The digital coin market offers many ways to make money. The most popular of them is cryptocurrency trading. The classic scheme: buy an asset cheaper and sell it more expensive. To do this, you need to calculate the entry point and wait for the price to rise. However, you can make a profit immediately, using a small difference in quotes on different platforms. For this purpose, digital currency arbitrage is involved. In 2023, many traders choose peer-to-peer platforms for direct transactions with counterparties. In the article we will explain what P2P cryptocurrency arbitrage is, in simple words. Readers will become aware of the features and strategies for earning, and step-by-step instructions for starting the activity will be available.

Explanation of the concept of “cryptocurrency arbitrage”

The term means reselling digital assets to profit from the difference in quotes. The task of the arbitrageur is to find working bundles on the purchase of crypto coin and the reverse transaction. For this purpose, one or more assets are used.

Bundles for P2P arbitrage can work within a crypto exchange or between different platforms and even countries. The price difference is usually insignificant, with part of the profit going to pay commissions. To make money, an arbitrageur must have a large capital in fiat. You can start with a small amount, but you need to be ready to constantly search for bundles and frequent transactions.

What is P2P arbitrage

On peer-to-peer platforms, transactions take place between users without intermediaries. The principle of arbitrage remains the same: buy digital currency cheaper and sell it more expensive.

The price difference is formed due to the use of multiple coins, a large number of fiat units and settlement methods.

In 2023, major exchanges have their P2P services. Therefore, arbitrageurs can conduct cross-platform transactions.

5020 $

Bonus til nye brugere!

ByBit giver bekvemme og sikre betingelser for handel med kryptovaluta, tilbyder lave provisioner, højt likviditetsniveau og moderne værktøjer til markedsanalyse. Den understøtter spot- og gearet handel og hjælper begyndere og professionelle handlere med en intuitiv grænseflade og vejledninger.

Optjen en 100 $-bonus

for nye brugere!

Den største kryptobørs, hvor du hurtigt og sikkert kan starte din rejse i kryptovalutaernes verden. Platformen tilbyder hundredvis af populære aktiver, lave provisioner og avancerede værktøjer til handel og investering. Nem registrering, høj transaktionshastighed og pålidelig beskyttelse af midler gør Binance til et godt valg for handlere på alle niveauer!

Sådan fungerer det

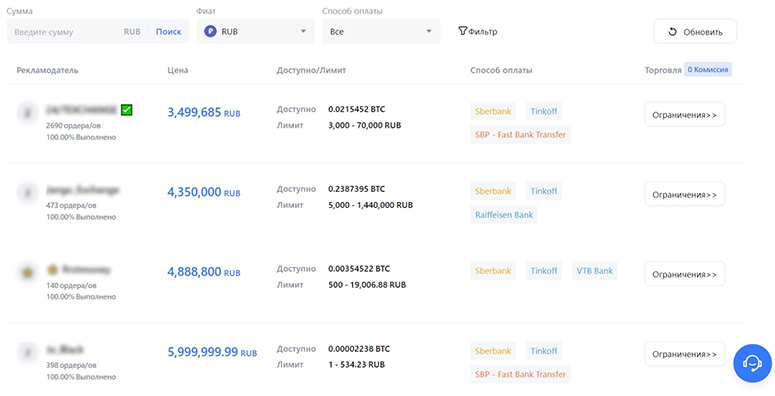

On peer-to-peer platforms, traders set their asset prices based on the market rate. This gives options for classic arbitrage. You can buy a coin from an exchange’s spot terminal and sell it more expensive from a native P2P service.

Usually, cryptocurrency rates on peer-to-peer platforms are slightly higher than market rates. Rarely it happens the other way around. The difference in price is determined by the calculation methods presented. Many traders are willing to overpay for a direct withdrawal of cryptocurrency to the card of a particular bank or the necessary EPS.

