Bitcoin started the era of digital assets in 2009. The flaws and limitations of the first cryptocurrency, as well as its open source code, led developers to create other coins. They are called altcoins. Bitcoin remains the market leader. It owns 56.4% of the total capitalization. However, other assets also have value and bring real benefits. Users will find it useful to read the article about cryptocurrency and altcoins for dummies. Digital assets are different from each other even though they have many overlapping features.

What are altcoins

In its early years, BTC dominated the crypto market by more than 90%. As the industry grew, the flagship’s share gradually declined. However, the role of the first cryptocurrency is difficult to overestimate. From the beginning of the market’s formation, members of the community began to separate Bitcoin and the rest of the assets.

If explained in simple words, altcoins are any digital currencies that are not BTC. Now the crypto coin market is valued at $2.32 trillion, with more than $1.25 trillion placed in Bitcoins. The value of existing Bitcoin units is almost 4 times more than the second largest coin (Ethereum) and almost half the total crypto market capitalization.

Reasons for the emergence and the first altcoin

New cryptocurrencies were built on the success of bitcoin by changing the rules to attract different groups of users. For example, the developers of Ethereum (the second largest coin by market capitalization) implemented the idea of smart contracts (codes that are automatically triggered when certain conditions occur).

Altcoins are a cryptocurrency. They have improved the functionality, transactions, and scaling of the blockchain. The crypto market continues to expand. Experts have long debated which of the coins created after Bitcoin will be able to take the lead from it.

5020 $

bonus pro nové uživatele!

ByBit poskytuje pohodlné a bezpečné podmínky pro obchodování s kryptoměnami, nabízí nízké poplatky, vysokou úroveň likvidity a moderní nástroje pro analýzu trhu. Podporuje spotové i pákové obchodování a pomáhá začátečníkům i profesionálním obchodníkům díky intuitivnímu rozhraní a výukovým lekcím.

Získejte bonus 100 $

pro nové uživatele!

Největší kryptoměnová burza, kde můžete rychle a bezpečně začít svou cestu světem kryptoměn. Platforma nabízí stovky oblíbených aktiv, nízké poplatky a pokročilé nástroje pro obchodování a investování. Díky snadné registraci, vysoké rychlosti transakcí a spolehlivé ochraně finančních prostředků je Binance skvělou volbou pro obchodníky na jakékoli úrovni!

Namecoin was the first altcoin. The asset appeared in 2011. The purpose of its creation was a decentralized replacement of the domain name system.

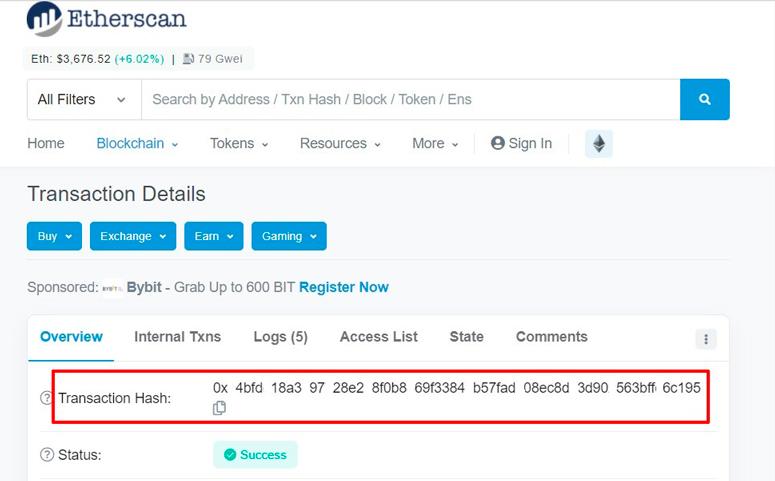

To access any site with a .bit extension, the owners of the project developed a plugin. It automatically transfers users to the location specified in the registry stored in the Namecoin blockchain. To register a domain on the network and store it, you need to send a transaction to the chain.

