Digital assets are a type of virtual money. It is based on different consensus methods. Digital currency is issued by users, developers. The issue can be limited or have no finite value. To combat inflation, which fiat money is subject to, different methods are used in the world of cryptocurrency. The Bitcoin network has a halvering mechanism. Developers and users also resort to burning coins on the cryptocurrency market. This mechanism is in later protocols. Destroying koins is a conscious decision. It helps to increase or stabilize the exchange rate. The method has disadvantages, but there are more advantages.

What is the burning of cryptocurrency

Control over fiat money is carried out by regulators – financial authorities of different countries (Central Banks). They decide on the issue, the size of the discount rate, conduct monetary policy. Central banks control the volume of money supply, the exchange rate of currency against the units of account of other countries.

In the digital world, there is no central control. Developers decide in advance on methods of fighting inflation, methods of issuance. For example, in the Bitcoin network there is a limited issue – the maximum number of BTC is 21 million. The time of coin mining reaches 10 minutes. After a certain number of recorded blocks, there is a 2-fold decrease in remuneration to miners. This happens approximately every 4 years. This is how the emission rate is regulated in the network.

There are projects with unlimited issuance. Developers apply a mechanism for withdrawing cryptocurrency from circulation. Despite the formidable name, destruction serves a good purpose. It is the withdrawal of a certain amount of virtual money from circulation. Burning does not always give a positive result. If the koin is not in demand, then destruction will not bring popularity, will not attract the interest of investors. Therefore, the withdrawal of assets from circulation is only one of the factors that affect the rate, the image of the project. The benefit is received by developers and investors, holders of koins.

Among the projects that use the burning of cryptocurrency are:

Miners are also interested in destruction. Antpool is a large pool that is engaged in mining. The owners of the company decided to burn 12% of the amount of all commissions when Minedrift Bitcoin Cash. This should increase investor interest in the network, attracting the attention of the crypto community.

5020 $

Bonus til nye brugere!

ByBit giver bekvemme og sikre betingelser for handel med kryptovaluta, tilbyder lave provisioner, højt likviditetsniveau og moderne værktøjer til markedsanalyse. Den understøtter spot- og gearet handel og hjælper begyndere og professionelle handlere med en intuitiv grænseflade og vejledninger.

Optjen en 100 $-bonus

for nye brugere!

Den største kryptobørs, hvor du hurtigt og sikkert kan starte din rejse i kryptovalutaernes verden. Platformen tilbyder hundredvis af populære aktiver, lave provisioner og avancerede værktøjer til handel og investering. Nem registrering, høj transaktionshastighed og pålidelig beskyttelse af midler gør Binance til et godt valg for handlere på alle niveauer!

Coins obtained as a result of various operations are subject to destruction:

- Profit of the cryptocurrency exchange.

- Commissions for transactions in the network.

- Part of the assets (embedded in the Proof-of-Burn consensus algorithm).

If the decision to burn is made by developers in advance, it is written about it in the technical documentation (white paper). Users can give up cryptocurrency by reading about the owners’ intentions. All destruction operations are recorded in the blockchain as transactions. Anyone can look at it: to make sure that the koins are burned and not transferred to an interested party.

For what purposes is it conducted

Withdrawal of coins from circulation is an irrevocable process. Cryptocurrency becomes inaccessible forever, even for developers. Regardless of the methods of destruction, the result is the same – a decrease in the total number of koins.

Despite the negative coloring of the process, positive goals are pursued when burning cryptocurrency:

- Boosting the exchange rate.

- Maintaining stability.

Cryptocurrency appreciation

The rule works: the less assets exist, the higher their price. A vivid example is precious metals. The volume of gold in the world is smaller, the price is higher. There is more silver, and the metal is cheaper. Burning coins reduces the volume within a project, thereby increasing the value.

Artificial scarcity of virtual money makes sense in the short and long term. By burning assets, project owners or others involved in the procedure increase demand, which further raises the value. Users will purchase popular koins in the face of a decrease in the total amount.

The benefit goes to developers and investors, especially those who bought assets cheaply at the beginning of the project launch. All of the above is true in one case, if the cryptocurrency had any circulation. Unpopular among investors and other users coins can be destroyed all: their rate will not grow if they did not represent value.