It is also possible to put up your own ads to buy or sell coins. In both cases, the trader specifies the desired price of the asset. For example, you can buy bitcoin below market value and sell at the current rate on a spot or P2P (open a second ad).

The price difference and popularity of such offers is explained simply. Users are willing to sell assets below market value and buy more expensive, if there are additional benefits: exchange for a rare national currency or direct withdrawal without commission.

Features

Cryptocurrency P2P arbitrage provides for a set of transactions for buying and selling coins, as a result of which the trader receives the original fiat in a larger volume. The money must return to the original account. Other features of P2P arbitrage transactions:

- One can trade as a maker and taker. The former creates ads, the latter responds to them.

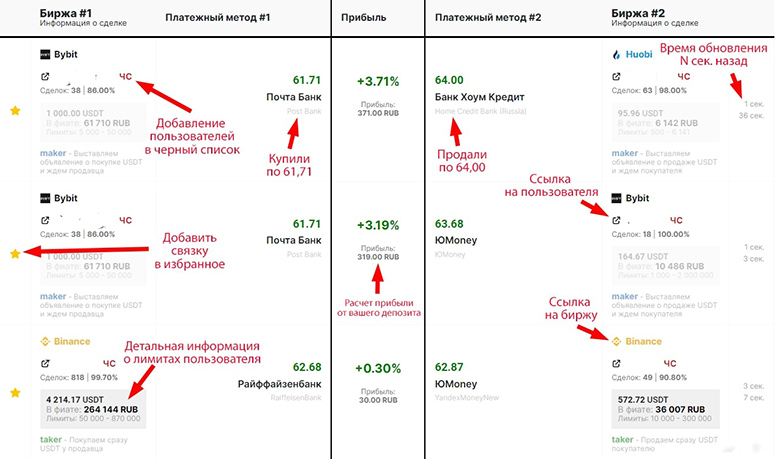

- It takes time to find bundles, so many traders use scanners. Programs can be found for free or purchased.

- Peer-to-peer platforms give more opportunities for arbitrage compared to classic exchanges. Spreads (the difference between bid and ask prices) appear due to the multitude of fiat currencies and payment methods.

- Arbitrage transactions on peer-to-peer platforms of regulated exchanges are safer than transactions on decentralized P2P. Escrow services provide protection of funds.

What are bundles

Arbitrageurs trade according to algorithms. Bindings explain the sequence of trader’s actions to get profit. The simplest algorithm involves buying cryptocurrency on one platform at X rate and selling it on another at Y price (more expensive). In practice, the bundles are more complex – they can involve multiple exchanges, digital assets and payment methods. Two types are used in arbitrage transactions:

- Momentum. Spreads occur due to sudden changes in exchange rates (for example, when news is released). The difference in price can be as high as 10-20%. The risk of such bundles is in the equally rapid closing of the spread. Therefore, it is important to act promptly.

- Permanent. Such opportunities appear on the market regularly. The simplest ones are due to the difference in quotes for buying and selling coins. Usually it is small: 1-2%. The risk is the change in the spread in the opposite direction.

When calculating the profitability of the scheme, it is necessary to take into account the network and platform fees (for inter-exchange transactions). The income is determined as a percentage of the deposit earned per round (full cycle of actions).

Possible profits

In a transaction with constant algorithms earn an average of 1-2% per cycle. Momentary ones earn 1-20% or more. Potential profits vary due to the following factors:

- Amount of capital. The larger the transaction amount, the higher the earnings. However, the risks also increase.

- Rate volatility. Strong fluctuations in the price of a coin provide more opportunities for earning.

- Market environment. Important events in the economy and trading environment can provoke sharp price spikes. This also provides more opportunities to make profits in arbitrage trades.

- Preferential conditions on exchanges. Active traders often receive preferential treatment on CEX in the form of reduced commissions or margin concessions. VIP-client status allows to increase profits in arbitrage trading.

- Trader’s knowledge and skills. The ability to analyze markets plays an important role in arbitrage trading. It allows to find profitable schemes and minimize risks.

