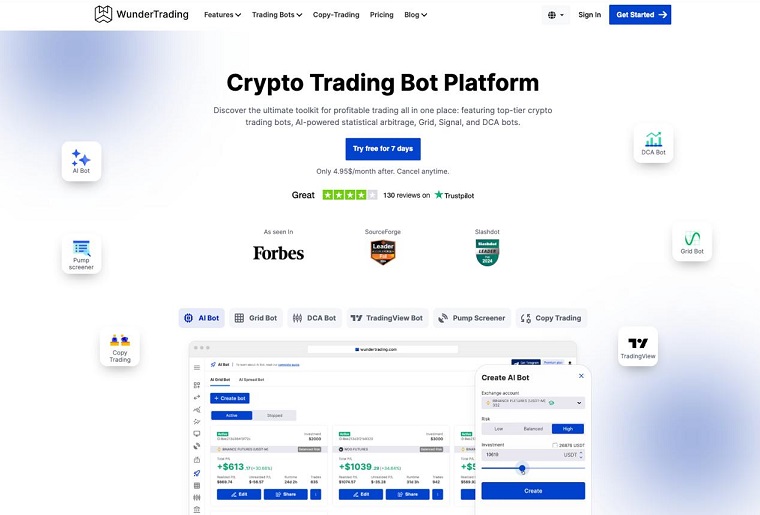

Trading digital assets offers great opportunities for earning money. Unlike traditional markets, cryptocurrency markets are not characterized by prolonged sideways movement, so traders open positions more often. Routine actions can be automated with the help of bots. The user only needs to configure the program and control its work. On the WunderTrading platform you can choose a bot for any task – from simple order placement to independent search for arbitrage bundles. The service also offers additional tools for trading automation with a free trial period.

What is WunderTrading

This is a platform of trading bots and manual tools for making deals on crypto exchanges. The developers have gathered everything you need for profitable trading on one platform. They have organized the tools into sections according to their purpose:

- Functions. Traders are offered smart trading terminals that allow them to place orders on different exchanges simultaneously and create complex strategies. Multiple accounts can be managed and assets can be monitored offline via API.

- Trading bots. You can choose programs for any strategies and trading styles. WunderTrading integrates with leading crypto exchanges, allowing you to customize bots for specific working conditions.

- Copytrading. Users are offered to earn autonomously by selecting a successful trading participant and repeating his trades. An exchange account can be connected to WunderTrading via API.

The platform has been operating since 2019 and is popular among traders. For 5 years, WunderTrading clients have created more than 39 thousand trading bots.

At the time of preparing the review, the audience of the service exceeds 121 thousand people. More than 10 thousand traders make transactions daily. The total trading turnover is $500 million per month.

Platform capabilities

WunderTrading users get access to a large number of tools for automated cryptocurrency trading. The intuitive interface is equally convenient for beginners and experienced traders. Additional security settings allow you to strengthen the protection of accounts.

5020 $

bonus pro nové uživatele!

ByBit poskytuje pohodlné a bezpečné podmínky pro obchodování s kryptoměnami, nabízí nízké poplatky, vysokou úroveň likvidity a moderní nástroje pro analýzu trhu. Podporuje spotové i pákové obchodování a pomáhá začátečníkům i profesionálním obchodníkům díky intuitivnímu rozhraní a výukovým lekcím.

Získejte bonus 100 $

pro nové uživatele!

Největší kryptoměnová burza, kde můžete rychle a bezpečně začít svou cestu světem kryptoměn. Platforma nabízí stovky oblíbených aktiv, nízké poplatky a pokročilé nástroje pro obchodování a investování. Díky snadné registraci, vysoké rychlosti transakcí a spolehlivé ochraně finančních prostředků je Binance skvělou volbou pro obchodníky na jakékoli úrovni!

WunderTrading does not store user funds, which eliminates the risk of hacker attacks and theft.

Traders connect their exchange accounts via API and manage trades directly. At the same time, full control over assets is maintained. Platform features also include:

- Support for automated screening to find potential trading signals. For example, Pump Screener is able to detect rapid and significant price spikes, identifying coins with unusual activity in real time.

- A wide range of strategies for trading, including gridbots, DCA and signal-based algorithms. Users can customize the tools to suit their goals.

Automated cryptocurrency trading

WunderTrading users can place orders on different exchanges from a single account. The trading terminal is equipped with advanced tools. They allow you to create complex strategies and edit orders by adding additional functions (Take Profit, Stop Loss, Trailing Stop).