For example, the exchange Binance burns its crypto assets BNB every 2 months. However, the rate does not always rise: it is in the general trend of the market and follows it.

In his project, Vitalik Buterin launched the EIP-1559 update, which also includes the mechanism for burning Efirium. Since August 5, 2021, about 202 ETH has been destroyed every hour. According to the project, since the launch of the London hardfork, $4.8 billion has been taken out of circulation and new coins have been generated – for $2.3 billion. The exchange rate has increased, so we can say that the burning of the cryptocurrency is working for the benefit of the asset.

Maintaining stability

Unlimited issuance of coins leads to the depreciation of the project. To prevent this and maintain stability, developers apply different mechanisms, burn a part of the volume. Relevant for continuous mining in old projects. When the number of coins is more than 1 billion, even if the interest of users is high, the rate will not increase in proportion to the issue. The overall capitalization of the network falls. The frequency of withdrawal depends on the speed of issuance, the number of holders.

Destruction of surplus after the ICO

Developers of digital currency enter the market with an initial offering (Initial Coin Offering). By doing so, projects attract investors, issue crypto-assets, which are received by investors in exchange for money. Excess tokens unsold during the ICO are sometimes burned. This is a necessary procedure that will prevent the price of the asset from falling, increasing the income of investors and other holders.

Burning of project tokens by famous people

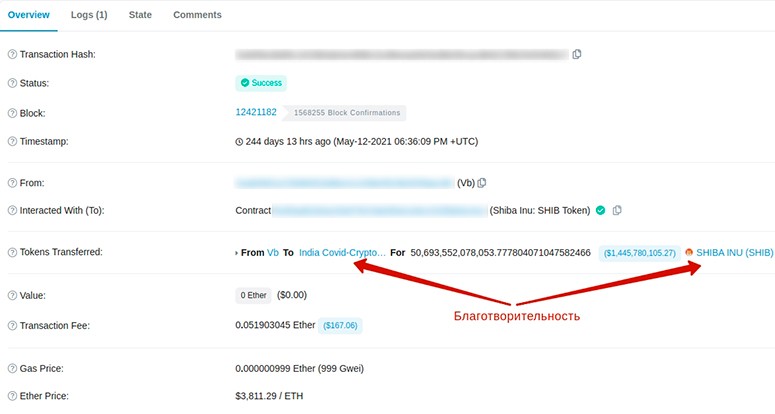

The most striking example is related to Buterin. The developer of SHIBA INU, known under the pseudonym Ryoshi, sent Vitalik 50% of all issued SHIBs. This is about 250 trillion koins totaling $13 billion. According to Ryoshi, the purpose of the transfer was destruction.

Buterin burned some of the SHIB coins he received from developers in the spring of 2021. It was about 40% of the total volume of the meme cryptocurrency. Vitalik donated the remainder to India’s COVID-19 fund.

There is information that the developer of SHIBA INU did not act on his own. He was supported by a friend, who could well be Vitalik Buterin.

Withdrawal from circulation is also performed as a result of wrong actions. An example is Tether. The issuance of stablecoins is centralized. When 5 billion USDT were mistakenly generated based on the Tron network, the company burned them. Otherwise, the system would have collapsed.

Benefits

The withdrawal of cryptocurrency from circulation is related to the costs of the people performing the procedure. The assets to be burned have a value that will be lost forever. But different categories of participants in the system benefit.

For developers

Owners want:

- Increase the value of the asset, leading to increased revenue.

- Raise the image of the system (also related to material benefits).

For investors

Owners of large amounts of cryptocurrency earn on the increase in price over time. The destruction of the asset by developers or large holders will favorably affect the exchange rate. All investors will benefit.

When excess tokens are destroyed after an ICO, developers benefit in the long run. Investors benefit immediately. Projects that initially declare their intention to burn unspent tokens after the ICO are in demand.

Destroying coins does not necessarily lead to a price increase. If the project is not interesting or is outright scammer, the withdrawal from circulation will not add popularity. Also, if the market situation is negative, a positive effect from burning may not be expected.

Under favorable circumstances, the withdrawal of some tokens from circulation increases the attractiveness of the project and ensures the interest of investors. There is another positive factor – the burning of coins on the part of developers or owners means their faith in their network, their desire to improve the situation in the market. Investors consider this a positive argument.

