In 2009, a programmer under the pseudonym Satoshi Nakamoto launched a peer-to-peer network and created the BTC cryptocurrency, changing the world of financial transactions. He was not the first expert who voiced the idea of P2P-transactions with full decentralization and transparency. But it was his project that was realized. He turned Bitcoin into the digital gold of the 21st century. In simple words, Bitcoin appeared in the world and made transactions faster, cheaper, 100% transparent, eliminating intermediaries from the chain.

In what year bitcoin appeared

Satoshi Nakamoto (or a group of specialists who hide under this pseudonym) developed a protocol for P2P transactions for over 2 years: from 2007 to 2009.

The main network was officially launched on January 3, 2009. The GMT time of creation of the first block of the chain, named Genesis, is 18:15:05 (21:15 MSC).

As a reward, the first 50 BTC were credited to Satoshi’s account.

But if we consider the history of the bitcoin cryptocurrency from the beginning, the documented decentralized payment system and coin were described earlier. Back in October 2008. The White Paper of the project was included in the Cryptography newsletter.

This is not the first time that developers have presented technologies for digital money transactions. Events that may have influenced the emergence and development of bitcoin:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- The creation of Hashcash – a verification system that confirms the correctness of operations. It is used in Bitcoin and many altcoin networks. The developer is Adam Back.

- E-cash protocol release.

- The Reusable-Proofs-of-Work (proof-of-work) mechanism was created on the basis of Hashcash. The creator is Hal Finney.

- Description of the algorithm for BitGold digital currency. The project was not implemented, but explained a 100% decentralized P2P network. The idea belongs to cryptographer Nick Szabo. Later, he also solved the BFT. This Byzantine generals problem is one of the fundamental properties for blockchain protocols. The algorithm became used for mining and storing coins in some projects.

Journalists suspected that each of the technology developers who contributed to the BTC creation story could have been Satoshi Nakamoto. But the programmers denied involvement.

How new coins emerge

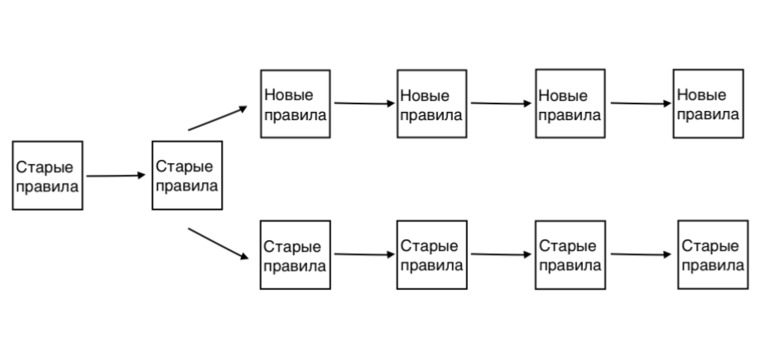

Many altcoins (alternative cryptocurrencies) are created through forks. This means that the original chain is split. A global protocol change is made. The new chain operates under different rules. It has its own native coin.

Top popular koins that emerged as a result of BTC forks:

- Bitcoin Cash (BCH) as of August 1, 2017. One of the most successful branching of the protocol.

- Bitcoin Gold (BTG).

- Litecoin (LTC).

Coins are also issued on proprietary blockchains developed from scratch. In addition to the Bitcoin chain, there are Ethereum, Polkadot, Solana, and dozens of others.

They differ from the first blockchain in the ways of consensus, algorithms, degree of centralization, functionality. It is possible to issue tokens on the basis of new networks. For example, in the Etherium blockchain – according to the ERC-20 standard.

History of Bitcoin development by year

To understand what led to a radical change in the financial system of the 21st century, you need to know the history of the first coin. Bitcoin was created in 2009. It was the initial step to build a new architecture of monetary transactions. After led to the creation of smart contracts and decentralized dapps applications.

