Cryptocurrency exchange Bybit

Trading derivatives is profitable for traders for two reasons. Transactions with futures contracts allow you to earn not only on the growth, but also on the decline in the price of cryptoassets. In such operations it is possible to use leverage, which increases the potential profit. Bybit cryptocurrency exchange was founded as a platform for transactions with digital futures. Later on, customers have other options, including spot trading and investing.

- The platform complies with AML and KYC regulations. This provides protection against fraud

- The website and app work in multiple languages

- Futures, open-ended contracts with leverage up to 100x, options are available

- Large selection of investment products

- Multi-level referral program

- High level of security. Several types of authentication are supported

- Limited region-specific support for fiat currencies

- Some users report delayed responses from the support team

Baybit services

The main direction of operations on the Bybit platform is transactions with cryptocurrency futures. In addition, the company’s clients have access to such services:

- Purchasing coins for fiat.

- Trading cryptoassets on immediate delivery terms (spot trades).

- Investing in staking and liquidity pools.

- Earnings in affiliate and referral programs.

- Bybit Launchpad – investing in promising startups as part of IEO (initial token distribution through a centralized exchange).

- Crypto loans with high LTV and repayment at a convenient time.

- Copying trades of top traders.

- Launch of futures and spot grid-bots.

Features of the Bybit exchange

Initially, the trading platform specialized in derivatives transactions. This affected the functionality. Fiat transactions were not supported in the personal cabinet. It was possible to make a deposit only with cryptocurrency, and fiat was accepted through intermediary sites. In addition, the possibilities of exchange transactions were limited. The company did not provide leverage for cryptocurrency transactions.

By 2024, the platform has expanded its list of options. Among the features of the exchange:

- Support for fiat and cryptocurrencies. Transfer of assets between accounts.

- Margin trading on spot. The option is available through the Unified Trading Account.

- Attractive conditions for new clients. In particular, the company offers a bonus on the first deposit.

- Soft KYC (verification) policy. You don’t have to confirm your identity to access trading. Anonymous customers can withdraw up to 2 bitcoins per day.

At the same time, the exchange for online cryptocurrency trading Baybit in January 2024 remains one of the largest platforms for transactions with futures and open-ended derivative contracts. In particular, the average daily volume of transactions with Bitcoin derivatives exceeds $8.3 billion.

History

The crypto platform was founded in March 2018 under the leadership of Chinese entrepreneur Ben Zhou. The main office of the company is located in Singapore. In the first years, the platform specialized exclusively in transactions with derivatives. At the same time, clients were attracted by the absence of a mandatory identity verification procedure.

5020 $

Bonus til nye brugere!

ByBit giver bekvemme og sikre betingelser for handel med kryptovaluta, tilbyder lave provisioner, højt likviditetsniveau og moderne værktøjer til markedsanalyse. Den understøtter spot- og gearet handel og hjælper begyndere og professionelle handlere med en intuitiv grænseflade og vejledninger.

Optjen en 100 $-bonus

for nye brugere!

Den største kryptobørs, hvor du hurtigt og sikkert kan starte din rejse i kryptovalutaernes verden. Platformen tilbyder hundredvis af populære aktiver, lave provisioner og avancerede værktøjer til handel og investering. Nem registrering, høj transaktionshastighed og pålidelig beskyttelse af midler gør Binance til et godt valg for handlere på alle niveauer!

The situation changed in July 2021. The option of spot trading appeared on the crypto exchange. At the same time, under pressure from regulators, the management was forced to introduce the KYC procedure. In addition, by the end of 2022, the developers launched a built-in cryptocurrency wallet Web3.

Regulation

In April 2023, the company moved its headquarters from the British Virgin Islands to Dubai. Previously, the platform had been building a presence in the Middle East and North Africa for 12 months. In 2023, Bybit ranked 2nd in trading volume among 400 cryptocurrency companies in the UAE.

Dubai is one of the most progressive blockchain centers in the Middle East and the world. Loyal legislation has allowed Bybit to retain full functionality, while other major exchanges have had to limit capacity to a number of countries to comply with European and US regulators.

