Against the backdrop of problems in the global economy, people do not trust fiat currencies and are looking for new options for storing and accumulating capital. Virtual assets can replace conventional money in all spheres, including trade and investment. Highlight the advantages and disadvantages of cryptocurrency. Understanding the mechanisms behind coins and symboler, you can find assets for different purposes: both trading and investment.

The main advantages of cryptocurrencies

Interest in virtual assets shows the level of capitalization. In November 2021, the volume of all coins and tokens was about $3 trillion at the maximum price of bitcoin and altcoins. The exchange rate has changed and the market capitalization has fallen, is at the level of the developed world.

Virtual money has existed since 2009, when Satoshi Nakamoto developed and launched the Bitcoin network. Since then, the world has changed: supporters of digital assets have appeared. No one denies the very existence of cryptocurrencies, the value of which depends on people’s trust in them.

Virtual assets are based on blockchain – a decentralized distributed network. There is no regulator that manages the rate, emission, sets the rules. All transactions are stored in the blockchain, everyone can see any information (except personal). The work of the system is controlled by the users themselves – miners, validators and other participants (depending on the validation algorithm).

The benefits of cryptocurrency attract people. Some traditional banks and state governments have adopted virtual money. The main advantages are:

- Decentralization.

- Anonymity.

- Low cost of transfers.

- Immunity to inflation in the traditional sense of fiat currencies.

- Alternative to gold (for bitcoin).

- Great investment opportunities.

- Other features that traditional fiat currencies do not have.

Many of the advantages of virtual assets are based on comparisons to fiat. So far, digital coins cannot displace traditional money from circulation and replace it as the main means of payment. However, in some areas they have already proved to be better than fiat.

5020 $

Bonus til nye brugere!

ByBit giver bekvemme og sikre betingelser for handel med kryptovaluta, tilbyder lave provisioner, højt likviditetsniveau og moderne værktøjer til markedsanalyse. Den understøtter spot- og gearet handel og hjælper begyndere og professionelle handlere med en intuitiv grænseflade og vejledninger.

Optjen en 100 $-bonus

for nye brugere!

Den største kryptobørs, hvor du hurtigt og sikkert kan starte din rejse i kryptovalutaernes verden. Platformen tilbyder hundredvis af populære aktiver, lave provisioner og avancerede værktøjer til handel og investering. Nem registrering, høj transaktionshastighed og pålidelig beskyttelse af midler gør Binance til et godt valg for handlere på alle niveauer!

Decentralization

Financial systems of different countries of the world control money. These are special organizations and structures (banks, credit institutions). This approach increases the cost of service and complicates many processes. Trust in the actions of the regulator is at a low level. This is especially noticeable against the background of countries with poorly developed economies and high inflation.

Cryptocurrency is based on blockchain, the network is controlled by the participants themselves. For this purpose, there are consensus validation mechanisms – among the popular ones are PoW, RoS andothers. Miners or validators (depending on the algorithm) check transactions and create new blocks. For this they receive remuneration, the size of which depends on the network, the transaction.

Decentralization is an advantage that differs from accepted norms and rules. This fact prevents digital assets from being recognized. People do not understand why no one controls the work of the blockchain.

Decentralization is a new format for securing money. No one can steal a transfer, send it to another account, as it sometimes happens in conventional banks. Fraudsters also exist in the digital world, but their methods are different: people themselves install fake applications, transfer private keys, and send coins. In blockchain, no outsider can direct a transfer to another wallet. The system is safe despite the absence of regulators – central banks, supervisory authorities.

There are the following centralized platforms for work:

- Exchanges.

- Exchange services.

- Credit platforms and others.

Decentralized analogues of trading exchanges are developing. They represent the next stage in the development of the digital market.

Anonymity

Transactions do not need personal information. To transfer coins to another user, it is enough to know the wallet address and private keys to access the assets. The owner’s name, personal data, other information are not displayed. In this respect, cryptocurrency is anonymous.

Data on transactions are in the network. At the address of the wallet, anyone can see all the information about the movement of funds. There are free services for this purpose. There is no specific data about the owner of the wallet, but it is realistic to find them. For example, if a user specifies information about himself, pays with coins, it is possible to link these 2 events and reveal the person.

All centralized trading platforms require registration and full verification. Information about the user of the digital assets is available, including personal details.

Anonymity is both the pros and cons of cryptocurrency. Coins are believed to be untraceable. This is what digital currency attracts fraudsters.

Cheap transfers around the world

The capabilities of cryptocurrency do not depend on the country, distance or other factors. It is easy to make a transaction and send coins to a user in another state. And the fee is not determined by the transfer amount and other factors that usually affect the cost of traditional cross-border transfers at banks.

Transactions are serviced by miners or validators (other participants depending on the validation algorithm). They are rewarded for their work by the users who make the transfer. Its size is determined by such factors:

- The weight of the transaction.

- Network load.

- The volume of other transactions.

You can control the size of the reward for a transfer. Its size is determined by the speed of the transaction.