Hashing algorithms

Hash functions arose from the need to make the length of content uniform. It is a form of computer security that ensures data integrity and authentication. The function works by converting readable text into unreadable text. Unlike encryption, hashing is irreversible and provides a barrier against attackers. If a criminal tries to access the database, they will only see the code (digest) and will not be able to return it to its original value.

The function has these characteristics:

- Zabezpečení – the process is irreversible.

- Uniqueness – 2 different data sets cannot give the same digest.

- Fixed size – the function produces a hash of a certain length.

Cryptographic hashing is an algorithm that encrypts digital assets. Miners decrypt it. If the decryption is successful, a new block is created. It stores the records of transactions conducted in the system. In this way, miners maintain the network and get paid for it.

Differences from Bitcoin

Bitcoin was developed as an alternative decentralized payment system that can replace paper money. The coin was created for simple transactions and uses a peer-to-peer consensus mechanism. However, bitcoin as a payment method still lags behind credit cards and other electronic systs. Moreover, verifying transactions (mining) is resource-intensive and costly.

New cryptocurrencies use mechanisms to reduce the cost and complexity of mining and can process more transactions per second than the Bitcoin network. Some altcoins implement smart contract technology that allows for innovative applications on the blockchain.

For example, Ripple and EOS have introduced new features to speed up payments. XRP is designed to facilitate centralized cross-border transactions between large corporations and institutions. EOS is an altcoin whose transactions are completed in as little as 0.25 seconds.

In its original state, bitcoin cannot compete with alternative cryptocurrencies. Despite this, BTC still plays a paramount role in the market and attracts a lot of investor interest.

Pricing

To understand how cryptocurrency rates are set, you must first learn how digital assets differ from fiat money. Euros, dollars, yen and other units of account are backed by governments and are considered legal tender. Central banks and foreign exchange reserves control the supply of money to curb inflation.

Crypto coins and altcoins are not regulated by governments. Many have a fixed supply, which reduces the risk of inflation. There is also a one-time issuance and coins are gradually released into the market to control rates.

Tokenomics explains the purpose and distribution of the asset. The term also refers to the economics of making a coin attractive to investors. The value of altcoins is determined based on the following factors:

- Placement and distribution. There are 2 ways digital assets appear on the market. They are either pre-mined (generated and distributed to some addresses before sales start), or they become available through issuance (where the entire community gets the right to invest in altcoins). Many crypto projects appear with pre-mined tokens. However, if there is a wallet that accumulates a significant portion of the circulating volume, there is a risk that its owner will dump assets and drop the price.

- Token (coin) supply. Cryptocurrency volume is captured by 3 types of supply – circulating (altcoins in circulation), total (assets existing in the current period, excluding those that may have been burned), maximum (the maximum possible number of digital units that can ever be generated).

- Market capitalization. The indicator captures the entire investment in the project. The higher the market capitalization of the altcoin and the smaller the number of coins in circulation, the more valuable the asset may become in the future.

- Token model. The structure of the cryptocurrency shows whether the asset is inflationary or has growth potential.

Capitalization

One of the key metrics for understanding the value of altcoins is the market price of circulation. The metric shows that BTC is still the number one cryptocurrency, with other coins following.

| Capitalization ($) | ||

|---|---|---|

Uses

Many of the more than 15,500+ digital assets available have no real use. Cryptocurrency prices depend on supply and demand. The assets are not backed by an underlying value. The future potential growth of an altcoin in the market depends on how well the technology solves community problems.