Proof-of-Burn algorithm

In the digital world, different methods of verifying and confirming transactions are used. Among the popular algorithms are Proof-of-Work, Proof-of-Stake. There are other methods such as Proof-of-Burn – Proof-of-Burn. In this mining algorithm, the user must burn some assets to get others. Cardinal method, but there are no costs except the value of the coin being taken out of circulation. Burning cryptocurrency shows the user’s commitment to the system in which he works. The process ensures the stability of the project’s existence.

The concept of “virtual mining” applies. By burning coins, the user gains access to the creation mechanism. The process of mining with the PoB algorithm is simple:

- The validator sends a part of the coins of another system to a public address with inaccessible private keys.

- For this he receives a reward in the form of tokens of the other network (the amount is proportional to the burned assets).

- A user can become a validator for life.

There are variations of the method – coins of someone else’s project or one’s own are burned. PoB is a symbiosis of two main algorithms – PoS and PoW. In the first case, financial resources are spent, and from the second got the procedure of mining, albeit virtual.

Pros and cons of PoB:

| Fordele | Ulemper |

|---|---|

| Lower resource requirements for extraction equipment | There is not enough evidence base to confirm the effectiveness of the method on a large scale |

| Lower power consumption, especially compared to PoW | Verification of work done by miners is slower than with PoW or PoS |

| Burned coins create market scarcity and cause deflationary processes | PoS validators can take their assets if they decide to finish with steaking. In the PoB algorithm this is not possible – the coins are burned. |

| Miners are more committed to their project | PoB – coins are destroyed forever, effort has been expended to mine them, the value of which is nullified |

| There is no centralization like pools in the case of PoW | Indirect impact on the environment, especially when destroying bitcoins |

An example of a project with a PoB validation algorithm is Counterparty (XCP). Coins are created when bitcoin is burned. A user who sends BTC to a public address receives XCP.

Ways to burn a coin

In addition to cryptocurrencies based on the Proof-of-Burn consensus confirmation algorithm, other projects also destroy their assets. There are 2 methods for withdrawal from circulation:

- Manual.

- With the help of a protocol.

The manual method includes redeeming coins and destroying reserves. Early platforms did not assume in their protocol the possibility of burning. But when the need arose, developers and large holders began to periodically destroy some of the cryptocurrency.

Programs

The use of protocol functions assumes a special possibility of withdrawal from circulation. Binance Coin (BNB) and OKEx Coin (OKB) tokens are examples. They are based on the Binance Smart Chain and Ethereum protocols respectively. Burn Function is used for burning. It works in both protocols (Binance Smart Chain is based on Ethereum).

The user calls Burn Function, specifies the number of assets to be withdrawn. The smart contract sends tokens to an address unavailable for further use. Beforehand, the program will check if the required amount is available in the wallet. Burn Function is available in other networks based on the ERC-20 protocol.

Sending to a public address

Any coin holder can make a transaction, including for withdrawal from circulation. It is enough to send cryptocurrency to a public address, to which there are no private keys. It is impossible to select access, for this there is not enough computing power of the equipment.

Public addresses are used: you can check the number of coins, as well as their movement on this account.

Commission

Burning fees for miners is one of the deflationary methods. An example is the Ethereum update called EIP 1559. The changes are aimed at reducing commissions that had reached too high. Users of the network started paying less money for transactions. Part of the commission is burned – thus a certain amount of cryptocurrency is withdrawn, the exchange rate increases. However, validators remained dissatisfied. They receive only a “tip” (priority fee), the base commission is burned.

Reward

Another option to withdraw a part of assets from circulation. It is necessary to request an incomplete commission or reward for transactions. For practical implementation, you need special software or changes in the program code. The method was used by some pools for deflationary purposes.

Example of BNB cryptocurrency burning

The owners of the trading platform Binance use the withdrawal of tokens from circulation. Each quarter, a different amount of BNB is burned. The volume depends on the number of transactions on the platform for the specified period.

