Bitcoin is the first cryptocurrency and it is not backed by traditional financial assets. Since 2017, BTC became popular because of the rapid growth of the coin’s market rate. This event caused a resonance among financial analysts and ordinary internet users. Then many began to say that bitcoin is a bubble. But by 2021, the coin proved the opposite.

The concept of a “bubble”

A basic term for traditional financial markets. A bubble is understood as a sharp and rapid growth of certain assets. A justified increase in stock market quotations is a good thing. However, the emergence of a bubble has no fundamental prerequisites.

Signs

A bubble has 2 main indicators:

- A rapid increase in the value of the asset. A price increase of even 300% in a few months is an abnormal event for traditional financial markets, but not for cryptocurrency. For example, Bitcoin’s chart showed a similar rally in late 2020-early 2021. Literally in 3 months, Bitcoin went from 13 to 40 thousand dollars.

- The hype. The bubble is evidenced by the “fashion” to buy a certain financial asset. People who know nothing about trading on exchanges start to engage in investments. The market is overflowing with amateurs, because of what later increases the chance of panic. When the price starts to fall, all newbies sharply sell their personal investments and thus cause the value of the asset to collapse.

An example is the Great Depression of the 1930s in the United States. Prior to this event, most of the states’ population was involved in securities trading. However, in 1929, citizens began to strongly reduce business activity and at the same time contribute to a sharp increase in the price of shares of large companies. The result was the collapse of the U.S. economy.

Bitcoin is a digital coin. Cryptocurrency has a number of features that make it hard to apply methods of analyzing traditional markets:

- Peer-to-peer network technology – blockchain.

- Decentralization of cryptocurrency projects.

- Restriction of coin issuance and other features.

Why some consider bitcoin to be a bubble

The lack of a traditional asset to back this cryptocurrency gives users the feeling that Bitcoin is a scam and a made-up currency for speculation. However, it sells for a lot of money: the BTC exchange rate as of November 22, 2021 was $57,450.

5020 $

Bonus til nye brugere!

ByBit giver bekvemme og sikre betingelser for handel med kryptovaluta, tilbyder lave provisioner, højt likviditetsniveau og moderne værktøjer til markedsanalyse. Den understøtter spot- og gearet handel og hjælper begyndere og professionelle handlere med en intuitiv grænseflade og vejledninger.

Optjen en 100 $-bonus

for nye brugere!

Den største kryptobørs, hvor du hurtigt og sikkert kan starte din rejse i kryptovalutaernes verden. Platformen tilbyder hundredvis af populære aktiver, lave provisioner og avancerede værktøjer til handel og investering. Nem registrering, høj transaktionshastighed og pålidelig beskyttelse af midler gør Binance til et godt valg for handlere på alle niveauer!

Part of people think bitcoin is a bubble because it is growing rapidly. The opinion is partially true, but cryptocurrency as a whole is a new technology. For example, in 2021, blockchain has become a business tool for entrepreneurs. This fact indirectly accounts for the high growth rate of the Bitcoin price. It is worth noting that the Internet at the stage of development also seemed a dubious venture – a kind of bubble. However, in 2021, more than 61% of entrepreneurs conduct online business.

Bitcoin cemented the title of bubble after the first cryptocurrency boom, which occurred in 2017. By December, the value of a single BTC coin reached the $20k mark. However, since the beginning of 2018, the price of Bitcoin began to decline rapidly. In 12 months, the value fell below $4 thousand – the bubble “burst”.

Similarities to tulip fever

In 1636 in the Netherlands, investors started “inflating” a bubble. People invested in bulbs to plant rare species of tulips. Within 12 months, the price rose about 10 times. However, in 1637, tulips depreciated a lot – becoming worth even less than before the flower boom.

In 2020, Gabriel Makhlouf, a member of the Council of the European Central Bank, reminded the public that more than 300 years ago, people put money into flowers because they thought it was a good investment. Opponents of the bitcoin cryptocurrency partially support him. Since Bitcoin’s inception, blockchain technology has been compared to tulip mania.

However, the 2 phenomena have no practical similarities. Tulips are only a bouquet of flowers. Bitcoin is a digital technology, and it is evolving. The demand for decentralized networks increases every year. Also, cryptocurrency has financial utility for the world – it replaces banking systems.

Bitcoin fundamentals

To understand the further movement of Bitcoin, it is worth considering the factors that affect its price. The fundamental analysis of Dmitry Noskov, a cryptocurrency broker from StormGain, whose trading experience is more than 5 years, is taken as a basis.

Since October 2021, the demand for bitcoin has increased among institutional traders – large investment hedge funds. At the beginning of the month, they invested more than $226 million in BTC. Total bitcoin deposits have grown by 227%.

Noskov attributed the positive mood of traders to the support of the release of ETFs on Bitcoin by SEC (Securities and Exchange Commission) Chairman Gary Gensler. Bitcoin futures contracts were approved on October 18, 2021. Also, US Federal Reserve Chairman Jerome Powell said that the regulator will not restrict cryptocurrency. This fact reassured investors.

Other fundamentals:

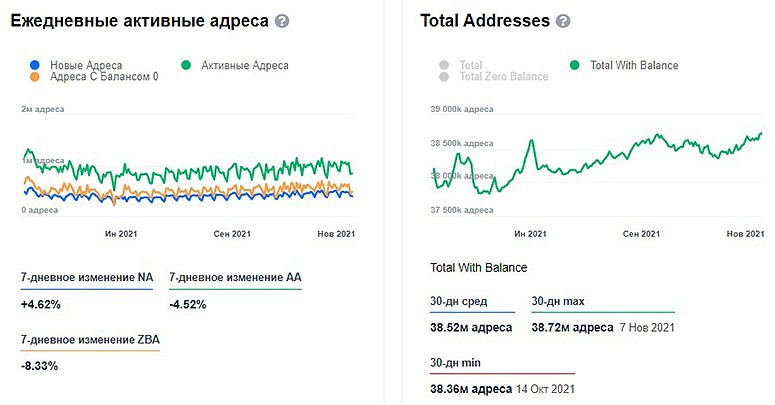

- An increase in the average transaction size from 0.9 to 1.3 BTC.