Inception and first mentions

The important events of bitcoin, the history of the creation and the emergence of the crypto coin are considered in the table.

| Year | Date | Event |

|---|---|---|

| 2008 г. | August 18 | Registration of bitcoin.org domain |

| October 31 | Publication of WhitePaper in the newsletter | |

| November 9 | Project registration on SourceForge, a site for open source software. | |

| 2009 г. | January 3 | The first block is created and 50 koins are generated. This is how the cryptocurrency Bitcoin appeared |

| January 9 | Release of the first version of the Bitcoin Core program, necessary for mining coins and conducting transactions | |

| January 10 | The second node is connected to the network. The project was supported by programmer Hal Finney. He created block #78 and was rewarded with 50 coins. | |

| January 12 | The first transaction of 10 koins is performed. The transaction is recorded in block 170 of the chain | |

| October 5 | New Liberty Standard website launched, where the coin can be exchanged for dollars | |

| October 9 | IRC channel registration | |

| December 16 | Software update: Bitcoin Core version 2 launched | |

| December 30 | The network was supported by a large number of nodes and became decentralized. At block 32,256, the complexity of mining was increased | |

| 2010 г. | February 6 | The first cryptocurrency trading exchange Bitcoin Market was launched |

First transactions

An important date in the development of the project – May 22, 2010. Developer Laszlo Hanec bought 2 Papa John’s pizzas for cryptocurrency.

They cost him 10,000 koins (about 25 dollars at the exchange rate of the time). Later, he bought pizza in this way several more times.

Other important events in the history of the project are considered in the table.

| Year | Date | Event |

|---|---|---|

| 2010 г. | July 7 | The third updated version of the protocol was released |

| July 17 | MtGox cryptocurrency exchange launched | |

| July 18 | OpenGL GPU mining farm created, adding a new block to the chain | |

| Aug. 15 | The first bug in the code was noticed and fixed. It caused an incorrect operation in block 74,638. It was replaced with a new structure 74,691 | |

| September 14 | Another large-scale deal was made. User jgarzik paid his colleague puddinpop 10 000 BTC for launching their common project – CUDA hardware and software architecture. | |

| Oct. 1 | The first bitcoin miner that uses OpenCL framework to mine coins has been developed. | |

| October 16 | For the first time, a deal is struck to deposit coins with a third party (user themmos) | |

| Nov. 6 | The first 100 koin transaction is made through the IRC channel for trading #bitcoin-otc | |

| December 7 | Bitcoind mobile application for smartphones is released | |

| December 8 | First transaction via phone | |

| December 16 | The first pool of miners was launched. The pool generated 1 block | |

| 2011 г. | January 1 | Silk Road, a large platform for trading illegal goods for crypto, started its work |

| January 27 | Conducted the largest transaction at the time. Bought 4 bitcoins for 100 trillion dollars Zimbabwe | |

| February 4 | For the first time they wanted to sell a car for cryptocurrency. The price of Porsche – 3000 BTC | |

| March 27-April 5 | Exchanges launched to exchange crypto for fiat currencies: English pounds, Brazilian reals, Polish zloty | |

| April 12 | Option contract signed for the first time on a crypto exchange | |

| December 12 | The largest account of 171 coins was paid. The event took place on block 157,235 | |

| 2012 г. | June 1 | Coinbase major exchange launches |

| September 27 | Bitcoin fund established | |

| December 6 | For the first time, a crypto exchange received a European banking license | |

| 2013 г. | March 19 | Bitcoin Core updated to version 8.0 |

| March 28 | After 4 years from the date of creation of the first Bitcoin, the capitalization of the project has grown to 1 billion | |

| August 20 | Cryptocurrency legalized in Germany | |

| October 2 | Silk Road market for selling illegal goods is shut down |

An important event of this period – December 16, 2010 Satoshi Nakamoto intervened in the protocol for the last time and added to the code. After that, he disappeared.