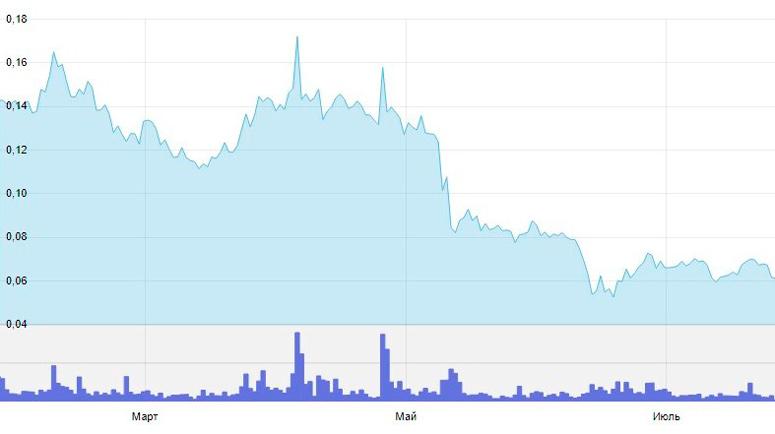

Meme coin and token trading is popular right now: Dogecoin (DOGE) and Shiba Inu (SHIB). Both cryptocurrencies grew over 12,000% in a short period of time in 2021. After that, the meme-tokens trend only gained momentum.

Speculators invest in cheap altcoins with the expectation of high profits. However, in fact, such cryptocurrencies are useless and carry risks for investors.

Types of altcoins

Digital coins can be classified based on several features. Here they are:

- Cryptocurrency and types of altcoins based on technology platforms (e.g. Ethereum, which provides the basis for decentralized finance).

- Stablecoins tied to real currencies or other assets.

- Meme currencies based on symbols, phrases, ideas popular on the Internet.

Another classification of altcoins relies on genealogy. Many digital currencies are based on a modified Bitcoin code (Litecoin, Bitcoin Cash and others). Each asset differs from others in a whole set of ways:

- Scripting language.

- Transaction management.

- Security rules.

- The method of issuance.

- Consensus method.

By hashing algorithm

Encryption forms the basis for confirming transactions and creating a blockchain. Without it, the blockchain will not be protected from unauthorized access. The network will also not be able to maintain its immutability. It will be difficult to prove who owns what number of assets. Each altcoin uses a specific hashing algorithm. The table shows popular encryption methods.

| Algorithm | Popis | Kryptoměny |

|---|---|---|

By method of network protection and purpose

The consensus algorithm can also be the basis for the classification of altcoins. Cryptocurrencies work on the following protocols:

- Proof-of-Work. The protocol is designed to prevent cyber attacks (DDoS). Miners perform a lot of calculations to develop a valid block and get rewarded in coins.

- Proof-of-Stake. In the proof-of-stake model, validators (equivalent to miners) block funds in a smart contract. The algorithm grants the selected participant the right to create the next block. The challenger is determined based on the share in the pool of funds delivered. If one staker controls 30% of the placed assets in the network, he has the same chance to mine the next block and get the reward.

Top 10 Coins

There are over 15,500 cryptocurrencies in the industry. Many of them have almost no users and trading volumes. Others, on the contrary, are popular among investors. The total value of the top 10 altcoins (Ethereum, Tether, Ripple, Cardano and others) exceeds $719.51 billion.

Ethereum (ETH)

Etherium is the largest altcoin by capitalization. The volume of ETH coins in circulation is estimated at $320 billion. Unlike Bitcoin, Ethereum is not only a digital asset. It is a platform for token development. Ethereum smart contracts are used in the DeFi and NFT sectors. Many initial coin offerings (ICOs) have been launched on the main altcoin’s blockchain.

Tether (USDT).

The largest stablecoin has a capitalization of $119 billion. Tether, formerly known as Realcoin, launched in 2014. The coin is backed by the dollar at a 1-to-1 ratio. Tether’s goal is to keep cryptocurrency prices stable and protect investors from market volatility.

Binance Coin (BNB)

Binance exchange’s own coin was created on the Ethereum blockchain in 2017. In 2019, the developers moved the coin to the Binance Smart Chain network. BNB’s offering is limited to 146 million coins. Binance burns the cryptocurrency on a quarterly basis to reduce issuance. The total value of available coins is $86.8 billion.

