Digital assets are an entire ecosystem. Bitcoin is the first cryptocurrency. Now, as of November 2021, there are already more than 7300 coins and symboler. All cryptocurrency other than bitcoin is called alternative cryptocurrency. Digital assets differ in purpose, mining method, algorithm. At the same time, bitcoin leads in terms of coin price and capitalization. Not all altcoins reached popularity, some of them closed. Others, on the contrary, have become the centers of separate ecosystems, DeFi applications(decentralized finance) are implemented on their basis, various projects operate.

The main types of cryptocurrencies

Digital assets are distinguished by a number of features, among which it is worth highlighting:

- Consensus algorithm or the way of confirming transactions.

- The type of blockchain.

- The level of centralization and other features.

By the method of confirmation of transactions

To exclude double spending in a distributed network, a consensus algorithm is used. There are many options for confirming transactions. Some of them are popular and are used in various digital assets, while others are little-known and are implemented in a few projects. Among the main ways of confirming transactions are Proof-of-Work of different factors:

- Proof-of-Work (PoW) – of work performed.

- Proof-of-Stake (PoS) – shares of ownership.

- Proof-of-Capacity (PoC) – resources.

- Proof-of-Importance (PoI) – importance.

- Proof-of-Activity (PoA) – authority.

- Proof-of-Authority (PoA) – reputation.

- Proof-of-Burn (PoB) – burns.

Among the above algorithms, PoW and PoS are in demand.

The Proof-of-Work algorithm is implemented in the Bitcoin network, Gafler based on it. Thanks to the first cryptocurrency, this method of confirming transactions became widespread. The essence of the algorithm is the solution of a complex mathematical problem by the nodes of the network. The result of the work is verified by other participants. When validated, the block is entered into a distributed register, and the miner receives a reward. To make a profit, it is necessary to be the first to find the correct solution to the cryptographic problem and validate transactions. This requires productive equipment: home PCs can no longer cope with Minedrift.

5020 $

Bonus til nye brugere!

ByBit giver bekvemme og sikre betingelser for handel med kryptovaluta, tilbyder lave provisioner, højt likviditetsniveau og moderne værktøjer til markedsanalyse. Den understøtter spot- og gearet handel og hjælper begyndere og professionelle handlere med en intuitiv grænseflade og vejledninger.

Optjen en 100 $-bonus

for nye brugere!

Den største kryptobørs, hvor du hurtigt og sikkert kan starte din rejse i kryptovalutaernes verden. Platformen tilbyder hundredvis af populære aktiver, lave provisioner og avancerede værktøjer til handel og investering. Nem registrering, høj transaktionshastighed og pålidelig beskyttelse af midler gør Binance til et godt valg for handlere på alle niveauer!

On this algorithm, other cryptocurrencies, except bitcoin, can be next:

The disadvantages of the algorithm are energy costs. Part of it is meaningless – there are many nodes working on the task, the solution is found only by one. Network security is achieved with a large number of miners who fight among themselves for rewards. Otherwise, a 51% attack is possible, when the user gains control of the network.

PoS – Proof of Share Ownership. A popular algorithm in which the validators are the owners of koins. No need to solve complex problems, hardware power requirements are lower than with PoW. To become a validator in a PoS-based blockchain, you need to block coins. Payment depends on the amount of work. The system gives priority to those who have blocked a lot of coins. Advantages of PoS: high transaction speed, low computer performance requirements (compared to PoW).

Popular cryptocurrencies whose blockchain is based on the PoS mechanism:

Proof-of-Capacity algorithm – a mechanism that allows you to use a hard disk for calculations. It is an alternative to the energy-intensive PoW method. The free space of the hard disk drive is used to confirm transactions. The basic principle is that the larger the HDD volume, the higher the probability of rewarding the work. Examples of cryptocurrencies with this mechanism are SiaCoin, Storj, Filecoin.

Proof-of-Importance. This method was first implemented in the blockchain of the NEM platform. The node that confirms transactions gets a share of the commissions. The right to harvesting (encouragement in the protocol) depends on the volume of XEM – at least 10,000 coins are required.

Validation is done by software (PoA), by looking for proof of coin burning (Slimcoin) and other methods.

By blockchain type

The distributed ledger is used in different spheres. Besides finance, it is banking, voting, goods control, data exchange and other areas. There are different types of blockchain:

- Public – an open or fully decentralized network. All participants have equal rights, there is no common governing body. Development, transactions take place under the supervision of trusted nodes (depending on the confirmation algorithm used).

- Private – a closed network. Access to it is by agreement and invitation only. Examples of a private blockchain include a private company network or a voting application.

Pseudo-centralized

Cryptocurrencies are based on the principle of a distributed ledger. Popular coins belong to the decentralized type. Information about all transactions is stored on each full node of the network. It cannot be destroyed or changed. The user has access to the full database, that is, to the entire history of the blockchain. There is no control center. An important feature: transactions cannot be canceled, deleted. The principle of immutability is the main one in the blockchain.