Collapse and revival

Since December 2013, the project began to have a black streak. About $100 million in BTC was stolen from users. Then the ban on the use of cryptocurrency in China came out and the largest exchange BTC China was closed. Bitcoin legalization was also abandoned by Norway. Other negative events:

- On January 8, 2014, the arrest of one of the heads of the Bitcoin Foundation, a charitable foundation, took place. His activities are aimed at encouraging the use of bitcoin. He was accused of money laundering. The price of the coin immediately fell by $40.

- From February 7 to February 12, 2014, transaction problems were detected at all major exchanges. Vulnerabilities in transactions were discovered. Because of this, the price of the coin fell by 30% to $600.

- In February 2015, the coin was trading at $262.

But since 2016, the project began to gain popularity again. The price of the koin increased. In March, BTC was recognized by the Cabinet of Ministers of Japan, the largest marketplace for trading digital assets Bidorbuy was launched.

In April, the Steam Service, an online service for the distribution of computer games and programs, began accepting the coins for payment. In July, the Uber cab network in Argentina switched to using BTC. In September, the number of bitcoin ATMs increased – 771.

The number of academic articles focused on BTC increased from 83 (2009) to 3,580 in 2016.

In 2017, the number of partners, websites and companies that accept cryptocurrency increased rapidly. For example, the number of stores in Japan working with BTC increased 4.6 times.

Activity on cryptocurrency exchanges also increased. From winter to early summer, the number of transactions on the Poloniex trading platform showed a 640+% spurt. The legalization process started in Japan (acceptance of BTC as a legal payment), Russia, Norway.

In January 2017, the coin was trading at $1150. And on December 15, 2017, the coin reached a new level and set a high of $17,900. But then came a sharp decline.

For investors, 2018 became the toughest, as the price was constantly decreasing. In winter, in 16 days, the cost fell 2 times. Already on February 7, the coin was trading at $3399.

Explosive growth

Since the beginning of 2019, the recovery of the rate began. Already on February 24, the first significant jump to $4199 was recorded. And eight days later, the price reached $5256. This was the beginning of explosive growth and the setting of new historical highs:

- May 29, 2019. Coin price – $8721.

- June 16, 2019 – $9311.

- June 22, 2019 – the $10,000 milestone was crossed and a record of $10,738 was set.

- June 26, 2019 – $12,637. The jump is attributed to the announcement by Facebook management of the creation of its own cryptocurrency Libra and the general development of the blockchain technology industry.

- December 2020 – A new record of $28,700 is set.

Coronavirus epidemic, uncontrolled increase in the mass of the dollar and other currencies, unstable economic situation led to a loss of confidence in fiat.

More and more investors, in order to hedge risks, began to transfer assets into the digital gold of the 21st century. While the koin was worth $28,700 at the end of 2020, by April 14, 2021, the price reached a record $64,863.

Our timing

After the peak in the spring of 2021, a natural decline began. Its acceleration was influenced by news from China. The government of this country banned mining on its territory.

By July, the price fell to $31,700. By August, a gradual recovery of the cryptocurrency market began. In early September 2021, the coin was trading at $46,000+. But its value was unstable. Upward jumps alternated with falls.

The forecasts of crypto experts are optimistic. They expect a gradual recovery and a new wave of growth by winter 2021.

History of the BTC rate

For the first time, the ratio of bitcoin to the dollar was announced on the New Liberty Standard exchange site – $0.00076392443 per coin.

The rate was calculated using the formula: power required to create 1 blockchain link x the price of electricity in the US / reward for 1 block.