Solana (SOL)

In 2021, the altcoin was among the top 10 largest cryptocurrencies by capitalization. But now Solana is fifth in the ranking. The value of the current offering is $12 billion. SOL is characterized by high transaction speed (69 thousand TPS) and low commissions ($0.00025).

USD Coin (USDC).

Stablecoin is backed by the dollar in the proportion of 1 to 1. USDC has a capitalization of $35.9 billion. The asset was launched in 2018 by Circle and Coinbase as an alternative to Tether (USDT).

Ripple (XRP)

The cryptocurrency is created for money transfers between financial institutions. The RippleNet network is used by major banks and payment providers (Bank of America, American Express). XRP works on its own eponymous blockchain. The developers have limited the supply to 100 billion coins. There are now 56.4 billion XRP in circulation with a total value of $33.14 billion.

Dogecoin (DOGE)

The cryptocurrency is named after a viral meme featuring a dog. In 2013, software engineers Billy Marcus and Jackson Palmer launched the satirical token to mock bitcoin and other digital assets with grand plans to take over the world. The meme coin quickly became popular. The asset has been backed by Tesla and SpaceX CEO Ilon Musk since 2021. The capitalization of DOGE is $15.5 billion.

Toncoin (TON)

A digital asset circulating on The Open Network. The blockchain is open source. It is based on the Gram project, the launch of which failed after a legal battle with the SEC. Now the capitalization of the Toncoin coin is $27.69 billion.

Since 2020, the TON network has been supported by members of the cryptocurrency community. The system works on the Proof-of-Stake algorithm, which allows it to scale.

TRON (TRX)

This is a decentralized network created in 2017 under the leadership of Justin Sun. After 7 years, it acts as a competitor to the Etherium system. TRON supports the development of smart contracts and respectively dApps. The uniqueness of blockchain is the opportunity for content creators to interact directly with their audience. The capitalization of all TRX coins is $13.22 billion.

Cardano (ADA)

Altcoin ranks 11th in the ranking of the largest cryptocurrencies with a capitalization of $12.7 billion. ADA is a native coin of the blockchain of the same name, released in 2017. The project was founded by one of the co-founders of Ethereum – Charles Hoskinson. Cardano uses the Proof-of-Stake protocol, which is 20 thousand times more energy efficient than bitcoin’s Proof-of-Work algorithm. The issuance of the asset is limited to 45 billion coins.

Buying and selling

Ordinary users were previously unable to trade on fiat money exchanges on their own. All transactions were carried out with the involvement of an intermediary – a broker.

With the emergence of cryptocurrencies, the situation has changed.

Digital coins can be bought and sold on exchanges and in exchangers. The first offer favorable rates and security, the second attract the speed of operations.

Výměny

This format of working with digital assets is convenient, but not always safe. The exchanger itself owns cryptocurrencies, so transactions with users become peer-to-peer (P2P). The seller sets the conversion rate taking into account the market price and its own benefit. The altcoin selection is often limited to a few popular coins.

The best exchanges

Altcoin trading starts with choosing a platform. The trader needs to register and fund an account. The table shows the largest cryptocurrency services – leaders in terms of trading volume in 2024.

| Výměna | Počet mincí | Trading volume per day (billion $) | Number of visits per day (million people) |

|---|---|---|---|

Different altcoins are available on each exchange. For example, assets that are traded on Binance may not be listed on Bybit. Rates on trading platforms also differ. Prices are determined by supply and demand, depending on the liquidity of the exchange.

Earnings of altcoins

Cryptocurrencies have different purposes. For example:

- Project management.

- Use as a means of settlement.

- Payment of transaction fees.

However, more often than not, coins are considered as investments. The easiest way to get digital assets is to buy them. But there are other opportunities for earning coins.

Without investment

By participating in giveaways, you can get tokens of new projects at an early stage for free. Many startups launch airdrops to gain initial publicity and create a community of enthusiasts. Users complete simple tasks and receive tokens for free. Once the project hits the market, the assets can be exchanged for others or sold for cash.

