Digital assets appeared in 2009. The developer of bitcoin is Satoshi Nakamoto (unknown person or group of people). At the beginning of 2023, the number of types of cryptocurrencies exceeded 16.7 thousand. Some virtual money disappeared. Others, on the contrary, became popular. People made fortunes by investing in crypto-assets in the first year. In 2023, there are more opportunities to profit: mining, trading, staking. If these words do not say much, you need to start learning about cryptocurrency. You don’t need to buy courses to do this. CryptoProGuide.com has collected useful information for studying the topic of virtual finance and blockchain.

General information about cryptocurrency for beginners

Beginners need to understand the essence of digital assets. Of course, it is not necessary to study the theory of mathematical algorithms. Basic information about the blockchain is enough.

Cryptocurrency is a program code that has no physical expression. It is often used as a means of payment, a tool for investment.

Digital currency is based on a decentralized network – blockchain. The system resides simultaneously on all users’ computers and has no single management. That is why it is called distributed.

In the blockchain, users do everything:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- Mining new coins.

- Verify and confirm transactions.

- Writing data to the blockchain.

- Participate in project management.

Transactions are recorded in an open system. No user identity information is available, this cannot be viewed.

Crypto-assets are not secured in any way. That said, few people know that fiat money is also unsecured since 1971, when all countries abandoned gold. The crypto asset’s exchange rate depends on supply and demand. As long as coins are bought, those have a price. If no one wants them, the rate will fall. The price of assets is also influenced by:

- News background.

- Regulation at the level of states.

- Events in the world.

- Statements of businessmen, investors.

If you compare cryptocurrency with fiat money, you can notice the differences.

| Operation | Fiat | Digital assets |

|---|---|---|

| Issuance | The issuance of fiat money is handled by governments. There is no limit to the amount of currency, you can print as much as you want. At the same time, inflation is created. | The issue of cryptocurrencies depends on the project. The volume of bitcoin and some other coins is limited by developers (not always). The assets are extracted by the participants of the network themselves. |

| Management | Centralized – the state fully controls the financial system. | Cryptoassets are managed by the community, changes to the program code are made after discussion with participants (depending on the project). |

| Anonymity | Owners of fiat money are controlled by banks. It is impossible to use currency without government oversight. | Transactions and cryptocurrency wallets are not tied to a specific person, although information on them is available to users. |

| Security | Fiat currencies are counterfeited by fraudsters: it’s difficult but real. | Digital assets are protected by cryptographic methods, it is impossible to crack the key. The user can give out information, otherwise it is impossible to lose access to funds. |

| Reversibility of transactions | A bank transfer or payment in a store can be reversed. | The transaction is recorded in the blockchain forever, it cannot be deleted or changed. |

Cryptoassets have disadvantages:

- High volatility of bitcoin, other coins and tokens. The rate is affected by different factors, large changes in 1 day are possible.

- Irreversibility of transactions. This advantage is at the same time a disadvantage. A transfer to an erroneous address cannot be canceled, the money will be lost forever.

- The use of complex cryptographic methods. Strong protection can also become a disadvantage. If the user loses the private keys and seed phrase, he will not get the money.

The first cryptocurrency was bitcoin. Other digital money is called altcoins. They can be based on the Bitcoin blockchain or use other decentralized networks.

How to study cryptocurrency

The basic definitions of the digital world have been studied. Further study of bitcoin depends on the goals set. Information is presented on different resources, books are written, including in Russian. They are easy to understand, created for beginners. The main topics are: blockchain, bitcoin, other altcoins and tokens.

In general, the scheme of study is as follows:

- To understand the types of cryptoassets (coins, tokens).

- Look at the rating of digital money (sites with detailed information will help – for example, CryptoProGuide.com).

- Understand the peculiarities of storage, understand the types of crypto wallets, learn what private keys and seed phrases are.

- Identify ways to buy assets.

- Understand how to generate income.

- Understand how you can spend koins, what to do with them.

- Learn the security measures.

There are a lot of scammers. They create new methods to deceive users. You need to know how hackers can steal funds.

The rating displays the top assets taking into account the amount of capitalization and other parameters. Popular coins and tokens get there, but do not forget about other virtual currencies. They can represent promising projects, it is necessary to properly evaluate from the side of possible earnings.

To study the assets, you can find information resources that collect information from cryptocurrency exchanges, make ratings. They also create analytics, graphs, indicate historical data. You can select the services you need and save them in your browser bookmarks.

