When working in sideways trading, traders place limit buy orders at the bottom of the range and stop orders at the top (for flat breakout). It is inconvenient to open 2 orders – when one order triggers, you need to cancel the second one as soon as possible. Activation can happen at night or on weekends. That is why traders prefer to use the CCA order at Binance. When the first order is triggered, the second one is deleted automatically. The tool will be useful for limiting risk, entering and exiting positions. But to use it correctly, you need to understand the principle of its work.

Description of the CCA Order on Binance

One-Cancels-the-Other orders (in English – “one cancels the other”) can be used to open an order to fix a loss and profit at the same time. In other words, OCO at Binance places two mutually exclusive orders. The limit one is like a Take Profit and the stop order is like a Stop. When one part is executed, the second order is automatically deleted.

To place an order on the spot market, a check of the sufficiency of collateral is carried out. If two separate orders are created, double margin must be blocked.

This reduces the return on equity. Step-by-step instructions for activating a CCA order:

- Open a chart of the asset and conduct a technical analysis. Use it to determine the levels of entering the deal and fixing the loss.

- Go to the spot terminal, find a coin (OCO orders are not supported on futures).

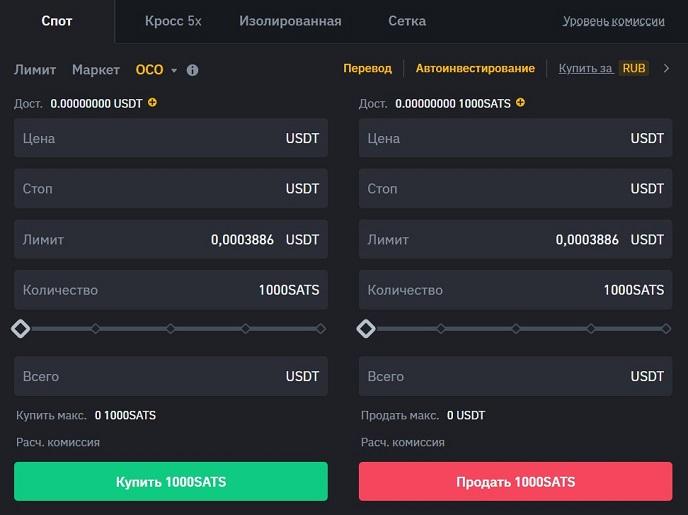

- Select OCO in the order window.

- Specify the limit price at which the asset will be automatically sold or bought.

- Enter the trigger and order quotes at which the order will be executed.

- Fill in the “Quantity” field. The amount is specified in USDT.

- A pop-up window with information on the transaction will appear. At the bottom of the page there is a tooltip with the details of the CCA order operation. Experienced users can hide the instruction. To do this, you need to click on the “Do not show anymore” button.

- Check the details and confirm the transaction.

Parameters

One of the advantages of CCA orders on Binance is the automation of trading. The cryptocurrency market is very volatile. Therefore, when placing two separate orders, it may happen that both orders are executed. This will disrupt the user’s plans and increase risks. Twice as many coins will be bought/sold as the strategy allowed. Therefore, it is better to use OCO orders. To do this, you need to fill out a form. It will be necessary to enter such parameters:

5020 $

Bonus til nye brugere!

ByBit giver bekvemme og sikre betingelser for handel med kryptovaluta, tilbyder lave provisioner, højt likviditetsniveau og moderne værktøjer til markedsanalyse. Den understøtter spot- og gearet handel og hjælper begyndere og professionelle handlere med en intuitiv grænseflade og vejledninger.

Optjen en 100 $-bonus

for nye brugere!

Den største kryptobørs, hvor du hurtigt og sikkert kan starte din rejse i kryptovalutaernes verden. Platformen tilbyder hundredvis af populære aktiver, lave provisioner og avancerede værktøjer til handel og investering. Nem registrering, høj transaktionshastighed og pålidelig beskyttelse af midler gør Binance til et godt valg for handlere på alle niveauer!

- Limit – the execution rate of the limit part of the order. It is necessary to specify the value below the market for buying and above – for selling.

- Stop – the level at which the market order is activated. For a long order it is necessary to enter a rate higher than the current one, for a short order – lower.

- “Limit ” – execution price of the pending order, it is activated only when the market reaches the Stop level. You can set any value according to the trader’s strategy.

- Transaction volume – the amount of cryptocurrency will be bought/sold when executing any part of the order.

Where it is displayed

When working using the site, unexecuted OCOs can be found in the “Open Orders” section. The order has the form of two orders (limit and stop) with the same creation time. Executed orders are displayed on the Trade History page.

In the mobile application OCO-orders are located in a similar section. They have the form of one order with two conditions. The user sees the trade volume and price levels for triggering. If one OCO is placed, the tab will display 2 orders (“Open orders (2)”). To view the executed orders, one should click on the icon at the top right.

How an OCO order works

Trading with linked orders helps traders to avoid overlapping positions, reduces time and effort for tracking executed orders. This reduces risks. The OCO order on Binance works like this.

