It is not difficult to invest in bitcoin or ether. But control over income generation is connected with competent diversification of assets (risk distribution). Some investors prefer to buy and hold only large digital currencies, while others experiment with promising altcoins. In any case, a conscious approach to compiling a cryptocurrency investment portfolio gives more opportunities for profit. At the same time, the investor needs to constantly work with the investments.

What is an investment portfolio

It is a common belief among newcomers to the cryptocurrency market that holding Bitcoins is the only way to profit from digital assets. However, there are many more opportunities than just acquiring BTC.

An investment portfolio is a collection of assets: stocks, bonds, real estate, and digital currencies. The crypto market is volatile, and owning only one type of coin can jeopardize an investor’s capital and financial goals. Diversification helps to better manage potential gains and losses.

A cryptocurrency portfolio helps bring all digital assets “under one roof” for easy management.

Benefits of creating one

The main principle of investment is diversification. Allocating capital to different types of cryptocurrencies eliminates the risk of each individual asset and allows you to balance your portfolio without sacrificing profits.

This protects against failures in individual protocols, poor implementation of projects, legal problems, low-quality technology. If an investor knows how to allocate his capital, he will be able to diversify the potential risks among several koins.

5020 $

Bonus für neue Nutzer!

ByBit bietet bequeme und sichere Bedingungen für den Handel mit Kryptowährungen, niedrige Kommissionen, hohe Liquidität und moderne Tools für die Marktanalyse. Es unterstützt den Spot- und Leveraged-Handel und hilft Anfängern und professionellen Händlern mit einer intuitiven Schnittstelle und Tutorials.

Verdienen Sie einen 100 $-Bonus

für neue Benutzer!

Die größte Kryptobörse, wo Sie schnell und sicher Ihre Reise in die Welt der Kryptowährungen beginnen können. Die Plattform bietet Hunderte von beliebten Vermögenswerten, niedrige Kommissionen und fortschrittliche Tools für den Handel und Investitionen. Die einfache Registrierung, die hohe Geschwindigkeit der Transaktionen und der zuverlässige Schutz der Gelder machen Binance zu einer guten Wahl für Trader jeder Ebene!

Example of a ready-made portfolio

All cryptocurrencies except Bitcoin are called altcoins. Altcoins differ from BTC in many ways. For example, the technologies of some networks allow blocks to be created or transactions to be verified using a different consensus mechanism, or they offer new features – for example, intelligente Verträge.

Shitcoins are digital currencies with low Kapitalisierung. Tokens with useless or weak technology are also included in this category.

The capitalization and popularity of altcoins is lower than the overall value of Bitcoin. However, there is a possibility that the profits of secondary tokens will be significantly higher during the pampa. Analyzing the position of the selected digital coins in the market allows you to start building a cryptocurrency portfolio.

The table shows examples of capital diversification based on low, medium and high risk tolerance levels:

| Risikoniveau | BTC | ETH | BNB | DOT | ADA | Doge |

|---|---|---|---|---|---|---|

| Niedrig | 80% | 10% | 10% | – | – | – |

| Moderate | 50% | 30% | 10% | 5% | 5% | – |

| Hoch | 30% | 30% | 10% | 10% | 10% | 10% |

How to create a cryptocurrency portfolio

Regardless of which assets a user invests in, there are 3 golden rules for putting together a set of investment tools:

- Distribute risks.

- Diversify between markets (depending on the application of the technology).

- Do not overestimate risks in the hope of big profits. It is better to have 5 strongest coins than 50 average or weak tokens.

Asset selection principle

Creating a cryptocurrency portfolio starts with identifying the appropriate coins. To evaluate the investment potential of a cryptocurrency, it is important to analyze the following parameters:

- Market capitalization (the sum of all issued tokens of the project, expressed in fiat money or digital assets).

- Usefulness (how applicable the project is in real life).

- Technology (what algorithms and protocols are used to implement the blockchain).

- Target market (the audience that uses the proposed solution).

- The team and its leaders (the people behind the project and their expertise).

- Project funding (the investment that goes into the implementation and development of the blockchain).

- Personal level of risk tolerance (how willing the investor is to accept possible threats).

Diversification by capitalization

The valuation of cryptoassets is paired with this criterion. Market capitalization is the total value of all issued coins, expressed in fiat currency (dollars, euros, rubles or others) or in cryptocurrency (BTC, ETH and others). This indicator reflects the current share of digital money in the market.

The cryptocommunity agrees that the greater the market capitalization of a coin, the less risk it can represent. An estimate of the total value of a virtual currency is determined by multiplying the current price by the number of coins in circulation.