| Mid-Market Exchange Rate Historv | |||

|---|---|---|---|

| $1.00 USD | = | 1,578.77 BTC | 12/28/2009 |

| $1.00 USD | = | 1,578.77 BTC | 12/27/2009 |

| $1.00 USD | = | 1,578.77 BTC | 12/26/2009 |

| $1.00 USD | = | 1,578.77 BTC | 12/25/2009 |

| $1.00 USD | = | 1,578.77 BTC | 12/24/2009 |

| $1.00 USD | = | 1,578.77 BTC | 12/23/2009 |

| $1.00 USD | = | 1,578.77 BTC | 12/22/2009 |

| $1.00 USD | = | 1,594.63 BTC | 12/21/2009 |

| $1.00 USD | = | 1,594.63 BTC | 12/20/2009 |

| $1.00 USD | = | 1,586.70 BTC | 12/19/2009 |

| $1.00 USD | = | 1,622.40 BTC | 12/18/2009 |

| $1.00 USD | = | 1,630.33 BTC | 12/17/2009 |

| $1.00 USD | = | 1,606.53 BTC | 12/16/2009 |

| $1.00 USD | = | 1,626.37 BTC | 12/15/2009 |

| $1.00 USD | = | 1,626.37 BTC | 12/14/2009 |

| $1.00 USD | = | 1,618.43 BTC | 12/13/2009 |

| $1.00 USD | = | 1,562.90 BTC | 12/12/2009 |

| $1.00 USD | = | 1,503.40 BTC | 12/11/2009 |

| $1.00 USD | = | 1,491.50 BTC | 12/10/2009 |

| $1.00 USD | = | 1,455.80 BTC | 12/09/2009 |

| $1.00 USD | = | 1,428.03 BTC | 12/08/2009 |

| $1.00 USD | = | 1,392.33 BTC | 12/07/2009 |

| $1.00 USD | = | 1,364.56 BTC | 12/06/2009 |

| $1.00 USD | = | 1,336.80 BTC | 12/05/2009 |

First prices for the coin according to the New Liberty Standard website

The first large-scale rate jump took place on July 12, 2010. For 5 days there was recorded a growth of 10 times to $0.08. And on November 6, when the capitalization of the project reached 1 million – up to $0.5. Other rate hikes:

- February 9, 2011 the price of $1 was reached for the first time.

- June 2, 2011 – $10.

- June 8, 2011 – the price on the MtGox crypto exchange reached $31.91.

- February 28, 2013 – since the coin was created, the $31.91 ceiling is broken for the first time.

- March 21, 2013 – jumped to $74.9.

- November 19, 2013 – a record of $1242 is set.

- 2014 – the maximum rate during this period was $310.

- 2015 – the bar of $360 was reached.

- 2016 – for the first time the price passed over $1000.

- 2017 – one of the historic highs of $19,000+ was set. The year was rich in ICOs (initial coin offerings), which helped attract new investors to the cryptocurrency industry.

- 2018 – the price dropped to $3552.

- 2019 – due to the growing popularity of cryptocurrencies, their legalization in different countries (legislation changed in the EU, USA, Canada, and later in Russia (2020), Ukraine (2021)), a stable growth began. The exchange rate reached $19,000.

- 2020 – against the background of an epidemic, economically unstable situation and a fall in the value of fiat, the price of the first coin rose to $28,700.

- 2021 – a historical maximum of $64,863 is set (as of September).

Regulatory history

The legal status of cryptocurrencies in 2021 is still unapproved. Although the level of acceptance has increased. But part of the countries still prohibit any activity with coins (Morocco, Algeria, Bolivia) or put restrictions on specific transactions (Iran, Bangladesh, Thailand). Important events:

- March 18, 2013 is the release date of a report on virtual assets and their legal status. The document was released by FinCEN, a financial crime network in the US. This is the first attempt to establish controls on the use of crypto by both individuals and businesses. The anti-money laundering policy extended to transactions on the Bitcoin network.

FinCEN head Jennifer Shasky Calvery suggested in 2013 that cryptocurrency should be subject to the same laws as fiat.

- In June 2015, Superintendent Benjamin Lawsky, who worked for the Department of Financial Services in the U.S., created a set of regulations relevant to New York State. They were supposed to help regulate the digital currency industry and protect customers using BTC.

- In August 2017, the Canadian Securities Administrators (CSA), a Canadian securities oversight organization, released the document. It specified the treatment of ICOs and the classification of tokens.

