The introduction of distributed registries is changing the laws and economies of different countries. You can ban or allow cryptocurrency, but you can’t stay on the sidelines. On January 1, 2021, Russia adopted new rules. They allow digital assets, but prohibit coins and tokens as a means of payment. With cryptocurrency you can make almost any transactions, but it is impossible for Russian citizens to pay with digital assets. The law allows the issuance of tokens, which has already been used by some enterprises and companies. Blockchain technology in Russia in 2024 has moved to a new stage of development. Legal regulation did not end there, the government is considering a complete ban on the ownership of cryptocurrency.

Government policy regarding the development of technology

Since the beginning of 2021, a law called “On digital financial assets and digital currency” has been in force in the Russian Federation.

The legislator defined cryptocurrencies – these are electronic data that can be used for payment. They were allowed to be exchanged, invested. However, cryptocurrencies are prohibited as a means of payment. They do not belong to the monetary units of the state. Virtual assets have no controlling authority.

Blockchain is a database that works according to established algorithms. Also distinguish the concepts of such digital units as:

- Currency.

- Financial assets.

Digital currency is electronic money tied to other assets. They are used to measure value. Cryptocurrency is not used as an official means of payment, but can be. Examples:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- Bitcoin.

- Ethereum.

- Litecoin and other blockchain-based coins.

Cryptocurrency is a property that cannot be paid with. All transactions need to be declared if the amount of transactions exceeds 600 thousand rubles per year. Digital financial assets differ from cryptocurrency by the issuer – a person who is responsible to the holders. Bitcoin and altcoins are issued by the community. There is no specific person responsible for the issuance, who can be asked for the decisions made. Digital financial assets are issued by a specific person or organization that is fully accountable to the law.

The country’s main regulator, the Ministry of Finance, has proposed a new article in the Criminal Code that penalizes violations:

- Illegal use of cryptocurrency is punishable by a fine from 100 thousand rubles.

- The same in large amounts – monetary penalty from 500 thousand rubles or imprisonment up to 3 years.

The regulator also proposed to change the CAO, to introduce penalties for such violations:

- Illegal issue of digital financial assets.

- Violation of the rules of circulation of cryptocurrency as a means of payment.

- Illegal transactions.

You can’t pay with cryptocurrency. Here’s what you can do with coins in the Russian Federation:

- Buy.

- Sell.

- Exchange.

- Own.

- Mine.

Russian experts believe that the law on CFA has opened a new stage of development for enterprises and organizations. Blockchain will be at the heart of the digitalization of all spheres. The technology attracts different players, including representatives of the public sector.

Blockchain has such advantages as:

- High reliability.

- Minimization of costs.

- Cross-border settlement.

- Diversification.

- Emergence and expansion of hybrid instruments.

- New holders, healthy competition.

At the end of 2020, the government commission for digital development of the Russian Federation approved a roadmap for blockchain implementation. The cost of its implementation is more than 10 billion rubles, 50% of which is planned to be attracted from off-budget sources.

Who is already using blockchain technology in Russia

Despite the ban on cryptocurrency as a means of payment, other areas of distributed ledger use are actively developing in Russia. Representatives of the public sector understand that the introduction of blockchain is a transition to a different organizational, infrastructural and social level. New technologies cannot be developed in isolation; they need to be integrated into existing structures.

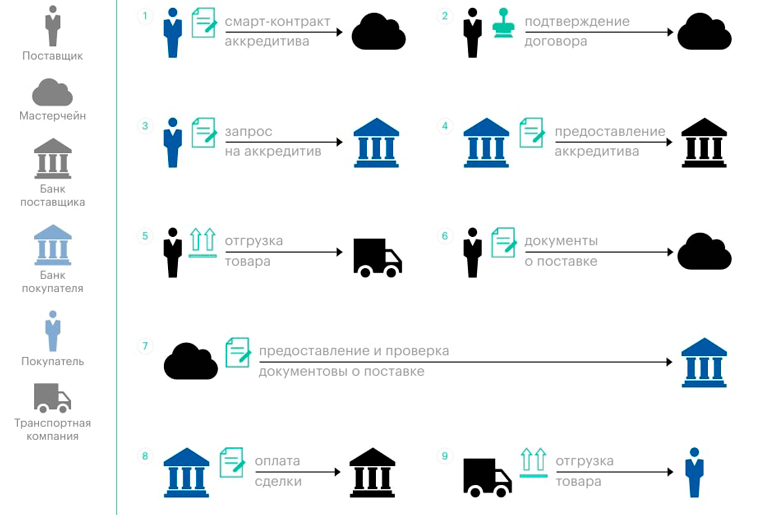

In 2016, the Masterchain project was created. The system allows to exchange information between users, transfer digital values. “Masterchain” is based on the Ethereum network with some modifications.

