For 2023, there are many active platforms that allow you to borrow and lend digital assets to other customers at interest. Usually, cryptocurrency lending is done between users of such services. Digital platforms are essentially brokers. Even dedicated platforms do not operate on the principles of traditional banks.

This method of lending is called cryptocurrency lending. Investors use this method to increase profits.

The principle of work of cryptocurrency lending

The method involves mutually beneficial cryptocurrency lending to users. Platforms rarely give loans to customers. Services often work as brokers.

Lending virtual coins and symboler implies giving and receiving cryptocurrency loans with interest. At the same time, it often implies lower annual rates than in traditional banks. The fact is explained by the mandatory collateralization of loans by borrowers. The amounts depend on the LTV. This parameter is equal to the following ratio: the amount of possible credit / collateral. It also reflects the investment risks of cryptocurrency loans.

If the borrower does not pay the lender the full amount issued with interest, his collateral will be transferred to the balance of the second party of the transaction. However, the risks are minimal when the obligations are fulfilled.

5020 $

Bonus til nye brugere!

ByBit giver bekvemme og sikre betingelser for handel med kryptovaluta, tilbyder lave provisioner, højt likviditetsniveau og moderne værktøjer til markedsanalyse. Den understøtter spot- og gearet handel og hjælper begyndere og professionelle handlere med en intuitiv grænseflade og vejledninger.

Optjen en 100 $-bonus

for nye brugere!

Den største kryptobørs, hvor du hurtigt og sikkert kan starte din rejse i kryptovalutaernes verden. Platformen tilbyder hundredvis af populære aktiver, lave provisioner og avancerede værktøjer til handel og investering. Nem registrering, høj transaktionshastighed og pålidelig beskyttelse af midler gør Binance til et godt valg for handlere på alle niveauer!

In the direction of digital lending, there is a concept of liquidation. The term means canceling collateral under certain conditions. For example, the risk often appears when the market rates of cryptocurrencies decrease. In this case, the amount of mandatory collateral increases (in the number of coins or tokens). Then borrowers need to replenish their collateral account. Only this will avoid liquidation.

Types of lending

For 2023, there are 3 methods of obtaining favorable loans in cryptocurrencies.

| Method | Description |

|---|---|

| Lending | This method involves obtaining loans from users of digital assets. Lending is usually done through broker services. |

| Leverage | The method involves taking loans from cryptocurrency exchanges specifically for trading in the virtual asset market. This type of lending is used for margin trading. |

| Buying cryptoassets from a credit card | In 2021, many popular exchanges began to introduce such a function. At the same time, when buying cryptocurrencies from credit cards, loans are issued by traditional banks. They provide the acquisition of assets. |

The best platforms

For 2023, there are many platforms for cryptocurrency lending. Of these, the popular ones among users are:

Salt

Salt platform was created in 2016. It issues cryptocurrency loans to users on its own. The platform was developed by a small group of enthusiasts, which founded Salt. After 6 years, the corporation has about 50 employees.

The service has the following features:

- Issuing loans to regular users and businesses.

- Cryptocurrency credit cards.

- 24/7 customer support.

- Mobile app.

- Use of multi-signature and cold storage.

As of 2023, Salt supports 11 cryptocurrencies. Among them are some popular coins: Bitcoin, Ethereum and Ripple.

Project Salt offers a cryptocurrency lending lending platform with floating lending rates. This means that the annual interest is subject to change.

To get a loan from Salt, you need to register an account on the platform. The second prerequisite is to purchase a loan package. The company provides 3 membership options:

- Member. Such members of the system have access to urgent financing up to 10000 USD. The loan period is from 3 to 24 months.

- Premier. Users of the platform with this status have access to favorable credit lines and urgent financing up to $100000 in 5 fiat currencies.

- Enterprise. Companies can apply credit lines from Salt and take urgent loans of more than $1 million. Such users have access to loans in fiat currencies from a special set of the platform.

The pros and cons of Salt are described in the table.

| Fordele | Ulemper |

|---|---|

| Mobile application | Centralization |

| Availability of 3 credit packages | Russian language is not supported |

| Digital credit cards | |

| Businesses can borrow from Salt with cryptocurrencies as collateral |

Celsius

Celsius cryptocurrency service was launched in 2018. It was created by 2 developers – Alex and Daniel (last names are not specified on the project website). At first, Celsius was an unpopular platform. But after 4 years, the number of active customers has grown to 2 million people.

Celsius features:

- A $750 million insurance fund.

- Mobile app.

- Utilization of zk Audit and Chainlink Proof-of-Reverse technologies.

- Availability of 4 awards in the financial field (“CeFi’s Best Lending Platform” and others).

