One way to select a project for investment is to evaluate an idea that has already received the attention and support of a large fund. The blockchain sphere requires certain knowledge and understanding of specifics, so not all venture capital companies fund cryptocurrency startups. Major projects in this segment include Binance Labs, Coinbase Ventures, and Animoca Brands. The first two appeared as elements of the ecosystem of popular trading platforms. This article describes how the incubation program and projects of Binance Labs (BL) are built to support crypto startups. It also tells you in which areas of the digital industry the fund has invested the most money.

What is Binance Labs

The unit was originally founded as a classic investment company. It was necessary for the launch of its own blockchain network Binance Smart Chain (BSC). Then on the deployed chain, the fund began to support technological ideas and innovations for the development of the ecosystem.

Startups also seek funding on their own. External investment facilitates the realization of an idea that the team may not have the funds to launch. Another advantage for these startups is the availability of Binance’s comprehensive system. It includes:

- An exchange platform with significant trading turnover. This helps to create your own cryptocurrency, as well as get advice and build the economic policy of the project.

- Mentorship from experts in the necessary specialization. Binance attracts reputable consultants in every field.

- A prepared audience and interested VCs. This is a challenging step for startups. Previously, it took years to gain trust from segments. Incubation programs reduce this period to 2-4 weeks.

Apart from Binance Labs, Launchpool and Launchpad provide support and startups. The programs have funds that are different from traditional funding.

Binance Labs invests its own funds or engages other venture capital firms. Launchpool and Launchpad offer the mechanics of getting investment from private exchange users without having to provide stock funds.

5020 $

Bonus til nye brugere!

ByBit giver bekvemme og sikre betingelser for handel med kryptovaluta, tilbyder lave provisioner, højt likviditetsniveau og moderne værktøjer til markedsanalyse. Den understøtter spot- og gearet handel og hjælper begyndere og professionelle handlere med en intuitiv grænseflade og vejledninger.

Optjen en 100 $-bonus

for nye brugere!

Den største kryptobørs, hvor du hurtigt og sikkert kan starte din rejse i kryptovalutaernes verden. Platformen tilbyder hundredvis af populære aktiver, lave provisioner og avancerede værktøjer til handel og investering. Nem registrering, høj transaktionshastighed og pålidelig beskyttelse af midler gør Binance til et godt valg for handlere på alle niveauer!

Founders and participants

Binance Labs was created right after the exchange launched in 2017. From its inception until 2022, the fund was led by Bill Qian. Since last year, the project has been led by Yi He. She is considered Changpeng Zhao’s second person and partner in managing the exchange and subsidiaries.

In addition to the foundation, Yi is in charge of business promotion of the entire Binance ecosystem as Chief Marketing Officer (CMO). She also heads the token listing arm of the exchange.

The fund has recruited bankers with experience at large investment firms. In September 2023, the team includes:

- Dana Hou (Dana Hou) is an ex-macro strategist at Goldman Sachs.

- Andrew C. is a strategic integration (mergers and acquisitions) specialist. As part of BL, Andrew has responsibilities in the same area.

- Alex Odagiu is a banker with two years of experience at a London-based technology fund. He also worked at Goldman Sachs (4 years).

- Jerry Zhao is an ex-investment specialist at GenesisCare Venture Capital and Morgan Stanley.

- Nicola Wang is a former consultant with three decades of experience in cryptocurrencies, IT infrastructure solutions and TMT (“Technology, Media and Telecommunications”).

- Michael Siu is a venture capitalist at private equity funds OCP Asia and HOPU Investments (past position).

- Kevin Poh is a former employee of the Monetary Authority of Singapore (MAS).

- Kenneth Chan – Previously served as the manager of corporate restructuring and partnership ventures. In the BL team, Chan also focuses on this area.

Portfolio

More than 200 projects have received investment from the Binance fund. Apart from the instant “financial elevator”, the startups are gaining visibility in venture capital circles. This helps to raise additional funds for the realization of the next stage of development. Therefore, publications about business and cryptocurrencies actively cover the topics of Binance Labs, its projects and programs. The table shows the startups and operating companies that have received the largest investments from the fund.

| Industry | År | Name | Amount of capital deployed ($, mln) |

|---|---|---|---|

MVB program

In 2021, Binance Labs launched its first accelerator (incubation) program. The format resembles a competition between teams for investment. Gas pedals are called incubators for their ability to unlock potential and “grow” a working technology out of an idea.

