In the 12 years since bitcoin was founded, its rate has increased more than 100 million times. At the first exchange trades it was possible to buy 1,578 BTC for $1. The growth of quotations convinced millions of users that anyone can quickly make money on cryptocurrency from scratch. Of course, this is a stereotype: not everyone can get rich in one transaction, and novice investors often lose money. But cryptoassets really allow you to earn in 2024, even for those beginners who do not have a significant starting capital. The article describes methods of generating income that do not require much effort.

The main ways to earn money on cryptocurrency

“Buy cheaper, sell more expensive” – the main principle of exchange trading. Speculative transactions are the main scheme for earning money on cryptocurrency. The average daily trading volume of digital assets on exchanges exceeds $70 billion.

However, users have other ways to earn money on virtual currencies. Among them:

- Long-term investing.

- Investments in lending, farming and other methods of profitable placement of symboler and coins.

- Minedrift and generating income through confirmation of transactions(staking, forging, masternodes).

- Transferring assets into trust management.

- Earnings on related services (accepting cryptocurrency as a means of payment, setting up an exchange office).

Investments

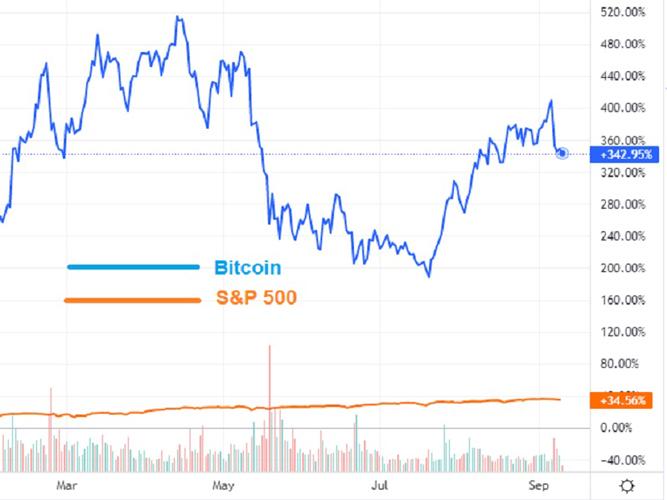

From January 1 to September 23, 2024, the Bitcoin exchange rate increased by almost 50.65%. During the same period, the price of Ethereum increased by 16.6%, and the altcoin Solana rose by 42.24%.

Users can make money on the cryptocurrency exchange rate today in 2024 by simply holding promising tokens and coins in their wallet. Such a strategy is called holding.

Besides buying assets for the long term, there are alternative ways to earn cryptocurrency:

5020 $

Bonus til nye brugere!

ByBit giver bekvemme og sikre betingelser for handel med kryptovaluta, tilbyder lave provisioner, højt likviditetsniveau og moderne værktøjer til markedsanalyse. Den understøtter spot- og gearet handel og hjælper begyndere og professionelle handlere med en intuitiv grænseflade og vejledninger.

Optjen en 100 $-bonus

for nye brugere!

Den største kryptobørs, hvor du hurtigt og sikkert kan starte din rejse i kryptovalutaernes verden. Platformen tilbyder hundredvis af populære aktiver, lave provisioner og avancerede værktøjer til handel og investering. Nem registrering, høj transaktionshastighed og pålidelig beskyttelse af midler gør Binance til et godt valg for handlere på alle niveauer!

- Staking (mining blocks on networks that use the Proof-of-Stake algorithm).

- Lending (cryptocurrency loans on exchanges).

- DeFi-tokens (units of account used on decentralized platforms).

- ICO projects (investment in cryptocurrency startups).

