With the advent of digital money, perceptions of business and personal finance have changed dramatically. Cryptocurrencies offer good opportunities for profit, but are controversial among regulators and are used for illegal purposes. Investing can lead to loss of funds by inexperienced users. Therefore, many people are interested to know about the risks with cryptocurrency.

Risks with cryptocurrency in today’s world

There are aspects that users need to pay attention to when dealing with digital assets. There is still no legal framework in different countries as of 2021. Users lose their funds for various reasons.

Legal

One of the main problems when dealing with cryptocurrencies is that there is no insurance system for investors’ money. Many exchanges call themselves virtual banks but do not reimburse losses.

Bitcoin, etherium and other cryptocurrencies are all digital money. When they are stolen from virtual wallets, it is impossible to find the thief (due to anonymity). It is also impossible to claim ownership of the coins.

Lack of guarantees for the reimbursement of funds

To exchange on a cryptocurrency exchange, the user transfers digital assets to the site’s wallet. Coins are stored in the system of the virtual bank and controlled by it. If it is a hot wallet with constant access to the Internet, hacking by hackers and theft of funds is possible.

5020 $

Bonus til nye brugere!

ByBit giver bekvemme og sikre betingelser for handel med kryptovaluta, tilbyder lave provisioner, højt likviditetsniveau og moderne værktøjer til markedsanalyse. Den understøtter spot- og gearet handel og hjælper begyndere og professionelle handlere med en intuitiv grænseflade og vejledninger.

Optjen en 100 $-bonus

for nye brugere!

Den største kryptobørs, hvor du hurtigt og sikkert kan starte din rejse i kryptovalutaernes verden. Platformen tilbyder hundredvis af populære aktiver, lave provisioner og avancerede værktøjer til handel og investering. Nem registrering, høj transaktionshastighed og pålidelig beskyttelse af midler gør Binance til et godt valg for handlere på alle niveauer!

Customers of the Bitfinex exchange lost 120 thousand BTC in August 2016 as a result of a hacker attack. To save the reputation, the head of the trading platform divided the damage between all accounts. For this purpose, 36.067% of assets were used, and as compensation, users received BFX tokens at a price equal to one bitcoin at the time of the hack.

Exchanges continue to suffer losses from hackers despite the best efforts of the technical team. Therefore, payout funds are created to cover possible losses from massive attacks.

Erroneous transactions

The danger of cryptocurrency is related to the inability to cancel the transaction and return the amount sent, even if only one digit in the recipient’s address is incorrect.

As correctly pointed out by a financial analyst of the cryptocurrency exchange Currency.com. Mikhail Karkhalev:

“There are no governing organizations, support services or other third parties in the blockchain that can verify information about an erroneous transaction and return it.”

Loss of the secret code from the wallet

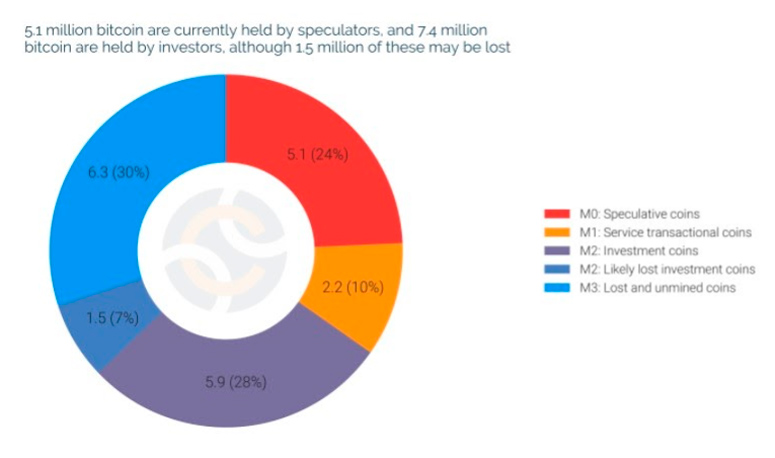

This kind of thing happens when there is a malfunction or the integrity of a PC hard disk or flash card where the access code is stored is compromised. According to the Chainalysis platform, 7% of the world’s existing 18.7 million bitcoins (as of July 2021) are placed on wallets that are not accessed by their owners due to the probable loss of the digital key. It is impossible to recover it and return the crypto assets.