Available cryptocurrencies and popular trading pairs

There are 399 coins traded on the spot market in January 2024. There are 493 pairs of assets available for trading. The main volume of transactions falls on such instruments:

- ETH/USDC – $475.22 million (26.35% of average daily turnover).

- BTC/USDC – $328.1 million (18.2% of the market).

- BTC/USDT – $242.61 million (13.45% of daily turnover).

- ETH/USDT – $92.46 million (5.13% of the market).

- SOL/USDT – $75.69 million (4.2% of deals per day).

In the review of Baybit exchange it should be emphasized that the main volume of transactions falls on Bitcoin and Ethereum perpetual contracts. In January 2024, the service ranks 2nd in terms of the activity of transactions with derivatives.

Exchange token

The platform’s ecosystem lacks an internal cryptocurrency used for settlements between traders. But in 2021, with the active participation of Bybit, a decentralized (DeFi) project BitDAO was launched. A key role in the ecosystem of the organization is played by the native (service) token BIT. In November 2021, this cryptocurrency was in the top 100 of the Crypto.ru ranking with a capitalization of about $1.5 billion.

In July 2023, BitDAO was renamed to Mantle. Holders were able to convert BIT tokens in an exchange account to MNT at a 1:1 ratio.

In January 2024, Mantle is ranked 46th in the global capitalization ranking with a $1.95 billion market cap.

Types of orders

Traders can leave 3 types of orders:

- Marketable. Executed immediately at the current price.

- Limit. The order is entered into the order book and awaits a counter-offer to exchange at the rate set by the trader.

- Conditional. The user specifies a trigger price. As soon as the quotes reach the specified level, the order is activated and executed as a market or limit order. This type of transaction is identical to Stop Market and Stop Limit operations used on other trading platforms.

Working conditions

Trading on Baybit is available to all adult users, except for residents of prohibited jurisdictions. In 2024, registration is closed for visitors from the United States, mainland China, Singapore, Quebec Province (Canada), North Korea, Cuba, Iran, Sudan, as well as Crimea and Sevastopol.

The peculiarity of the crypto platform is the fixed rates of commissions for trading operations. The fees do not depend on the number and volume of transactions. The difference in the size of the commission is related only to the type of order used.

Traders who trade using limit orders are called makers. They are charged a lower commission compared to takers (users who use market orders). Derivatives trading has a negative limit order fee.

| Type of transaction | Commission | |

|---|---|---|

| Maker | Taker | |

| Spot | 0,1% | 0,1% |

| Derivatives | 0,03% | 0,1% |

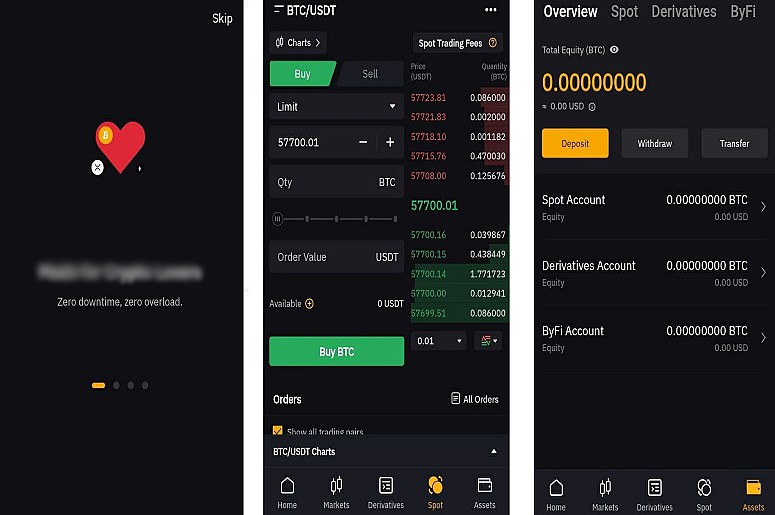

Mobile app

Crypto traders and investors have access to the services through a program compatible with iOS and Android operating systems. To install the mobile application you need to:

- Visit the official website of Baybit Exchange and click on the phone button in the upper right corner of the screen.

- Scan the QR code on your mobile device to go to the app store.

- Install the program and authorize in the personal cabinet.