As of 2023, the Celsius platform supports 47 digital currencies and 1 fiat – USD. Among the available crypto assets are Bitcoin, Binance USD and others.

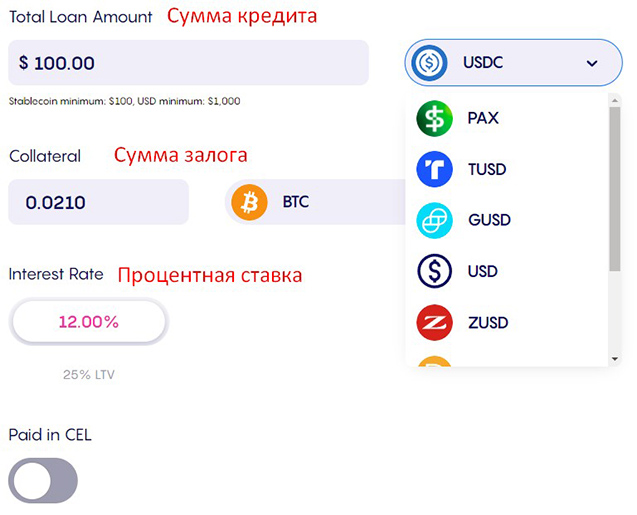

The Celsius platform has floating annual interest rates. Rates start at 1%.

To borrow cryptocurrency collateral from Celsius, you need to register on the app. After creating an account, the loan processing will become available. The minimum amount is $100 for Stablecoins and $1000 for other assets. These are very low limits. But the average LTV is 25%. Therefore, customers have to deposit secure cryptocurrency collateral of 400% of the loans.

| Fordele | Ulemper |

|---|---|

| Mobile software (software) | Supports only 1 fiat |

| Ability to borrow from $100 | Large amount of mandatory collateral |

| Cryptocurrency technologies | Centralization |

| Insurance fund |

BlockFi

This service was launched in 2017. After 5 years, its developers remain unknown. The service automatically issues loans to users. BlockFi is not a broker. All applications are processed by a special cryptocurrency algorithm.

The BlockFi platform has 4 features:

- Credit cards.

- No lending history needed.

- Accounts with yields up to 8.6% per annum on deposits are available.

- Compliance with US laws.

As of 2023, there are 6 cryptocurrencies available to BlockFi users. The supported ones include Ethereum, Litecoin, and Bitcoin, as well as 3 stablecoins (USD Coin and 2 less popular tokens).

BlockFi provides loans to customers at a fixed rate of 4.5% per annum.

On BlockFi, the LTV level is between 20% and 50%, which is lower than the average on the cryptocurrency lending market. At the same time, the minimum loan amount is $5,000. However, users can close loans earlier than the deadline. The BlockFi platform does not penalize customers for this.

| Fordele | Ulemper |

|---|---|

| Credit cards | Supports only 6 cryptocurrencies |

| Proprietary mobile software | Centralization |

| Digital deposit accounts | Low LTV |

| Compliance with US laws | |

| Favorable low rates |

Nexo

This service was created in 2018. One of the main developers is Antoni Trenchev. He created Nexo to “destroy the traditional financial system”. As of 2023, the platform has more than 4 million active users from 200 countries.

Nexo features:

- Digital cards.

- A $775 million fund.

- Wallet in the Nexo system.

- Robust mobile app.

As of 2023, Nexo customers can pledge 39 different cryptocurrencies. Available include Bitcoin, Ethereum, and other trusted digital assets.

Nexo users can borrow at 0% APR. The maximum rate is 13.9%.

Registered users have access to loans from $50 to $2 million in over 40 fiat currencies. Transfers of fiduciary loans to customer accounts take 1 to 5 days. The time to send and receive cryptocurrency loans is less than 1 hour.

| Fordele | Ulemper |

|---|---|

| Digital cards | Long processing time for fiat loans |

| $775 million in collateral insurance | Complexity of mobile and browser versions |

| Ability to borrow from $50 | |

| Wallet available from Nexo developers | |

| Many fiat currencies and cryptoassets | |

| LTV 90% for stablecoins | |

| Mobile software |

Binance

It is a well-known ecosystem of cryptocurrency products. It was established in the year 2017. The head of the digital project is the entrepreneur Changpeng Zhao. The Binance platform is registered in Malta. The company has licenses to conduct financial activities in many countries. One of the products of the system is a cryptocurrency lending service.

Features of Binance:

- Ecosystem. The digital platform consists of several services. The main product is a popular cryptocurrency exchange with high trading liquidity.

- Availability of reliable applications. Binance developers have created desktop and mobile software.

- Brokerage. The service offers earnings on the landing with floating and fixed annual rates. The site uses the funds received to issue loans to Binance clients. Also, investors’ investments help to provide margin accounts.