In January 2024, bitcoin is trading at $39.9 thousand. Let’s say the user expects a correction to $35 thousand, but if growth continues without a pullback, the rate will go above $49 thousand. Therefore, the trader places an OCO order – regardless of the market direction, the position will be opened.

When creating the order, the user specifies the lot size in USDT. If the order is executed at a low price, more bitcoin will be bought.

Limit

If the rate reaches the execution, the transaction will take place. The stop order is automatically canceled. If the user changes his mind and removes the limit order, the second part of the order will also be removed.

Stop Limit

If a trader wants to buy bitcoin at a rate above $49 thousand, this value is recorded in the Stop field. In the “Limit” column, you should enter the price of the pending order – it will be activated only after reaching the stop level. The following values can be entered in the Limit block:

- Above the stop price – for long, below – for short. The deal will be executed immediately.

- Below the Stop level – for buying and above – for selling. The order will be executed at a price pullback. If the order is placed far from the stop value, the order may not be executed.

After successful execution of a Stop-Limit order, the order will be added to the order book at the “Limit” price, the second part of the order will be deleted. If the Stop-Loss is canceled, the Limit order will be canceled.

Tips for setting up an OCO order

Beginning traders most often use limit and market orders. But for realization of some strategies it is more convenient to use OCO-orders. This is a powerful tool for limiting risks and fixing profits. It is not difficult to understand how the function works. To set it up correctly, you should use the following recommendations:

- Limit price should be below the market for longs and above for shorts. Otherwise, the order is executed immediately.

- The Stop rate can be at any level depending on the user’s strategy. But most often CCA orders are set at the range boundary (order down, stop up or vice versa).

- One of the frequent variants of use is to create an order to fix a loss and profit in one order. In this case, the price of the stop loss limit should be as close as possible to the Stop level. This ensures that the trade will be executed. The trader will lock in a profit or exit the position with a small loss.

- The user can enter the price of the stop loss order well above/below the market. The trade will be executed at the current rate. Loss/profit fixing will definitely happen, but in a fast market large slippages are possible. Therefore, it is better not to place the order in this way.

- If a trader is in the cache and wants to buy a coin when leaving the sidewall, the level of stop-limit can be set at 0.5-1% below the Stop rate. This will allow you to save a bit of money and buy the coin at a good price.

Example of a CCA order

In January-September 2023, Ethereum was trading in the range of $880-2k on the weekly chart. Users could open trades from the boundaries of the sidewall in anticipation of its breakout.

In case of a breakdown, the price will continue to move with a high probability, so it is necessary to fix a small loss as soon as possible.

The table shows an example of filling in CCA orders. You can compare the levels for long and short.

| Parameters | Buy ($) | Sell ($) |

|---|---|---|

To buy

Let’s assume that the trader believes that the current consolidation is a respite before a new exponential growth. According to the forecast, the price will roll back to the level of $1.44 thousand, and then rewrite the annual maximum. If the expected correction will not occur, it is necessary to enter the market at the break of the sidewall. In this case, an OCO order with the following parameters is set:

- Limit – 1.44 th.

- Stop – 2 thousand, execution at the price of $1.95 thousand.

In this case, the entry level is just below the breakdown line. The first movement is often followed by a pullback. And only then the impulse continues. But in a fast market the correction may not occur. In order to open the deal accurately, you can set a stop-limit just above the activation price – $2.01 thousand.

To sell

In the following example, the trader is trading inside the sidewall. The sale is made on the signal on small timeframes. At the bottom of the range the profit is fixed, and at the break of the last low on D1 the loss is taken. A trader opens a short at the price of $1.8 thousand and sets an OCO order with the following parameters:

- Limit – $880. This is the take profit level.

- Stop – $2 thousand. When the level is reached, it becomes obvious that the forecast was wrong. It is necessary to get out of the deal as soon as possible to avoid a bigger loss. The user sets the stop-limit level a few points above the activation price. This guarantees a quick exit from the deal.

FAQ

🔔 Why can’t OCO orders be set up in the futures market?

It is not necessary. The user can add take profit and stop to any open position. No margin is blocked when placing the order, so the trader is free to create any number.

📌 What happens if an OCO limit order is partially executed?

Regardless of the amount of assets bought/sold on the order, the stop order will be canceled.

📢 Can the OCO order be used in the Binance mobile app?

The option is available on the website and in programs for smartphone, PC. To go to the spot trading terminal in the mobile app, you need to select the “Markets” section, click on the coin and click on the “Buy/Sell” button.

⚡ How to cancel a CCA order?

The Trade History section contains all created orders. The user can click “Cancel” against any order. To cancel all orders, the corresponding button should be selected.

🔎 What is the difference between “Stop Limit” and “Stop Market” orders?

In the first case, the trader specifies the price of an order that will be placed in the stack after reaching the trigger. When placing a stop-market order, the level does not need to be specified, the transaction is executed according to the market. This type of orders on Binance can only be used on futures.

Fejl i teksten? Fremhæv den med musen, og tryk på Ctrl + Kom ind.

Forfatter: Saifedean Ammousen ekspert i kryptovaluta-økonomi.