- Transaction fees. When calculating the potential profit in a bundle, network and service fees, as well as other operational costs should be taken into account.

An example of a profitable case study on P2P arbitrage was published in 2022 in one of Zen channels. Its author proposed the following algorithm:

- Buy Ethereum from Rosbank card on Binance P2P.

- Exchange ether coins for USDT at the exchange’s spot terminal.

- Sell the stablecoin for rubles on the peer-to-peer platform.

The average yield per round was 7%, the maximum yield was 8.6%. The trader conducted 6 cycles per day and managed to increase his deposit of 30 thousand rubles to 514 thousand rubles within a week.

Types of arbitrage

P2P-trading provides direct interaction between the parties. A large number of directions expands the opportunities for arbitrage operations. Traders profit from price differences between currencies, exchanges and regions. In general, it is possible to distinguish three main types of arbitrage with cryptoassets:

Each of them has peculiarities, potential advantages and risks. You should choose one based on your strategy, skills, and available resources.

Intra-exchange

This type of earning involves trading within a selected site for P2P currency arbitrage. Traders conduct a series of transactions with one coin, using different tools. For example, you can buy BTC for USDT, exchange bitcoin for ether, and then sell ETH for USDT. The bundle is formed due to a sharp jump in trading traffic in the Bitcoin/Ethereum pair. Schematically, it looks like this:

- Let’s say bitcoin is worth $44k USDT.

- The price of ether is $2 thousand.

In this case, BTC is worth 20 ETH. During a sharp increase in trading turnover, this ratio may change: BTC = 21 ETH. At the same time, the prices of coins in USDT will remain the same. For a trader, this means a trading opportunity with the potential to earn $2 thousand on the exchange rate difference. The pros and cons of intra-exchange arbitrage can be compared in the table.

Interexchange

This is a popular way of making money on the difference of quotes. The strategy is to find the gap in the price of one coin on different P2P platforms.

For example, bitcoin is traded on one exchange for $43.5 thousand, on another – for $43.6 thousand. You can buy the asset on the first platform and sell it on the second.

It is difficult to independently monitor prices on crypto exchanges. Therefore, traders use bots. The programs can only look for interexchange bundles for P2P arbitrage or open positions when trading opportunities are detected. In 2023, 99% of such trades are conducted with the help of programs. The pros and cons of trading are in the table.

International

This is essentially inter-exchange arbitrage on a global scale. The schemes use P2P platforms and fiat money from different countries. For example, you can buy bitcoin for rubles in the Russian Federation, transfer it to a crypto exchange in the UAE and sell it for dirhams. Pros and cons of the strategy – in the table.

Top exchanges for trading with P2P bundles

To start trading, the arbitrageur will need to study the peer-to-peer services available in the region. In the Russian Federation, most P2Ps work as add-ons to CEX. To access them, you will need to create and verify profiles on the main platforms. In the table you can compare the most popular P2Ps in 2023.

Strategies for making money in P2P trading

On peer-to-peer platforms, users themselves form the rates of coins and exchange them for fiat money. Cryptocurrency prices are constantly changing, so arbitrage can bring stable profits.

Earning on small price differences

This is the simplest arbitrage trading strategy. Traders buy cryptocurrency on one platform at a relatively low price and sell it on another at a higher price. The difference makes up the arbitrageur’s earnings.

In the calculation of potential income, you need to take into account the commissions for transferring the asset between platforms. Earnings on small price differences can be increased by a deposit.

Cross-border arbitrage

The strategy is based on cross-platform trading of cryptocurrencies. A trader buys a coin on one exchange, sells it on another and earns on the difference in rates. Cross-border trades attract potentially high returns, but can be risky due to regional restrictions.

Payment method premiums

The P2P marketplace offers a large number of options for settling transactions. The standard CEX peer-to-peer marketplace supports dozens of payment methods. The most popular ones generate more liquidity. However, earnings are higher on the rare ones.