Buying for the long term

The rapid growth of quotes of BTC, ETH and other virtual assets caused a stir among novice investors. In social networks and media there are stories about users who bought bitcoins for a few hundred dollars and sold them at a rate of more than $10,000. Many beginners have decided to become investors or crypto traders. However, it is impossible to predict to what mark the price of tokens and coins will reach. Long-term holding of assets carries the risk of losing the investment if the demand for cryptocurrencies drops and capital outflow to other areas begins. Passive investing has several pros and cons.

| Fordele | Ulemper |

|---|---|

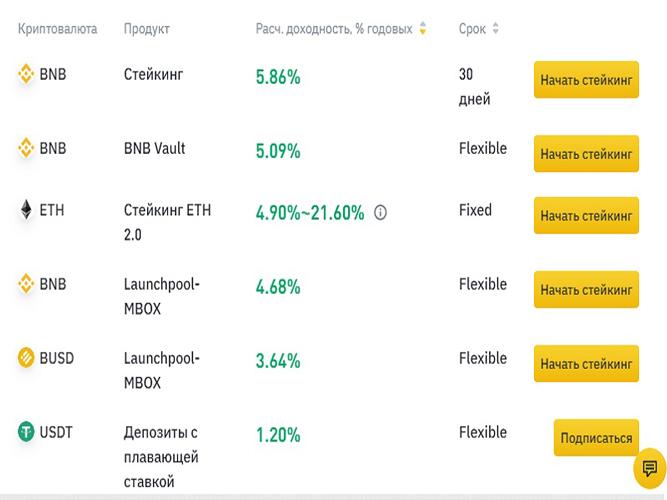

Staking

In the world’s main cryptocurrency (Bitcoin), transactions are validated using the Proof-of-Work (PoW) method. To mine a new block, users provide computing hardware that verifies transactions using a special algorithm. Mining BTC and other PoW-based coins is an interesting way to make money online on the cryptocurrency rate without investment for beginners on the Internet. But this method has a disadvantage – significant expenses for the purchase of equipment and electricity.

In networks operating on the Proof-of-Stake (PoS) algorithm with proof-of-stake, a different approach to verifying transactions is used. The probability of a user mining a new block is proportional to the number of coins that are in his wallet. Thus, when storing a large amount of assets, their holder can receive additional remuneration for participating in transaction validation. This way of earning money is called steaking. It is quite common on cryptocurrency exchanges:

- A client registers on the site and buys assets running on the PoS algorithm.

- Coins are transferred to the management of the virtual exchange (blocked on the account).

- The user is rewarded for participation in the staking.

The disadvantages of the method include the risk of losing money due to a decrease in the quotes of cryptocurrencies.

Lending

Customers of crypto exchanges can transfer assets to the platform for temporary use. This money is then applied for various purposes:

- Cryptocurrency loans.

- Increasing liquidity and securing exchange transactions.

- Financing leveraged trading.

The owner of tokens and coins receives a fixed interest rate reward from the crypto exchange in return. Lending can be compared to fiat deposits in traditional banks:

- The platform guarantees the return of borrowed funds.

- The client lends money to the exchange for a certain period of time (usually from a week to several months).

- The platform accrues interest to the lender.

Lending is characterized by low rates: remuneration for deposits in BTC and ETH usually does not exceed 3-5%. At the same time, the exchange guarantees the timely return of money. Therefore, lending is an easy way to make money on cryptocurrency.

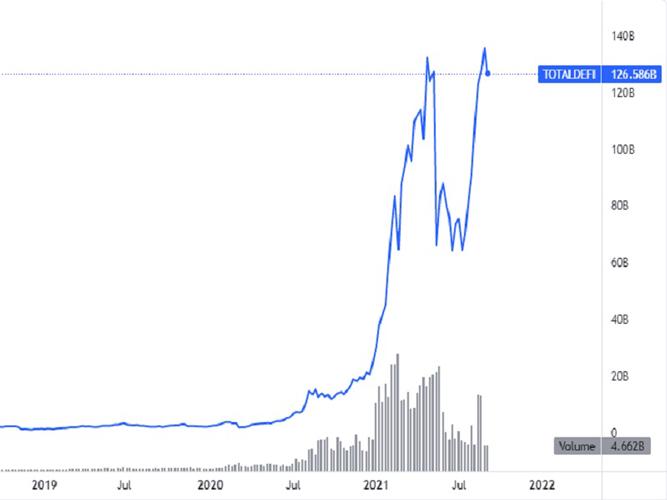

DeFi tokens

In 2020, decentralized platforms (DeFi) began to grow in popularity. These services provide different services (cryptocurrency exchange, loans, insurance) without the ability of developers to influence the relationship between clients. Decentralized platforms issue service tokens used for settlements between network participants.

