Many people have made widely varying and contradictory predictions about Bitcoin. However, in 2013, one of the users of the Reddit content platform published a prediction mentioning bitcoin. According to this person, fiat money will cease to be quoted in the future. It is useful for participants of the cryptocurrency community to know what this prediction was and what the rate of the main digital coin actually depends on.

What factors affect the value of Bitcoin

BTC is considered the strongest and most independent asset in the crypto market. It is not tied to fiat currencies, so almost all models of evaluation of the traditional economy are inapplicable to Bitcoin. The bitcoin exchange rate is influenced by, for example:

- The general state of the BTC market.

- The degree of confidence in digital assets.

- Minedrift.

- The development of altcoins.

- Critical situations in the traditional economy.

General state of the BTC market

The news background has a great impact on the bitcoin price. Positive and negative headlines in the media appropriately affect the price of the coin. Investors are usually aware of upcoming events and current news. They need this to conduct fundamental analysis of the cryptocurrency.

The louder and more anticipated the event, the stronger the impact of the news on the digital asset.

Since 2020, the interest of institutional investors (large companies) in the cryptocurrency market has increased a lot. They started investing big money in digital assets to preserve capital amid fiat inflation due to the Covid-19 pandemic. This fact inevitably caused the rise of Bitcoin. In 2021, the largest institutional investor in bitcoins from the top 10 is MicroStrategy. It is engaged in business research, cloud solutions, and data analytics software development. As of Dec. 2, MicroStrategy owns 114,042 BTC, which is worth $6.46 billion.

5020 $

Bonus til nye brugere!

ByBit giver bekvemme og sikre betingelser for handel med kryptovaluta, tilbyder lave provisioner, højt likviditetsniveau og moderne værktøjer til markedsanalyse. Den understøtter spot- og gearet handel og hjælper begyndere og professionelle handlere med en intuitiv grænseflade og vejledninger.

Optjen en 100 $-bonus

for nye brugere!

Den største kryptobørs, hvor du hurtigt og sikkert kan starte din rejse i kryptovalutaernes verden. Platformen tilbyder hundredvis af populære aktiver, lave provisioner og avancerede værktøjer til handel og investering. Nem registrering, høj transaktionshastighed og pålidelig beskyttelse af midler gør Binance til et godt valg for handlere på alle niveauer!

In 2021, the remuneration for creating new links in the Bitcoin blockchain is equal to 6.25 BTC. The payment is systematically halved on a programmatic level. The reduction of the reward is done without the participation of developers every 4 years. This process is called halvering. There is also a trend that after each reward reduction, the price of BTC rises. Due to the knowledge of this trend, analysts create predictions about bitcoin. The next halving is expected on May 11, 2024. The reward for creating new blocks will be reduced to 3.125 bitcoin.

The U.S. Securities and Exchange Commission (SEC) approved several applications to register funds to trade Bitcoin-ETFs (futures contracts) on October 18, 2021. The regulator’s decision has increased the flow of money into the cryptocurrency market from institutional traders. However, Bitcoin-ETF was discussed back in mid-2018. Users have been waiting for this event for about 40 months.

On the Bitcoin network, the Taproot update was activated on November 14, 2021. It brought 3 significant improvements to the old blockchain.

| The innovation | Description |

|---|---|

| Increased privacy | Composite transactions with multiple addresses can no longer be tracked |

| Improved scalability | Making smart contracts has become easier. However, in the cryptocommunity this event is not considered the beginning of the decline of Ethereum. |

| Reduced fees | More transactions can fit in a single block thanks to the new signature algorithm MAST (“Merkle Abstract Syntax Tree”). The mechanism also speeds up the processing of BTC transfers. |

Bitcoin on November 10, 2021 set a new historical high price at $68,600. After the natural correction of quotations to $54,000 began. However, this fact did not embarrass institutional traders. According to the largest European investment house CoinShares, from November 13 to November 20, 2021, large companies additionally invested about $154 million in the cryptocurrency market.

Degree of confidence in digital assets

In a general sense, the price of Bitcoin is influenced by the number of its users. Public trust plays an important role in this. For example, in 2021, people became more loyal and interested in cryptocurrency assets. Part of the increase in confidence was triggered by another rapid growth of Bitcoin and the renewal of the historical maximum price on November 10 – $68,600.

Also, the public’s loyalty to the cryptocurrency market increases over time. People begin to trust BTC more when its price stays at the same level for a long time or rises for an extended period of time. On the contrary, when the value of the coin collapses sharply, a negative attitude towards bitcoin as a “burst bubble” will prevail among the public.

Minedrift

Another major factor that strongly influences the market price of bitcoin is the cost of production according to the Cost of Production analysis model. It allows you to make predictions about Bitcoin and understand how expensive it is to mine 1 BTC.

For mining, nodes use hardware like video cards or ASICs (efficient computer hardware that is configured to perform calculations using only one hashing algorithm). These require a large amount of energy. Because of this, electricity fees make up the main cost of Bitcoin mining. Other expenses include the purchase of equipment and its customization.

The number of miners in the Bitcoin blockchain is constantly growing. However, the rate of issuance of new cryptoassets does not increase. This is explained by the algorithm for regulating the complexity of mining.

This indicator determines the required number of calculations to create a block in an average of 10 minutes. Every 2,016 links of the chain, the regulation algorithm checks the speed of their generation. If it has become higher, the complexity of mining increases, and vice versa.