For trading, experts recommend cryptocurrency exchanges. Large platforms provide many different tools, opportunities to make money on the volatility of koins. There are ratings of exchanges that will allow you to choose a resource.

Types of cryptocurrency

In December 2021, more than 7300 coins and tokens were listed on trading platforms. Virtual money has differences in structure, operating principle and other parameters. Cryptoassets are divided into types depending on the features:

- The principle of transaction confirmation.

- The type of blockchain.

- Level of centralization.

Most assets use Proof-of-Work and Proof-of-Stake algorithms. In PoW, transaction confirmation is handled by miners: they mine koins, perform certain work (solve a complex mathematical problem). The first to perform the required actions is the one who creates the block and receives a commission for it. Mining requires powerful equipment, as the task is very resource-intensive. PoW is used in bitcoin and forks based on it.

The main work in the network on the PoS algorithm is performed by validators. They leave a part of the coins in the wallet. Depending on the amount of assets, validators receive rights to create and validate blocks. PoS is used in such projects:

- Stellar.

- Cosmos.

- Binance Coin and others.

Ethereum (the second most popular and capitalized cryptocurrency after bitcoin) also plans to switch to PoS. This algorithm implies more advantages.

One needs to understand the difference between a coin and a token. Digital assets include both terms, but they are different. A coin (koin) is a means of payment. It can be earned, created by mining or otherwise, and used for transactions. A coin is based on its blockchain – this is the main difference from a token. Under the word “cryptocurrency” is most often understood exactly a coin.

A token is an analog of securities. Sometimes it is a means of payment, but more often it serves other purposes. Token is based on the blockchain of other projects, managed by smart contracts.

Rating of the best cryptocurrencies

It is difficult to choose an effective virtual asset. For investment, you need a stablecoin with a growing rate. Trading is better to perform on highly volatile assets.

There are cryptocurrencies based on a HYIP. They can have a large price, capitalization. But after a year or even a few months, the rate falls.

The rating of the best virtual coins is compiled by the experts of CryptoProGuide.com. Information was collected from leading exchanges, other sites. All active projects were studied. In December 2021, the list of the top 5 cryptoassets looked like this:

- Bitcoin

- Ethereum

- Binance Coin

- Solana

- Ripple.

When compiling the list, experts took capitalization into account. There is no such definition as a cryptocurrency for beginners. Beginners can use any assets and earn on them.

What is a wallet

Cryptocurrency is software code. Any transfers of funds are simply records on the blockchain. No one physically transfers coins, it’s not possible. Transactions use an address and keys. A wallet is also a program that stores the necessary information. Users can find out the balance, transaction history, perform a transaction.

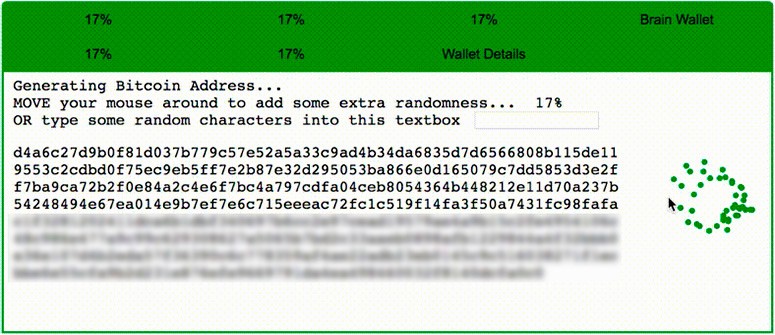

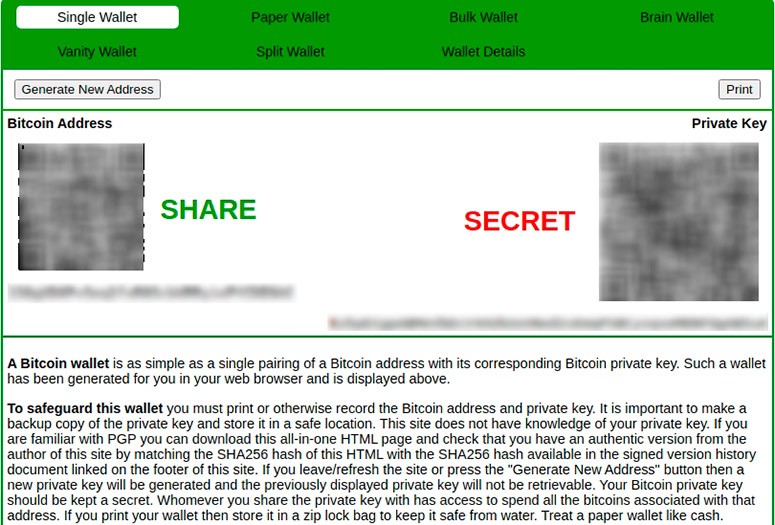

Private and public addresses

Beginners do not always understand the main concepts that are used when storing and exchanging cryptoassets. It is worth knowing 3 basic tools:

- Wallet address – a set of characters containing numbers and letters. There are several writing formats: at the beginning can be 1, 3 or bc1.

- Public key (public) – the initial data for forming the wallet address. Encryption methods are used, the most popular is SHA-256.

- Closed (private) key – information that serves to confirm transactions. To generate it, a cryptographic function is used.

The address is used for transactions. It is transmitted to receive money. The private key should not be opened to anyone, otherwise you can permanently lose funds. To restore access, a seed phrase is used, which is created when setting up the wallet. It must not be shown to anyone either.

Types of cryptocurrency wallets

In 2023, developers offer several types of address management software. Depending on the method of connection, wallets come in:

- Hot

- Cold.

Each of these categories is divided into types:

- Software-based

- Mobile

- Online services

- Hardware

- Paper-based.

The choice depends on the tasks and requirements of the user. If security is important, a cold-type wallet is better. For trading, the internal storage of the exchange or a mobile application is recommended.

Hot

Wallets of this type are permanently connected to the Internet. They provide quick access to cryptocurrency, the possibility of instant transfer. At the same time, security falls. Fraudsters can hack the software, use phishing and other methods. Hot wallets come in different varieties:

- Software-based – thick and thin. In the first case, the entire blockchain is downloaded to your computer, you need a wide access channel. Thin ones take up less space on the hard disk.

- Exchange – internal wallet services. The access keys are held by a third party. The user is more at risk of losing his funds than with any other option. It is possible to operate money faster, convenient for trading.

- Online services – cryptocurrency is stored on the site. The user gets quick access to assets, but the level of security is lower.

- Mobile crypto wallets – this is a variant of software storage, designed specifically for smartphones. The app provides quick access and security. The mobile device can be disconnected from the internet so that the money is secure.

Cold

This type of wallet involves storing funds for a long time. Since there is no access to the internet, there is virtually no way for fraudsters to steal cryptocurrency. It is only necessary to safely store the private keys. The minus of cold wallets is that the internet is required for transactions. With frequent transactions, this can be inconvenient. Another disadvantage of the method is the high price of the wallet.

Security measures

The first steps in learning about cryptocurrency necessarily include the basics of data protection. Fraudsters create new methods of deceiving users every year. It is necessary to follow the rules of security:

- Use the latest versions of software.

- Install applications only from trusted sources, better from the official websites of developers.

- Control the browser line – fraudsters can replace a popular resource with a similar one and steal personal data.

- Do not follow links to unknown sites.

- Do not believe the offers from different services (low commissions, bonuses, huge income). These are scammers who lure users to their site.

- Keep secret information in a safe place, it is best to write it down on paper.

Ways to buy cryptocurrency

To use digital money, you need to get it. The easiest way is to buy coins for fiat. Several different ways are available, which differ in convenience, commissions. If coins are needed for trading, then it is better to use exchanges. There are other options for purchase.

Where to buy virtual assets:

- Cryptocurrency exchange services – allow you to buy coins through bank cards, transfers. There are aggregators that will help you choose a resource with optimal commissions, the volume of koins, a convenient way of input and output.

- Cryptocurrency exchanges – offer internal storage, trading tools, several ways to earn money on digital money. You can also use aggregator information resources to choose from. CryptoProGuide.com offers a handy list of the best cryptocurrency exchanges.

- P2P platforms are direct exchange services. Users buy assets from each other. You can find a favorable rate, convenient direction.

- Cryptomats – not too popular method. There are not many devices for buying yet.

- Telegram bots – messenger applications that offer a search for options for exchanging coins and tokens.