In 2020-2021, the liquidity of the DeFi market grew intensively. The capitalization of decentralized services exceeded $182 billion. Due to this, buying DeFi tokens has become a popular investment method.

A separate type of earning on decentralized services is yield farming. Exchanges on DeFi platforms are conducted through liquidity pools. The participant transfers his own capital to the service, receiving service tokens. These units of account can be sent to the staking, increasing their number, and then exchanged for regular cryptocurrency.

ICO projects

Creating a new virtual coin or decentralized application requires startup capital. Some projects were started with the resources of their creator. In particular, Bitcoin was launched by an anonymous person (or team), and the start of this network was made without investment. But in most cases, money is needed to pay developers, advertising campaign, rent servers and computing devices. Often investors’ funds are raised for this purpose. In simple words, you can earn on cryptocurrency from scratch and without investment, but the tokens and coins themselves will be released only if you have startup capital.

ICO (Initial Coin Offering) is a way of attracting investment for a startup, where users fund the creation of the project, receiving tokens or coins of the new network in return. If the developers’ idea is successful, the cryptocurrency will grow in value and the investment will quickly pay off.

The peak of the popularity of ICOs came in 2017. Subsequently, the inflow of investments from the initial public offering decreased. The main reason was that many startups turned out to be “scams” (useless and uninteresting products). ICOs were replaced by alternative ways of raising initial capital:

- IEO – an analog of an initial public offering, in which assets are credited to investors on a crypto platform. This procedure is similar to the sale of shares of public companies on stock markets.

- IDO – a type of initial public offering in which coins are distributed using decentralized platforms.

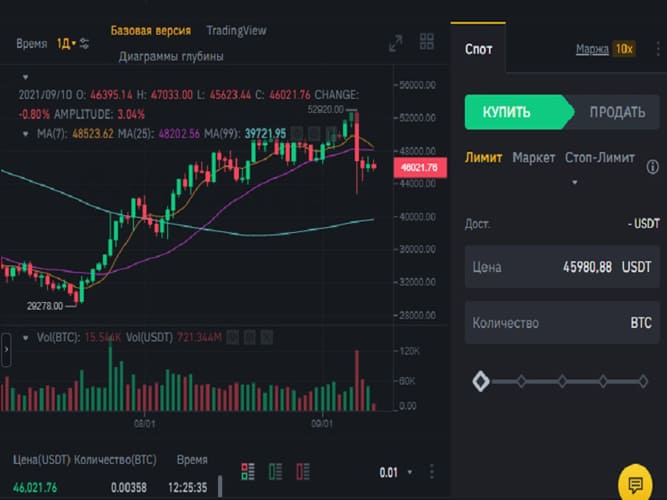

Cryptocurrency trading on the exchange

The peculiarity of digital assets is high volatility, that is, rapid changes in quotations. This allows you to earn on speculative transactions:

- A trader registers on a crypto exchange and makes a deposit (fiat money).

- The most promising asset is selected from the list of traded assets.

- The trader buys a token or coin and waits for the price to increase.

- After reaching the desired mark, virtual funds are sold, and the proceeds are spent on a new transaction.

When engaging in speculative trading, the user is not interested in the distant future of the project. In some cases, purchased tokens and koins are sold in a few minutes (provided that during this time their price has changed in the desired direction for the trader).

