Since 2009, there have been many alternative coins besides Bitcoin. Some are similar to it, others are based on completely new platforms. Competition among cryptocurrencies is growing, but BTC still leads at the end of 2021, ranking first in terms of capitalization. Bitcoin analogs are created to solve scalability problems that have arisen with the growing popularity of the coin and the load on the network.

Why you should invest in more than just BTC

When investing money in any assets, there is a risk of depreciation. Proper portfolio diversification is to allocate capital across different cryptocurrencies to achieve the following goals:

- Protect against high volatility by dispersing risk. If one coin goes down in price a lot, it prevents you from losing all of your capital due to a bad trade.

- Asset diversity by including coins from different segments of the cryptocurrency market such as: decentralized applications (DApps), DeFi financial instruments, and stablecoins.

- Increased profitability in case of a hype demand for a promising coin.

Split investments reduce overall risk by overlapping losses from some positions with gains from others. Not all assets can be profitable, but if invested correctly, the chances of additional funds increase. Spreading out investments yields returns more often than concentrating them. Managing such a portfolio requires time and careful consideration.

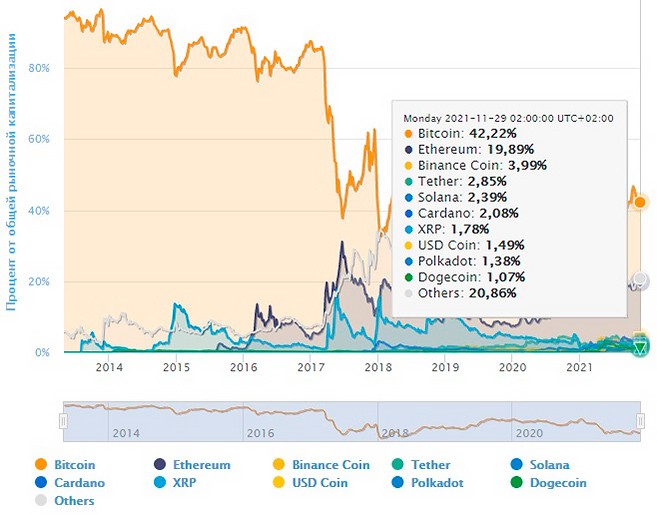

Bitcoin’s dominance is decreasing every year, giving way to new projects.

The concept and prospects of Bitcoin forks

The basis of the cryptocurrency is distributed ledger technology, which involves the continuous creation of a chain of blocks with encrypted transaction data. When difficulties or vulnerabilities are identified, the project community makes a decision to update the blockchain algorithm.

Bitcoin has a BIP system that allows participants to make suggestions for improving the protocol. If the initiative is approved by 95% of the community, the new rules of operation are adopted. If there is a split, then there can be a branching of the chain into 2 independent networks within the same blockchain. This is called a hardfork. As a result, a new analog of cryptocurrency emerges.

5020 $

Bonus til nye brugere!

ByBit giver bekvemme og sikre betingelser for handel med kryptovaluta, tilbyder lave provisioner, højt likviditetsniveau og moderne værktøjer til markedsanalyse. Den understøtter spot- og gearet handel og hjælper begyndere og professionelle handlere med en intuitiv grænseflade og vejledninger.

Optjen en 100 $-bonus

for nye brugere!

Den største kryptobørs, hvor du hurtigt og sikkert kan starte din rejse i kryptovalutaernes verden. Platformen tilbyder hundredvis af populære aktiver, lave provisioner og avancerede værktøjer til handel og investering. Nem registrering, høj transaktionshastighed og pålidelig beskyttelse af midler gør Binance til et godt valg for handlere på alle niveauer!

| Update type | Description |

|---|---|

| Softfork | A protocol update where new blocks are validated by all nodes and included in the shared registry. |

| Hardfork | The splitting of the blockchain into 2 branches due to a global protocol update. Subsequent blocks cannot be validated by all nodes in the network due to software incompatibility. The two chains begin to exist in parallel, losing compatibility between them. |

The first analog of BTC that was created to change the imperfect scalability of bitcoin was Litecoin. It was based on the same principles and code base, but offered a new hash finding function, increased block size and coin issuance.

The most famous branching within the original Bitcoin blockchain happened on August 1, 2017, when a split among miners resulted in a new cryptocurrency, Bitcoin Cash.

It increased the block size from 1MB to 8MB, expanding network bandwidth. After existing for a little over a year, Bitcoin Cash itself split into 2 cryptocurrencies. These are Bitcoin ABC, which as a result of the update started working with smarte kontrakter and a modified method of storing records in the blockchain, and Bitcoin SV. The team of the latter called themselves true followers of Satoshi Nakamoto and remained to function on the canonical principles of the world’s first cryptocurrency with an increased block size.

Despite all the innovations, these forks have not been able to compete with the classic bitcoin and, according to data as of the end of November 2021, are significantly losing to it in market capitalization:

- BTC – $1.1 trillion.

- Bitcoin Cash ABC – $ 2.2 billion.

