By itself, the real value indicator does not say anything about the speed or direction of the koin exchange rate, whether it is an explosive growth or a gradual decline. But the calculation of the market capitalization of a cryptocurrency depends on price changes and can indicate trends over a certain period of time. For an objective assessment, you need to take into account additional indicators.

Determination of capitalization in the crypto market

The total price of allcoins on the market is considered the main indicator in the rating of digital assets.

Cryptocurrency capitalization is the value of all coins that are in circulation at the current moment. It depends on the price of the asset and affects the dominance in the market.

This indicator allows investors to get information about the potential of coins. Investments in digital assets with large capitalization are considered safer than those with small capitalization, and their volatility is much lower.

What it is used for

This factor is taken into account when categorizing digital currencies and measuring their popularity. There are 3 categories of assets by capitalization (project data in parentheses as of November 2021):

5020 $

Bonus für neue Nutzer!

ByBit bietet bequeme und sichere Bedingungen für den Handel mit Kryptowährungen, niedrige Kommissionen, hohe Liquidität und moderne Tools für die Marktanalyse. Es unterstützt den Spot- und Leveraged-Handel und hilft Anfängern und professionellen Händlern mit einer intuitiven Schnittstelle und Tutorials.

Verdienen Sie einen 100 $-Bonus

für neue Benutzer!

Die größte Kryptobörse, wo Sie schnell und sicher Ihre Reise in die Welt der Kryptowährungen beginnen können. Die Plattform bietet Hunderte von beliebten Vermögenswerten, niedrige Kommissionen und fortschrittliche Tools für den Handel und Investitionen. Die einfache Registrierung, die hohe Geschwindigkeit der Transaktionen und der zuverlässige Schutz der Gelder machen Binance zu einer guten Wahl für Trader jeder Ebene!

- Large. Exceeds 10 billion US dollars (Bitcoin, Ethereum, Binance Coin, Solana, Cardano and others).

- Medium. Between $1 billion and $10 billion (Elrond, Stellar, Internet Computer and others).

- Small. Up to $1 billion (Illivium, Ethereum Name Services, and others).

Market capitalization serves to compare the overall value of cryptocurrencies, but when assessing the risks of any investment, you should consider trends, the stability of the digital asset, and the amount of your own funds.

Why it matters

Unlike fiat money or stocks, cryptocurrencies are completely unregulated by anyone, meaning they are decentralized. This means that the supply of coins and Token on the market, as well as their price, are correlated with supply and demand, the work of miners. Because of this, the market capitalization of a cryptocurrency can be used as an indicator of its presence on the exchange.

An increase in the number of coins in circulation leads to dominance against competitors. This is why this figure is used as an indicator of its popularity in the market.

What it affects

The value of the total capitalization of the cryptocurrency affects the volatility of the rate. The value of bitcoin is more difficult to influence. To do this, you need to sell (buy) it for millions of dollars. New altcoins are more volatile and can change in price by 70%-80% or more in a short period of time. Large players use tokens with small market value, controlling enough of the total supply to cause significant price movements – pumps.

Performance also affects the recognizability of an asset. Cryptocurrencies that are in the top ten of the rating are more often bought by users (including newcomers) and mentioned in the media.

Accuracy

The indicator takes into account the currency in circulation. But it may not be accurate enough. For example, the loss of a private wallet key results in the irretrievable loss of koins.Theoretically, they are considered to be in circulation, but they will never be offered for sale on the market.

This is a useful tool, but not enough to get an idea of the value of a cryptocurrency. Analyzing liquidity, volumes, official documents of companies (projects), understanding the purpose of the altcoin are fundamental.

Overall market capitalization

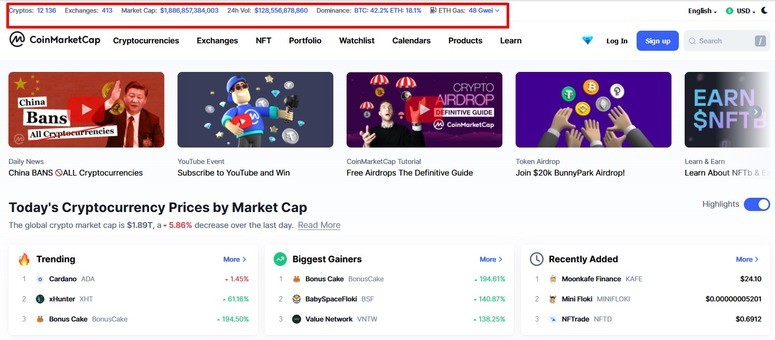

This is an indicator of the value of the entire cryptocurrency market, the sum of all assets existing in the digital space. As of November 2021, there are more than 14 thousand coins and tokens on CoinMarketCap, and their total value is $1.964 trillion. This figure determines the growth and strength of the cryptocurrency market.