Basically, transactions are made in spot trading mode (with immediate delivery of purchased coins to the cryptocurrency wallet). But other types of trading are also common on platforms:

- Margin trading. A crypto exchange provides customers with credit money. These funds are only allowed to be applied when making trades. Margin trading allows you to increase capital, but it also increases risks.

- Derivativestransactions. The cryptocurrency market uses futures, options and other derivative contracts. It is difficult for beginners to understand these instruments, but experienced traders often use derivatives to accrue additional profits or reduce risks.

Peculiarities of trading

To generate income, the trader needs to determine in which direction the quotes of cryptocurrency will change. To select the asset and the moment of transactions, the following methods are used:

- Fundamental analysis. Attendees study the state of the cryptocurrency market, the advantages and disadvantages of individual projects. The situation in the world economy, politics, finance is also taken into account. In particular, cryptoassets can grow in value if the stock markets collapse: large investors, saving capital, will buy Bitcoin and altcoins, raising their value.

- Technical analysis. The prospect of quotes growth is determined by indicators (mathematical formulas), support and resistance levels, figures and patterns on the chart of the trading pair. In general terms, technical analysis is based on the assumption that all participants of transactions have the same psychology, and therefore their behavior can be predicted by looking at the price of the asset.

- Trading on news. Traders try to react quickly to important events that occur in the world of cryptocurrencies. For example, if news comes out that the US government plans to ban all digital assets, the price of tokens and coins can fall sharply. In this case, those who are the first to sell the cryptocurrency will profit.

- Automated (robotic) trading. The trader orders a program (algorithm), which prescribes the conditions for creating and closing transactions. With the help of API, the robot connects to the Personal Account on the platform and sends orders to the server without the user’s participation. In this case, the result of trading is not affected by the psychological state of the client (fear, excitement, desire to recoup losses).

The best cryptocurrency exchanges

For many years, most transactions with digital assets are made on the Binance platform. However, do not evaluate the level of the platform only by the indicator of trading volume. CryptoProGuide and other information resources published ratings of cryptocurrency exchanges. They display such data:

- Availability of registration in the visitor’s country of residence.

- The number of traded assets.

- The possibility of replenishing the account with fiat.

- General evaluation of the service (based on the reviews of other clients and the opinion of the site’s editorial staff).

Criteria for choosing a crypto exchange

The evaluation of the trading platform depends on several factors. First of all, the reliability and decency of the service should be evaluated. In addition, beginners should pay attention to the following characteristics of the platform:

- The number of available assets (trading pairs).

- Rates of commissions and fees.

- Methods of depositing and withdrawing money.

- The possibility of registration on the site of users from the country of residence of the trader (some exchanges do not work with clients from the CIS).

It takes time to start and learn how to earn on cryptocurrency speculation from scratch. It is advisable for beginners to register on services that provide access to demo accounts. In this case, the trader gains experience without risking real money.

Minedrift

Verifying transactions in peer-to-peer networks is a complicated process in terms of math. Each transaction is matched against the past data of other participants in the system and entered into the blockchain only if the results of the calculations match. For this work, miners (owners of computers that provide their power to verify transactions) are rewarded.

For each block mined, its creator is paid 3.125 BTC. This size of the reward will remain until halving in 2028. Different blockchains use for cryptographic tasks:

- GPUs (graphics cards).

- ASIC devices (farms). This is hardware designed for mining. ASIC farms usually have a high hash rate (number of computational operations per second).

- Central processing units.

- Hard disks. Memory carriers can be used in a very small number of blockchains – for example, Chia.

Earning money from mining has several pros and cons.

| Fordele | Ulemper |

|---|---|

Cloud mining

One of the main disadvantages of earning money from mining blocks is the high cost of equipment. But today services offer cloud mining – renting computing power. In this case, the investor does not need to find a supplier of cheap ASIC-devices, customize the equipment and pay electricity bills. Otherwise, the process of earning money does not differ from classic mining.

