Blockchain has provided an opportunity for every cryptocurrency holder to earn money. Gaming, investment in other projects, and charity in the blockchain world are parts of the DeFi sphere. In each of them it is possible to earn in one way or another. This material describes how the DeFi sector works and the options for generating income. Described are the most famous services, the advantages of the sphere, as well as what difficulties users face at the first experience.

What is DeFi

Decentralized Finance has become one of the most important innovations in the global economy. It is a generation of applications and services launched on the basis of blockchain technology. They operate fully automatically. A software algorithm helps users to conduct financial transactions between each other directly.

All elements (wallets, protocols and others) are put together in a large and debugged system. DeFi is an acronym for its name in English. The concept of blockchain economy is transparent, simple and automated.

However, it has its own nuances that may cause difficulties at first. For example, DeFi does not have banks and their employees. This may seem like an obstacle at first. However, thanks to the absence of intermediaries, the user can get all services from anywhere in the world: you only need internet access, a smartphone or a computer. The service does not require documents, credit history and any personal information about the person.

When a mortgage or loan is required in the familiar world, the bank gives out the money. Traditional financial institutions get it from other customers – for example, from depositors or by encashing retail outlets.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

DeFi has no such institution that raises, issues and manages money. However, assets are still collected. This is accomplished through a software algorithm.

Some users evaluate the conditions of the services and voluntarily transfer assets from their wallet to the protocol. Others may borrow them. This is just one way to use decentralized finance.

What it consists of

At first glance, DeFi seems complicated because of the variety of services, new feature names, and superficial similarities between services. It’s easier to understand if you know what they are similar to. The main elements of the decentralized finance sphere are shown in the table.

| Element | Explanation |

|---|---|

| In the blockchain world, there is no user identity. Only the address of the storage is specified in the blockchain. Therefore, it is the first and important element of a DeFi system. | |

| These include popular coins and tokens, as well as steblecoins. There is no fundamental difference between them – they are money created in the blockchain. They are bought and sold for other assets, including fiat assets (ruble, dollar or others). Cryptocurrencies can also be rewarded, earned or invested. | |

| These are protocols, applications, and DEX exchanges. Decentralized services help one wallet transfer digital money to another vault under certain conditions. | |

| To oversimplify at all, this is program code. The protocol is the interface of the application, but not its technical “stuffing”. Smart contracts describe in the form of algorithms the conditions for blocking assets, issuing loans, charging interest, and insurance. In blockchain there are no individual rules and “fine print”, the program for all users is the same and is available in public access. Any technical expert can verify the authenticity and reliability of the source code. | |

| Works as the foundation for the previous four elements |

How to make money

In the DeFi world, there is a wide range of financial instruments and services. On the one hand are the familiar options from the traditional monetary system: deposits, lending, investing and trading. On the other are services that have been formed in blockchain. Among them are steaking and pharming.

On commissions

All transactions on the blockchain are accompanied by transaction fees. From them, the income of centralized exchanges (Binance, Bybit and others) is built. Therefore, the higher the trading turnover, the higher the profit of CEX platforms. In the case of decentralized exchanges, commissions are shared between users who have made deposits into the liquidity pool. DEX platforms that pay out revenue based on commissions:

Commissions are also used as rewards for staking and lending. For example, on the Ethereum (ETH) blockchain, payouts are made up of transaction fees and the pool of new coins issued by the network.

Cryptolending

A simplified description of the process: some users lend their money to others. More detailed: a smart contract (protocol) offers terms and conditions for traders to place personal assets. Interest is paid for this, as in traditional deposits. Users’ money is sent to a general purpose pool. This is called liquidity.

The same smart contract invites other users to take money from the pool at interest. An alternative method is liquidity locking (liquidity locking). The process takes place on DEX exchanges and ensures that there are enough assets for traders to trade among themselves.

The name comes from the English to lend – “to lend”.

The post Lending appeared first on DeFi. Steaking and farming are derivatives of it. Each of these methods fundamentally collects and blocks user funds. The key difference between steaking and lending is that the owner does not transfer the tokens themselves, but only the rights to use them. The coins remain in the account in locked form. This provides a high level of security, which makes steaking the most reliable way to invest. Earnings (interest) depend on which cryptocurrency has been deposited, as well as the current market returns and DeFi platform rules.

Farming

Holders also invest digital assets in farming programs. The name comes from the English farming, which translates to “farming” or “farming.”

From the first, farming got the opportunity to earn money on the blockchain of cryptocurrencies, from the second – the safety of assets. The principle of its work:

- An investor buys and deposits his assets into a liquidity pool on a trading or financial platform. In return, he receives LP-tokens of the project.

- Then the received assets are blocked (staked) in the smart contract of the DeFi service.

- As a result, the investor receives regular payments in LP-tokens of the project. That is, the same assets “grow”. This explains the name “farming”.

How to start investing

To earn in the DeFi sphere, you need to follow 5 steps. Instructions for novice users:

- Create a wallet. To begin with, you need to learn the differences and principles of storing private keys. This is important for choosing the most secure wallet. It is recommended to use non-custodial storage – for example, MetaMask.