How it is calculated

Cryptocurrency capitalization is calculated by multiplying the current price by the number of coins in circulation. Both determining parameters are constantly fluctuating, the final value also changes. For example, during the third week of November, the value of bitcoin was in the range of $65.2 thousand to $55.9 thousand. With a total number of 18,880,275 BTC coins in circulation, the capitalization within 7 days varied between the following values:

- Highest – $65,200 x 18,880,275 = $1.231 trillion.

- The lowest – $55,900 x 18,880,275 = $1.055 trillion.

That is, during the week, the amount of blocked funds in BTC adjusted by $176 billion.

The price of BTC increases the market capitalization. This can be seen in comparison to other koins. Efirium with 118.44 million coins and a price of $4247 has a valuation of $503 billion.

| The value of | Bitcoin | Etherium |

|---|---|---|

| Coins in circulation, million USD | 18,88 | 118,44 |

| Price, thousand dollars | 58,2 | 4,2 |

| Market capitalization, billion USD | 1100 | 497,5 |

Diluted market capitalization

This term comes from the stock market. Capital is diluted when a company issues new shares to investors and option holders exercise their right to buy them. More shares in the hands of multiple shareholders means that each holder owns a smaller or diluted percentage of the company. In addition, their share of the company’s profits is diluted. This happens because the total number of securities increases, but the net income (after taxes) stays the same and decreases per common share. Often, this also reduces its value.

To mitigate these disadvantages, business executives must be careful to use the money raised from the new stock offering to increase the company’s revenue and net income, thereby raising the price above the issue.

This concept is also characteristic of digital currency. Diluted market capitalization is the product of the current price of an asset by the maximum supply of the coin that can be issued at all. Despite price fluctuations, the indicator helps to determine overvaluation or undervaluation.

Factors affecting the capitalization of cryptocurrencies

Digital assets gain value based on user demands, scarcity or utility. Since most of the cryptocurrencies in the market are issued by private blockchain related companies, the price will also depend on the effectiveness of the marketing strategy, the image of the executives and the viability of the project, perceived value.

Utility. To make an electronic currency valuable, you need to increase its utility. For example, you can’t use Ethereum platforms without ether. This coin is designed and customized to perform transactions on the Ethereum blockchain. Therefore, its value depends on the demand for the services of the Ethereum platform. Other factors that determine the value in terms of utility are dividend payments, ways of exchange in the blockchain environment, voting rights, etc.

Scarcity. Scarcity refers to the finite nature of digital currencies. The number of bitcoins is limited to 21 million. As more and more BTC are mined and introduced into the blockchain environment, the demand for them increases. This affects the price. Some cryptocurrencies utilize a burn mechanism that wipes out some of the supply. This results in fewer coins and their value goes up.

Perceived value. Overall viability and project management progress are 2 important factors that determine the value of a digital currency.

Acceptance by the masses. The value of cryptocurrency can increase dramatically if a large number of users begin to adopt it universally. Due to the limited number of available units of cryptocurrency, demand increases. Accordingly, prices increase. But if coins start to be accepted as a medium of exchange in transactions, demand will increase even more.

Costs. The cost of mining some coins is high. This also includes energy costs that affect their price.

Regulations. The introduction of rules and bans affects the price of digital currency.

In addition to the above indicators, it should be taken into account that big players and influencers can also influence the market.

The more large companies invest in cryptocurrency, the more difficult it will be for individuals to influence the industry.

Bitcoin Dominance Index

This is an index that traders can use to quickly compare bitcoin to the rest of the digital coin market. This index measures the market capitalization of BTC and the rest of the cryptocurrencies.

The index was created to demonstrate how important bitcoin – the first scalable digital currency – is in the overall crypto economy.

If the value of altcoins starts to fall and bitcoin holds value, it could mean that investors are buying up BTC as the safest asset.