In the creation participated:

- Bank of Russia.

- Sber.

- VTB.

- Tinkoff.

“Masterchain” offers representatives of the banking industry such areas of activity:

- Financial assets.

- Digital letters of credit.

- Use of KYC service.

- Digital bank guarantees.

- Decentralized depository system for mortgage accounting.

- Distributed register of digital bank guarantees.

This is not the only case of blockchain application in Russia. There are other successful companies that are implementing solutions based on decentralized networks in their structures.

Banks

Sber launched its own blockchain platform based on Hyperledger Fabric on May 20, 2021. The community can access:

- Libraries for working with tokens.

- APIs for implementation.

The blockchain platform from Sberbank developers allows creating client applications, making transactions with tokens, and using smart contracts. A special payment unit is used for settlements in rubles. Renewable electricity certificates have already been tokenized on the blockchain from Sberbank. The issuance of digital financial assets is planned.

Storage and validation of data is carried out at the expense of independent participants. A cryptographic encryption mechanism is used. Validators do not have access to the information being validated.

Sberbank wants to integrate basic banking operations into blockchain. There are developments for transferring population lending, insurance and other products to a distributed network.

Companies

In addition to the banking sector, representatives of the financial sector and industrial groups are showing interest in blockchain in Russia. The companies include not only Nornickel, which was one of the first to be included in Forbes’ global rating, but also other economic leaders.

NSD

The National Settlement Depository provides financial services, investments. It deals with the securities market in Russia. NSD uses a blockchain solution based on Hyperledger Fabric. With the help of distributed networks, National Settlement Depository plans to optimize transactions, keep records and documentation. The company’s management intends to develop the financial market on the basis of high-tech solutions. With the help of blockchain it is possible to simplify the company’s architecture and make services cheaper. Digital assets will protect investors’ rights and ensure transparency of the securities market for regulators.

Norilsk Nickel

The company is a producer of rare metals and Russia’s leader in terms of capitalization. Nornickel uses the Hyperledger Fabric blockchain to facilitate trading. For this purpose, the company issues tokens that are backed by valuable metals: palladium, copper, and cobalt. The company uses the blockchain to keep track of its production.

Gazprom

Russia’s largest oil producer is also using Hyperledger Fabric blockchain. The distributed network at Gazprom is used to account for logistics, sales. With the help of blockchain, the company tracks cargo transportation. Gazprom has developed its own Smart Fuel platform for gas stations.

S7

Russia’s second largest air carrier uses blockchain based on Hyperledger Fabric. S7 sells tickets using a distributed network.

Other popular blockchain projects

In addition to large companies and banks, developers and programmers are showing interest in the distributed network and tokenization of various activities. They create startups based on blockchain. The projects’ activities are aimed at promoting different technologies in the world.

There are 4 popular projects for 2023. Their main directions and development goals are presented in the table.

| Startup | Direction | Objective |

|---|---|---|

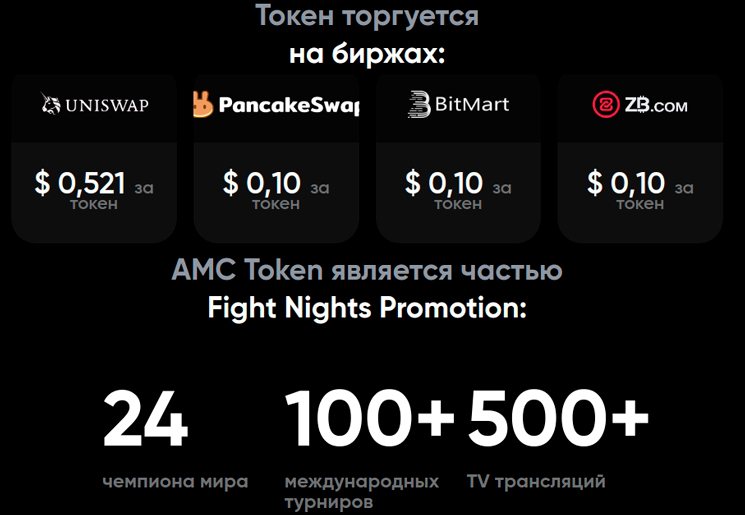

| AMC | MMA (mixed martial arts) | In 2020, the project team decided to tokenize the promotion of MMA tournaments, to attract investors. With the help of blockchain, it provides open solutions for all participants. The developers plan to build an entire ecosystem using NFT and DeFi technologies. |

| Gotbit | Consulting activities | The project team assists blockchain startups in promotion. The company’s assets include more than 200 cases. Besides blockchain, other innovative technologies are used – artificial intelligence (AI), quantitative research (QR). |