As of 2023, the loan service from Binance supports 74 cryptocurrencies. Among the available ones are popular coins, stablecoins and various tokens.

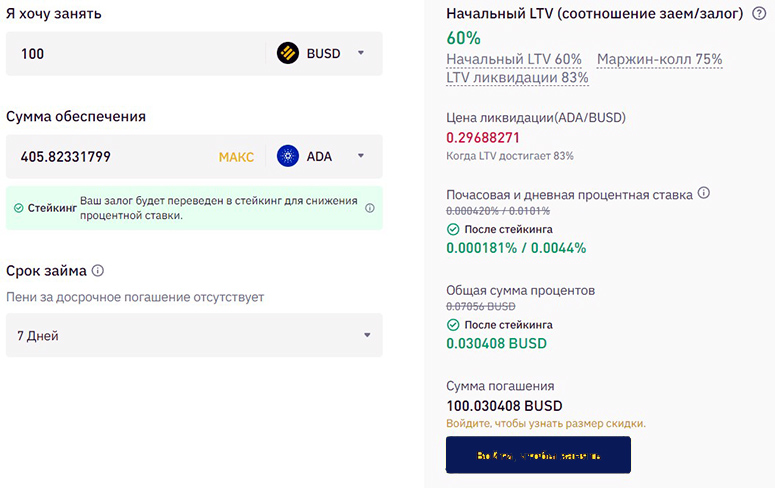

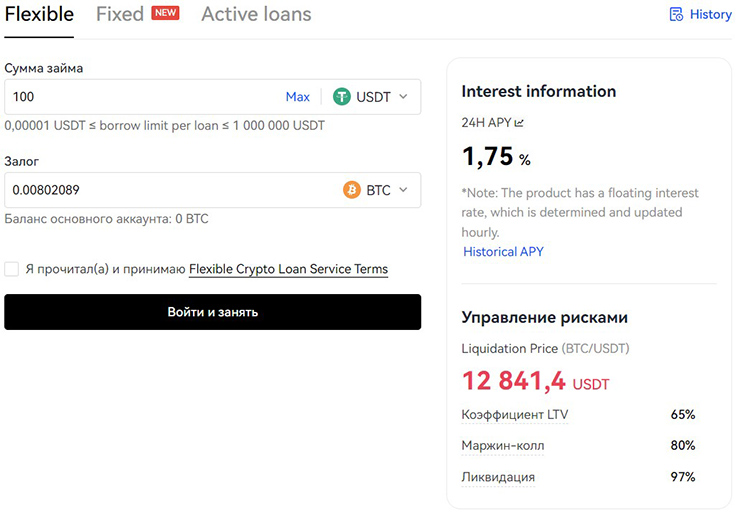

Binance issues loans at a fixed interest rate of 0.0101% per day (3.6865% APR). However, some collateral tokens the platform automatically invests in staking. This allows you to reduce the rate by 2-3 times.

Binance users have access to loans for a period of 1 week to 6 months. At the same time, the minimum LTV is 60%, and the maximum LTV is 65%. Also, the liquidation rate is always 83%. Under such conditions, loans become more profitable and less risky.

| Fordele | Ulemper |

|---|---|

| Ecosystem | Difficulty for beginners |

| High and favorable LTV | No support for fiat currencies |

| Official Russian translation | |

| High liquidation rate | |

| Low fixed rate |

Gate.io

This is a fairly well-known cryptocurrency ecosystem. It was launched in 2017. The platform was created by the company Gate Technology. According to different data, the firm is registered in the Cayman Islands or in the United States. Gate.io has no financial licenses. However, users trust the platform due to high liquidity and a large number of active clients.

Gate.io’s features:

- Ecosystem. Gate.io’s main product is a digital asset exchange.

- Availability of programs. Gate.io developers have released their own apps for mobile and desktop devices.

- Intermediation. The service does not issue loans to clients. It is only a broker between the parties of loan transactions. For its services, Gate.io takes a commission of 18% of investors’ profits.

As of 2023, the lending service from Gate.io supports 397 virtual currencies. Users can borrow popular crypto assets with high liquidity.

The minimum interest on lending through Gate.io is 0.01% per day (3.65% for 12 months). The maximum rate is 1% per 24 hours (365%).

The levels of average LTV and liquidation on Gate.io are constantly changing. To calculate them, the platform takes into account the volatility of established cryptocurrencies. Gate.io also provides for the lending of virtual assets only for a period of 10 days.

| Fordele | Ulemper |

|---|---|

| Ecosystem | Fixed small loan terms |

| Low rates | Large service commissions |

| Russian language support | Volatility of collateral liquidation level and LTV |

OKX

This digital ecosystem was launched in 2014. It was created by Okx Technology Company, a cryptocurrency company. As of 2023, the platform’s place of registration is Malta. The company has no financial licenses.