The index is inaccurate for reasons such as these:

- It doesn’t take into account the illiquidity of many digital currencies. The index only calculates the value of an altcoin’s last recorded trading price and uses that against bitcoins

- New assets are created and launched on exchanges on a weekly basis, which weakens bitcoin’s dominance in the overall market. The index includes all coins in the crypto ecosystem, reducing BTC’s supremacy as new projects emerge.

Deflationary coins

This is a form of digital asset with a depreciated supply. The value is determined by its limited supply. This is characteristic of bitcoin.

Deflationary assets often have a fixed maximum supply limit built into their code that cannot be changed.

This contrasts with inflationary digital currencies, which may or may not have high supply limits. Such coins are similar to traditional fiat money, with the value of the currency decreasing as it is issued.

In addition to tight restrictions, some currencies are deflationary because of their high burn rate. Others choose a fixed rate of destruction of a portion of the transaction fee.

Alternatively, individual funds or blockchain organizations may employ a buyback scheme. This is where a significant amount of cryptocurrency is purchased and then sent to a dead wallet. These coins are withdrawn from circulation.

Use in trading

The market capitalization weighted strategy means that the buyer makes a proportional investment in each asset based on the total value. If you take the total market price of bitcoin and etherium and then calculate the percentages of each digital asset in that sum, you can get, for example, a value of 71% and 29%, respectively. That is, if one were to invest $100 in the 2 largest coins, it would be worth investing $71 in Bitcoin and $29 in Ethereum.

In theory, you could use the same philosophy for all assets to be purchased. The amount of each coin is calculated in proportion to their market value. This allows you to invest in safer assets.

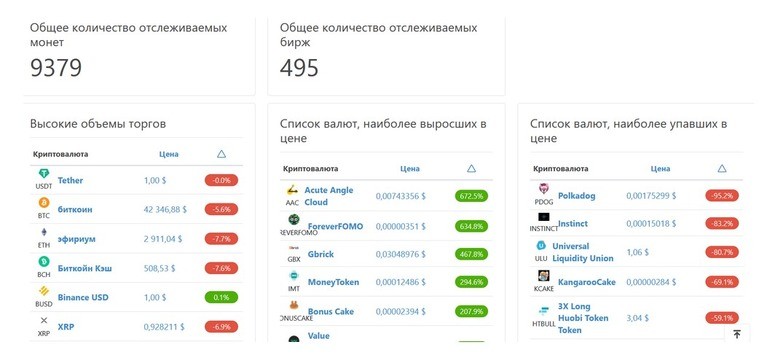

Resources for viewing coin capitalization statistics

The most well-known online services for viewing financial indicators are.

CoinMarketCap. Tracks cryptoassets in circulation, their popularity. The site features various financial indicators for asset valuation. Prices are calculated by weighted average volume from different exchanges.

Profinvestment. On the site you can find rates, ratings, exchangers, exchanges and other useful information. The data is constantly updated.

CoinChekup. The site provides detailed statistics on each cryptocurrency, rate dynamics, opinions of leading analysts. Filters are used for convenience.

CryptoCompare. The service allows you to monitor transactions, coin dynamics, profitability. You can view fundamental data.

CoinGecko. The site has a convenient interface and navigation. Information is presented on all cryptocurrencies.

Resources help users and investors to get in a compact form relevant information for decision-making:

- Price change graph.

- Total value.

- Supply of assets on the market

- Ratings.

- Forecasts of industry experts and analysts.

Häufig gestellte Fragen

📚 What coins other than bitcoin have high capitalization?

There are a number of altcoins that have a high overall market value: Ethereum, Ripple, Tether, Bitcoin Cash, Solana, Cardano, and others.

🔍 Can the total value of a coin be manipulated?

This often happens with tokens that have a low active trading volume and a small amount in circulation. This makes it easy to manipulate the price with a few thousand dollars.

📉 What are the metrics to consider when investing?

Price, active trading volume, circulating and maximum supply, volatility.

📝 What determines the demand for an asset?

It can be: behaviors of major players in the market, news, legislation and others.

❓ What is the bitcoin dominance index criticized for?

One comment on it is that market participants can reduce its value by creating their own coins by holding airdrops, where members of the digital asset and blockchain community receive free units of digital currency.

Befindet sich ein Fehler im Text? Markieren Sie ihn mit Ihrer Maus und drücken Sie Strg + Eingabe

Autor: Saifedaner Ammouseinem Experten für die Wirtschaft der Kryptowährungen.