For technical analysis of cryptocurrencies, traders use a chart with built-in indicators. The tool is especially useful for spread trading. It allows you to find the best points to buy and sell the asset at a particular moment.

In the WunderTrading terminal, traders can also open trades on different exchanges simultaneously. To do this, you need to select a list of accounts and start trading with one click. The volume of a deal on each exchange can be defined as a percentage of the deposit or set a fixed amount for all APIs.

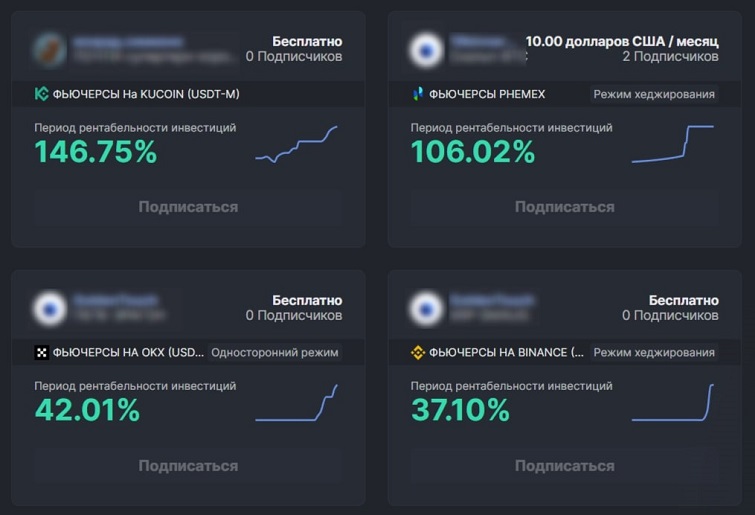

Copytrading

Platform users can activate the auto-sequencing feature. The algorithm will repeat the trades of selected traders on connected accounts in real time.

Copytrading on WunderTrading allows you to quickly start trading digital currencies without having to monitor market changes in search of the optimal entry point. Transactions take place via API. This eliminates unauthorized access to funds.

You can start copytrading as follows:

- Authorize on the selected crypto exchange. Create and copy an API key.

- Insert the data on the WunderTrading platform to connect.

- Select the “Copytrader” role. Go to the “Marketplace” tab.

- Find a suitable trader or bot. The history of transactions can be viewed in the user’s account.

- To connect to the selected crypto trader or bot, you need to click on the “Follow” button.

The trades will be copied to the subscriber’s account. The user can automatically manage strategies (edit, close trades) or wait for an exit signal from the cryptotrader.

Automatic spread trading

The technique involves the simultaneous opening of two opposite trades for the same amounts. Spread is the difference in prices between positions. On WunderTrading, the strategy can be applied when trading futures. The instructions are as follows:

- Go to the “Terminal” tab. Select spread trading.

- In the search bar specify the ticker of the coin. Select base and quoted pairs.

- A horizontal channel will be displayed on the chart. The user can choose which position to enter – long or short. To do this, click on the name of the corresponding option.

- Determine the percentage of the deposit to be used within the strategy.

- Set additional orders – Take Profit and Stop Loss.

- Click on the “Create Strategy” button.

You can track the transaction in the “Positions” tab. To manage it, click on the corresponding line. You can edit Take Profit and Stop Loss settings.

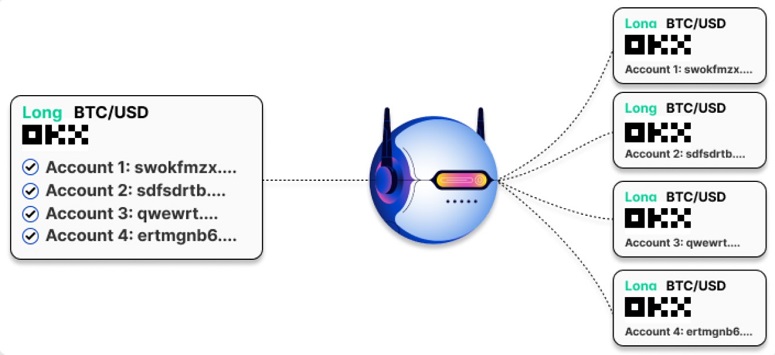

Managing multiple accounts

With the help of WunderTrading tools, you can automate actions for different APIs within a particular crypto exchange and execute transactions on them in one click. The option is in demand among traders who manage several accounts on one trading platform.

You can also create automated asset portfolios – link a number of APIs to the selected bot. This will allow you to open the same trades on all accounts at the same time. Each portfolio will have its own transparent statistics that can be shared with other users.