Mobile terminal interface

Bonuses

Bybit offers rewards for new users. There are many bonus programs available in January 2024. Some of them are in the table.

| Title | Receipt condition | Amount of remuneration |

|---|---|---|

| Welcome bonus for fiat | Buy $100 worth of cryptocurrency from a card or EPS | $10 |

| Action to SAROS listing | Register and verify an account on the exchange. Buy $100 worth of SAROS tokens | $25 for the first 1800 participants |

| AIOZ Trade Award | Sign up for the promotion. Trade AIOZ – reach a turnover of $500 | $10 for the first 100 traders |

Trading on Bybit

The Baybit platform has 2 sections for buying and selling cryptoassets. Users can choose between:

- “Spot” – designed for the exchange of tokens and coins.

- “Derivatives” – includes futures and perpetual contracts.

In addition, users have the option of buying cryptocurrency for fiat. It is possible to conduct transactions through intermediary sites and P2P platform.

Spot trading

The main direction of operations on the platform is the exchange of tokens and koins for Tether stablecoin. USDT is the underlying asset for most trading pairs. This means that the trader does not have the opportunity to directly exchange individual cryptocurrencies. For example, to buy Solana coin for Bitcoin you need to:

- Deposit bitcoins.

- Exchange Bitcoin to USDT.

- Buy Solana for Tether.

In this case, a trader trading market orders has to pay the taker’s commission twice. The second feature of Bybit is the absence of margin trading. Only personal capital can be used in transactions.

P2P

In January 2022, the company launched a peer-to-peer platform. At first, users could only buy Tether for fiat. Then the list of cryptocurrencies was expanded to include BTC, ETH, USDC. You can pay for tokens from debit/credit cards, via electronic and bank transfer systems, as well as cash. To do this, you need:

- Go to Buy Cryptocurrency – P2P Trading.

- In the search menu, select the direction of exchange, the amount and the desired payment method.

- Find a suitable application in the list and click on the “Buy USDT” (or other coin) button.

- Specify the exact amount of the transaction.

- Pay the request with fiat or wait for the counterparty to complete this action.

- Send tokens to the other side.

Verified clients can create requests to exchange cryptoassets. In this case, the trader independently specifies payment methods and transaction limits.

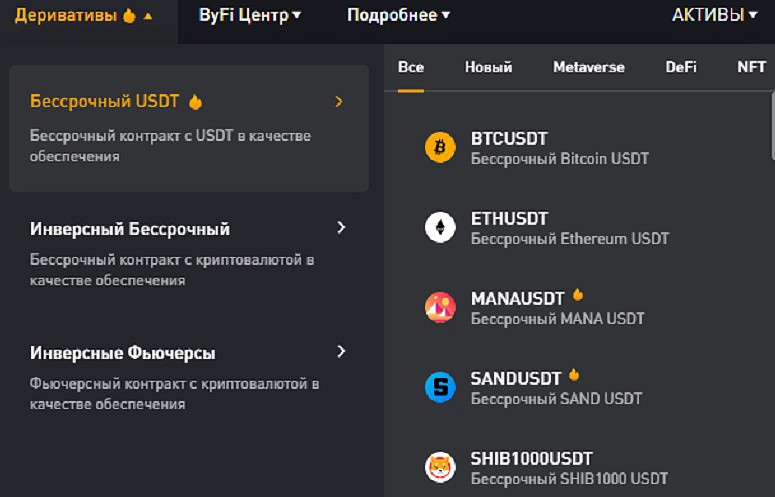

Derivatives

Is available on Bybit:

- Inverse futures on Bitcoin and Ethereum. These contracts stipulate the obligation of the parties to exchange at a specified time. The term “inverse” means that the collateral currency of the contract is the traded coin (BTC or ETH). Profits from the transaction will be paid in bitcoins, not Tether.

- Straight and inverse open-ended contracts. Unlike futures, they have no expiration date. The transaction can be closed by the holder at any time he/she wishes.

For derivatives transactions, crypto traders have access to leverage up to 100x. But beginners should remember that futures and contracts are different from regular spot transactions. Therefore, before using leverage, you should carefully study the terms and conditions, especially in terms of calculating margin and closing positions.

