Russian legislation prohibits the use of bitcoins in the country to pay for services. Therefore, when mining cryptocurrencies, clients have to make a withdrawal of money from mining to a card and only then change it into fiat (rubles, dollars). There are several options for selling coins, differing in the size of the commission and security.

Legality of withdrawing funds from mining in Russia

In the Russian Federation, you can not pay with digital assets. However, the legislation does not prohibit earning from mining and trading cryptocurrency. Users can sell coins in exchangers and on exchanges to get rubles. The main thing is to pay taxes. The exchange of assets is a source of income for the miner.

If you mine cryptocurrency without paying state fees, a citizen will receive a fine from the Russian Tax Service. Liability is provided for non-paying miners.

Taxes for cryptocurrency transactions

If the mining farm brings income, its owner must pay fees to the treasury – 13% from each transaction. Cryptocurrency in the Russian Federation is the same asset as real estate. Therefore, part of the miner’s profit from the sale must be given to the country.

If coins were bought and then exchanged, the tax base is the difference between the prices of operations. Here it is necessary to show how many roubles the currency was received for.

To the form PIT-3, which is submitted to the tax service, you need to add the history of wallet transactions, confirming income. It is enough to take a screenshot of the transactions.

5020 $

Bonus til nye brugere!

ByBit giver bekvemme og sikre betingelser for handel med kryptovaluta, tilbyder lave provisioner, højt likviditetsniveau og moderne værktøjer til markedsanalyse. Den understøtter spot- og gearet handel og hjælper begyndere og professionelle handlere med en intuitiv grænseflade og vejledninger.

Optjen en 100 $-bonus

for nye brugere!

Den største kryptobørs, hvor du hurtigt og sikkert kan starte din rejse i kryptovalutaernes verden. Platformen tilbyder hundredvis af populære aktiver, lave provisioner og avancerede værktøjer til handel og investering. Nem registrering, høj transaktionshastighed og pålidelig beskyttelse af midler gør Binance til et godt valg for handlere på alle niveauer!

A more favorable option for miners is the status of self-employed. They need to pay only 4% for selling coins to individuals and 6% to exchanges. However, they will have to find out information about the recipient of the assets.

How to withdraw money from mining

Several ways to exchange bitcoins for rubles are offered. Below we will tell you how to withdraw money from mining to the card in Russia and what advantages the options have.

Cryptocurrency exchanges

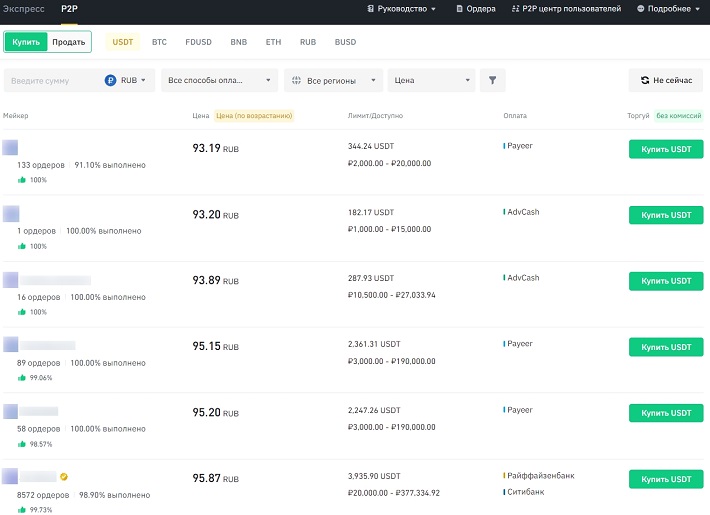

The most popular and safe way to get rubles. More than 40 cryptocurrency exchanges are available in Russia, but they work with some restrictions in 2023. On these platforms, you can exchange coins directly and withdraw them. P2P trading is also available.

The minus of exchanges – the commission is higher than exchangers take. It is also necessary to specify personal information during verification. For this trading platforms provide security and check the honesty of operations.

In addition, large exchanges (Binance) have high liquidity. This allows you to quickly exchange even huge amounts to rubles. However, platforms do not support all currencies, so you need to look at the list of coins in the listing. To cash out funds, it is necessary:

- Open a wallet on the exchange.

- Click on “Withdraw funds”.

- Choose a payment method and coin.

- Specify the data of an e-wallet or bank card, as well as the amount to be withdrawn.

- Enter the confirmation code.

Exchangers

When cryptocurrencies in Russia were just becoming popular, it was difficult to get fiat. The exchanges known today have just appeared and worked with restrictions. Back then, miners mainly used exchangers.

Forfatter: Saifedean Ammousen ekspert i kryptovaluta-økonomi.