Cryptocurrency Portfolio Tracker

Users can track assets using the API. To autonomously monitor a crypto portfolio, you need to connect a dongle to the platform. The information will be displayed in the account.

Arbitrage trading

Under this strategy, the crypto trader’s earnings are derived from the difference in asset prices on two or more exchanges. With the help of WunderTrading tools you can automate arbitrage. A specially configured bot will search for trading opportunities and open deals simultaneously on different platforms. The algorithm also allows you to set additional orders – Take Profit and Stop Loss. This is necessary to lock in profits and limit losses.

On the platform you can create arbitrage bots for any tasks.

For example, an intra-exchange algorithm will search for the difference in asset prices on a particular platform. Bybit arbitrage bot will be able to track bundles within the native service.

Demo account

Crypto traders can test the functionality of the service by running a trading simulator. For beginners, this is an opportunity to hone their order handling skills without risking their own funds. It is usually recommended to trade in demo mode for 2-3 months before moving to a real account.

Professional traders use the simulator to test strategies. If something went wrong, you can adjust the methodology until you get the desired result.

WunderTrading offers a demo period to test the platform tools. Users can create bots for free, copy strategies of other traders, launch arbitrage deals via API during 7 days. To continue working after the test period is over, you need to choose a tariff.

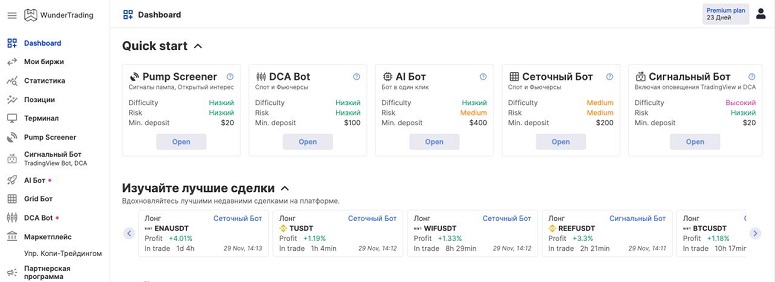

Trading bots on WunderTrading

With the development of the crypto market, traders have special tools that allow to facilitate and automate routine processes. Depending on the settings, bots can perform various functions:

- Buy and sell digital assets according to predetermined parameters.

- Analyze current market data, including indicators, and make decisions about opening a deal or exiting a position. Users receive information in the form of signals.

- Find arbitrage bundles for trading within a particular site or on different exchanges.

In the WunderTrading system you can create more than 30 cryptobots for any task. Popular algorithms can be compared in the table.

| Cryptobot | Purpose and capabilities |

|---|---|

| With the help of WunderTrading tools you can automate any TradingView strategy, turning it into a fully autonomous bot. Entry and exit points will be displayed on the chart. Appropriate alerts and automatic trading on signals can be set up. | |

| The tool helps to manage passive income. The robot implements the strategy of dollar cost averaging when buying an asset. For example, the algorithm can open transactions for a fixed volume of coins at regular intervals. The second method involves buying cryptocurrency when the price falls below a predetermined level. | |

| The robot works on a similar principle to DCA. The difference is that Grid-bot places orders in a grid. Each buy order provides for a separate order for profit taking. | |

| The algorithm connects to exchanges via API and tracks the difference in the exchange rates of cryptocurrencies. When user-specified criteria are identified, the robot opens trades. | |

| The bot uses artificial intelligence to find trading opportunities for pair trading. The strategy is based on the belief that the rates of two compared assets eventually return to the average after deviating from it. If the spread price exceeds a predetermined value, the algorithm signals an opportunity to enter a trade. |

How to create a trading bot on WunderTrading

To launch an automated strategy, you need to register an account on the platform, connect one or more cryptocurrency exchanges, set the settings for entering transactions and closing positions. Specific parameters are set when creating the bot. The size of the deposit and the trader’s goals are taken into account.

Registration and account setup

To start working with the platform, you need to create an account. You can register by e-mail. The instructions are as follows:

- On the main page, click on the “Start” button.

- In the registration form, specify your e-mail and password. Accept the terms of use, agree with the Privacy Policy.

- Click on the “Register” button. You can also authorize using your Google account.

Login to the site will be performed automatically. After registration, newcomers get trial access to the Pro tariff with advanced features for 7 days.

The interactive assistant will offer to choose a product to launch, focusing on the trader’s level of training. Beginners are recommended to pay attention to AI and DCA bots. At the intermediate level, it is worth testing auto-sequencing, grid trading and Pump Screener. Professional crypto traders will be able to evaluate signal bots and multifunctional trading terminals.