Masternodes

In some blockchains, not all participants are involved in confirming transactions, but only special devices. Usually, the right to create such a server can be bought by making a deposit. The work of a masternode is similar to a mining farm: a computer verifies transactions and adds new blocks to the chain. This way of investing has an important advantage – a stable level of income.

In networks with masternodes, the number of such servers usually does not change. This means that the investor has no risk of losing money due to competition with other miners.

Funds and trust management

It can be difficult for beginners to learn how to trade crypto assets on their own. Beginners are hindered by fear of opening an unfavorable deal, a sense of excitement, faith in intuition and luck. Investment funds and trust companies allow you to invest money, for which managers buy tokens and coins. In return, the investor receives a portion of the profits.

| Independent trading | Trust management |

|---|---|

Affiliate and referral programs

Trading, mining and investing are often not suitable for beginners because of the lack of startup capital. Make money on cryptocurrency to a beginner on the Internet without investment can be done with the help of affiliate and referral programs. After registering on the service, the client receives a link or code to send to other users. If the referral (invited) will make a targeted action (replenish the account, start trading, order a service), the partner is rewarded.

Business or work with payment in cryptocurrency

The sphere of application of digital money is actively expanding. For cryptocurrency, people buy clothes, shoes, appliances, services in online services. Freelancers and store owners can create wallets and accept tokens and coins. As BTC and altcoin quotes rose in previous years, paying with digital money can be more profitable than fiat transactions.

How to make money with cryptocurrency without investing

Beginners are not always ready to invest real money in the digital currency market. But people earn on cryptocurrency and without initial capital. Some services organize the distribution of tokens and coins to attract new customers, others pay rewards for completing tasks.

These ways of earning are suitable for beginners, because they do not require risking their own savings.

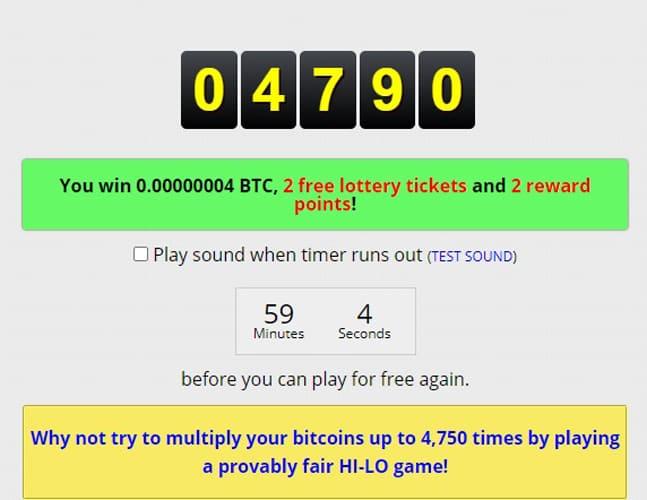

Cranes

Many sites give away cryptoassets for performing simple tasks. The visitor is offered to:

- Solve captcha.

- Browse web pages or emails.

- Combine pictures (anti-spam protection option).

Usually the reward value per action does not exceed a few satoshis (fractions of bitcoin). However, faucets sometimes hold similar lotteries for active participants or offer to join a referral program.

Cryptocurrency games

The distribution of tokens andcoins can be conducted in different forms:

- Gambling (with the opportunity to make the first bet for free).

- Lotteries.

- Performing tasks in game form for cryptocurrencies.

In general, this direction resembles bitcoin cranes and does not provide for a lot of earnings.

Airdrop and Bounty

The success of new decentralized projects depends on the activity of the community. The more subscribers and visitors the service has, the higher the chance for the blockchain or platform to get to the top of the rating. To attract new customers, some startups hold airdrop – free distribution of tokens or coins. These assets can be exchanged for fiat or saved on a wallet in the expectation that the popularity of the project will grow.

Bounty campaigns are a similar way to attract visitors. Money is paid out for assistance in the development of the project. Participants are asked to perform the following actions:

- Find vulnerabilities in the source code.

- Write a review about a product or service.

- Share the company’s records on social networks.