Selection of derivatives in the main menu of the service

Futures

In November 2024, Bitcoin and Ethereum contracts are being traded on Bybit with expiry in 1 or 4 months. This means that the trader buys cryptocurrency at the current price, but the delivery of tokens or coins must take place in the future. Since transactions on the platform are conducted to make money on the difference in exchange rates rather than the actual acquisition of assets, no BTC or ETH is transferred to the buyer during the expiration. At this point, the price of Bitcoin or Ethereum is compared to the quotes at which the contract was concluded. If the exchange rate difference is in favor of the buyer, he is credited with profit.

Indefinite contracts

The disadvantage of traditional futures is that the settlement is tied to the expiration date. Quotes of tokens and coins are characterized by sharp fluctuations. In a few hours, the price of cryptoassets can temporarily increase or decrease. If this happens on the day the contract closes, the trader will undeservedly receive a loss.

Perpetual derivatives are devoid of this disadvantage. Their terms do not specify the term of settlement between the seller and the buyer. The trader can close the transaction at any time. Even if cryptocurrency quotes have changed to the disadvantage of the holder, there is a chance of a trend reversal and profit in the future.

Buying cryptocurrency with fiat

At the beginning of 2024, the exchange supports direct payments from cards and via Advcash EPS. To purchase BTC and altcoins for fiat, you need:

- Authorize on Bybit.

- Go to Bybit Fiat by clicking on the “Buy Cryptocurrency” button at the top of the main menu.

- Choose an exchange direction and payment method.

- Go to the service and deposit fiat to the specified details.

- Wait for tokens and koins to be credited to the deposit.

KYC is a mandatory procedure at Bybit in January 2024. Therefore, customers should prepare a package of documents in advance to confirm their identity.

Earning opportunities on Bybit

In addition to trading, crypto exchange Baybit offers a number of investment services. These include:

- Steaking.

- Dual-mining.

- Liquidity Pools.

- DeFi Mining.

To access investment offers, you should put your cursor over the “Banking” pop-up menu at the top of the screen. After that, you need to select Earn and then select the investment method.

New users should note that the term “mining” on Bybit does not refer to mining blocks in Bitcoin and other blockchains. In this case, the word means transferring assets to the liquidity pools of one of the decentralized platforms.

Steaking

Some blockchains use the Proof-of-Stake (PoS) algorithm to validate transactions. In this case, coin owners receive income from participating in the verification of transactions. Investing in staking on Bybit and other crypto exchanges does not always mean the automatic blocking of assets to confirm transactions. But in general, to earn money, the investor needs:

- Deposit any suitable cryptocurrency.

- Under Earn, select “Bybit savings” and go to the page with current offers.

- Find the desired cryptoasset in the list.

- Specify the amount of coins or tokens and click on the “Start” button.

The advantage of the Flexible Staking program is the ability to withdraw investments at any time. The accrued interest is not lost. The average rate of return depends on the cryptocurrency deposited:

| Token (Coin) | Expected annual profit | Maximum investment amount |

|---|---|---|

| BTC | 5% | 10 BTC |

| ETH | 3% | 100 ETH |

| USDT | 12,26% | 500 000 USDT |

| USDC | 10% | 500 000 USDC |

| MNT | 3,5% | 1 000 000 MNT |

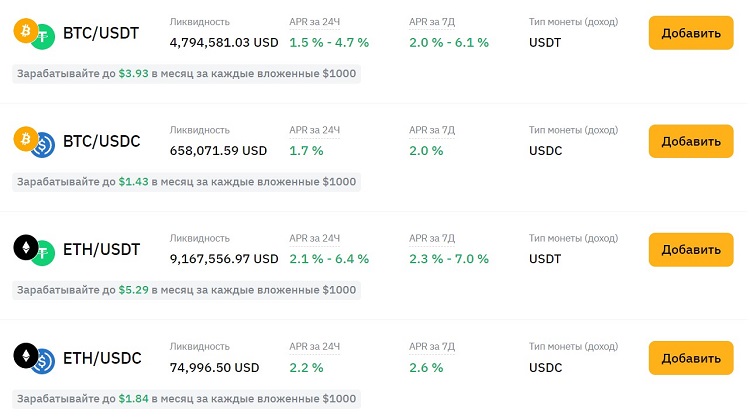

Liquidity pools

Uniswap and similar protocols allow the exchange of cryptocurrencies without a single server. Unlike centralized exchanges, DEX-platforms perform transactions directly between users. But to exchange assets, the protocol developers must create liquidity pools where investors deposit tokens and coins. In return, their owners receive a percentage of DEX-exchange commissions.