Exchange Connection

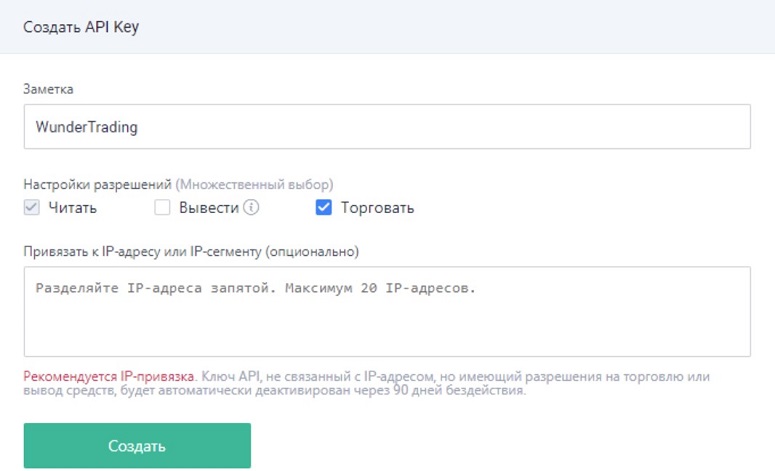

You can bind your trading account to the WunderTrading terminal using the API. To do this, you need to authorize on the exchange and create a key. In the API settings you need to set permissions for viewing information and trading. Withdrawal of funds must be closed.

The ready key should be saved in a safe place. Next, the order of actions is as follows:

- Go to the WunderTrading platform.

- Open the “My exchanges” section. Click on the “Add” button.

- Choose a platform from the list.

- Fill out the form – enter the nickname of the account and insert the API-key.

- Click on the “Connect Exchange” button.

Creating and launching the bot

The developers updated the functionality of the platform. Now you can select the type of cryptobot in the left panel. Next, the algorithm of action is as follows:

- On the tool page, click on the “Advanced” button to set the algorithm settings.

- Select a trading pair and the direction of the transaction – Long or Short.

- Check that the amount on the balance is enough to implement the strategy. For example, when launching a DCA-bot, a minimum of $400 is required.

- Set the amount per trade, the percentage of deposit per step.

- Select the condition for launching the crypto-bot – immediately or by indicator.

- Determine the type of customization. With automatic, the program will calculate the maximum number of orders in the strategy, the percentage and multiplier of deviation from the price, the Take Profit level. User customization allows you to set the parameters manually.

- Before launching the program, you can check the effectiveness of the strategy on a historical chart. To do this, click on the Backtest button.

- It is also possible to optimize the strategy. The program will automatically calculate potentially effective parameters based on the current market data. To use them, you need to click on the “Apply Settings” button.

- Set additional orders to capture potential profits and minimize possible losses.

- Click on the “Create Bot” button.

Tariffs

You can test the products of the platform for free. After registration, users are given access to the options included in the professional tariff.

The trial period is valid for 7 days. At the end of the test, you can extend the tariff or choose another one.

There is also a free version, but with limited functionality. You can compare tariffs in the table below.

Partnerský program

In WunderTrading you can get additional profit from inviting new users. The service pays up to 50% of referral commissions. Details – in the table.

| Level | Number of referrals with active subscription | Remuneration (% of commissions) |

|---|---|---|

The reward is calculated in USDT (TRC-20). Funds can be received in your personal wallet when you accumulate a threshold amount of $30. To participate in the affiliate program you need to:

- Authorize in your personal cabinet.

- Go to the “Referrals” tab.

- Click on the “Apply now” button.

- Fill out the form and wait for the operator’s response.

Často kladené otázky

🔔 What other benefits do participants of the referral program receive?

The platform promotes partners’ video content in their communities. Members also receive a set of free basic subscriptions to give away to referrals and access to AMA sessions with professional traders.

📌 What is a hybrid DCA bot?

The algorithm combines a strategy of buying a fixed volume of assets at regular intervals and averaging based on price. For example, the bot might buy $100 worth of bitcoin on Mondays and another $100 each time the rate drops below $90k.

📢 What is the minimum amount required to run a grid strategy?

To create and activate a GRID bot, you need to have $400 in your balance. In this case, $20 is allocated for each trade. This amount can be changed.

✨ For which trading strategies is the GRID-bot used?

The tool is effective with various techniques. The most popular are trend following, scalping, price return to the average level, arbitrage.

Je v textu chyba? Označte ji myší a stiskněte tlačítko Ctrl + Vstupte.

Autor: Mgr: Saifedean Ammous, odborník na ekonomiku kryptoměn.