The rate of the main cryptocurrency in 2021 reached a record high and exceeded $69 thousand. In its history, bitcoin has grown in value by hundreds and thousands of percent annually. This has greatly changed the public’s attitude towards digital currencies. Bitcoin has become an asset worthy of attention. Investors are constantly waiting for the price of the coin to rise and hope for good profits in the future. But you can earn 1 bitcoin not only through exchange on the exchange. There are other ways of obtaining it.

Minedrift

Bitcoin mining is considered a lucrative niche. Miners receive the cryptocurrency as a reward for completing blocks of verified transactions that are added to the blockchain. To accomplish this task, nodes use specialized equipment around the clock. Miners earn income due to the fact that BTC issuance is continuous.

Network participants mined bitcoins with the help of graphics processors, but they were quickly replaced by more powerful mining systems (ASIC-farms). The profitability of nodes is affected not only by the rate of the main cryptocurrency. It is necessary to take into account electricity prices, the cost of installing mining farms, the complexity of the network, as well as the efficiency of the equipment. The user has to find the perfect bitcoin miner that offers the best hashing performance. The profitability depends on the price of the device, its shipping cost, taxes (if coin mining is regulated), and electricity consumption.

Due to the high costs and increasing complexity of Bitcoin mining, many participants use mining pools. This is an opportunity for small farms to make some profit and recoup the cost of equipment and electricity.

By creating a pool, miners pool their resources together, which increases the chances of being rewarded in bitcoins. When a block is mined, the income is distributed among the participants in proportion to the amount of computing power each person has invested. The pool is chosen based on important factors:

- Commissions. Participation fees are charged. Fees are taken from transaction confirmation fees and typically range from 0% to 4%.

- Size. The larger the pool, the more frequent the payouts. This is due to the hashing power. The higher it is, the more actively blocks are mined. It also means that payouts are shared among more participants. Smaller pools receive funds less frequently, but in significant amounts.

- Security. Miners are looking for a pool that will not steal user funds or be hacked.

Mining on video cards

This method of bitcoin mining requires the graphics processing unit (GPU) of a gaming computer. This method was popular a few years ago.

5020 $

Bonus til nye brugere!

ByBit giver bekvemme og sikre betingelser for handel med kryptovaluta, tilbyder lave provisioner, højt likviditetsniveau og moderne værktøjer til markedsanalyse. Den understøtter spot- og gearet handel og hjælper begyndere og professionelle handlere med en intuitiv grænseflade og vejledninger.

Optjen en 100 $-bonus

for nye brugere!

Den største kryptobørs, hvor du hurtigt og sikkert kan starte din rejse i kryptovalutaernes verden. Platformen tilbyder hundredvis af populære aktiver, lave provisioner og avancerede værktøjer til handel og investering. Nem registrering, høj transaktionshastighed og pålidelig beskyttelse af midler gør Binance til et godt valg for handlere på alle niveauer!

Costs

GPUs are cheap, and it is possible to run multiple graphics cards on a single motherboard, allowing you to mine several types of cryptocurrencies at once. Users also sometimes reconfigure their machines to hash different coins.

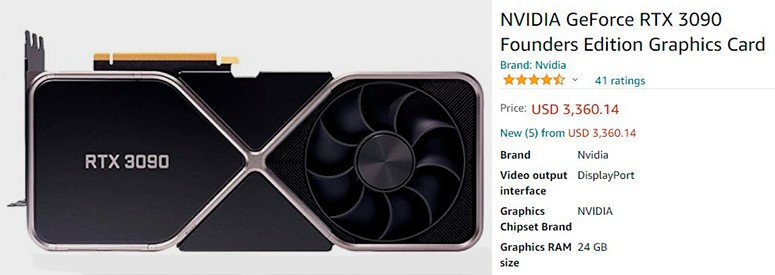

It is relatively easy to start GPU mining, especially if the user already has a computer with a gaming card. The main expense is the purchase and installation of the hardware. A GPU can cost thousands of dollars depending on its type.

Calculating Profits in BTC

It is impossible to calculate the potential earnings from GPU mining. As with any other cryptocurrency investment, there are risks involved. And it is almost impossible to make a profit from bitcoin mining on GPUs because of the low bandwidth of video cards.

It is difficult to predict the financial result because of constantly changing factors: the cost of electricity, the rate of cryptocurrency. The price of equipment also has a direct impact on the return on investment.