Supporting projects at an early stage of development within the framework of the program is a common tool for solving 2 tasks:

- Financial assistance to budding startups.

- Development and filling new ecosystems with tools.

The gas pedal from Binance Labs is called Most Valuable Builder. It is abbreviated as MVB. To participate, teams must propose a relevant innovation suitable for the parent blockchain of the Binance Smart Chain ecosystem.

The fund not only financially supports the teams, but also organizes intensives and consultations with involved experts in marketing and development. In this way, promising crypto startups can quickly realize an idea.

Based on the results of participation, the team can receive investments from $10 thousand to $2 million. The gas pedal consists of 3 phases:

- The first phase is the submission of applications and selection of the top 20. Then the fund organizes conferences, intensives and consultations – usually within 2-4 weeks. The teams use the knowledge gained to implement the idea on their own.

- The second stage is the selection of the first startups for financial support. Ten projects that have shown the best results get to this stage. Each of them can receive up to $10 thousand.

- The third stage – the top 5 and the MVB leader. The 5 most productive teams according to the results of the first part of the investment remain on this stage. External venture companies pay attention to them and they are also invited to participate as experts. The top 5 can additionally receive up to $100 thousand. The most promising projects receive funding of up to $2 million.

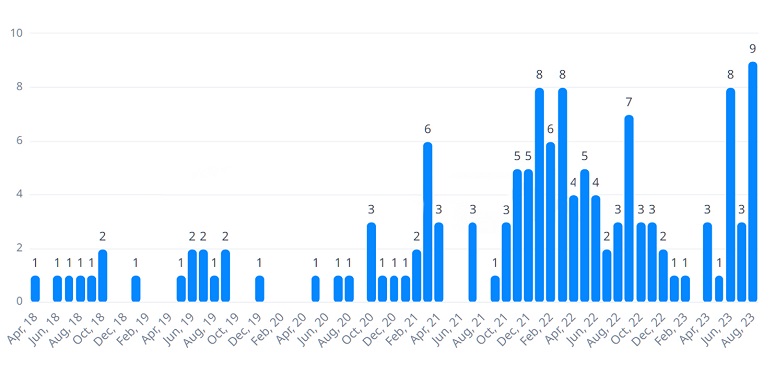

By 2023, 6 launches of separate MVB programs have been successfully completed. The last gas pedal ended in June.

Existing partner funds

Binance Labs also helps startups find common ground with other venture capital firms. There are 330 organizations involved in programmatic and collective investment partnerships. The following funds have joined Binance Labs in the largest collaborations:

- Animoca Brands – co-investments of 12 projects.

- HashKey Capital – 10.

- Coinbase Ventures – 9.

- NGC Ventures – 8.

- Hashed Fund – 7.

- IOSG – 6.

- Andreessen Horowitz (a16z) – 6.

- LD Capital – 5.

- FTX Ventures – 5.

What projects Binance Labs invests in

In total, the fund has invested more than $3.5 billion in crypto startups. There are several priority industries for funding to choose from.

| Category | Share of total fund, % |

|---|---|

Ofte stillede spørgsmål

✨ How to become a participant of the accelerator program?

Binance announces the start of the application process on its blog. After that, teams can propose ideas via a Google form. In the last (sixth) MVB campaign, only 1% of applicants made it into the top 20.

📌 What is seed investment?

It is the earliest stage of funding for startups. Seed stage funds (translated in this context as nascent, initial phase) attract companies that are just starting to create their first products or services.

🔔 What kind of investments are called strategic?

This is funding from partners or corporations that see potential in cooperation with a startup. Strategic investments can also be non-financial – for example, co-development agreements.

⚡ What do the A, B, and C series mean in project funding?

After a successful seed stage raise, teams conduct a development launch. The A round helps raise the next piece of capital if the company has already demonstrated potential and is ready to expand. The B round comes after the completion of A, and the C round comes after B.

📢 What is an ICO?

It is a pre-sale of assets to obtain funding. The process is initiated by the creators of the project. It is usually held in addition to seed investment raising.

Er der en fejl i teksten? Fremhæv den med musen, og tryk på Ctrl + Kom ind.

Forfatter: Saifedean Ammousen ekspert i kryptovaluta-økonomi.