Bybit liquidity mining allows you to earn in two ways:

- Supply of cryptocurrency to pools. Income is generated from swap commissions.

- Delivering liquidity to increase share in the pool, generate additional funds and increase revenue.

The pools work on the model of an updated AMM (automated market maker). Each of them supports a pair of coins.

Liquidity pools

Different investment products on Bybit differ not only in description, but also in characteristics, including the level of risk, investment lock-in period and potential profitability. Therefore, beginners should look not at the type of earning (mining, staking), but at the basic conditions when choosing an instrument. Each investment product is accompanied by a card that specifies the estimated yield, the cryptocurrency to be deposited and the term of the transaction.

Registration on the official website

Only authorized users can make money on the platform. To create an account on the Bybit crypto exchange, you need to follow these steps:

- On the home page, click on the “Registration” button.

- Enter your e-mail address or phone number. Make up a password and specify a referral code (if available). Another way is to log in to the exchange using a Google or Apple account.

- Confirm agreement with the service rules.

- Click on the “Create Account” button.

- Enter the verification code sent to your e-mail or phone.

- Specify the level of training for trading. This option does not affect the list of available instruments. The platform collects information about beginners in order to help them with training.

Identity verification

Until July 2021, the crypto platform did not have a strict user verification (KYC) procedure. Anonymous traders could trade without restrictions. With Baybit seeking legal status in many countries, the rules have been tightened.

As of January 2024, KYC is a mandatory procedure on Bybit. To operate the service without restrictions, you need to:

- Authorize on the official Bybit website and go to the account settings section.

- Click on the “Pass” button on the “KYC Verification” line.

- Enter personal data (full name, date of birth, passport or driver’s license details).

- Scan the document.

- Go through the facial recognition process.

After completing the first KYC level, the withdrawal limit will be increased to 50 BTC per day. In order to remove all restrictions, you should additionally confirm the registration address. To do this, you need to provide a certificate from the bank or another document that indicates the client’s place of residence.

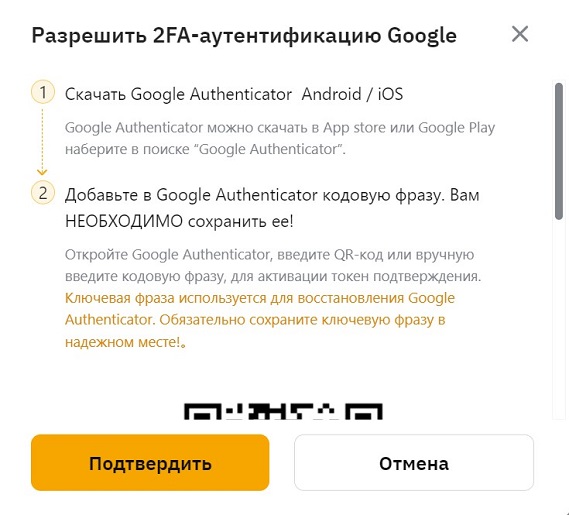

Account security and protection

To counteract account hacking, special measures are applied on the company’s website. In the “Account” section, you can activate the following security settings:

- 2FA-authentication by e-mail and SMS, Google Authenticator, YubiKey.

- Authorization log with IP addresses and types of devices from which the account was logged in.

- Phishing protection code.

- Financial password.

- White list of addresses for withdrawal.

- Sending funds to saved contacts.

- Blocking of withdrawal to a new address within 24 hours.

Two-factor authentication

Password verification when logging in to a website does not provide 100% protection against hacking. To improve security, most crypto platforms use two-factor authentication (2FA). After entering the login and password, the client needs to additionally confirm authorization with:

- A one-time code from an SMS or email.

- Google Authenticator application.

- YubiKey code.

To select the 2FA method, go to the “Account and Security” section of the account settings menu. By default, two-factor authentication is performed by e-mail or phone number. But the most reliable method is considered to be logging in via the application.