The composition and size of the fee depend on the network. Popular projects provide a favorable transfer of a large amount to another country compared to traditional systems.

No inflation

The financial market is characterized by different indicators. Inflation is the process of devaluation of monetary assets, the growth of prices with a fall in purchasing power. These are features of the economy, without which there is no development. The process is characterized by the rate of growth.

| Inflation | Value, % per year |

|---|---|

| Low | Up to 6 |

| Moderate | From 6 to 10 |

| High | From 10 to 100 |

| Hyperinflation | Over 100 |

Low inflation is about 6% per year, ensures the development of the economy. All countries of the world strive to maintain this level. The other indicators have a negative status.

Among the factors affecting inflation, you can distinguish the weakening of the fiat currency of a certain country. There is also an increase in the money supply. The issue of fiat currency is not limited by anything except the desire of the regulator or the government of the country.

Cryptocurrency is not as susceptible to inflation. Many projects have limited issuance, which positively affects the asset rate. For example, Satoshi Nakamoto limited the maximum number of bitcoins at the level of 21 million. At the end of 2021, almost 90% of coins were mined, some of which are permanently blocked in forgotten wallets.

Despite the presence of inflationary processes to which crypto-assets are subject, the level of decline in purchasing power is less than that of fiat currencies.

Digital gold

Precious metals are stable investment instruments. Gold continues to be the primary vehicle for saving. Its price is on the rise. This is what attracts investors to the metal.

Bitcoin is often compared to precious metals, called digital gold. The currency is gradually growing in value. Even if the rate falls, it will not last long. Unlike physical gold, cryptocurrency does not require large storage costs. Metals take a long way to the bank.

According to experts, bitcoin is no longer a speculative instrument, but a means for savings. Etherium is referred to as digital silver.

Investment opportunities

This is a significant plus of cryptocurrency. The low threshold of entry into the market allows anyone with access to the Internet and a small capital to work and make a profit. A potential investor must understand the peculiarities of the market, understand the mechanism of the processes that exist in the digital world. However, this does not require licenses or courses. Knowledge can be obtained for free, many exchanges provide such information.

A low level of entry is not always a good thing. It is necessary not to panic, invest for a long period of time and carefully choose the asset to buy. It is important to determine the method of storage and study the market.

New opportunities

Digital money is an ecosystem of coins and tokens that contains many avenues for making money. Cryptocurrency acts as a means of payment just like fiat. More and more merchants are offering customers the ability to pay for goods and services with coins. For example, Tesla accepts Dogecoin.

Other features:

- A trading tool for trading.

- A tool for investing and saving capital.

- A tool for earning money ved minedrift (fiat currency does not).

- A means to generate income and so on.

The main disadvantages of cryptocurrencies

The digital market is still developing. Many problems are already in the past. However, there are disadvantages that prevent virtual assets from taking the place of fiat money.

Volatility

The main problem of bitcoin and altcoins is sharp fluctuations in the exchange rate. Volatility prevents the coins from being invested as an investment. Beginners in trading can lose funds at the first drop in the rate.

The value of cryptocurrency is based on the trust of users. Coins are not secured by anything (except for a separate category). Therefore, the price depends on external factors:

- News background.

- The actions of regulators in each country (ban, legalization).

- Events in the world.

- Recognition by companies as a means of payment.

For trading, volatility is a positive phenomenon. The greater the risk, the higher the opportunity to earn. Requirements to trader’s experience and knowledge grow. In general, volatility prevents coins from becoming a means of payment.

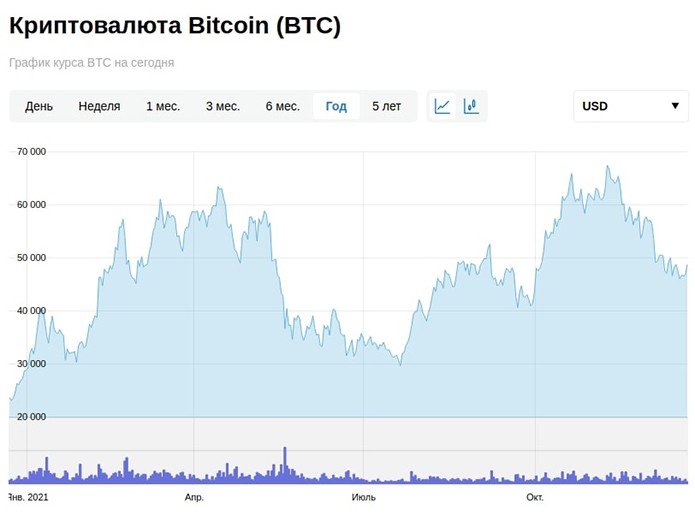

For example, in 2021, the bitcoin rate varied from $30 thousand at the beginning of the year to $48 thousand at the end. At the same time, the value of the coin exceeded $60 thousand several times. The price of other assets fluctuated following the value of bitcoin.

High fees

During the formative period of the digital world, when there was no demand, the load on the network allowed transactions to take place without high fees. At some points, the commission in popular networks reached values at which the transaction of a small amount was unprofitable.