With investments

There are other ways to earn cryptocurrencies. Among them:

- Staking in blockchains with the Proof-of-Stake security method. The algorithm selects a validator to validate transactions based on the number of coins in the balance. The more cryptocurrency in a user’s wallet, the higher their chances of making a blockchain.

- Yield Farming. To earn cryptocurrency, you need to provide liquidity to the DeFi pool. The reward is paid daily to an internal account. When the minimum threshold is reached, the money can be withdrawn to the wallet. Popular DeFi projects include Uniswap, Kyber Network, and Aave.

Těžba

This method of cryptocurrency mining works on networks with the Proof-of-Work algorithm. Miners use computers to solve complex math problems that keep blockchains secure. Participants receive the network’s cryptocurrency as a reward.

Mining conditions vary depending on the altcoin. For example, mining Bitcoin requires powerful hardware (ASIC). Ethereum can be mined on video cards, Monero – on PC CPUs.

Trading

Cryptocurrency trading is the exchange of one coin for another for profit. Trading is usually conducted according to 2 main strategies:

- Short-term trading. Traders speculate on altcoins by holding them for some time (a few minutes, hours, days). The strategy will make a profit if the price rises in a short period of time.

- Long-term trading. Altcoins are bought for long-term holding (from 1 year). For example, a user who bought Ethereum in 2015 for $1 could sell the asset in October 2021 for $3.5 thousand.

Investments

Long-term trading of digital assets is relatively easy and only requires time. All you need to do is buy coins and keep them in your wallet. In essence, such trading can be considered an investment.

During tokensales, users also invest money in new projects. They count on big profits. Participants buy tokens at the pre-launch stage at a low price in order to sell them at a higher price on the exchange. Profits can reach hundreds and thousands of percent.

Evaluating the future

The success of investing in new altcoins is based on careful analysis. To choose a startup, you need to study information about the company and the project:

- Understand how the technology works.

- Analyze the tokenomics and assess the risks.

- To find out if the altcoin has a real application in the commercial market.

The value of the token is also affected by how realistic and valuable the project concept is. Once the altcoin enters the market, its rate will fluctuate depending on demand. Therefore, it is necessary to invest in assets that can be utilized.

Storage wallets

If the investor does not trade on the exchange, then he should think about placing capital. Developers have created a large number of multicurrency wallets for the safe storage of altcoins.

Such services do not physically contain assets. Instead, they generate account keys. The owner of the secret code is the only person with access to the funds.

Many wallets have a built-in internal exchange feature.

Users can convert one asset to another without leaving the account. Popular multi-currency wallets are:

- Atomic Wallet.

- Coinbase Wallet.

- MyEtherWallet.

- MetaMask and others.

Advantages and disadvantages of altcoins

| Klady | Mínusy |

|---|---|

Často kladené otázky

🏆 Which altcoin is the most popular in 2022?

The second after Bitcoin is still Ethereum. In July 2022, the asset has a capitalization of $181 billion – almost triple that of the next in the ranking, Tether ($67 billion).

❓ What blockchains are altcoins built on?

Coins support their own chains (SOL, BNB, ADA), tokens work on various networks (USDT, WETH, USDC are available on the Ethereum blockchain).

💰 Which altcoins can be invested in?

The choice depends on the user’s financial goals and strategy. Traders profit from the volatility of coins. Long-term investors choose capitalized assets.

✅ DeFi are altcoins?

Decentralized application tokens are considered a cryptocurrency alternative to bitcoin.

❔ How can I find out which exchanges the coin is traded on?

The information can be obtained on exchange sites (Coingecko, Coinmarketcap).

Je v textu chyba? Označte ji myší a stiskněte tlačítko Ctrl + Vstupte.

Autor: Mgr: Saifedean Ammous, odborník na ekonomiku kryptoměn.