Activating Google Authentication

Trading Terminal

An identical interface is installed for spot and futures transactions. There are 6 parts in the terminal:

- Menu for selecting a cryptoasset. It is located at the top of the page. There is a pop-up list and a search bar to select a trading pair.

- Chart. Occupies the left half of the screen. The basic version of the chart is displayed by default. In the advanced mode, technical analysis indicators and a diagram with market depth (ratio of long and short positions) are available.

- Order Book. It is placed near the chart.

- Order-form. It occupies the right side of the page.

- Transaction History. It is located under the chart. In this section you can see the placed orders and previous transactions of the trader.

- Assets (balance). It is located in the lower right corner of the screen. In this section the visitor can see the current balance of the selected pair and quickly go to the deposit page.

Standard chart interface in the spot terminal

How to trade on Bybit

To get started with the crypto platform, you need to go through registration and KYC. Further actions:

- Make a deposit or purchase digital assets with fiat.

- Go to the terminal for spot trading or futures contracts.

- Select an asset.

- Fill in the order form.

API trading and use of trading robots

Most traders buy and sell digital assets manually. But with the help of a software interface (API) it is possible to automate many processes:

- Connect a trading advisor or robot. These programs independently analyze the market and choose the moment to create an order.

- Transmit stock exchange quotes to other services.

- Integrate the account with program crypto wallets.

A client can have up to 20 API keys. Each of them has unique access settings. In particular, the user can allow or restrict transactions via API. To create a key it is necessary to:

- Set up two-factor authentication through the Google Authenticator app.

- Go to the API section of the account settings menu.

- Click on the “Create a new key” button.

- Select the API access mode, including authorized IP addresses.

- Save the key and enter it into the command line of the robot or analytics application.

How to top up the account

Only cryptocurrency and regular money can be deposited. Digital funds are credited to the spot account and funding account. Fiat – only to the second one. If a trader plans to work with futures, the account settings menu should include auto-transfer of money to the derivatives account.

Fiat currency

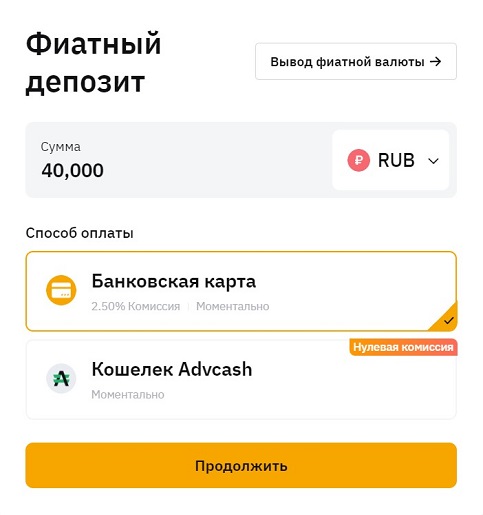

You can replenish the exchange account in rubles from a card or via Advcash EPS. The instructions are as follows:

- Authorize on the platform.

- Click on “Assets”.

- Go to the financing account.

- Select the “Fiat” tab.

- Find RUB. Click on the “Deposit” button.

- In the replenishment window, specify the amount in rubles, select the payment method. Bank card and Advcash wallet are supported.

You can deposit money to your account with or without a 2.5% fee

- Click on the “Continue” button.

- Go to the service page. Pay for the application.

Cryptocurrency

A digital coin exchange account can be funded from any third-party wallet. Procedure:

- Go to the “Assets” section.

- Select the type of account to deposit (spot, funding).

- Find the desired crypto asset in the list and click on the “Deposit” button.

- Copy the wallet address or scan the QR code.

- Send the cryptoasset to the specified details.

Minimal deposit

For most cryptoassets on Bybit there are no restrictions on the amount of deposit. The exception is the Solana coin. When depositing this cryptocurrency, there is a minimum deposit of 0.1 SOL.

Withdrawal

Sending tokens and koins to other wallets is available through the “Assets” menu. The visitor should select the cryptocurrency and click on the “Withdrawal” button. A prerequisite for withdrawal is a connected 2FA via Google Authenticator.

Commissions and limits Bybit

The deposit of tokens and coins to a personal account is carried out without restrictions. The limit on withdrawal of cryptoassets depends on the level of verification. After full identity verification, the trader is allowed to withdraw up to 100 BTC per day.