You can estimate the approximate profitability of mining on special calculator sites. These resources take into account many parameters: what coin is best to mine, with what graphics processor to do it and what profit the user can earn daily with a given electricity rate.

Mining on ASICs

In 2013, specialized devices took over the bitcoin mining industry. As a result, many participants switched their outdated graphics cards for mining altcoins.

In 2018, many cryptocurrencies were mined primarily using ASICs. Anyone mining coins using video cards has to compete with large pools.

These pools use ASIC hardware that is specially customized to solve complex cryptographic problems generated by blockchain algorithms. So going up against them with GPUs is virtually pointless and unprofitable.

ASICs are created strictly for cryptocurrency mining. This is the most efficient type of chipset. For example, a miner based on integrated circuits for one application has computing power equivalent to several hundred GPUs.

However, it is worth keeping in mind that each ASIC is designed to mine coins of a specific algorithm. It cannot be repurposed for other currencies.

Costs

It is impossible to buy one ASIC machine to mine a certain amount of bitcoins per month. For 2021, the best farm was considered to be the Bitmain Antminer S19 Pro model with a hash rate of 110 TH/s. The device was calculated to bring only 0.0293 BTC per month. It is possible to mine 1 bitcoin using 34 ASICs. Each consumes 3250 watts of power and costs between $2500 and $4500 depending on where and when you buy them:

| ASIC model | Purchase price per unit. | Cost of mining 1 BTC at the price of electricity | |

| 5.5 ¢/kWh | 3.5 ¢/kWh | ||

| Antminer S19j Pro, 100T | $14 000 | $19 965 | $17 796 |

| Antminer S19j, 90T | $11 000 | $17 736 | $15 286 |

| Antminer S19 Pro, 110T | $16 000 | $21 778 | $19 677 |

| Antminer S19, 95T | $12 000 | $18 690 | $16 257 |

| Avalon 1246, 90T | $10 000 | $17 431 | $14 729 |

| Avalon 1166 Pro, 81T | $9000 | $17 209 | $14 224 |

| Avalon 1066 Pro, 55T | $7000 | $18 556 | $14 354 |

Calculating the return in BTC

In terms of return on investment, $2500 equals about 0.16 BTC in December 2021. Using free electricity, the miner will pay off the farm in about 6 months. This is the best case scenario (lowest possible purchase price of equipment with the lowest electricity costs). And it is also assumed that the complexity of mining will remain constant. However, this factor varies and depends on how many people are mining. If more people join, the generation of BTC per month will drop.

Investments

Bitcoin is the most famous cryptocurrency. After 10 years of discussions, many big investors started to consider Bitcoin alongside traditional assets: stocks, gold.

The Bitcoin community is confident that cryptocurrency will grow in the future, as its issuance is limited, unlike the supply of fiat currencies: the US dollar or the Japanese yen. The full issue of BTC is 21 million coins, and the money, controlled by the central bank, can be printed at will by politicians. Many investors expect bitcoin to rise as fiat currencies depreciate.

The most common investment strategy for bitcoin is buy and hold. There is no need to worry about how to trade. It is possible to get 1 BTC on a cryptocurrency exchange. An investor simply buys bitcoins, transfers them to a wallet and securely stores a private key to access the address.

If the user buys BTC periodically, he also does not need to worry about the time to enter the market. The right time is “here and now”. People who actively trade cryptocurrency have to look for profitable positions every time they are going to buy it or sell it. This approach is stressful and requires more time. With the HODL (asset holding) strategy, you don’t have to wait for the market to start rising and look for a good buying opportunity.

Micro-earning without investing

There are a few different ways to grow your crypto portfolio. You can buy coins, exchange them, send them to staking. There are also methods of earning without having to invest.

Paid-to-Click

With the advent of cryptocurrencies, the number of opportunities to obtain BTC has increased. Paid-to-Click sites pay cryptocurrency for viewing ads.

The visitor’s task is to view ads that advertisers place on the page. Payment is made in bitcoins or the company’s own symboler. Once the user accumulates a minimum amount of BTC, he can withdraw his income. However, you can’t get a lot of money on such sites, even if they pay in bitcoins.

For example, the famous BTC Clicks service offers only one way to earn cryptocurrency – by viewing ads. Users are paid in mBTC ( 0.001 bitcoin). In monetary terms, as of October 2021, the value of 1 Bitcoin was $43,500, so 1 mBTC equaled $43.5.