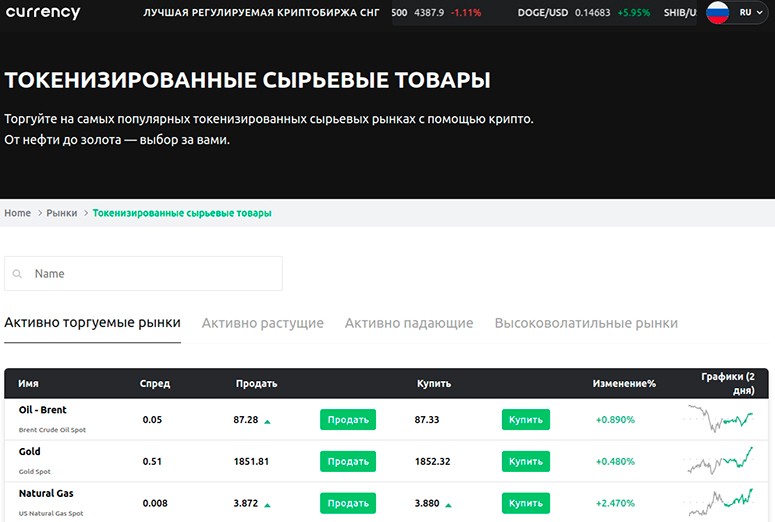

The best crypto exchanges

Different services are available for working with virtual coins. The best option is a cryptocurrency exchange that offers several avenues for making money.

In 2023, there are hundreds of services on the market. They differ in interface, turnover, the number of cryptocurrency pairs.

The portal has prepared the top 5 services for trading koins in 2023:

- Currency.com is a Belarusian exchange that offers the best conditions for Russia and the CIS. Users have access to 337 pairs. The service has a turnover of $216 million.

- Coinbase is one of the oldest platforms. Users have access to 393 pairs. The trading volume per day is $4.29 billion.

- Cex.io is the editor’s choice, the oldest exchange with a Russian-language interface.

- P2PB2B is a platform with the ability to buy coins via bank cards. Daily turnover is $996 mln. You can trade in 668 pairs.

- Poloniex is an exchange with a simple trading terminal. Users have access to 646 pairs. The daily volume is $147 mln.

The list was compiled based on a comprehensive analysis of all indicators, including localization, user reviews, and trust rating.

Ways to make money with cryptocurrency

Digital assets are a great tool for generating income:

- High volatility is convenient for trading.

- Features of mining allow you to earn on mining or staking.

- The market of decentralized finance(DeFi) is developing.

You need to understand the main tools and methods.

Investments

Placing capital with the aim of making a profit – passive income on cryptocurrency from scratch for beginners. You need to choose an asset that will grow. Investments involve buying coins for a period of a year or more. In the long term, bitcoin and altcoins will grow in value. The main thing is not to panic at a correction of the rate or a bearish trend. Users who bought the first cryptocurrency at the beginning of its existence and did not sell during periods of falling prices have now become millionaires.

It is important not to invest all the money in one instrument, but to divide it. It is difficult for beginners to properly compose a portfolio to reduce risks and raise returns. Therefore, they are often recommended to invest in coins from the top 10 by capitalization.

Trading

Trading on the exchange is popular in the digital world. The price of cryptocurrencies changes, trading allows you to earn income on the difference in exchange rates. However, it is not easy. Beginners can quickly lose all their savings, especially if they use leverage (increase the volume of transactions at the expense of exchange funds). It is better to practice on a demo account. Popular platforms provide such an opportunity.

For serious work, you need to study the theory of trading, technical and fundamental analysis. To earn money on cryptocurrency trading, different strategies, programs-bots are used. A variant of trading is arbitrage. This is earning on the difference in prices on exchanges. Trading is carried out on several platforms.

Cranes

The essence of earning is the performance of the simplest actions for a small reward. It does not require knowledge and investment. Cranes are an easy way to get some money on cryptocurrency. You can enter captcha, view ads. Cranes do not pay too much, so this method can not be considered serious.

Mining

Users themselves mine new coins and confirm transactions. The specifics of the process depend on the project and algorithm (PoW, PoS and others). Mining is the solution of a mathematical problem on a computer. The user who found the answer, gets the right to add another block of data to the network. For this, he is paid a reward. For example, in the Bitcoin network, a miner will receive 6.5 BTC for each block. The amount of remuneration is constantly decreasing when halving (dividing the fee by 2 every 4 years). This is laid down in the basis of the Bitcoin network by the developer.

In 2023, it is difficult to make money from mining. The power requirements of bitcoin mining equipment have long exceeded the capabilities of a home PC. Investments are needed to create a farm for mining, access to cheap electricity. The price is too high, it is difficult to recoup the investment in a year.