- Choose a DeFi platform. It is important to research decentralized finance protocols with different capabilities. This piece will describe the 6 most popular DeFi platforms in 2023.

- Top up your balance with crypto assets. You need to buy a digital currency to invest it in the future: for example, Tether USD (USDT) stablecoin.

- Connect your wallet to the DeFi protocol. This is the only step you need to take to use the decentralized finance features. Account registration is not necessary.

- Choose a strategy. It is not necessary to stop at the only type of earning. You can split the deposit and deposit it in different protocols: steaking, farming, providing liquidity and others.

Risks

DeFi’s full automation is both an advantage and a disadvantage. Smart contracts remain inherently program code. In addition it operates with significant money. Therefore, DeFi protocols are becoming a target for hacker attacks. In July 2023, cybercriminals found a technical vulnerability in the program code of the Curve loan service and stole more than $60 million.

The largest theft occurred in 2022. From the DeFi protocol Ronin criminals withdrew a record $625 million.

How to use the wallet

It was difficult for beginners to use cryptocurrencies 10 years ago. However, modern wallets are convenient and fast. Detailed instructions are written for them and step-by-step video guides are created.

The most decentralized variant of blockchain storages are services with non-custodial private key storage.

However, in this case, the responsibility for storing the cid-phrase lies with the wallet owner. If it is stolen, attackers can gain access and steal funds. In case of loss, it is recommended to create a new vault as soon as possible and transfer cryptocurrencies to it.

Known DeFi platforms

To determine the way to earn money, it is important to study the list of actual services. More than 100 protocols have already been deployed in the sphere. Among the most popular DeFi platforms are:

- AAVE

- Uniswap

- PancakeSwap

- MakerDAO

- Compound

- Curve Finance.

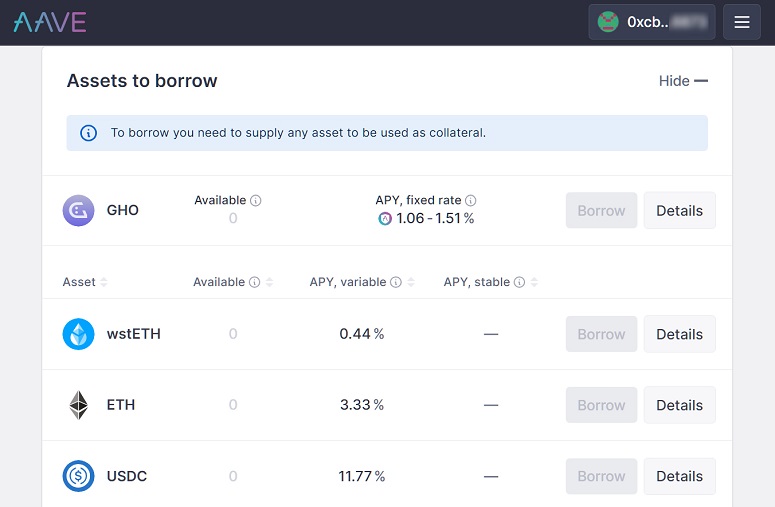

AAVE

The most famous DeFi protocol is a lending service. Users invest their tokens in the AAVE smart contract and receive interest income for it. The protocol also exchanges assets on the principle of an exchange. The advantage of the service is a system of flexible functions for risk and profitability management.

AAVE token is used as the basis of operations. Its holders receive a share of commissions for transactions. AAVE holders participate in the distribution of additional fees of the platform and thus form the internal economy of the project.

Uniswap

The service is considered the largest exchange in the DEX segment. The daily turnover exceeds $224 million. Users lock a couple of assets into the liquidity pool. The digital currencies then get traded between other participants. Depositors receive a share of commissions for each cryptocurrency transaction in the pair. Uniswap has protocols deployed on multiple networks. This is because smart contracts need to be developed for each blockchain separately. Services are available on the following chains:

- Ethereum – the main platform with a trading volume of $162 million.

- Arbitrum – $42.65 mln.

- Optimism – $21.96 million.

- Polygon – $11.01 mln.

- Base – $3.74 mln.

- Binance Smart Chain (BSC) – $2.02 million.

- Celo – $39k.

PancakeSwap.

In 2017, the Binance exchange was launched. The platform was developed in a centralized format. However, the popularity of the service led to the creation of an ecosystem and the launch of its own blockchain network Binance Smart Chain in 2020. At the same moment, the DeFi protocol of an additional DEX format exchange was deployed. It was named PancakeSwap.

In 2023, it became the second most popular decentralized exchange platform after Uniswap. Its users passively earn from creating pools of liquidity, as well as trading directly from their wallets.

MakerDAO (MKR)

In this protocol, users pledge cryptocurrencies. In return, steiblcoins of the Dai project are issued with a peg to the fiat US dollar. The asset can be blocked in internal steaking or borrowing programs and receive regular payments.

Compound

With the service, investors also deposit cryptocurrencies into pools and receive interest for it. Other users borrow funds. To do this, you need to leave a deposit. It is also locked in cryptocurrencies. The recipients pay interest for the use of the loans.

