scratch. The buy-and-hold strategy has proven to be effective with bitcoin. In 12 years, the coin has added about 81.3 million times in value (from $0.0008 in the beginning to $65 thousand in October 2021).

Holding cryptocurrency can bring additional income, in addition to the growth of quotations. In some blockchains, coins are required for system operation (transaction validation).

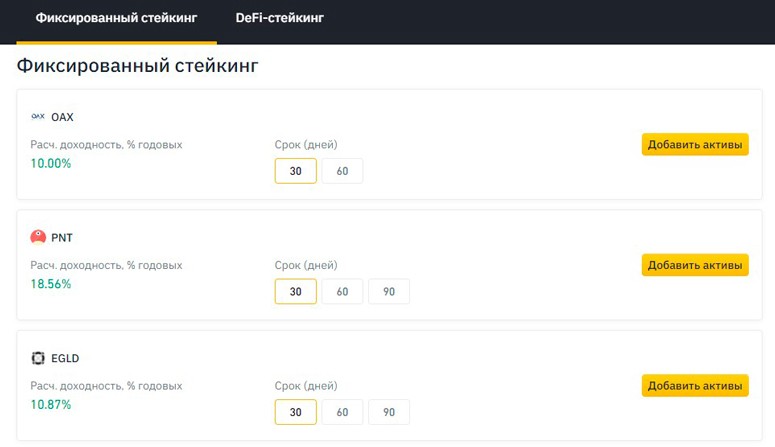

Staking (blocking cryptoassets to validate transfers) is possible on platforms with the PoS algorithm. On them, the validator of new blocks is assigned in proportion to the number of coins on his wallet. The average annual income of an investor from staking is 10-12%. This is several times higher than bank offers.

5020 $

μπόνους για νέους χρήστες!

Η ByBit παρέχει βολικές και ασφαλείς συνθήκες για συναλλαγές σε κρυπτονομίσματα, προσφέρει χαμηλές προμήθειες, υψηλό επίπεδο ρευστότητας και σύγχρονα εργαλεία για την ανάλυση της αγοράς. Υποστηρίζει συναλλαγές spot και μοχλευμένες συναλλαγές και βοηθά τους αρχάριους και τους επαγγελματίες εμπόρους με ένα διαισθητικό περιβάλλον εργασίας και εκπαιδευτικά προγράμματα.

Κερδίστε ένα μπόνους 100 $

για νέους χρήστες!

Το μεγαλύτερο ανταλλακτήριο κρυπτονομισμάτων όπου μπορείτε να ξεκινήσετε γρήγορα και με ασφάλεια το ταξίδι σας στον κόσμο των κρυπτονομισμάτων. Η πλατφόρμα προσφέρει εκατοντάδες δημοφιλή περιουσιακά στοιχεία, χαμηλές προμήθειες και προηγμένα εργαλεία για συναλλαγές και επενδύσεις. Η εύκολη εγγραφή, η υψηλή ταχύτητα των συναλλαγών και η αξιόπιστη προστασία των κεφαλαίων καθιστούν το Binance μια εξαιρετική επιλογή για τους συναλλασσόμενους κάθε επιπέδου!