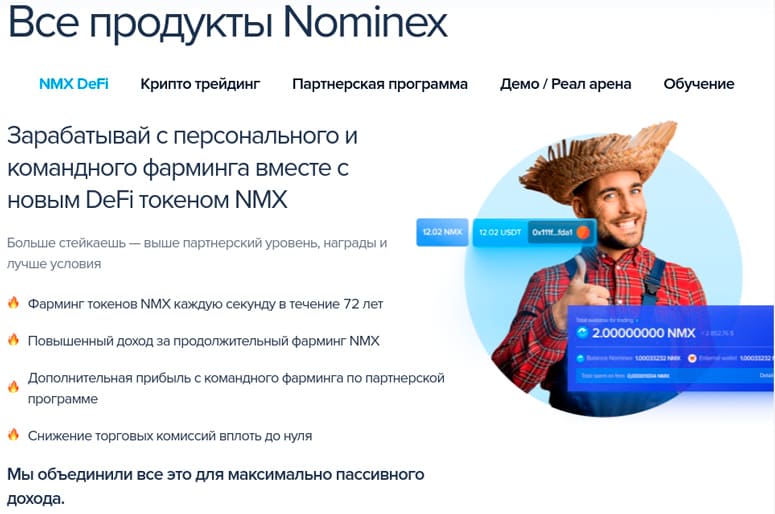

| Nominex | Cryptocurrency trading | The centralized marketplace offers a number of features, including team farming. Since 2020, the exchange token NMX is used, through which rewards are paid. |

The Nominex cryptocurrency exchange was developed by university graduates from Saratov. The project team is headed by Pavel Shkitin. Its uniqueness lies in the distribution of its own token NMX through the mechanism of farming on the decentralized platform Pancake.

Prospects for blockchain technology development in Russia

There is a surge of activity in the innovation market. Blockchain platforms are developing. According to analytical forecasts, the total volume of the sector in the world should grow 10 times – from $3 billion dollars in 2021 to $39 billion in 2025. The Russian Federation is no exception. The banking sector has already started implementing blockchain in Russia. Among the leaders are Sber, Alfa, Raiffeisen, VTB and other institutions.

Blockchain technologies are planned to be introduced in government projects as well. In the near future may be introduced:

- Electronic labor books.

- EDS authentication.

- Automated personnel document flow.

- Tax control.

Developments are carried out on the GBLedger platform, which meets the requirements of the legislation of the Russian Federation. The network is easily scalable and favorable in terms of implementation cost.

Other promising areas for blockchain technology in Russia:

- Issuance of digital assets.

- Tokenization.

- Trading of assets through decentralized exchanges.

- Development of money transfer systems.

- Alternative to SWIFT.

- Development of loyalty programs, cashbacks.

- Voting and other activities.

Summary

Blockchain technologies are actively developing in Russia, including at the level of implementation in large companies in various sectors of the economy. The government is developing a legislative framework to regulate digitalization. But cryptocurrency, one of the main derivatives of blockchain is under a ban. Coins cannot be used as means of payment, but they can be owned, they are property.

In Russian government circles, the attitude to digital assets is still ambiguous. In 2021, Sberbank CEO G. Gref said: “Cryptocurrency is a waste of blockchain technology!”.

At the beginning of 2023, legislation in the field of digital technologies is limited to a few acts. They do not regulate all types of activities, do not provide answers to the questions that arise in society. The legislation does not bring legal clarity to different concepts and definitions. Participants in the cryptosphere are themselves going to meet the government. They are teaming up with regulators for further interaction.

Frequently Asked Questions

❔ Is Nominex a Russian cryptocurrency exchange?

The platform was founded by Russian developers Pavel Shkitin, Alexander Petrovich and Denis Korablev. The exchange is registered in the Seychelles.

❌ Is it possible to repeal the law on CFA and allow cryptocurrency as a means of payment in Russia?

So far, there are no prerequisites for a monetary unit outside the government’s control to operate in the Russian Federation simultaneously with the ruble.

✅ Is it true that the Hermitage is selling tokenized paintings?

In late summer 2021, collectible NFTs were issued on the Binance exchange. The State Hermitage sold 5 tokenized paintings for a total of 32 million rubles. The most expensive was the canvas “Madonna Litta”. It was bought for 150.5 thousand BUSD (the trades were held in Binance tokenized tokens).

❓ What is Genesis Block?

A Russian company – a leading developer in the field of software, e-commerce solutions.

❕ Is it true that blockchain is being used by the tax service in Russia?

In 2020, the Federal Tax Service launched a platform for processing loans to small and medium-sized businesses affected by the coronavirus pandemic.

Error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.