The amount of mBTC that can be earned will depend on how long it takes a user to watch an advertisement. A 10-second commercial earns 0.00005 mBTC, while the longest (40 sec) yields 0.00008 mBTC. However, the number of ads on the BTC Click site is limited: 10-15. Thus earning 1 bitcoin is possible only after a long period of time. But there is no guarantee that the service will allow users to get the specified amount.

Cranes

Platforms that give users free cryptocurrencies for performing simple tasks: from passing CAPTCHA to watching ads. Rewards are paid out in satoshi equal to 0.00000001 BTC. Each platform has its own withdrawal limits.

When Bitcoin appeared in 2009, it didn’t generate much public interest. To spread the word about the cryptocurrency Bitcoin developers offered free coins for entering captcha on websites.

The first faucet paid 5 BTC for clicking on images. Over time, more participants appeared, and the profitability decreased.

When choosing a cryptocurrency faucet, you need to consider the following:

- The amount of reward: how many satoshis the user can earn and how often. In most cases, the more complex the action, the less frequently it is updated and the more expensive it is. Frequently repeated operations are usually useless.

- Frequency. Cranes have update times ranging from 15 minutes to one day.

- Minimum withdrawal. Many cranes will not allow money to be transferred to the wallet until the user has earned a certain number of satoshis.

- Withdrawal method. To receive funds, a digital wallet will be needed. However, some collectors have their own vaults available. Micropayment wallets are also provided specifically for withdrawing small amounts.

- Referral program. Cranes often offer quite good rewards for registering friends.

Fulfillment of tasks

There are many sites that give you the opportunity to earn free BTC. The user, viewing resources, receives a small amount of coins. However, the payback on the time spent is very small. Some services offer more complex tasks. For example, you can earn rewards in BTC for purchases or answer questions on the forum. But the income will still not be large.

Freelancing

Blockchain has a technical part that must be maintained by professional developers. Users with specialized knowledge can register on a platform with job openings. Bitcoin freelancer gets access to many offers from clients from different countries. Payment for tasks is made in cryptocurrency. There are decentralized services that pay rewards automatically.

Other ways

Blogs, news portals and forums dedicated to cryptocurrency pay with bitcoins for users sharing their ideas and writing for these resources. This suits those who are well-versed in the industry.

Popular cryptocurrency forums offer their regular members the possibility of monetization – companies can advertise their products and services in the captions to the articles.

Some exchanges give bonuses for registration or referral fees for promoting their services. For example, Coinbase offers new users $5 in BTC.

You can earn interest on bitcoin storage or in lending programs where the user lends cryptocurrency at about 7.4% APR.

Airdrops is a way to get free cryptocurrency. Developers give out coins for promoting their project.

Instructions for earning 1 Bitcoin

Since the cryptocurrency market is unstable, it is wise to start small. Before investing in digital assets, it is important to keep the rules in mind:

- Learn the theory about blockchain technology and cryptocurrencies. As well as your country’s legislation on digital assets.

- Choose a method and strategy (mining, trading, investing). Invest based on your own research, not on the recommendations of bloggers and analysts. It is important to remember that you can invest as much money in the project as the strategy allows in case of failure.

- Choose a suitable service. Check all information about projects that offer opportunities to earn money.

- Ensure the safety of the assets. Create a new email address for each investment to avoid the risk of data leakage. Create different wallets for coins and tokens to avoid losing all capital in case of hacking.

- Start earning. Remain patient – this will help preserve capital.

Registering a bitcoin wallet

The choice of storage for cryptocurrencies depends on the user’s needs: what BTC will be used for. If the investor has just started working with bitcoin, a program wallet will suit him.

Registration usually requires:

- Go to the app store or to the website of the cryptocurrency vault.

- Open the program and write down a secret phrase of 12-24 words. This will be the backup of the wallet.

- Set a strong password.

- Add the cryptocurrency to your vault.

The wallet automatically generates a bitcoin address. Often new credentials are created after each transaction. This increases the security of the network.

However, each address that previously received bitcoins can also be used again.

You should always copy and paste the credentials to receive and send BTC. This reduces the risk of error. You should not enter the address manually. All transactions with cryptocurrency are irreversible: once the coins are sent, it is impossible to return them.

Choosing a way to earn money

Depending on their financial goals, as well as the willingness to invest and attitude to risks, the investor can choose a variant of obtaining BTC. The fastest way is to buy on the exchange. However, this will require an investment.