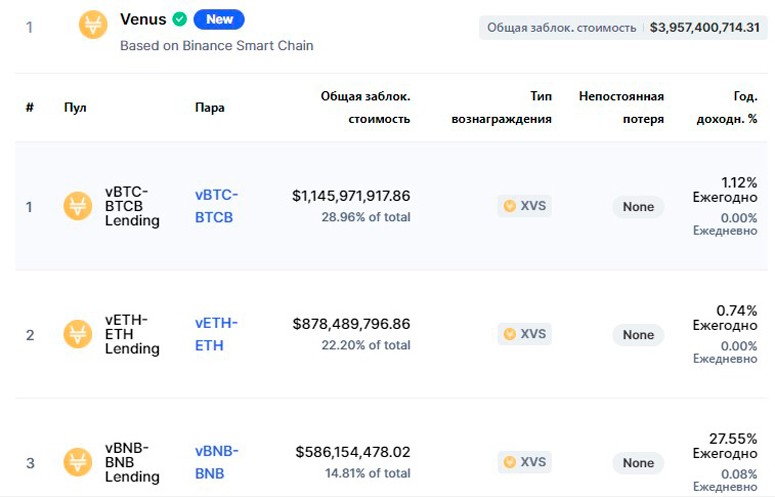

You can earn on the cryptocurrency market by supplying liquidity for DeFi projects(decentralized financial services). This way of generating income is called pharming. Customers transfer crypto-assets to the service, at the expense of which exchange transactions are carried out on a decentralized exchange.

In 2021, pharming on the DeFireX platform brought users 12-180% per year depending on the asset (12% – for ETH, 21% – for DAI, more than 120% – for USDT and BUSD, 180% – for BNB).

How to earn on a cryptocurrency exchange

The main task of an investor or trader is to determine the most profitable strategy. Earning on the cryptocurrency exchange is not limited to buying and selling koins. In 2024, profits can be made in various ways. To do this, you need to understand the tools, spend time studying the theory and features of digital coins.

Trading

The digital industry offers many opportunities to generate income. Trading is a classic way to make money on a cryptocurrency exchange by buying coins cheaper and selling them more expensive.

Digital assets are highly volatile. In a day, the price of coins can fluctuate by 10-20% or more. For example, on October 21, 2021, the bitcoin rate on the Binance US exchange collapsed by 88% – from $65.7 thousand to $8.2 thousand – and then quickly returned to its previous values.

To make money on cryptocurrency trading, you should study the theory of trading, technical and fundamental analysis. The first allows you to predict where prices will go using historical data. The second evaluates economic, technological and political factors that can affect the cryptocurrency market.

Επενδύσεις

To make money from cryptocurrency trading, you need to devote a lot of time to practicing strategies, tracking signals, and creating orders. But there is another way to multiply capital – investing in koins. While supporters of the traditional financial system dispute the value of cryptocurrencies, users who bought bitcoin in 2020 are earning passive income.

In 10 months of 2021, the asset has more than doubled in value (from $29.3k to $65k), and since January 2020 ($7.2k) has risen in value by about 900%.

Investments in the digital marketplace can be:

- Medium-term – up to 2-3 months.

- Long-term – for a period of one year or more.

It can be difficult for beginners to compose a portfolio of assets in such a ratio to minimize risks and increase profitability. Therefore, it is better to focus on coins from the top ten by κεφαλαιοποίηση (Bitcoin, Ethereum, Binance Coin).

Arbitrage

Popular cryptoassets are traded simultaneously on dozens of exchanges. The discrepancy in prices on the sites can be significant. And you can make money on it. Inter-exchange arbitrage of cryptocurrencies is simultaneous trading on two or more platforms. The trader’s algorithm of actions looks like this:

- Buying a coin on one exchange.

- Transferring the coin to another platform with a higher rate.

- Selling cryptocurrency with a profit.

For each operation will have to pay a commission, so the income from a complex transaction will be lower than the actual quote difference. In addition, the transfer of coins between platforms takes time, during which the rates will change. These risks can be eliminated if you place a deposit on several sites at once to buy the asset at the best price. But this method of arbitrage trading requires a lot of capital.

Another type of arbitrage is intra-exchange arbitrage:

- A trader buys a certain coin for fiat.

- Exchanges it for another asset.

- Sells the second currency for fiat.

Profit is formed due to the difference of asset rates against national currencies. The method is rarely used, as it is often unprofitable due to high commissions for depositing and cashing out fiat money.

Συναλλαγές με περιθώριο κέρδους

The exchange can provide the trader with borrowed funds (leverage) to buy assets. Trading with leverage is a risky way to make money. You can make hundreds of percent profit on a single trade or lose it all.