In the cryptocurrency market, in addition to bitcoin, there are pseudo-centralized digital assets. In such networks, transactions are confirmed not by validators, but by a pool of nodes. For example, in the EOS blockchain, this is done by a pool of 21 participants. The pool of users disposes of investments and makes important decisions for the system.

The main criteria of pseudo-centralized networks:

- A single center manages the project.

- Coin mining is performed by the project owners.

- Transactions are verified by individual users.

- It is possible to cancel a transfer, block the wallet.

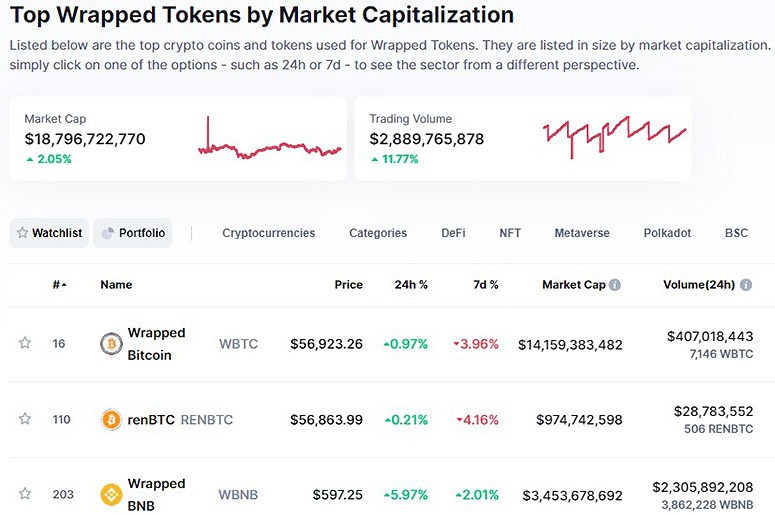

Types of tokens

Digital assets – this is a collective name, which includes cryptocurrencies and other elements. Token differs from coins in the absence of its own blockchain. At the same time, it is a unit of account, it is a record in a distributed register. Token management is realized with the help of smarte kontrakter.

For a better understanding of the essence of this term, you can use analogies from real life. For example, a token is a gift certificate or a token for playing machines. It has a value, it is tradable. But for tokens you can not buy goods in other systems (stores, entertainment centers). It is applied only within one network.

Non-interchangeable tokens

Tokens are issued as part of the project. They serve as a payment instrument, confirm rights to assets, and are used to collect investments.

Depending on the purpose, there are different types of cryptoassets:

| Tokens | Description |

|---|---|

| Applications (AppCoins) | Serve to access various services within the system. For example, the Sia project exists for decentralized file storage. To access its services, you need to buy Siacoins tokens. |

| DeFi | Decentralized finance is an ecosystem of blockchain-based instruments. The main objective is to replace the traditional banking sector. Most of the applications are based on Ethereum blockchain. An example of DeFi tokens is DAI from the MakerDAO service, offers cryptocurrency lending. |

| Leveraged tokens. | A trading instrument that represents a token with fixed leverage. Can be linked to any crypto asset. Issued by exchanges, used by traders. |

| Non-Futurable (NFT) | Unique tokens. They are used to digitize various tangible and intangible objects. NFTs are smart contracts that confirm ownership of assets. They help to register copyrights for any object. |

| Investment tokens (security tokens) | Provide income to their owner. They are intended for investments. |

| Utility tokens | Used to provide access to company products or services. Allows you to vote for network management. |

| Udveksling | Highly specialized tokens, used within the issuing platform. They are used for internal tasks: payment of commissions, transactions between system members, purchases on partner sites. |

| Payment tokens | A means for settlements. |

Top 10 most popular cryptocurrencies, except bitcoin

The total number of digital assets (as of November 2021) has exceeded 7000. Not all of them are widespread like bitcoin and other altcoins. Many coins are unknown to users, their capitalization is $0. Some, on the contrary, are popular, their price and volume are growing every day.

Top 10 cryptocurrencies other than bitcoin by capitalization:

- Ethereum.

- Ripple.

- Solana.

- Binance Coin.

- Tether.

- Cardano.

- Polkadot.

- Terra.

- Avalanche.

- Dogecoin.

The rating is based on information as of November 12, 2021. The volume of the first cryptocurrency in the list ($562.77 billion) is greater almost 15 times than the capitalization of the last one ($34.82 billion).

Ethereum, a blockchain project, is firmly in second place after Bitcoin in terms of popularity and capitalization among all digital assets. It was realized by Canadian-Russian programmer Vitalik Buterin. The Ethereum blockchain serves as the basis for its own eponymous cryptocurrency, creating applications, smart contracts, and DeFi projects. Ethereum blockchain operates on 2 protocols – PoS and PoW.