Malware

The first such programs were used to attack electronic payment systems (WebMoney and others). Now their analogs have been successfully adapted to the cryptocurrency market.

The main ways of fraud with bitcoin and other coins:

| Ransomware | Malware locks PCs and user files, demanding a ransom for restoring access, including cryptocurrencies. |

| Viruses | Get into a computer system, giving hackers remote access to the contents of a compromised PC. During a transaction, the virus changes the recipient’s wallet details to its own. |

| Fake links | The user goes to a fake site – a copy of a known exchanger, where he enters the storage data. |

| Phishing | The goal is to obtain access codes. The user is tricked into visiting a fake site where he/she specifies the wallet password. |

Protocol vulnerability

At the end of September 2020, bitcoin scaling solutions developer Joost Jager found a vulnerability that blocked new Lightning Network (LN) payment channels for 2 weeks. A month earlier, 2 blockchain analysts from the University of Israel discovered a way to steal BTC in LN when transferring cryptocurrency due to network congestion.

There are known cases when users of Lightning Network software closed the channel with a backup copy of the node created a few days earlier, not taking into account later transactions, and lost their coins. Because of the difference in transaction data, the nodes treated the action as an error. This is possible (and users confirmed this) due to a power outage that happened a couple days before the transfer. The software glitch prevented users from applying a more recent backup.

Hacker attacks

Cybercrime is a major one of the world’s problems. Damage from hackers reaches hundreds of millions of dollars. Fraudsters hack into private bitcoin accounts, wallets of users on exchanges and hedge fund investors.

In 2014, 850 thousand BTC, worth $450 million at the time, was stolen from clients of the Mt Gox exchange. Another high-profile case: in 2016, hackers stole more than $150 million in bitcoins because of a mistake in the digital code. This is how they gained access to the cryptocurrency wallets of investors of the hedge fund DAO.

A more vivid example: On September 26, 2020, hackers broke into the KuCoin crypto exchange. The damage from the attack amounted to $200 million. A year earlier, Cryptopia cryptocurrency exchange went bankrupt due to hacking. As a result of the hacker attack was stolen $21 million BTC.

Closure of exchanges

The risks with cryptocurrency are not only related to hackers, but also to internal factors. Since 2012, 50% of exchanges have stopped their work, among which were large platforms and growing projects. The reason for the bankruptcy of small platforms is low profitability. The founder of the exchange has to invest large sums, and the turnover of digital money reaches the level of $100 thousand to $1 million. This is not enough to pay off the project. And so that the turnover of trade could pass the break-even level, interest charges are raised. But this makes the exchange less attractive for users.

Also, technical failures occur on the sites. Clients who lost money from virtual wallets, it is useless to demand their return because of the lack of a legal framework.

Volatility

Fluctuations in the exchange rate of cryptocurrencies are a problem for many. The value of digital money can fall or rise by 5-10% or even more in a day. This makes investing in bitcoins difficult, especially for inexperienced traders. They do not always understand when it is worth selling and buying tokens, and when it is better to stop in order not to risk assets. Digital coins are a tool for making good profits, but only if they are in the hands of experienced traders.

The danger of investing in digital currencies is due to the decentralized nature of the payment system. There is no management body, no one can maintain the minimum value of coins. If investors decide to sell a lot of coins at the same time, a drop in the exchange rate is inevitable.

Market crash

The rapid growth of the exchange rate may at some point be replaced by a sharp decline. So, there is a risk of a return to very low values. Economic and political events influence price fluctuations and rate drops. It is very difficult to predict these factors and prepare for them.

Unreliable ICOs

Representatives of the UK Financial Services Authority point out that users who invest assets in initial coin offerings (ICOs) risk losing their invested funds. This is due to the fact that part of the schemes are fraudulent.

Investing in cryptocurrency startups in 2017 was most popular in Shanghai and Beijing. There were 65 ICOs, in which about $300 million was invested from 105 thousand participants. But in September 2017, China outlawed and banned raising money through ICOs.