When an investor borrows funds from the platform, their principal balance is locked as collateral. In case of unsuccessful actions, the trader is obliged to return losses to the exchange. The amount of leverage and risks are determined by the coefficient with the prefix x. For example, if the leverage is 100x, then for every bitcoin owned, the user can receive up to 100 BTC belonging to the crypto platform.

| Ανταλλαγή | Maximum leverage size | Commission per transaction (%) | Average daily trading volume in October 2021 ($) |

|---|---|---|---|

| Binance | 125 | 0,1 | 2.5 billion |

| BitMex | 100 | up to 0.075 | 2.1 bln |

| Bybit | 100 | up to 0.075 | 1.1 bln |

| OKEx | 120 | 0,1 | 3.5 mln |

| Currency | 50 | 0,06 | 65 mln. |

Margin trading increases trader’s income and risks in equal proportions. Several recommendations will help to reduce losses:

- Use stop orders to sell the asset quickly when the price changes.

- Do not take a large leverage at first. The optimal ratio of borrowed funds for a beginner is up to 1:3.

- Calculate in advance the interest for the use of credit money.

- It is better to work with pairs of coins that have average volatility. With small price changes, the income will be minimal, and interest must be paid daily. When working with volatile assets, there is a high probability of losing the deposit.

Experienced traders often take leverage to make money on the crypto exchange. For beginners, this method is not recommended, as there is a high risk of losing the deposit.

Staking

New technologies in the blockchain allow you to passively obtain crypto assets. Staking is the mining of coins on the Proof-of-Stake (PoS) algorithm without computing machines. To receive rewards for generating new blocks, the user only needs to block assets on the wallet. The money works and brings the investor interest income.

The list of major cryptocurrencies offering staking rewards in 2021 includes:

- Ethereum – the second most capitalized coin is in the process of switching from the Απόδειξη εργασίας algorithm to Proof-of-Stake. The first phase has already been launched and allows anyone who can invest 32 ETH to expect passive income within 1-2 years.

- Tezos is a coin that appeared in 2018 and had the largest ICO with investments of over $230 million. Investments in XTZ bring 5-6% per year. The minimum investment amount is 8 thousand coins.

- Algorand – uses an improved Pure Proof-of-Stake (PPoS) consensus mechanism, but still needs stakers for the network to work. Annualized return on investment in ALGO is 5-10%.

- Icon – runs on the Delegated-Proof-of-Stake (DPoS) algorithm. One group of users finds new blocks and verifies transactions, while a second group of users delegates their assets to them. ICX generates returns of 6-36% per annum.

Major crypto exchanges (Binance, Coinbase, OKEx) also offer USDT, DAI, BUSD, USDC stablecoins. Investments in stable assets have small returns of 2-6% and protection from market volatility.

Δανεισμός

Lending money can be done by individuals and cryptocurrency exchanges that need it. Lending is lending digital assets to other users or platforms.

Usually, an investor lends coins to traders who engage in margin trading. And the exchange acts as an intermediary in the transaction. Interest and terms of such investments each platform determines independently. The borrower’s balance sheet acts as collateral.

Lending programs work on several major exchanges:

- Binance.

- Gate.io.

- Bobox.

- Bitmex.

The deposit period is 7-180 days. The rate of income reaches 350% per annum.

Trading with the help of bots

Work on the cryptocurrency exchange consists of monotonous actions. Therefore, immediately after the appearance of the first platforms, automated programs for trading koins were developed. Bots perform routine operations – for example, buy the asset at the moment the price falls to a certain level.

The functions of the programs become more complicated. For example, they add automatic analysis of the market according to specified algorithms and make decisions on selling currencies. Usually software is distributed by subscription and costs from 10 to several hundred dollars. Some bots take a small percentage of transactions.

The profitability of trading programs is 3-30% per annum. Most bots offer to test features on a demo account. Other pros:

- Working on both falling and rising markets.

- Automatic search for entry points.

- Insurance against high volatility.

- No market knowledge required.

Disadvantages of the programs:

- Need a deposit and money to buy a robot.

- Income grows in proportion to therisks.

- The crypto trader has no control over the actions of the program.

Some bots track the price of a certain digital currency and report a sharp change in the rate. But the most popular are still programs that help you automatically earn money on trading.