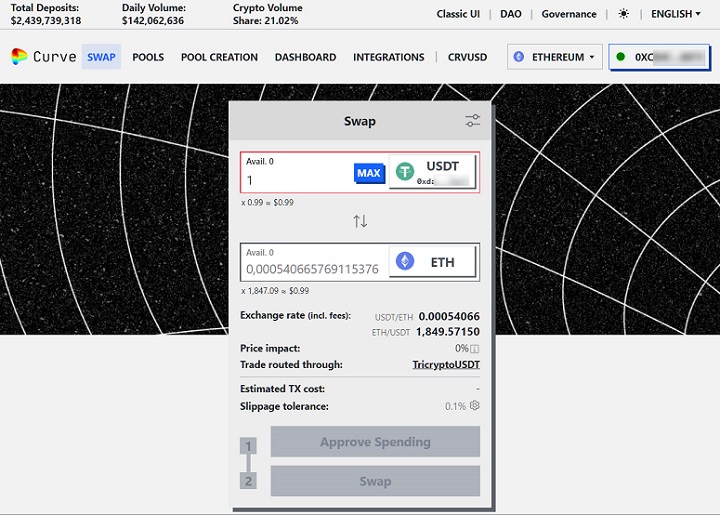

Curve Finance

The main purpose of the protocol was the exchange between stablecoins (USDT, USDC, DAI and others). On Curve, users create liquidity pools of stable cryptocurrencies. In them, assets are distributed in different proportions to ensure a favorable exchange rate and reduce losses. When a user needs to convert one stablecoin into another, the funds need to be redirected to the appropriate pool.

Curve’s automated algorithm calculates and prompts the user for the optimal asset ratio.

The advantage of the protocol is accurate and low-risk exchange rates. The service uses a native LP-token CRV to calculate income and reward payments.

The difference between decentralized and centralized finance

The difference lies in the management of such systems. In the familiar world, control over monetary operations is performed by the bank and, if you look even higher, the Ministry of Finance. These are centralized management bodies. If there is a technical failure in their work, it affects access to the entire system.

DeFi system technology is built on a blockchain network. The chain distributes data to the devices of all users. Therefore, if one computer is attacked, the entire system is not affected. This principle is called decentralization. Financial transactions then remain part of the blockchain and all information about them is also stored in a distributed manner.

Types of decentralized exchanges

Uniswap and SushiSwap can be clearly defined as DEX platforms. However, protocols often cannot be purely categorized as one type. For example, Curve simultaneously makes loans, provides fund lending, and exchanges assets as a DEX exchange. Elements of trading platforms are easily embedded in third-party blockchain applications. For example, DEX exchange capability is integrated into the interface of the Trust Wallet cryptocurrency.

What tokens are included in DeFi

In addition to special financial opportunities, the field of decentralized finance also includes its own liquid assets. Native protocol tokens participate in the internal economy of the parent DeFi service. This gives them value. Therefore, DeFi tokens are traded on third-party platforms (including centralized ones) on common rights. They are used in spot and futures trading or as a long-term investment. Earlier, the editorial staff published a material about the top ten best DeFi tokens.

Pros and cons of decentralized finance

DeFi has several weaknesses. The first and main one is the difficulty of understanding at the initial study of the sphere. It is important to know how to use cryptocurrency wallets and how transactions are performed in the blockchain.

The second weakness is the loss of funds due to holder error. Unlike centralized exchanges, there are no demo accounts and test periods in the sphere of DeFi services. All transactions are performed with real crypto assets from the very beginning. It is impossible to cancel a transaction in the blockchain. Therefore, there is still a possibility to perform the transaction erroneously – then access to digital money will be lost. In this regard, it is not recommended to invest from the main wallets. For access to DeFi, it is worth creating a separate vault. It is better to withdraw small amounts to it.

However, decentralized services give financial freedom. To use them, you do not need documents. Services are available to everyone anywhere in the world. Another advantage is that cryptoassets remain under the absolute control of the holder.

The first difficulties of use are leveled by practice, which leaves complete autonomy and programmed financial processes. In a global sense, this means high speed.

Frequently asked questions

🔔 Who are called liquidity providers?

In DeFi, they are the participants who invest in the reserves (pools) of the platform. Insufficient finances in the protocol slows down trading or makes it unprofitable.

📢 What does it mean to be a synthetic asset?

These are tokens that mimic other assets on the blockchain. For example, due to a technicality of cryptocurrencies, BTC cannot be transferred to the Ethereum network. Wrapped Bitcoin synthetic token is used as a solution. It is exchanged on the DeFi platforms of the Ethereum network.

📌 Are decentralized services tied to only one specific blockchain?

In most cases, yes. The Polygon network has become popular because it helps bypass this limitation. Protocols on it can develop in the space of multiple blockchains.

✨ What is the difference between spot trading and derivative trading?

In the former case, you can only get income from the appreciation of the exchange rate. That is, buy at a lower price and then sell at a higher price. In the second case, traders earn both on rate increases (long positions) and on rate decreases (short positions).

⚡ What is margin trading?

It is trading with assets borrowed from the stock exchange. Margin is the user’s own deposit, thanks to which a loan is granted.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.