Ripple is one of the most popular cryptocurrencies, occupies the honorable 3rd place in the ranking by capitalization level. The developers of Ripple were not satisfied with the huge power consumption when mining BTC. That’s why they used a different consensus confirmation algorithm from bitcoin. The program code was written from scratch. The main goal is a cheap and fast alternative to existing electronic payment systems. On the Ripple blockchain, the XRP coin is implemented. The management company Ripple Labs controls about 55% of koins.

Solana is a project based on its proprietary Proof-of-History (PoH) consensus validation algorithm. The goal is to build a convenient and scalable high-speed information transfer protocol. The Solana network blockchain serves as a basis for writing decentralized applications. The processing speed is up to 60 thousand transactions per second. The authors announce even more capabilities – up to 710 thousand transactions. This is one of the fastest platforms.

Binance Coin is a native token of the largest crypto exchange. Initially, it was used for discounts on the platform’s services. The token was issued on the basis of the Ethereum network for the ICO of the Binance exchange. Subsequently, its own blockchain Binance Chain (BC) was implemented, crypto-assets were transferred to it. Since September 2020, a distributed Smart Chain registry with the ability to create smart contracts is available. Blockchains function in parallel and support the BNB coin. BEP-2, BEP-20 standards are used.

Tether is a popular stablecoin, backed by US dollars. Several blockchains (Bitcoin, Ethereum, TRON, EOS, Solana and others) are used for generation. In other words, USDT is a digitized dollar, provides entry and exit for fiat assets into crypto trading. The target audience of the project: traders, investors, exchanges, blockchain companies.

Cardano is one of the main competitors of Ethereum. The project belongs to the former authors of Etherium Jeremy Wood and Charles Hoskinson. These are colleagues of Vitalik Buterin, who disagreed with him in their views on the further development of the blockchain. The Cardano platform is called the Japanese Ether by the localization of the bulk of investors. ADA coin is deployed on the blockchain. The main goal of the project is to create smart contracts and develop decentralized applications, including DeFi.

Polkadot is another cryptocurrency realized with the participation of former Ethereum creators. Gavin Wood together with a team of programmers developed an entire ecosystem that combines different blockchains into one network, allows data exchange. Polkadot is considered the “killer” of Ethereum, just as the latter was called the main competitor of Bitcoin.

Terra is a decentralized payment system for fast transfers. The blockchain specializes in stablecoins. Terra’s ecosystem includes the cryptocurrency LUNA and stablecoins UST, SDT, KRT and others. Stablecoins are mined by destroying LUNA and vice versa. In this way, the cryptocurrency exchange rate is equalized.

Avalanche. The first digital assets do not cope with the load on the network, have problems with scalability. This project brings a fast-performing platform to the market. De-Fi products, NFT games, decentralized applications are created on the basis of Avalanche. A proprietary PoS-based consensus protocol is used. Each application exists in a personal subnet. Avalanche is the first platform with transaction speed of less than 1 second. Avax – the proprietary coin of this cryptocurrency network.

Dogecoin – the project was launched as a parody of one of the popular memes on the Internet with the image of a dog of the Shiba Inu breed. Thanks to the support of Ilon Musk, the network, created in 2013, entered the top 10 largest by capitalization by 2021. In terms of its functionality, the cryptocurrency does not differ from bitcoin, copying it. However, unlike first-generation digital assets, Dogecoin uses an inflationary economic mechanism. The coin has an unlimited number of offerings.

There are also other cryptocurrencies other than Bitcoin and the presented list of top 10 coins.

Ofte stillede spørgsmål

🧾 Why is there no Litecoin in the top 10 digital assets?

The criteria for getting on the list is based on capitalization level. Litecoin was in 17th place at the time the list was compiled (as ranked by CryptoProGuide.com).

💰 How many Ripple coins can be issued?

The issuance of the cryptocurrency is done even before the market. A total of 100 billion coins have been issued, there will be no more.

❓ Is it true that stablecoins are 100% backed by fiat?

According to the developers’ statement, all stablecoins are backed by dollars, euros and other currencies. There are also stablecoins backed by precious metals and other digital assets.

💡 What does the name Cardano mean and why is the project coin called ADA?

Cardano is a famous Italian mathematician. The ADA coin is named after Ada Lovelace, the first programmer of the 19th century.

🔎 How to choose a cryptocurrency for investment?

A comprehensive approach is used. Determine the value of the cryptocurrency project, study the legality of the coin, analyze historical data. All information is presented on the CryptoProGuide.com website.

Er der en fejl i teksten? Fremhæv den med musen, og tryk på Ctrl + Indtast

Forfatter: Saifedean Ammousen ekspert i kryptovaluta-økonomi.