Profitable farming

According to CoinMarketCap, the total value of liquidity pools in October 2021 is $8.15 trillion. Income farming is one of the main ways to make money in decentralized finance (DeFi).

The name can be explained by the direction of investors. They “grow” their income from previously “seeded” investments. Mechanisms to achieve the goal: earning through borrowing digital assets and providing liquidity.

Issuing loans on exchanges

An investor registers with a project that issues cryptocurrency loans (e.g. Compound). The assets they provide are transferred to another participant who left a loan request on an interest-paying basis. The depositor receives a commission and the project’s native μάρκες.

Liquidity mining

Users are rewarded in native tokens for operating on the project’s network. They supply liquidity, contributing to the popularization of the protocol and the growth of the asset price.

Contests, tournaments

Newcomers to the crypto market often lack knowledge and practice. Therefore, many exchanges hold contests and tournaments in demo mode, for participation in which you can get koins and experience.

There are also competitions for experienced traders, to participate in them require large trading volumes, but you can get a lot. For example, in March 2021, a team tournament was held on Binance. The prize pool amounted to $1.6 million. 30% of the total guarantee was for the first place.

The best cryptocurrency exchanges for earnings

In October 2021, 308 platforms operate in the digital currency market, the average daily trading volume of which is $290 billion. The best exchanges offer high liquidity and a large number of tools for earning. In 2021, the top 5 in the CryptoProGuide rating were:

- CEX.io – a service with support for different language versions, digital and fiat currencies. The platform is regulated and fully complies with the requirements of the states in which it is represented. The average daily trading volume in November 2021 is $65.33 million.

- Currency.com is a universal platform for buying/selling cryptocurrencies and tokenized assets. The exchange’s pool includes digital stocks, commodities and currencies. Daily turnover in November 2021 – $150.66 million.

- Binance is one of the largest trading services with support for 393 digital and 46 fiat currencies. The company operates in more than 40 countries and serves more than 16 million users.

- Coinbase – the largest cryptocurrency exchange in the U.S., providing a simple mechanism for exchanging digital coins and supporting popular deposit and withdrawal methods (bank cards, electronic and cryptocurrency wallets).

- KuCoin is a platform with a large number of trading pairs (946) and low commissions. The average daily turnover of transactions in November 2021 is $4.11 billion.

Pros and cons of earning money at a crypto exchange

The market of digital currencies provides opportunities to earn every day. Most of the instruments are centered on exchanges. Trading platforms take care of the technical part of working with assets, without requiring users to have in-depth knowledge of the market. Other pros of interacting with crypto exchanges:

- The opportunity to generate income actively and passively.

- A large number of instruments.

- There are techniques for beginners.

Minuses of earning on trading platforms:

- Verification is often required.

- Operations with digital currencies are associated with risks.

You need startup capital to work on the exchange. Unlike the stock market, entry to digital is more accessible. You can start earning from almost any amount, gradually increasing the capital.

Algorithm of actions for beginners

To earn on the cryptocurrency market, you need to understand how it is organized. Knowledge will be useful for choosing a platform and assets.

Studying terms and theory

The crypto industry is full of words and designations that are not always clear even to an experienced trader. To work with digital money, you need to know a lot of terms and abbreviations:

- Altcoin – digital coins that are an alternative to Bitcoin (Litecoin, Cardano).

- Bitcoin – the first digital coin created in 2009.

- Token – a digital asset built on the blockchain of an existing cryptocurrency (Tron, VeChain).

- Stablecoin – a fixed-rate coin tied to a physical asset (USDT, DAI).

All terms can be found in literature or in guides published by exchanges for beginners. Another effective way to learn special words is to communicate on cryptocurrency forums. In such communities, there are often experienced investors and traders who can explain the meanings of terms and help with questions.

Choosing an exchange

The cryptocurrency market is evolving, and with it, the number of platforms is growing. Some offer many trading pairs, others offer a user-friendly interface, while others offer new technical and graphical analysis tools. Here are a few criteria to consider when choosing an exchange:

- Reputation. Before registering on the platform, it is worth reading reviews about it on forums (Bitcointalk, Reddit).