Altcoin development

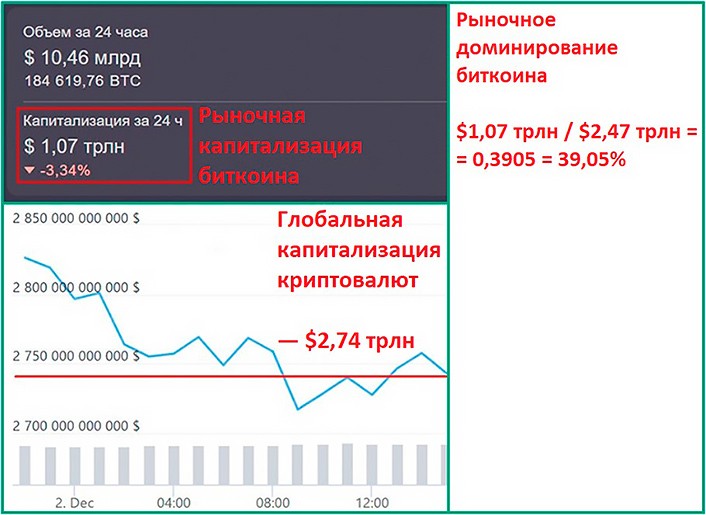

In the cryptocurrency world, there is a concept of “market dominance”. It actually means the share of a particular digital asset of the global capitalization of all coins and symboler. As of December 2, 2021, bitcoin dominates all cryptocurrencies. Its network value has a share of 39.05%.

Bitcoin’s market dominance figure is gradually decreasing due to the progress of altcoins. Bitcoin’s blockchain is based on old and poorly developed technology. This knowledge allows analysts to make accurate predictions about Bitcoin.

New digital projects, on the other hand, often offer better solutions and conditions for their users:

- Low transaction fees in the system.

- Fast transfers.

- Anonymity.

- New technologies.

- High security and other.

In this regard, altcoins are proving to be a more promising investment for investors. Money is flowing from Bitcoin to other digital projects, which entails a decrease in its market dominance and price.

Critical situations in the traditional economy

Since the end of 2020, the quotes of all cryptocurrencies have been rising. Some experts believe that the price increase is directly related to the attempts of institutional investors to protect their capitals. Specifically, they consider Bitcoin as an asset for saving funds and making profits.

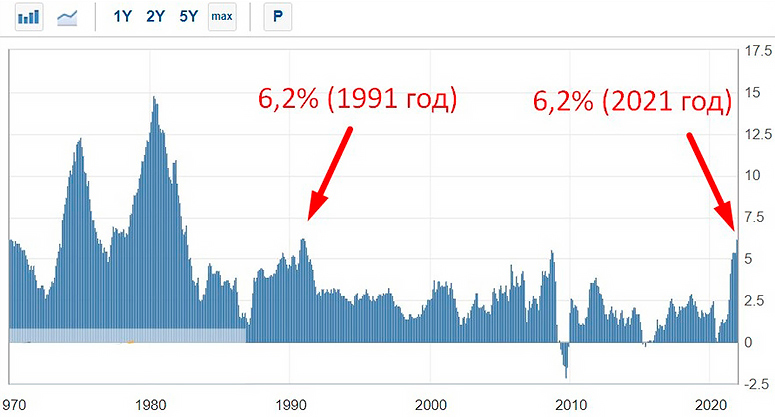

In December 2021, institutional investors are protecting their capitals due to a sharp decline in the purchasing power of the U.S. dollar. Over the past 12 months, the figure has fallen by 6.2%. The previous similar decline was recorded in 1991.

Over the 2020-2021 period. The US Federal Reserve (analog of the Central Bank of Russia) according to various estimates printed about $17 trillion, including to support the population during the pandemic Covid-19, and the total national debt of the country amounted to $29 trillion. This fact, coupled with 6.2% inflation, makes the U.S. dollar a less reliable asset for saving capital in the eyes of institutional investors.

Major players have changed the way they look at bitcoin. The cryptocurrency has begun to be seen as an inflation hedge.

Prediction on the value of bitcoin in 2025

In 2013, a user of the Reddit content platform under the nickname Luka_Magnotta published a “letter from the future”. In his post, this person introduced himself as a time traveler and talked about the terrible consequences of bitcoin development. According to Luka_Magnotta, in 2025 the hands of rich people will be covered with blood because of greed. This user’s BTC prediction also states that just 0.01 bitcoin will become a fortune enough for a lifetime.

Ofte stillede spørgsmål

❓ What are the main factors that have a major impact on BTC?

Bitcoin quotes depend on a number of indicators. However, the main ones are:

- The state of the BTC market.

- The degree of confidence.

- The cost of production.

- The development of altcoins.

- Critical situations in the traditional economy.

❗ Can institutionalizers manipulate the price of bitcoin?

It is theoretically possible, but Bitcoin’s market capitalization is too large ($1.07 trillion as of December 2, 2021). All institutional traders would have to sell their assets en masse or buy a large batch of BTC on a one-off basis to move the coin’s value.

🔎 How does halving affect the price of Bitcoin?

Halving the reward reduces the rate at which new coins are issued. By slowing down the issuance of BTC, halving creates a shortage of bitcoins on cryptocurrency exchanges and raises their price.

💡 Are the predictions from the “letter from the future” true?

By 2021, only one prediction has come true. In 2017 according to Luka_Magnotta bitcoin was supposed to trade at $10,000, but the value of the coin reached even $20,000.

✅ Why is the US Federal Reserve not afraid to print so many dollars?

The USD is a world currency that is used everywhere. A high degree of trust has been established in the dollar, because the history of the US has shown that the country has a stable economy.

Er der en fejl i teksten? Fremhæv den med musen, og tryk på Ctrl + Kom ind.

Forfatter: Saifedean Ammousen ekspert i kryptovaluta-økonomi.