Features of OKX:

- Ecosystem.

- Availability of desktop and mobile versions of the cryptocurrency platform.

- Brokerage.

As of 2023, the cryptocurrency lending platform supports 120 coins and tokens. Bitcoin, Cardano, Ripple and other popular digital assets are available to users.

The annual percentage on the platform is floating. It is updated every hour. At the same time, for many loans, the rate is 1% on average.

Users can borrow for a period of 7 to 180 days. At the same time, the site provides customers with a fixed high LTV – 65%. Liquidation rates vary – usually 92% or 95%. There are no such conditions of the lending site anywhere else.

| Fordele | Ulemper |

|---|---|

| Ecosystem | Lack of full translation into Russian (some pages are left in English) |

| Very low credit rates | Technical support communicates only in English |

| Russian translation | |

| Fixed LTV | |

| High level of liquidation |

How to choose a platform

There are many credit cryptocurrency platforms for 2023. It is often difficult for beginners to choose between them. In the process of searching for platforms, it is worth considering the following parameters:

- Number of users. It is necessary to choose among services with the maximum number of active clients. Their number of lending platforms often indicates the popularity of platforms and the trust of users in them.

- Credit rate. It is worth choosing sites with minimum annual interest on the lending. They will help you save on loan repayments.

- The level of loan collateral. It is necessary to choose sites with an LTV of at least 50%. Otherwise, the cryptocurrency loan will not make sense.

- Liquidation level. It affects the risk of the lending site. The higher the level, the better.

- Borrower rating. This is an optional parameter. However, the presence of such a rating allows you to immediately select more responsible borrowers. Otherwise, the earnings from the lending can be minimal.

Possible risks

They are associated with a small number of credit offenses. Part of the platforms have technical vulnerabilities, and fraudsters can find methods to steal money from investors. However, such a thing happens very rarely.

Part of the brokers have funds. They use insurance to reimburse clients for damages that happened due to insufficient security of the platform.

More risks are associated with the volatility of cryptocurrencies. A decline in the rates of digital assets leads to an increase in mandatory loan collateral. Borrowers then need to increase the amount of collateral. If it is not returned to the old LTV level, the platform will transfer the digital loan collateral to the lender.

Pros and cons of cryptocurrency lendings

The advantages and disadvantages of digital lending are listed in the table.

| Pros | Minuses |

|---|---|

| Fast processing. A cryptocurrency secured loan can be taken in 5 minutes. At the same time, borrowers do not have to provide any documents. | High risks. Cryptocurrency lending can be dangerous during periods of high volatility. |

| The services of official organizations are not needed. Lending is possible online with the help of private lenders and brokers. | Scammers. Although their number is very small, you need to use only popular reliable services. |

| Small annual rate. Conventional banks charge high interest on loans. | |

| You don’t need a credit history to get a loan. Brokers and investors do not request it. |

Sammenfatning

Cryptocurrency lending is a method of private lending. The method involves loans by some investors to other investors. The services of brokers are used to conduct loan transactions.

Lending is characterized by low interest rates and often favorable terms for both parties. For example, a borrower can deposit an existing cryptocurrency as collateral and borrow another to generate income.

For 2023, there are 2 types of digital lending:

- Conventional. This type of cryptocurrency lending involves interaction with specialized services, such as Nexo. Often they do not use a mediation scheme and issue loans to customers themselves. Usually such platforms support fiat currencies.

- Exchange. This type of lending involves the use of popular cryptocurrency systems, for example, Binance. The developers of some such platforms create services for issuing loans with a mediation scheme. Usually, they provide the opportunity to directly receive loans or collect customers’ investments to provide margin and credit accounts. However, cryptocurrency ecosystems do not allow users to work with fiat.

Ofte stillede spørgsmål

❓ What is cryptocurrency lending?

It is a lending method (often through brokers) in the world of digital assets.

🔧 What are the parameters to consider when borrowing cryptocurrencies?

You need to take into account the main characteristics – LTV and liquidation rate.

💻 Which exchange platforms for lending are better?

Binance, Gate.io and OKX digital ecosystems are more popular.

💲 For what purposes can you borrow cryptocurrency loans?

For almost any purpose. Borrowed coins can even be sold and withdrawn into fiat (if such an option is available on the chosen platform).

❗ What LTV is considered good?

The indicator of this parameter should not be less than 50%. The higher the LTV, the better.

En fejl i teksten? Fremhæv den med musen, og tryk på Ctrl + Kom ind.

Forfatter: Saifedean Ammousen ekspert i kryptovaluta-økonomi.