- A 19% increase in the number of active market participants.

- An increase in the stock of bitcoins in users’ wallets (13.3 million BTC – a record for 2021).

- Increased demand for lending to buy more Bitcoin.

Speculation in the cryptocurrency market

“Whales” are the largest players in the market of digital assets. Their capitals amount to billions of dollars. Such investors are able to manipulate the price of cryptocurrency coins.

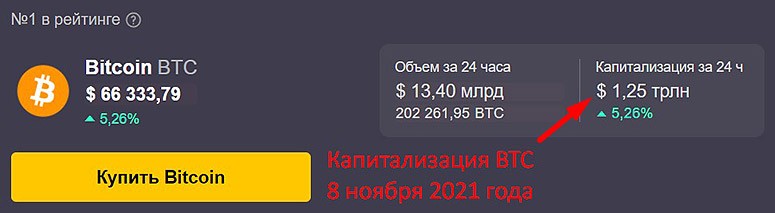

When predicting the price movement of Bitcoin, it is important to take into account the current activities of whales in the market of digital assets. Bitcoin is less susceptible to their attack because it has a large capitalization – $1.25 trillion as of November 8, 2021. But users of low-value altcoins periodically lose money due to the whales’ activities.

An investor needs to study the basics of fundamental analysis. This will allow you to timely notice the prerequisites for the approaching trend of cryptocurrency price movement. All the theoretical knowledge obtained is recommended to check in practice and accumulate experience.

Abduction

Deduction is the process of constructing one consistent conclusion based on the studied premises. The method is often used in mathematics and computer science.

Abduction is a somewhat simplified form of deduction. This method of deducing inference differs in that it recognizes the possibility of conclusions not being correct. Abduction allows for the best decision that the analyst can make due to the data and assumptions available.

Complexity of valuation

Even fundamental analysis of cryptocurrency has difficulties. Since bitcoin is not backed by traditional assets, it is difficult to predict the rise or fall in the market price of the coin.

Effective use of fundamental level analysis techniques will help to determine the fair price of Bitcoin more accurately. However, some investors do not foresee one factor: the research of the coin shows its justified value. The real value of the digital asset may differ from the predicted one. This fact adds to the complexity of accurately analyzing the market rate.

The fair price of Bitcoin

Many people believe that cryptocurrency is a bubble. But fundamental analysis proves otherwise, because it allows you to determine the real value of cryptocurrency.

| The main indicators | Description |

|---|---|

| Project Indicators | Allow the analyst to evaluate the developers’ approach to the startup. |

| Financial indicators | This is liquidity, trading volume of the cryptocurrency asset and other metrics. Indicators allow you to assess the demand for the coin. |

| Onchain metrics | These are indicators of the cryptocurrency network – the number of transactions, active addresses, bitcoin wallets and other characteristics of the digital system. An analyst uses onchain metrics to gauge user interest in a coin. |

By combining indicators and using the principle of abduction, the investor determines the real price of bitcoin.

Future of the coin

Bitcoin has the potential for future market appreciation. Large investors and analysts with extensive experience predict the value of BTC to increase even to $500 thousand within a few years.

Such optimistic views on digital money are supported by the growing interest in Bitcoin. Blockchain technology is becoming a tool for doing business. Also, a part of cryptocurrency users have started to consider coins as a safer investment item compared to traditional financial assets.

Is it worth buying BTC now

Before purchasing bitcoins, it is important to realize that it will be a long-term investment. In the long run, the cryptocurrency can prove to be a good investment – as the price of the coin increases over the years. However, it is not recommended for a novice investor to use BTC for short positions. The high volatility of this coin can make a trader very nervous and he will make wrong trading decisions.

You can read more about whether you should buy BTC now here.

Summary

Part of the cryptocurrency community believes that Bitcoin is a bubble. This idea is supported by arguments like:

- The coin has abnormally high volatility.

- BTC is not backed by traditional assets.

The arguments are partly true, but it is worth considering the basis of any digital currency – blockchain technology. It is now becoming a tool for entrepreneurs and developers of cryptocurrency projects. For example, Russia plans to use blockchain technology in the Federal Tax Service system to provide banking organizations with information about borrowers. In 2024, digital currency is becoming a part of people’s lives, so bitcoin is gaining true value.

Frequently Asked Questions

❓ How many signs of a financial bubble are there?

It is possible to identify speculative growth by more than 10 factors. These include a rapid increase in the number of short positions, investors ignoring or misinterpreting negative news, and other signs.

💰 What does the BTC rate depend on?

The market value of Bitcoin is influenced by the public mood of investors, which can change depending on various factors.

💡 Why does an analyst need abduction?

A simplified form of deduction allows you to find the most rational solution possible based on the available information. Abduction also allows for the possibility that the conclusion may not be correct.

🕺 What qualities should an investor possess?

The most important personality trait of an investor is cold-bloodedness (you can’t be afraid of losing money). Also, an investor must have patience, because it will not be possible to make a profitable transaction without it.

✅ Bitcoin – no longer a bubble?

Cryptocurrency has become a part of many people’s lives. For example, in Japan, bitcoin is the official means of payment. Because of this and other facts, it is difficult to call BTC a bubble.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.