Market Manipulation

When a new cryptocurrency appears, a large investor can invest his assets in it. And for the rate to rise, it is necessary to create a stir around the digital coin. The investor tries to attract the attention of beginners and experienced cryptocurrency users to it. After all, due to good demand for coins, the rate grows, and tokens can be sold more expensive.

There are also insiders in the market of digital currencies. They buy information from unscrupulous co-founders of projects about further plans of action.

An insider can earn good money if he contacts the right people. On resources for trading, offers of exclusive information appear.

Profitability of mining

It is possible to get cryptocurrency as a reward for providing computing power of computers or special equipment to ensure the functioning of the network of this digital money. “Young” tokens bring a lot of profit. Bitcoin mining gives profit after 1 year, etherium – 6 months. The term depends on the type of video cards, their power.

Today, mining is no longer synonymous with easy money. Mining coins is more difficult, because the number of computers employed in the bitcoin system is growing. In addition, a lot of electricity is used for the smooth operation of the equipment, which means that the total profit at a high cost of money and time is not so high.

Low level of liquidity on new exchanges

New platforms are characterized by low turnover. This means that due to very low supply and demand, when buying a significant batch of coins, digital money transactions will be conducted at a disadvantageous price, but will affect the value of tokens.

When trading takes place within a single exchange, problems often arise due to the presence of a large spread – the difference in selling and buying prices. If, for example, you buy bitcoins for $41,000 and then want to sell them immediately, the value will already be at $40,500. The investor loses $500 on one coin. But there is a way out – switching to a cryptocurrency trading platform with high trading turnover.

Risks of margin trading

The money borrowed from the cryptocurrency exchange at interest is used for investing. The strongest trading leverage – 1 to 100 – at the BitMex exchange and some other platforms. But with such a large ratio, there are significant risks of loss, and therefore a novice investor should not use credit funds.

For example, an anonymous user of the social network Reddit (his profile is currently unavailable) told about his successful cryptocurrency trading. He turned 3 BTC into 200 bitcoins in one year, but lost all the coins due to margin trading.

Risks in cryptocurrency exchanges

It seems that selling digital money to another person (P2P) in order to receive fiat funds is safe: one user sends cryptocurrency, receiving dollars or rubles. But there are known cases when a person who received digital coins, after that canceled the transfer through the bank. But the sent cryptocurrency can not be returned.

The risk of using cryptocurrency lies in the uncontrolled activity of the exchanger. Having received a lot of money from users, the platform can stop making payments at any time. In fact, the exchanger stops working, and no legal regulators will not help.

Technical problems

The risks of using cryptocurrencies are associated with failures in the activities of exchange platforms. When assets are stolen from accounts due to the actions of hackers or a software developer’s error, investors do not get their funds back.

Tips and recommendations for holders of cryptoassets

To avoid risks with cryptocurrency, you need to:

- Go only to known trusted links.

- Additionally, keep the mnemonic phrase of the cryptocurrency wallet access code in a safe place and in several copies.

- Before confirming a transaction, double-check recipient addresses, transfer amounts, and the amount of commission.

- When investing on exchanges, act clearly, do not panic.

- Use hardware wallets for long-term storage of digital assets.

- Invest an amount that can be lost.

- Use a good virus protection program.

Frequently Asked Questions

❓ What does a mining farm consist of?

From the motherboard, hard disks, video cards, power supplies.

💵 How much does a mining farm cost?

The amounts vary. In addition to the necessary equipment, you need to buy a powerful power supply and be ready for huge electricity bills.

💻 I have a very powerful computer. Will I be able to start mining cryptocurrency?

Even if a user has a powerful computer, it will not be possible to mine bitcoins in sufficient quantities to offset electricity costs without optimized mining. Very powerful ASIC cards cost 1-3 thousand dollars for 1 piece and are specially designed for this process.

❔ Which cryptocurrency exchanges support the Russian language?

Such platforms include Binance, Bitfinex, Exmo, BitMEX and others.

❕ China plans to create a digital yuan. When will the digital ruble appear?

It is not yet known. But the Russian government is considering the possibility of issuing a digital ruble.

Error in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.