- Translate a section of the site into another language.

Unlike free giveaways, there is work to be done when participating in a bounty campaign, but the rewards can be quite impressive as well.

Creating your own token

The whole truth about earning without investment is that no one will give away big money for nothing. To get a serious profit, you need to offer an interesting idea or project. With the help of their own token attract investors, as well as create communities in which a unique currency is circulating.

Thanks to the Ethereum project and similar blockchain technologies, any user or company can issue a separate payment unit and place it on exchanges. For this purpose, platforms often contain a menu for creating a new asset, where step-by-step instructions for beginners are published. However, serious traders will not buy virtual coins that have no prospects. Therefore, before creating a koin, you need to come up with a useful idea for others.

Blogging

Competent and creative users have an additional way to make a profit – keeping an author’s column. Running your own blog is profitable for the following reasons:

- Participation in affiliate and referral programs. With the help of articles and notes about crypto trading it is convenient to advertise trading platforms, exchangers and training services.

- Payments for blogging. Some sites offer rewards for publishing new texts. The resource increases attendance, and the author receives a small fee.

Tips for beginners on earning

Beginning market participants are afraid to engage in investing in cryptocurrencies on their own because of the risks of losing savings. To avoid this situation, it is enough to follow simple recommendations:

- Itis better to invest money in the direction with which the participant is familiar. It is easier for an economist to engage in speculative trading, for a system administrator to choose and configure equipment for mining, and for a copywriter to connect a new blog to an affiliate program.

- Itis impossible to make money on buying and selling cryptocurrency by opening transactions at random. Any action of an investor should be based on a thorough analysis of the market.

- Beginners often try to earn more on altcoins. This is due to the high volatility of crypto assets. But the stronger the quotes change, the higher the risk of losing your investment. Traders without experience should preferably start with trading stable and calm assets (BTC, ETH, BCH).

- Greed leads to loss of capital. Making money on digital currencies is a long process. Patient and persistent investors have an advantage in it.

| The way of making profit | Requirements to the participant |

|---|---|

| Availability of information | |

Sammenfatning

Demand for cryptocurrencies is intensively growing. Since the advent of the coin, the rate of BTC has increased more than 100 million times. Individual altcoins can appreciate by hundreds of percent in a month. In such conditions, users are looking for ways to earn money on digital assets.

Among all activities, such directions for investment are popular:

- Passive investing (storing tokens and koins).

- Cryptotrading (speculative trading).

- Mining.

- Other types of investing (staking, lending).

It is also possible to get income without initial capital. For this purpose, cryptocurrency faucets, lotteries and airdrops are usually used. But the potential profit from working without investment is much lower than the income from investment. The exception is the fees of specialists (programmers, marketers, designers, copywriters).

Ofte stillede spørgsmål

❓ Can I combine several types of income?

Yes, but all methods of income generation require attention. If an investor starts putting money into random projects without analyzing, he risks losing all the capital.

🤔 How do I learn how to trade and select coins?

There are manuals and video courses on cryptocurrency transactions on the Internet. However, the best way to learn how to trade is through personal experience. It is advisable to start with demo accounts where you don’t have to risk real money.

⏳ What methods of earning money are promising in the future?

It is difficult to predict, but speculative trading and long-term storage will be profitable all the time that cryptocurrency will exist.

❔ Is it possible to trade through exchanges and P2P services?

Peer-to-peer platforms and private intermediaries usually do not offer clients conditions for speculative trading (quote analysis tools, favorable commissions, leverage). Therefore, it is better to engage in crypto trading on exchanges.

🤫 How to distinguish real investment offers from fraudulent schemes?

Beginners should work only through reliable sites and platforms. It is recommended to choose a crypto exchange from the top 10 rating and invest in the services that the platform offers.

Fejl i teksten? Fremhæv den med musen, og tryk på Ctrl + Indtast

Forfatter: Saifedean Ammousen ekspert i kryptovaluta-økonomi.