Commissions and limits for depositing assets are absent. There are restrictions for withdrawing money to Bybit.

| Currency | Minimum outgoing transaction amount | Transfer fee |

|---|---|---|

| Bitcoin | 0,001 Bitcoin | 0,0005 BTC |

| Ethereum | 0,02 ETH | 0,005 ETH |

| Litecoin | 0,1 LTC | 0,001 LTC |

| Tether (ERC-20) | 20 USDT | 10 USDT |

The level of transaction fees is a drawback of the crypto platform. In particular, as of November 2021, the withdrawal fee in bitcoins when converted to US dollars was about $29.

Beginning traders may have a small starting capital. Therefore, before registering and depositing money, you should check the current financial conditions. Otherwise, the client risks losing most of the profit during the withdrawal of crypto assets.

Support Service

The FAQ contains information about working with the crypto exchange. The access button is located on the main page – you need to scroll down. Also, the developers have collected an extensive database of trading instructions for beginners and professionals in the “All about crypto” menu. But, if a trader has a problem, you can contact the support team via a feedback form or online chat.

The support team answers questions quickly. In online chat – within a few minutes.

Additional services

In addition to access to trading and investment operations, clients have other options. These include:

- Learning the basics of crypto trading.

- Earnings on attracting referrals.

- Trading non-fungible tokens (NFT).

- Participation in lunchepads (primary placement of cryptoassets on the exchange).

Training

The high interest in digital assets has led to the fact that inexperienced traders often register on exchanges. If a person does not understand cryptocurrencies, they risk losing money.

The Bybit Learn section has a selection of content on the topic of blockchain technology and trading. Beginners can find articles such as:

- What are cryptocurrency and altcoins.

- How the blockchain works.

- What does the result of a cryptotrader depend on.

- What are the risks of working with digital assets.

- What is DeFi, NFT and other promising trends in the crypto market.

Affiliate referral program

Раздел находится в нижнем меню сайта. Компания предлагает 2 формата сотрудничества:

- Referral Program. The user invites new clients through a special link or code. As a reward, the exchange pays up to 1750 USDT for different types of referral activity and 30% of the commission.

- Affiliate Program. Offer for cooperation with advertising agencies, owners of websites and blogs. Partner receives up to 45% of commissions paid by attracted traders. In addition, the company offers a multi-level cooperation scheme. This means that the partner receives payments for the clients attracted to the site by his referrals.

Referral earnings statistics can be tracked in your personal cabinet. For convenience, the information is divided into tabs – “Registrations”, “Copytrading”, “Map”.

Rewards in the referral program

Bybit NFT

Non-fungible tokens are unique assets, the ownership of which is entered into a distributed registry. Blockchain technologies make it possible to sell paintings, photos, music, and texts in the form of NFTs. In 2022, the company launched a marketplace – a platform for the sale of non-interchangeable tokens of the ERC-721 standard. These digital assets are stored on a spot account, but can be withdrawn to a personal wallet.

Bybit Launchpad

Initial token exchange offerings (IEO) are a popular way of raising capital for digital startups. Project creators generate their own cryptocurrency. Investors purchase these tokens, getting an opportunity to earn money for the further development of the startup.

To participate in investment programs, users need to have a certain amount of MNT on their balance. After depositing the cryptocurrency, investors receive the project’s service tokens.

Konklusion

In 2024, cryptocurrency exchange Bybit is the second in the ranking of platforms for trading futures and perpetual contracts. In addition, spot transactions and investment offers are available to customers.

The advantage of the service is full P2P access for Russians. It is possible to choose any payment method, including cards of popular banks, EPS, and cash.

Ofte stillede spørgsmål

❓ Do crypto exchanges have options and swaps?

Yes. The Exchange offers option contracts with USDC as collateral.

🔎 Why is there a negative commission rate for some transactions?

Limit order traders increase liquidity. Therefore, lower fees are set for them.

💰 Is there a no-deposit bonus for new customers?

No. The platform does not award money for registering on the site.

💡 Is it possible to exchange cryptocurrency for fiat through Bybit?

Yes, through a P2P service.