Miners receive cryptocurrency for their work on the Bitcoin network. They incur costs associated with maintaining mining equipment and the cost of electricity. This requires a significant investment. Less costly options for obtaining bitcoin will not bring much profit, but the risks are also minimal.

Withdrawal of BTC and exchange to fiat

Depositing bitcoins into a bank account is very similar to the process of converting regular money. Essentially, the user sells their BTC and buys fiat currency of equal value in dollars or other units.

The rate for this exchange is not determined by the economic actions of a country’s government or central bank. The price of bitcoin is influenced by demand.

Withdrawals are made on a cryptocurrency exchange or P2P exchange. The user sends funds from his wallet through a guarantor to another person. In return, he receives fiat money to his bank account.

How long it takes to mine 1 bitcoin in the world

Determining the exact time it takes to successfully mine 1 BTC depends on many factors: processing power, the type of equipment used and competition. However, in the best case scenario with the maximum parameters of the device, it takes about 10 minutes to obtain 1 BTC. This may not seem like a long time, but these ideal conditions are out of reach for many miners.

In fact, in terms of time, it is possible to earn 1 Bitcoin in about 30 days. This work is no longer as economical as it seems: after deducting the cost of electricity and the total price of hardware and software, the miner will be left with at best 0.1 BTC of profit each month.

The speed of mining depends on the type of mining device (ASIC or GPU) and its hashing speed, the total number of active pools.

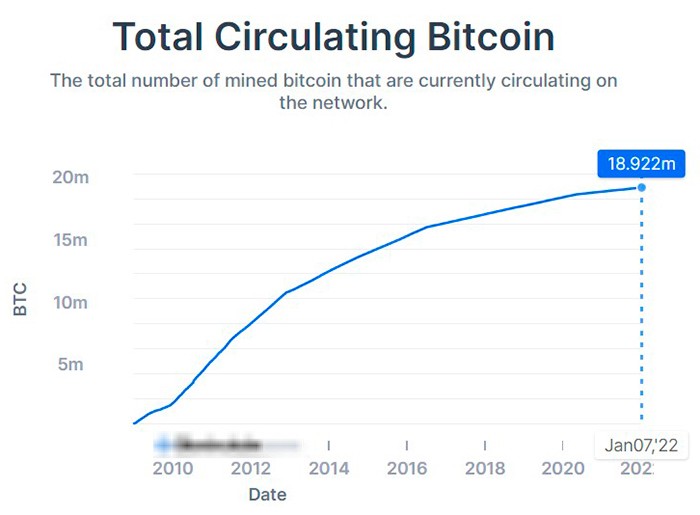

How many coins have already been mined

About 900 bitcoins are mined every day in the world, and 328.5 thousand new ones are created in 2021. The reward per block is set at 6.25 Bitcoin and will remain unchanged until the next halvering. As of October 2021, 90% of bitcoins have already been mined. This number changes about every 10 minutes when new blocks are mined.

Only 21 million BTC can be generated in total. However, the actual number of bitcoins in circulation is much less. Some holders have lost access to their private keys or died without passing them on to their heirs.

It is estimated that the last BTC will be mined in 2140. But there is a chance that the cryptocurrency’s network protocol will change before then.

How much can you earn 1 bitcoin for

This question is asked by beginners when they make a transaction for the first time. In theory, 1 Bitcoin can be earned in 10 minutes, but many factors increase this time. The speed of getting the main cryptocurrency depends on the size of the investment that the investor is going to make and the correctness of his actions.

The difficulty and cost of obtaining bitcoin is changing every year. If 11 years ago, one of the first users Laszlo Heinitz was able to mine 10,000 BTC on an ordinary laptop, today even the largest mining pools do not show such profitability.

Ofte stillede spørgsmål

🔥 What will happen when the global bitcoin supply reaches its limit?

Miners will make money on commissions and will continue to mine blocks. But the production of new coins will stop.

⏱ When will the next halving take place?

In the spring of 2024, the reward for mining a block on the Bitcoin network will be reduced to 3.125 BTC.

❗ Is it legal to mine bitcoin in the Russian Federation?

There is no direct ban on mining in Russia.

🔎 Can Bitcoin be inherited?

Cryptocurrency can only be inherited if it is legally recognized as property.

💰 How many bitcoins have been lost?

There is no exact answer. It is roughly estimated that about 3-4 million coins have been irretrievably lost.

Er der en fejl i teksten? Fremhæv den med musen, og tryk på Ctrl + Indtast

Forfatter: Saifedean Ammousen ekspert i kryptovaluta-økonomi.