- Average daily trading volume. High liquidity allows you to make transactions even with little popular assets.

- Commissions. The amount of commission that the user pays to the exchange for each transaction is usually in the range of 0.1-0.25%.

- Support of fiat currencies. It is worth studying the conditions and terms of deposit and withdrawal, the size of commissions.

- Verification requirements. Some services set strict conditions for identification (Bittrex, Poloniex). Others allow unverified clients to trade (Binance, KuCoin).

It is also worth finding information about the history of the platform, related events, founders. This data is freely available, as users share feedback about the sites, especially if there are difficulties in working with them.

Asset selection

Careful analysis of the koin helps to make successful investments. For beginners, it is better to choose proven assets from well-known companies. If such a project launches a new token, it is likely to grow in value. For example, TWT from Trust Wallet was worth about $0.01 in the summer of 2020. In October 2021, the asset trades for $1.1. In one year, the token’s price has increased more than 100 times.

It is better to analyze projects by several criteria:

- Popularity in the investor community. If major publications (forklog, bits.media) write about the project, tokens are available on popular crypto exchanges, and the creators are not hiding under pseudonyms, then, most likely, it is a promising option for investment.

- Transferring assets without waiting. New startups often cooperate with companies that have multi-currency vaults and provide fast coin conversion.

- The website of a new project should be well protected from possible hacker attacks. Two-factor authentication, notification of login via SMS, email or Push will be an advantage.

Basic mistakes and recommendations for beginners

Even experienced investors can make blunders and lose money. Beginners learn from their mistakes. But many of them can be avoided if you follow the recommendations:

- Commissions should not be ignored. Even 0.1% can “eat” capital over a long distance.

- Do not deny the risks. Cryptocurrencies are volatile, and the rate often changes within one day.

- You should not invest in one asset. Buying several coins at once will cover the loss from the collapse of other cryptocurrencies. And if one coin grows significantly in value, you can diversify (profit sharing).

- If a cryptocurrency has lost in price, it does not mean that the investor has chosen an unpromising coin. It is necessary to wait until the market situation stabilizes.

- It is not worth investing in assets about which nothing is known. It is better to first gather information about the project, and then make decisions.

If a coin has sharply soared in price, it is better to sell 30-50% to fix a part of the profit. Since a διόρθωση may follow a rise in the rate. In order to stay on the market longer, it is necessary to reinvest profits.

Περίληψη

Cryptocurrency exchanges offer different ways to make money on assets. Some are conservative (for example, trading on BTC rate changes). Others promise many times more income, but have significant risks.

The combination of several methods of earning profits at once can give tangible results. Therefore, you should first determine the platforms for work, having studied the conditions and theory of the market in advance.

Συχνές ερωτήσεις

🔽 How can I reduce the commission for operations on the exchange?

Many services are ready to take a lower percentage for transactions if certain conditions are met. For example, if you hold BNB tokens on Binance, you can reduce the commission by 25%.

❔ Why keep 50% of your savings in bitcoin if its price is too high?

BTC is in high demand. Experts believe that the coin’s rate will continue to grow in the future.

❗ Why do major exchanges hold contests and tournaments?

The main reason is advertising and attracting users. Not every exchange can spend millions of dollars on such events.

✅ Is it legal to use trading bots?

It is not prohibited. Bots do not give advantages in trading, but can only place orders to buy or sell assets based on the data that is freely available.

💵 What is more profitable, trading or passive investing?

It depends on the strategy chosen and the skills of the user. Trading can potentially bring in more money. But to make money on changes in quotes, you need to be able to analyze the markets and open trades in time.

Σφάλμα στο κείμενο; Επισημάνετέ το με το ποντίκι σας και πατήστε Ctrl + Μπείτε μέσα.

Συγγραφέας: Saifedean Ammous, ειδικός στα οικονομικά των κρυπτονομισμάτων.