Users are willing to overpay for the ability to withdraw cryptocurrency into the desired fiat.

Volatility of volumes

On crypto exchanges with small turnovers, the range of price fluctuations is higher. Therefore, arbitrageurs get additional opportunities for earning. Low liquidity is a risk for the trader. However, if you understand the dynamics of supply and demand, you can make good money on the volatility of trading volumes.

Margin arbitrage

This strategy requires an understanding of market trends and leverage skills. Arbitrageurs buy a coin on one platform and sell it in parallel on another. The risk of the transaction is proportional to the return.

Simultaneous buying and selling of assets

The strategy is used by experienced traders who can quickly analyze the market and make accurate decisions. The method allows you to profit from the difference in exchange rates on a cryptocurrency pair on different platforms. A trader purchases an asset on one exchange while selling it on another.

How to look for P2P bundles

The main criteria for evaluating arbitrage bundles are profitability, liquidity, and ease of execution. In practice, it is difficult to combine all characteristics. Usually, to get a high profit, you have to sacrifice liquidity or choose schemes with many steps.

Bindings for P2P cryptocurrency arbitrage can be searched manually and with the help of programs. The basic approach involves comparing digital coin rates, calculation methods and working conditions on available P2P. Bots perform these actions automatically. The user receives ready-made trading algorithms with step-by-step instructions.

Scanners

These are programs that automatically search for spreads and bundles to trade cryptocurrencies on different P2P platforms. There are two types of scanners used in 2023:

- The first notify where to buy and sell a coin to capitalize on rate differences.

- The second ones automatically open trades when specified parameters are reached.

Popular scanners monitor dozens of trading platforms. Among them are ArbitrageScanner, P2P Machine, P2P Helper, and others.

In messengers

Most Telegram channels of this topic are paid. However, the expediency of buying bundles is debatable. It is difficult to find a working profitable algorithm. The less traders use the bundle, the more profit is likely to be gained. That is why mostly already worked algorithms are offered for sale, which can be used for some time.

Free chats can be more useful. In such communities, visitors share their ideas and tips on trading.

Online

Looking for bundles for P2P arbitrage of cryptocurrencies in 2024 can be done on social networks, websites and blogs. The same approach applies here – no one will publish profitable algorithms, but there is a chance to get “in the last carriage” and test a trading strategy that is already “leaving”.

Most of them are paid. Some traders share arbitrage options in free access. You can search for such sites and subscribe to updates.

In addition, it is worth studying offers on popular P2P platforms: compare prices, take into account commissions, and calculate potential profits. With this approach, you can find real long-term bundles that will bring profit for months.

On forums

In 2023, the trend for P2P trading is gaining momentum. Arbitrage of digital currencies brings real profit, there are more people willing to engage in this type of trading. Users unite into communities where they communicate, discuss strategies, share schemes for P2P arbitrage. Such interaction brings more benefits than trading alone.

Bindings for P2P cryptocurrency arbitrage

An easy way to find working schemes is with the help of scanners. The programs give out bundles in tables. For example, P2P Army finds algorithms in two and three actions. For the former, more than 125 thousand ruble bundles are available in December 2023. Every 15 seconds, the data is reconciled with P2P services Bybit, OKX and others.

The second – three-step tables – offer more bundles for ruble pairs. In December 2023, the program gives out 619 thousand schemes.

How to start earning on P2P arbitrage

Extract income from the difference in coin rates from scratch will not work. First you need to understand how P2P-arbitrage of crypto works, how digital networks differ, how wallets and exchanges are organized. You will also need a fiat deposit. It is better to start with small amounts – 20-30 thousand rubles. It is recommended to use cards from SberBank, Tinkoff, Raiffeisenbank. The first steps of an arbitrageur in the cryptocurrency market:

- Make a list of available P2P. Study the working conditions. Choose platforms.

- Register trading accounts. If necessary, pass verification.

- Deposit funds into the account.