Pools make money on mining. They have resources, place their equipment in areas with cheap electricity.

Airdrops and bounties

To earn on cryptocurrency, you do not always need initial capital (investment, mining) or knowledge (trading). There are simple ways – airdrops and bounties.

Airdrop and Bounty – free distribution of tokens. These are done by developers of new projects. There are conditions for participation in airdrop:

- Comment on social networks.

- Register on the site.

- Create a news background around the new project.

For all this, developers provide a portion of tokens. They do not always become liquid. Cryptocurrency may not be listed on exchanges. However, the user spends only his time, and does not invest money.

Cryptocurrency projects

The possibilities of the digital world are wider than just making profits on buying or selling assets. Startup developers raise money through initial coin offerings (ICOs). They issue tokenized shares of their project and sell to raise funds for development. If the startup is interesting and promising, investors will make money. Tokens will grow in value and can be sold profitably. Startups also provide discounts on services or goods of their project and other opportunities.

This method requires capital to buy tokens. It is necessary to determine the prospects, the absence of fraudulent intentions of developers. There are scammers who raise money on ICO and close the project without realization.

Staking

The issuance of cryptocurrencies based on the PoW algorithm is performed through mining. Assets based on PoS use steaking – receiving income for storing money in a wallet or on an exchange.

This method is similar to a bank deposit. The user stores coins in a wallet or exchange, becomes a validator of the network. He confirms transactions, maintains the functioning of the blockchain and receives remuneration. Earnings depend on the amount of fixed funds. The more cryptocurrency is stored, the higher the income. In steaking, there are no requirements for the power of equipment, but you need funds to buy coins.

Cloud mining

This way of earning involves participating in mining on rented equipment. For simple mining, you need a productive device. You can rent part of the capacity through cloud services. Income depends on the invested funds: the more investment, the higher the earnings.

There is a high probability of falling for scammers. They collect money from customers, but there is no equipment. Then the attackers simply disappear. At the same time there is a site with beautiful indicators. Scammers can even make a few payments so that people believe them.

There are other ways to make money on cryptocurrency. Any exchange offers options. You need to carefully study the capabilities of each platform.

How to spend cryptocurrency

You can use digital assets in different ways. Often it is an ordinary means of payment, with the help of which you can pay for goods or services. The first purchase for bitcoins was made back in 2010, when one user bought 2 pizzas for 10 thousand BTC.

The ways to spend cryptocurrency depend on the country. In some states, it is a means of payment. In others, cryptocurrency exists as securities, commodities, or is banned altogether.

Bitcoin or altcoins can be paid on different resources and services. Such services provide:

- Electronic stores.

- Sites for the sale of tickets.

- Travel agencies.

- Cafes.

- Other platforms.

The service offers a choice of ways to transfer money. For payment, the user is provided with a wallet address or QR code, where he should send coins. The main disadvantage is the slow processing of transactions, commissions, because of which the price can be higher.

Beware: scammers

It is possible to work with cryptocurrency, but you need to be careful. Fraudsters use all means and methods to hack the wallet and get money. There are different schemes for deception:

- Phishing pages.

- Fake websites.

- Network marketing.

- Fictitious crypto brokers.

- Hidden mining using the resources of the user’s PC.

- Scam projects.

- Fraud in cloud mining and others.

Before you start buying and spending coins, you need to learn about cryptocurrencies. Beginners need to understand the storage, income generation, the principles of the blockchain, the basics of digital security. There is nothing complicated about it. You can use portals with useful information.

Frequently asked questions

📲 What is the technology behind cryptocurrencies?

At the core of digital assets is the blockchain.

🔑 Which wallet is better?

The choice of storage depends on the operations that the user performs with cryptocurrency. For investments, security is more important. A cold-type hardware wallet will do. For trading and constant use, fast access is important, so it is better to use hot storage.

❓ What is the best way to analyze the situation on the cryptocurrency market?

There are several tools for predicting price changes. For short-term investments, technical analysis is used, and for long-term investments, fundamental analysis is used. It is possible to apply both approaches at once.

❗ Does mining affect the environment?

Bitcoin mining is done on equipment that uses a lot of electricity.

💡 Is the use of cryptocurrency anonymous?

It is difficult to link digital assets to a specific person. The owner can self-disclose. There are mixer services that disguise the transfer.

An error in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.