- Bitcoin SV – $2.8 billion.

The most promising analogs of Bitcoin

Over the past 12 months, the volume of the crypto market grew 5 times, reaching $2.5 trillion at the end of November 2021. The main growth leader was not Bitcoin. Now the most impressive results are shown by projects focused on cross-blockchain integration and creation of decentralized applications.

Solana (SOL)

Innovative concept of multi-threaded parallelization of transactions, provides very high throughput – up to 50 thousand operations per second. A critical element of the future DApps ecosystem.

The growth of SOL coin rate for 2021 amounted to 19 thousand percent.

Terra (LUNA).

Decentralized instant settlement network with a link to stablecoins. This allows digital assets to be integrated into a financial system where users will not feel uncomfortable paying for goods with cryptocurrency. The two-way exchange takes place without any client involvement on the platform side.

The growth in the value of LUNA for 2021 is fixed at 7.5 thousand percent.

Chainlink (LINK).

An “oracle” system that allows verification and input of information from events outside the blockchain into smart contracts. The project is being actively developed and embedded in the DeFi sector as the technology brings real value and advances the field of decentralized finance.

LINK’s growth for 2021 is 200 percent.

Avalanche (AVAX).

A fast-growing smart contract conclusion platform that differentiates itself from Ethereum with high speed and efficiency based on Snow protocols. The developers’ global goal is to create a single financial market where users can perform the entire list of transactions without involving third-party resources. AVAX growth for 2021 is 3.1 thousand percent.

Elrond (ELGD)

The project is positioned as the future of the Internet of Things, with the advantage of high scalability. It is the first blockchain where segmentation is performed. At the moment there are 3 executive and 1 coordination. If there is a shortage of bandwidth, new sections can be easily added without compromising the stability of the core network. EGLD has a growth rate of 1.5 thousand percent for 2021.

Ethereum (ETH)

In 2022, the transition to an updated version 2.0 network should take place. Such a move is designed to address the blockchain’s scalability issues and change the transaction confirmation method from Proof-of-Work to Proof-of-Stake. This will raise Ethereum’s network capacity and lower fees, which should support the cryptocurrency’s growth in the future. The growth for 2021 is 560 percent.

Criteria for choosing a cryptocurrency to invest in

For profitable investments, it is necessary to carefully and scrupulously approach the search for promising projects. First of all, it is important to familiarize yourself with the development team and their product. This information can be found on the official website of the project and in the White Paper. The White Paper should describe in detail the task and the tools with which it will be solved. There is a small investor checklist for evaluation:

- Is there a working prototype. In cryptocurrency projects, this means whether the idea is already being tested.

- Progress on the roadmap. Whether the timeline and order of milestones that are outlined in the document are being followed.

- Community. To find out how the project itself is evaluated by the participants and how fast the communication with the developers is going.

ICO is an innovative way to attract investment in a project by selling the first coins issued at a fixed price. This happens through smart contracts with automatic execution. Participants who believe in the idea invest money in exchange for symboler, and after the final product is realized, they sell them at a profit at the beginning of the listing.

In addition, uniqueness is analyzed in comparison to already existing counterparts. If it is not possible to select a promising idea at the stage of initial placement, it is worth looking at already launched coins that are traded on exchanges. Here, important indicators will be the volume of trades, transactions and capitalization. This allows you to understand liquidity and interest among investors.

The distribution of assets in the portfolio is not only by risk and profitability, but also by urgency. For example, projects gaining popularity in the information space (“meme” coins) are recommended for short-term investments (up to 2-3 months). Often the buildup is artificial, and it is followed by a decline, as it happened with Dogecoin. Having received great support in a tweet from Ilon Musk, the cryptocurrency briefly showed a growth of 200 thousand percent, after which it promptly fell 3 times from its historical maximum.

Adjustment of selected assets in the investment portfolio should take place regularly, at least once a month. This will allow you to get rid of coins that did not meet expectations, and redirect the freed up resources to buy new promising cryptocurrencies.

Ofte stillede spørgsmål

❓ What is volatility?

Sharp fluctuations in the value of an asset over a short period of time. The higher this indicator, the greater the losses or gains that can be made.

💰 How is the price of cryptocurrency formed?

It depends on the supply and demand in the market. If there are more buyers than sellers, the price moves up and vice versa. Demand depends on the usefulness of the product itself, which the project offers, and the information field around it. If the publications are positive, it encourages the purchase of the asset.

✅ Where is it better to buy cryptocurrency?

🔑 How do new bitcoins appear?

Through mining, as a reward for the resources spent to generate new blocks and validate transactions. Total issuance is capped at 21 million coins. It is estimated that the last BTC will be mined in 2140.

💡 Who manages bitcoin?

It is a decentralized project that is not overseen by a group of people or the government. It requires the peer approval of at least 95% of the network to make changes to its operation.

Er der en fejl i teksten? Fremhæv den med musen, og tryk på Ctrl + Indtast

Forfatter: Saifedean Ammousen ekspert i kryptovaluta-økonomi.