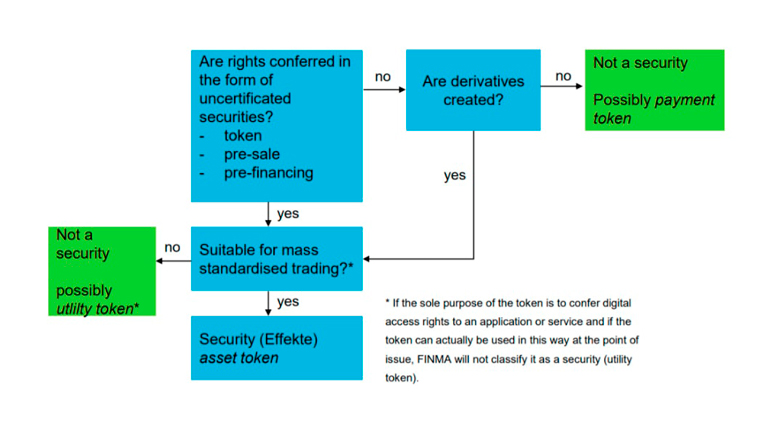

- On September 29, 2017, the Swiss Financial Market Supervisory Authority (FINMA) released its document. It specified the classification of coins. Thanks to this, it can be determined whether a particular coin is a security and whether certain provisions apply to it.

- July 2018 – the emergence of the Virtual Assets Act from the Government of Malta. It included the classification of coins + terms and conditions for the handling of coins.

- In October 2019, the SEC determined that Bitcoin could not be classified as a security token. An adaptation of the Howey test was used for the analysis. The laws cannot be applied to the coin as a security token.

- In January 2019, the UK’s FCA (the country’s regulator) issued the Guidelines on Cryptoassets. This is how the formation of a new classification occurred. According to it, BTC is an Exchange Token or exchange token.

- December 2020 – Russia adopted federal law No. 259 “On Digital Financial Assets”.

- September 2021. In the Ukrainian parliament, deputies approved the law “On Virtual Assets” (draft #3637) in the second reading. Its adoption creates prerequisites for the legal operation of projects, including crypto exchanges, in the country.

The future of Bitcoin

The rapid growth of the coin’s rate in 2020-2021 against the background of the falling price of the dollar, euro and other currencies showed that more and more investors are losing confidence in fiat and the current financial system.

Bitcoin has become the new digital gold and a means of saving in times of instability. The rise in the exchange rate did not come out of nowhere. It is a consequence of the change in monetary and commodity relations and the transition to a decentralized system based on the P2P principle.

This was the first time that the exchange rate was pushed up by institutional investors: large private investors and companies. This trend could intensify in the future.

Bitcoin, despite the emergence of a huge number of new blockchains and coins, will remain the flagship of the market and will set the general mood of trading. But its influence will gradually weaken. The price, according to experts’ forecasts, will break the historical maximum more than once.

Summary

The emergence of BTC has fundamentally changed the financial system. Despite the predictions of skeptics, the coin’s rate continues to grow. It sets all new historical maximums.

Periods of price decline after a sharp rise are normal and natural tendencies in the market.

Knowing the origin and history of bitcoin rate changes, the preconditions for growth and decrease in value, investors can make more informed and profitable investments.

Frequently Asked Questions

⏰ When was Bitcoin officially born?

Satoshi Nakamoto received the first 50 coins for creating the blockchain on January 3, 2009.

❓ What does Bitcoin look like visually?

Like code that appears on the screen of a laptop, smartphone or other gadget. It has no physical embodiment.

❕ What consensus method is used to keep the network running?

Proof-of-Work, SHA-256 algorithm. This makes classic mining available to users.

❌ Does the payment system have an owner?

No, it is 100% decentralized. In order for changes to be made to the protocol, they must be supported by a majority of node owners.

❔ Who is Satoshi Nakamoto?

The identity in 2021 has not been established. A pseudonym can hide either one or a group of programmers who wish to remain anonymous. The P2P Foundation profile states that the creator of the project was born on April 5, 1975 in Japan. That is, he would have turned 45 years old in 2021. But journalists and researchers believe the information in the profile is false.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.