- Study the market. Find and test arbitrage bundles.

- Make a deal.

It is better to search for the first schemes manually. This will allow you to gain experience in the market and not to spend money on a tool that does not work. Over time, you can increase the trading turnover.

Registering an account on the exchange

In 2023, many cryptoplatforms offer their peer-to-peer services. They are accessed by registered users with a passed KYC procedure. Instructions on how to create an account, using Bybit as an example:

- Open the exchange’s website. Click on “Registration”. The button is located in the upper right corner.

- Choose the method of registration – by email, phone number, using a Google or Apple account.

- Make up a password (if necessary) and enter a referral code (if available).

- Confirm registration by e-mail (phone number). If the account was created using Google/Apple, it is recommended to connect an additional method of authorization.

When entering the profile, you need to open the “Security” section, confirm your identity according to the instructions. You will need to specify personal data, attach scans of documents and take selfies.

Account replenishment

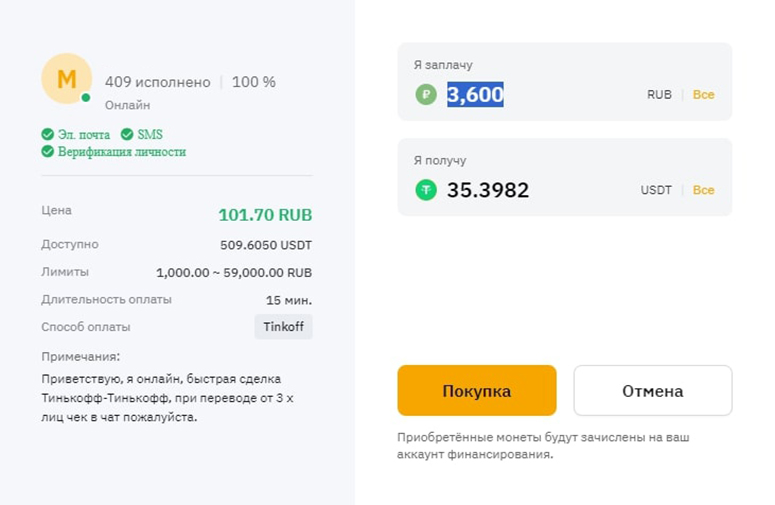

For arbitrage transactions, speed is important, so you need to keep cryptocurrency on the trading account, and fiat money – on bank cards. You can replenish the balance on Bybit in the following ways: transfer from a digital wallet, buy in one click using P2P. Instructions for buying with fiat:

- Authorize on the site.

- On the homepage, click on “Buy cryptocurrency”.

- In the drop-down list, select “P2P trading.”

- In the top menu, specify USDT, fiat – RUB, payment method.

- Select an ad. It is worth considering the status of the merchant, the number of completed transactions. Information can be obtained by clicking on the nickname of the user.

- Click on “Buy USDT”.

- Check the data. Click on “Purchase”.

- Transfer money to the seller’s details. Click on “Payment completed”, then click on “Confirm”.

- Wait for the coins to be credited to the balance. Usually merchants confirm receipt of money within 2-5 minutes. The exchange will unlock the cryptocurrency and transfer it to the buyer’s internal account.

Realization of bundles

A simple way to start earning on P2P arbitrage is to buy a coin on a spot and sell it on a peer-to-peer service at a small premium. For example, in December 2023, the Bitcoin exchange rate on the Bybit exchange is $43.49 thousand. The trader switches to native P2P, puts up an ad to sell BTC at 2% above the market price – for $44.35 thousand. The profit from the operation will be $0.86 thousand per bitcoin.

After that, you can buy bitcoin again at the market and repeat the circle. If the rate of the asset decreases during the transaction, the trader’s income will increase.

Reasons for the popularity of P2P arbitrage

It is believed that this direction appeared as a result of the logical development of cryptocurrency trading. However, users started to earn on the difference of coin rates long ago – at the beginning of the formation of the digital market. The first P2P arbitrageurs began to notice that the prices of assets on trading platforms differed. This served as a source of profit for them.