Market Capitalization = Current Price x Circulating Supply

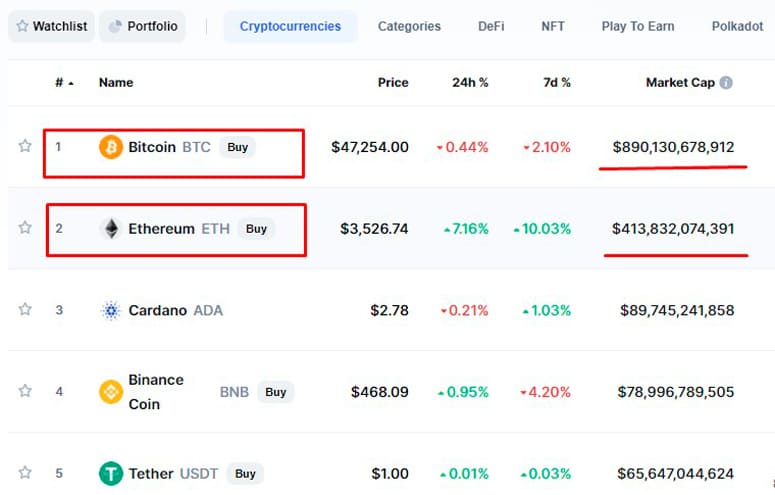

This indicator speaks to the popularity of the coin. At the end of August 2021, the leader of the cryptocurrency market is Bitcoin with a capitalization of over $890 billion, followed by Ethereum (>$410 billion).

All digital assets on the market can be divided into 3 big categories:

- High capitalization. Coins from this category have a market capitalization of more than $10 billion, so they can be a relatively safe investment. However, there are few such cryptocurrencies.

- Medium capitalization. The amount invested in the digital asset is less than $10 billion, but exceeds $1 billion.

- Low capitalization. This category includes coins with a total value of less than $1 billion.

These numbers are important because they reflect the volatility of the coins. Giants like BTC or ETH are fairly stable, although they can experience significant price fluctuations compared to traditional investment instruments. Digital currencies with small capitalization are considered high-risk. These coins are sensitive to market sentiment. The balance between the above 3 types depends largely on the investor’s risk tolerance.

Diversification by type

A well-known crypto asset allocation strategy is to choose technologies that improve particular industries.

For example, an investor believes that very soon many people will work remotely. He analyzes the needs that may arise from this change and the potential threats. For any industry, game-changing technologies have already been created. Therefore, some tokens may become winners, while others will disappear forever. The investor’s job is to identify the most viable coins early on and acquire them.

This cryptocurrency does not necessarily have to be the market leader. Even if it is not in the top ten, the token can bring good profits.

Strengthening promising areas

The technology on which the coin is built is also important. Before including digital currencies in a crypto portfolio, it is necessary to study the advantages and limitations of blockchain to understand what problems can be encountered. Analyzing solutions to these issues is also necessary. For example, Ethereum’s scaling issues are addressed by switching to a Proof-of-Stake consensus algorithm. An approach in the Bitcoin blockchain to a similar issue is the Lightning Network.

Either technology could receive increased demand. This has a direct proportional effect on the value of the investment.

Stablecoin

Stablecoins are coins whose exchange rate is pegged to real currencies, mainly the US dollar. There are 2 types of stablecoins: some are backed 1:1 by the fiat they are backed by, while others are backed by a combination of different cryptocurrencies or algorithms.

USD Tether, USD Coin, and True USD are coins that are pegged to the US dollar.

DAI is a stablecoin backed by a cryptocurrency with no fiat backing. Algorand and Frax use complex multi-token ecosystems and liquidity pools to maintain a dollar peg.

Collateralized coins are the least secure assets for a crypto portfolio. Stablecoins can serve as a buffer during times when markets are volatile. If, for example, an investor holds 50% BTC and 50% USDT in their $10,000 portfolio, on a day when Bitcoin drops 25% (which is possible), the total value of the cryptocurrency portfolio will only drop by 12.5% or $1250. This is much safer than holding 100% in BTC. Then the loss would be $2500.

Thus, stablecoins can serve to protect a portion of a crypto portfolio depending on what level of risk an investor chooses.

However, a change in Bitcoin’s price in the opposite direction would involve lost profits. If Bitcoin rises by 25%, those who hold 50% BTC in a $10,000 crypto portfolio of 50% BTC will realize $1250 in profit. Those holding 100% Bitcoin will realize a $2500 return.

Balancing risk and return is essential for any investment strategy: there is always a trade-off involved.

Token for passive income

One way to increase capital while keeping it protected is to make sure that secured assets generate returns. If 50% of the stablecoins yield an annual percentage yield (APY) of 10%, the value of a $10,000 crypto portfolio will increase by $550. This is possible as long as the secured coins are sent to staking. Uniswap and PancakeSwap platforms offer investors the opportunity to earn interest on owning USDT, USDC, BUSD. The more koins users store on their wallets, the higher income they will receive.

Stacking secured assets is a great strategy to protect capital while maximizing growth. Having a high proportion of stablecoins creates a solid support during market volatility and ensures that a portion of the crypto portfolio remains safe.

Bonuses from exchanges

Investing in virtual currency can be started by getting free coins. Many exchanges offer bonuses to new customers. Exchange platforms are the main way to buy and sell assets. On most platforms, both Bitcoin and hundreds of all sorts of altcoins are available. The user simply registers on the exchange and receives free coins to his wallet. For example, Coinbase gives $5 in BTC for registration.