Unlike traditional banks, the commission in the Bitcoin network does not change. You can’t predetermine the size of the fee and the time of the transaction. You can set your own value of remuneration to miners, but it takes longer than usual to wait for the transaction to be completed.

In addition, there are commissions for withdrawing cryptocurrency into fiat via exchange services or trading platforms. This reduces the advantages of digital assets, making it unprofitable to use. Sometimes it is more convenient to keep funds in koins, not to transfer them into fiat money.

The costs of the exchange operation consist of several commissions:

- For entering currency into the service.

- For the purchase of coins or tokens.

- For withdrawing coins into fiat.

The user should calculate the costs in different ways of buying cryptocurrency. High fees are a disadvantage of cryptocurrencies.

Difficulty of public perception

Bitcoin and other coins are misunderstood by many people. People who are not exposed to digital assets don’t know what it is. The complexity of public perception is the reason for users’ distrust. Cryptocurrency is not characterized by ease of access. It is necessary to have knowledge, to understand the nature of digital assets in order to apply coins. If traditional payment systems are used to traditional payment systems, there are available mechanisms (cards, terminals for payment, ATMs for cash), it is more complicated with cryptocurrency.

The strong growth of bitcoin rate makes users think that it is a speculative asset. People think cryptocurrency is a pyramid scheme or a fraudulent scheme. There is no tangible collateral behind digital assets. Most do not understand how their price is formed. At the same time, the rate of fiat currencies, which are familiar to everyone, is also formed under the influence of factors unknown to ordinary people. Like virtual money, dollars, rubles or euros are not backed by tangible assets.

Regulation

The different approach to cryptocurrencies in countries constitutes a big challenge for the development of digital assets. Decentralization and the lack of a single regulator is an advantage of cryptocurrency. However, for its application at the state level, it needs to be recognized, to determine its legal status. Without regulation, virtual money cannot be used legally. This is the main conflict of interest:

- Owners are attracted by decentralization and the absence of a supervisory body.

- Governments fear an unregulated system.

Therefore, countries around the world have different approaches to digital currency – from a complete ban to its use as a means of payment on par with national money.

Cryptocurrency is banned in 10 countries, in 107 countries it is allowed in some form, and in 135 countries there is no government position. At the same time, in the United States, the attitude to digital money varies from state to state. This is due to the large physical size of the country and a special structure with broad rights of subjects.

Prosperity of shadow business

According to the central banks of different countries, cryptocurrency attracts representatives of the criminal world. This is possible due to the lack of controlling and regulatory bodies, decentralization and anonymity of payments.

Bitcoin and some other coins gained popularity thanks to the “darknet”. It is convenient to use the coins to pay for drugs, weapons and other illegal items. Anonymity is the main quality of digital assets that attracts criminals. Cryptocurrency mixers are used, hiding a trail of transactions behind each coin.

Experts believe that bitcoin has given a boost to the black market. The possibility of control by law enforcement agencies is reduced, there is no need to mess with bank transfers, which are easy to trace. Everyone knows the online market Silk Road, where the main means of payment was bitcoin.

It is worth noting that criminals use many tools that are used for quite normal purposes (for example, ordinary currency, cars, computers and other things). With cryptocurrency, it is a similar situation. In order to fight the illegal circulation of digital assets, it is necessary to adopt appropriate legislation.

Fraudsters

One of the disadvantages of cryptocurrency is the irreversibility of transactions. A transaction cannot be canceled or adjusted. No one will return the coins obtained by criminal means.

There are many ways to deceive users. Most of them are based on people’s gullibility. Many believe in the huge interest, quick income, lack of commissions on the exchange service. This serves as a lure for owners to transfer coins. It is impossible to cancel such an operation, even if you prove that it occurred under the influence of fraudsters.

To protect yourself, you need to think about each favorable offer, do not trust advertising, promises of large profits. It is important to use reliable sites, check the address when going to third-party resources. It is necessary to install software from the official sites of developers or application stores.

Ofte stillede spørgsmål

📈 Why does the price of bitcoin change sharply?

The rate is affected by events in the world economy, politics. There was a crisis, countries closed markets, and the price falls. The company reported payment in bitcoin – the rate went up.

🙅♂️ Why don’t some countries recognize digital currency?

States can not control the digital market, fear competition from coins and tokens.

⚖ What is the advantage of volatility, because you can lose a lot?

Maximum profit in trading is possible when trading assets with sharp changes in the exchange rate. You need to have a lot of experience, understand the mechanisms that affect the price.

🤝 In which country is cryptocurrency accepted as a means of payment?

In El Salvador, bitcoin is officially accepted and used on par with the US dollar in 2021.

🤔 How can digital currency inflation be reduced?

They use an asset burn mechanism – withdrawing a certain amount of coins from circulation. Reducing the number increases the price, provided the popularity of the project.

Fejl i teksten? Fremhæv den med musen, og tryk på Ctrl + Indtast

Forfatter: Saifedean Ammousen ekspert i kryptovaluta-økonomi.