Unlike classical peer-to-peer transactions, arbitrage allows you to earn income on the difference between the current prices on two exchanges or more. Profits can be controlled – correctly calculate the percentage and perform a certain number of rounds.

Direct transactions

Peer-to-peer transactions simplify the trading process. The absence of intermediaries leads to lower commissions and increased speed of transactions. Since the terms of transactions are determined by the users themselves, trading becomes more flexible and gives better results.

Huge selection of price offers

Traders get more opportunities to earn money due to the support of fiat currencies and multiple settlement methods. A huge choice of price offers is created, so more flexible trading strategies can be used.

Variety of payment methods

The forms of settlement are determined by the ad creators. In 2023, you can buy cryptocurrencies on peer-to-peer platforms using a card, bank transfer and EPS. Popular services and rare destinations are supported. P2P arbitrage forms a global market without the rigid restrictions inherent in classic exchanges.

A wide range of settlement methods allows you to create your own strategies and implement them quickly.

Risks of P2P-arbitrage of cryptocurrencies

Like any method of trading, earning on the difference in coin rates has its disadvantages. The main risks are related to losing money. A trader may miss a trading opportunity due to a delay in the execution of the transaction by the exchange, counterparty or due to a sudden change in the coin’s exchange rate.

The transaction risks to be derailed if the platform stops supporting the selected bank or introduces other restrictions. In addition, traders may encounter fraudsters.

Delays in transaction execution

Direct settlements between the parties allow you to get the desired asset quickly. In rare cases, the counterparty delays in responding. Most transactions take a few minutes. Delays can occur on the side of the peering platform, blockchain (due to overloading) or payment service. These events lead to reduced profits and even losses.

To reduce risk, you should choose effective tools and follow a clear strategy.

Limitations of exchanges

Trading platforms can change the terms of work and commissions at any time. In the best case the profit from the operation will be reduced, in the worst case – the transaction will fail and the trader will receive a loss. To minimize the risk, you should periodically review the news and rules of exchanges. Usually changes are announced in advance.

Sharp market fluctuations

Cryptocurrency rates are highly volatile. A sharp jump in price in any direction can turn a profitable opportunity into a losing one. Relative safety will be ensured by constant monitoring of rates, the use of signals and stop orders.

Risk of fraud

Peer-to-peer transactions are less secure than transactions on exchanges. Escrow accounts are used to keep clients safe, but there are no AML filters. Traders risk becoming participants in fraudulent schemes that will lead to loss of money and problems with law enforcement agencies. It is recommended to choose the platform carefully and interact only with verified counterparties.

Ofte stillede spørgsmål

📕 Is it legal to arbitrage on P2P in Russia?

Federal law equates digital assets with property, so they can be bought, sold, pledged, and inherited. To get legal protection of transactions, it is necessary to declare income and pay tax.

💳 Can an arbitrageur’s bank card be blocked?

Financial organizations monitor suspicious transactions as part of the Prevention of Money Laundering Act. In case of active work with the card, the bank will have questions to the owner, the account can be blocked. The trader will have to prove the economic feasibility of transactions. It is worth keeping screenshots of transactions.

❓ How do peer-to-peer platforms verify merchants?

The status can be claimed by users who have reached a high volume of completed transactions and passed full verification. Specific conditions are set by the platform.

📰 Do I have to pass KYC to trade on a CEX peer-to-peer platform?

It depends on the exchange. Some platforms require KYC, while others leave the decision up to the ad creators.

❗ What is a chartback?

It is a fraudulent scheme. The attacker reverses a fiat transaction after receiving cryptocurrency from the counterparty.

Er der en fejl i teksten? Fremhæv den med musen, og tryk på Ctrl + Indtast

Forfatter: Saifedean Ammousen ekspert i kryptovaluta-økonomi.