So far, digital assets are mainly used as an investment tool (for earning money). Therefore, it is important to know about the existing trends in the market. To track changes in quotes, traders use an online chart of the cryptocurrency exchange rate for 2024. It helps to identify the trend, choose the optimal strategy.

Why do you need a chart of the cryptocurrency exchange rate for the year?

With the help of this tool, the dynamics of the value of the coin, trading volume, capitalization and other market indicators are studied. Knowing them, the trader will be able to find opportunities for earning and determine the existing risks for investment.

How to calculate the capitalization of cryptocurrencies and the market

To begin with, you need to understand the theory. Market capitalization is an important indicator that allows you to establish the total value of the network. Working with cryptocurrencies, traders determine the price tag of the project in the same way as companies on the stock market. Only instead of stocks, experts look at the value of coins and their number.

The formula for calculating the capitalization of cryptocurrency assets: token price × circulating supply. For example, investors own 1000 coins at $6. Hence, the capitalization is $6000.

You don’t need to know how to calculate the value of projects, as aggregators and exchanges have up-to-date data. These platforms automatically collect information about the number of coins, so you can always find out about the status of the project on them.

5020 $

Bonus til nye brugere!

ByBit giver bekvemme og sikre betingelser for handel med kryptovaluta, tilbyder lave provisioner, højt likviditetsniveau og moderne værktøjer til markedsanalyse. Den understøtter spot- og gearet handel og hjælper begyndere og professionelle handlere med en intuitiv grænseflade og vejledninger.

Optjen en 100 $-bonus

for nye brugere!

Den største kryptobørs, hvor du hurtigt og sikkert kan starte din rejse i kryptovalutaernes verden. Platformen tilbyder hundredvis af populære aktiver, lave provisioner og avancerede værktøjer til handel og investering. Nem registrering, høj transaktionshastighed og pålidelig beskyttelse af midler gør Binance til et godt valg for handlere på alle niveauer!

What the price of cryptocurrency depends on

The cost of digital assets is influenced by several factors. Among them:

- The actions of developers.

- The activity of major market players.

- The general state of the industry.

- People’s confidence in the token and cryptocurrency in general.

Also, the rate is influenced by news. Bitcoin and Ethereum have gained popularity in the media, so they are quoted above their competitors. Investors have known them for a long time and therefore trust them more.

How to read coin rate charts

There are several variations of the analytical tool. Of these, a novice trader should master the linear and candlestick charts. They allow you to study the movements in the market from different angles.

To understand the price changes for a large period, it is worthwhile to look at a linear chart of the cryptocurrency exchange rate for a month. The points that correspond to the prices at the time of closing sessions are connected with one line.

The line chart has only 2 parameters: time and price. The horizontal line indicates the day, hour or minute, and the vertical line indicates the price at that moment.

A candlestick chart provides more detailed information, which is useful for a short distance. It shows the extreme values for a certain period. It also shows the opening and closing prices.

If the indicator is green, then the value at the end of the session was greater than at the beginning. Red candles indicate the opposite.

Indicators presented on the chart

Traders mostly have problems with candlesticks. They are very different from a line chart and contain a lot of information.

| Indicator | What it looks like | What it means |

|---|---|---|

Cryptocurrency rate dynamics

Digital assets are characterized by high volatility: quotes change every 5-15 minutes. This should be taken into account when developing a trading strategy. It is also important to create a stop loss. This is the percentage of losses from the purchase price, when it reaches which the exchange will automatically sell the token.

The future of the cryptocurrency market

The industry is still reeling from Bitcoin’s steep decline and the collapse of FTX. The U.S. regulator SEC continues its stringent inspections, due to which new projects cannot quickly enter the U.S. market. Digital assets have dubious prospects in 2023, causing big players to invest only in BTC and ETH.

The bankruptcy of FTX and the closure of a number of crypto funds causes distrust among private investors. The 1inch Network believes that this year CEX exchanges will lose some of their regular clients, as traders fear losing money due to the unscrupulousness and unprofessionalism of the management of centralized platforms.

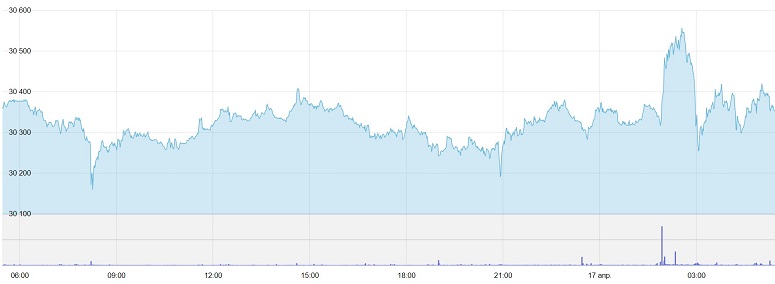

Experts give a favorable forecast for 2023: closer to its end, the cryptozyme will probably end. In April, the BTC rate is kept at $30 thousand. Experts are looking forward to the upcoming Bitcoin halving. They predict a rise in quotes as early as the end of 2023.

Ofte stillede spørgsmål

📌 What is fundamental analysis?

This is a special method of studying the basic parameters of cryptocurrency to determine the value of the digital asset. It looks at how the token is used, the number of investors, technical indicators, the state of the global economy and the community’s interest in the coin.

🔔 What is a timeframe?

It is a time frame that is set up to group quotes when creating a price chart. It is needed for candlestick plotting to determine the minimum and maximum for a particular period.

📢 Which timeframe is optimal for scalping?

To find the pivot point and sell cryptocurrencies in time, short-term traders update the chart every 15 minutes. As a rule, this period is enough to detect a relatively long correction to one side.

🔥 How does halving affect the value of an asset?

Each time the award decreases, the scarcity worsens, causing demand to exceed supply and the exchange rate to rise.

✨ What are patterns?

They are patterns that repeat with a certain frequency. Relying on the patterns, a trader can predict a rise or fall without studying the news agenda.

Er der en fejl i teksten? Fremhæv den med musen, og tryk på Ctrl + Kom ind.

Forfatter: Saifedean Ammousen ekspert i kryptovaluta-økonomi.