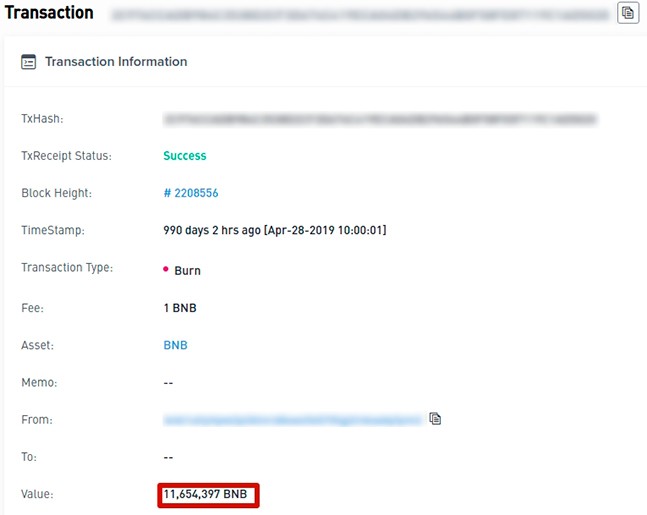

Initially, the Binance Coin token worked in the Ethereum network. Burning was performed on the basis of smart contracts. The purpose of the procedure is to withdraw 100 million BNB (50% of the total settlement issue) from circulation.

After the burn, the owners of the exchange make an official statement, indicating the volume of withdrawn assets. Transactions can be checked in the observers.

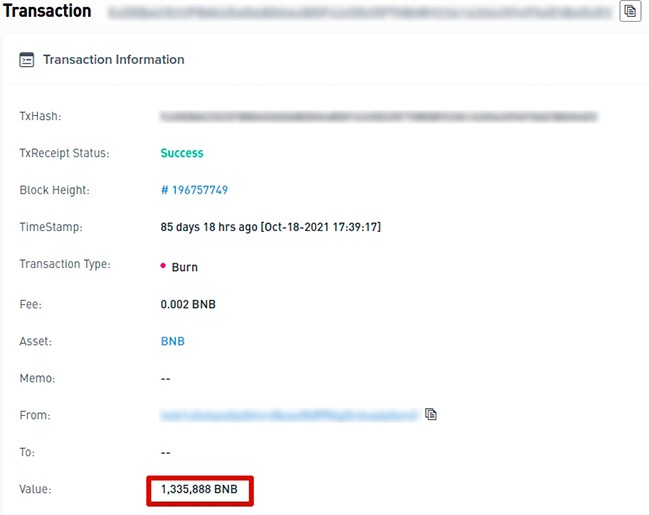

Later, the cryptocurrency moved to its own blockchain Binance Chain. For the destruction is used not a smart contract, but a separate function in the network. At the same time, all the withdrawn BNB ERC-20 tokens were duplicated in the new blockchain. Immediately after the launch of BNB BEP-2, 11,654,397 cryptoassets were burned.

As of December 2021, the Binance exchange has conducted 17 destruction procedures. A total of 33,199,679 tokens worth $2.22 billion have been removed from circulation.

Sammenfatning

Cryptocurrency burn is one of the deflationary mechanisms. If used skillfully, it can achieve important goals for the project: increase the value of the asset and attract investors. It is important to have unconditional trust in the developers or owners of the network. Using the method without a set of other measures may not lead to the expected result. The price of cryptocurrency depends on various factors, including the general situation in the market and the trust of users.

Ofte stillede spørgsmål

🔥 Developers can burn assets fictitiously and apply them in the future?

There is no resonance in this. Own assets that have value are being destroyed. A transaction is always easy to verify and detect fraud.

❓ If you create a project, issue coins and burn half of them, will the exchange rate rise?

For an unclaimed cryptocurrency, withdrawing from circulation will not increase the value. If no one is interested in the project, destroying it won’t automatically attract investors.

💰 Why isn’t bitcoin being burned?

According to the terms of the network, the issue of BTC has a limited number – 21 million koins. They do not need to be burned, especially since about 90% of the maximum value has already been mined. Of these, a part is permanently blocked in the so-called “forgotten” wallets in the first stage of development.

💡 Why burn the remaining tokens after the ICO, you can sell them and make a profit?

For a new project it is more important to increase the rate, the interest of investors, and not short-term profit from the sale.

🏹 If you burn cryptocurrency regularly, the price will increase each time?

This is in theory. In practice, everything depends on the overall market and the demand for the project. With growing interest in virtual currency, its value will increase with decreasing supply.

En fejl i teksten? Fremhæv den med musen, og tryk på Ctrl + Indtast

Forfatter: Saifedean Ammousen ekspert i kryptovaluta-økonomi.