At first glance, the amount seems small, but $5 in free tokens can someday give a significant boost to assets.

Speculative Cryptocurrency

The rapid rise and fall of crypto assets attract traders. It is a common practice in the market to gain or lose a large percentage of capital at high speed. Therefore, before asset allocation, it is taken into account for what purposes the coins will be used: active trading or long-term storage.

Where to create

At a certain point, it becomes difficult for an investor to monitor the assets in the cryptocurrency portfolio and collect information about how the prices of each specific token are moving. In this case, the investor can use software solutions to monitor their digital currencies.

Cryptocurrency wallets

A less risky option for storing crypto coins. The user does not have to worry about an exchange being hacked, resulting in the loss of digital assets, or otherwise mismanaging the coins. In this respect, cryptocurrency wallets are safer than storing on centralized platforms or through DeFi protocols.

Software or hardware wallets provide the greatest asset security.

To see the whole picture of their assets, investors use multi-currency software vaults such as Exodus, Jaxx Liberty and others. Additional private key protection is provided by Ledger or Trezor hardware wallets.

Cryptocurrency exchanges

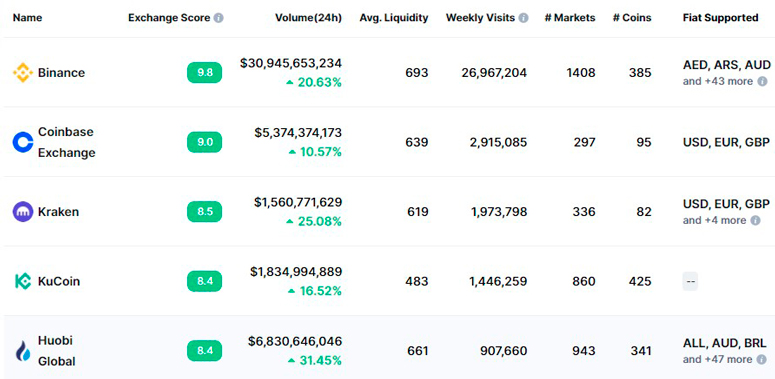

Holding assets in exchange services such as Coinbase, Binance and others means jeopardizing your portfolio. Unless investors are actively trading on an exchange. The problem with exchange platforms is that they store the cryptocurrency of all their users. Thus, exchanges are targeted by hackers who often hack them.

According to CoinMarketCap, as of August 2021, the popular centralized cryptocurrency exchange platforms are:

- Binance.

- Coinbase Exchange.

- Huobi Global.

- FTX.

- Kraken.

Another option is to store assets on decentralized platforms that do not require investors to relinquish control of their private keys.

Tracking and rebalancing

The market capitalization of a virtual currency is a measure of the coin’s value. The more an investor diversifies into volatile assets, the more frequently the crypto portfolio will need to be rebalanced. This protects assets from unplanned risk.

Portfolio rebalancing is the reallocation of asset shares to balance risk. Rebalancing the crypto portfolio structure involves buying or selling coins to reach a target level of possible danger. However, this is not the only function. Rebalancing controls the psychology of the investor’s desire to constantly beat the market, and eliminates emotions. From this point of view, it is much easier to make a rational and logical assessment of risk tolerance and choose the appropriate strategy.

Monitoring tools

Crypto portfolio trackers allow investors to monitor their digital currencies. Users can manage assets with a single account. With the help of monitoring tools, investors will see profit and loss and market prices in real time. Google has identified 5 popular trackers based on queries on its search engine:

- Blockfolio.

- Delta.

- CMA.

- CoinStats.

- BitUniverse.

General tips for assembling a portfolio

Investing in virtual currency remains a risky endeavor. And while capital diversification is challenging and takes time to research and analyze, if an investor knows how to build a balanced portfolio, they will be successful in achieving their goals.

If an investor wants to “sleep easy,” when diversifying capital, they will assess their risk appetite, as well as analyze the activity of the cryptocurrency project’s community and the potential applications of the token. These and other factors will help maximize the potential return on investment.

Häufig gestellte Fragen

❓ How many cryptocurrencies should I have in my portfolio?

Depends on the risk profile of the investor. For the least risky investments, 3 cryptocurrencies with the highest capitalization are enough: BTC, ETH, USDT.

❔ What does HODL mean?

In cryptocurrency slang, this is the name of the “buy and hold” strategy. HODL stands for the misspelled word “hold”.

⏳ How often should a portfolio be rebalanced?

Investors distinguish 2 strategies of risk balancing: by time (after a predetermined interval – day, month, year) and by deviation (when an asset’s weight exceeds a certain value).

💸 How many cryptocurrencies are circulating in the world?

As of August 2021, there are 11,382 coins officially registered.

❗ Which strategy is better: trading or HODL?

Second. In trading the risks are higher, 95% of novice speculators lose money. Therefore, the choice depends on the investor’s risk profile.

Ein Fehler im Text? Markieren Sie ihn mit Ihrer Maus und drücken Sie Strg + Eintreten.

Autor: Saifedaner Ammouseinem Experten für die Wirtschaft der Kryptowährungen.